Venture capital involves funding startups through equity investment from professional investors, typically providing substantial capital and strategic guidance. Crowdfunding raises smaller amounts from a large pool of individuals via online platforms, making it accessible for early-stage projects with less stringent requirements. Both methods offer distinct advantages depending on the startup's growth stage, funding needs, and control preferences.

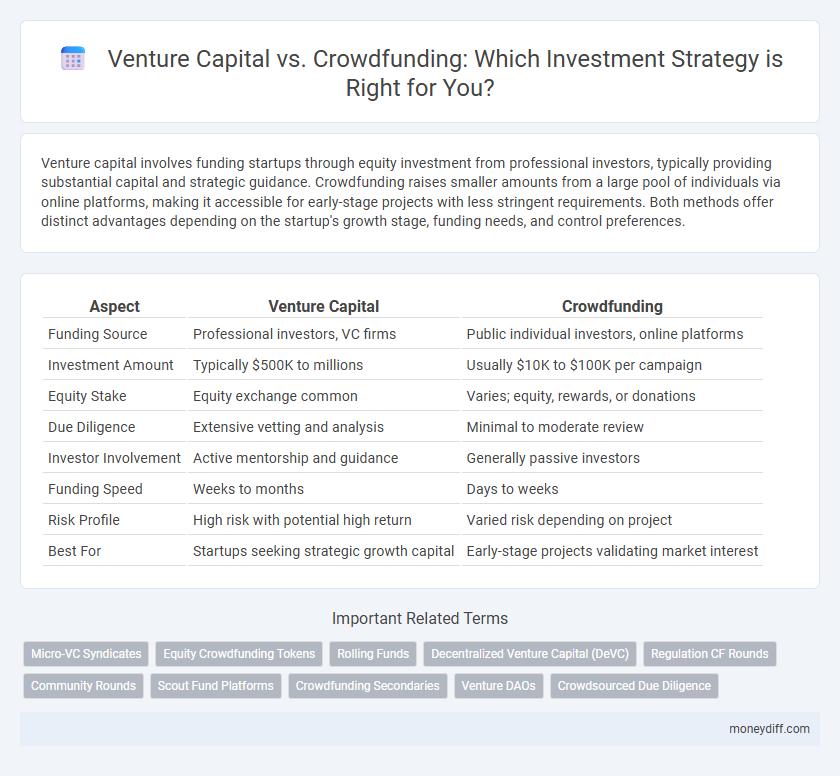

Table of Comparison

| Aspect | Venture Capital | Crowdfunding |

|---|---|---|

| Funding Source | Professional investors, VC firms | Public individual investors, online platforms |

| Investment Amount | Typically $500K to millions | Usually $10K to $100K per campaign |

| Equity Stake | Equity exchange common | Varies; equity, rewards, or donations |

| Due Diligence | Extensive vetting and analysis | Minimal to moderate review |

| Investor Involvement | Active mentorship and guidance | Generally passive investors |

| Funding Speed | Weeks to months | Days to weeks |

| Risk Profile | High risk with potential high return | Varied risk depending on project |

| Best For | Startups seeking strategic growth capital | Early-stage projects validating market interest |

Introduction to Venture Capital and Crowdfunding

Venture capital involves investing substantial funds into early-stage startups with high growth potential in exchange for equity, typically managed by professional investors and firms. Crowdfunding allows a broad audience to contribute smaller amounts to fund projects or startups, often through online platforms, enabling access to capital without traditional financial intermediaries. Both methods offer distinct advantages in terms of risk distribution, funding size, and investor involvement tailored to different entrepreneurial needs.

Key Differences Between Venture Capital and Crowdfunding

Venture capital involves professional investors providing significant funding in exchange for equity and active involvement in a startup's growth, typically requiring rigorous due diligence and higher investment thresholds. Crowdfunding allows a large number of individuals to contribute smaller amounts through online platforms, enabling democratized access to capital without relinquishing substantial control or facing intense scrutiny. The key differences lie in funding scale, investor involvement, risk tolerance, and regulatory requirements, with venture capital offering strategic guidance and crowdfunding emphasizing broad community support.

How Venture Capital Investment Works

Venture capital investment involves professional investors providing significant funding to startups and early-stage companies in exchange for equity ownership, often taking active roles in company growth and strategic decisions. This type of investment typically follows rigorous due diligence, valuation assessments, and staged funding rounds to mitigate risks and maximize returns. Unlike crowdfunding, venture capital investors seek high-growth potential businesses with scalable models and aim for substantial returns through eventual exits like IPOs or acquisitions.

Understanding the Crowdfunding Model

The crowdfunding model enables investors to collectively fund startups or projects through online platforms, offering access to a diverse range of opportunities with relatively low capital requirements. Unlike venture capital, which involves significant equity stakes and often active involvement from investors, crowdfunding allows small investors to participate without direct influence on company decisions. This democratized investment approach broadens market access and mitigates individual risk by pooling funds from a large number of backers.

Advantages of Venture Capital for Investors

Venture capital offers investors access to high-growth potential startups with expert management and scalable business models, increasing the likelihood of significant returns. It provides thorough due diligence and active portfolio management, reducing investment risks compared to crowdfunding. Furthermore, venture capital investments often include strategic support and networking opportunities, enhancing company performance and long-term value creation.

Benefits of Crowdfunding for Investors

Crowdfunding offers investors access to a diverse range of startups and projects with lower entry barriers compared to traditional venture capital, enabling participation with smaller amounts of capital. It fosters a democratic investment environment where investors can directly support innovative ideas while potentially enjoying early rewards and equity stakes. The transparent platform nature of crowdfunding also allows investors to track project progress and engage with creators, enhancing investment confidence and community building.

Risks and Challenges in Venture Capital Funding

Venture capital funding presents significant risks including high dilution of ownership and intense pressure to achieve rapid growth and profitability. Investors may face challenges such as stringent due diligence processes and the potential for loss if startups fail to scale or exit successfully. Unlike crowdfunding, venture capital demands substantial control and influence over business decisions, increasing the stakes for founders and investors alike.

Potential Drawbacks of Crowdfunding Investments

Crowdfunding investments often face challenges such as limited regulatory oversight, which increases the risk of fraud and project failure. Investors may experience lower liquidity compared to traditional venture capital, making it difficult to exit or sell their stakes. Additionally, the lack of professional due diligence can result in backing less viable startups, leading to higher chances of financial loss.

Which Investment Option Suits Your Financial Goals?

Venture capital offers substantial funding and strategic support ideal for startups seeking rapid growth, while crowdfunding provides access to a broad base of small investors, making it suitable for businesses aiming to validate ideas and build community engagement. Your financial goals determine the right choice: venture capital suits entrepreneurs focused on large-scale expansion and accelerated market entry, whereas crowdfunding aligns with those prioritizing brand exposure and incremental capital. Assess risk tolerance, desired control, and funding timelines to select the most effective investment route.

Future Trends in Venture Capital and Crowdfunding

Future trends in venture capital emphasize increasing use of artificial intelligence and big data analytics to identify high-potential startups, enhancing decision-making efficiency and risk assessment. Crowdfunding platforms are evolving with blockchain integration, offering greater transparency, security, and fractional ownership opportunities that attract a broader range of retail investors. Both investment methods are likely to converge with hybrid models, combining the scalability of crowdfunding with the strategic guidance and funding capacity of venture capital firms.

Related Important Terms

Micro-VC Syndicates

Micro-VC syndicates offer targeted investment opportunities by pooling capital from niche investors, providing startups with focused mentorship and faster decision-making compared to traditional crowdfunding platforms. These syndicates typically manage smaller funds, enabling higher deal frequency and more personalized support, which can lead to better alignment between founders and investors in early-stage ventures.

Equity Crowdfunding Tokens

Equity crowdfunding tokens enable investors to acquire fractional ownership in startups through blockchain-based digital assets, offering greater liquidity and transparency compared to traditional venture capital funding. Unlike venture capital, which involves large, selective investments from institutional investors, equity crowdfunding democratizes access, allowing a broader pool of retail investors to participate in early-stage equity financing.

Rolling Funds

Rolling funds provide a flexible venture capital model allowing continuous capital deployment and investor onboarding, contrasting with traditional crowdfunding's fixed funding rounds and broader investor base. This model appeals to startups seeking consistent funding over time while offering investors ongoing access to emerging opportunities and diversified venture portfolios.

Decentralized Venture Capital (DeVC)

Decentralized Venture Capital (DeVC) leverages blockchain technology to enable transparent, community-driven funding models that contrast traditional Venture Capital's centralized decision-making and Crowdfunding's broad, often less structured financial contributions. By utilizing smart contracts and tokenized equity, DeVC fosters increased investor participation, liquidity, and governance, presenting a transformative approach to startup investment dynamics.

Regulation CF Rounds

Regulation Crowdfunding (Regulation CF) rounds allow startups to raise up to $5 million annually from a wide pool of investors, including non-accredited individuals, under SEC oversight with limits on individual investments based on income or net worth. Compared to traditional venture capital, Regulation CF offers broader access and transparency but often involves smaller ticket sizes, longer timelines, and stricter disclosure requirements, impacting funding speed and investor relations.

Community Rounds

Community rounds in venture capital enable startups to raise funds from a dedicated group of supporters, offering strategic guidance and larger capital injections compared to crowdfunding's broad public contributions. While crowdfunding taps into a wide audience for small investments, community rounds leverage close-knit networks to align investor goals with long-term company growth and stronger governance oversight.

Scout Fund Platforms

Scout fund platforms streamline venture capital by enabling early-stage, high-growth startups to access institutional-grade funding while offering investors curated deal flow and reduced risk through diversified portfolios. Crowdfunding platforms attract a broader, non-institutional investor base, providing startups with capital in exchange for equity or rewards but typically involve higher risk and less due diligence compared to venture capital-backed investments.

Crowdfunding Secondaries

Crowdfunding secondaries allow investors to buy and sell existing shares in startups through online platforms, offering increased liquidity compared to traditional venture capital investments. This secondary market enhances portfolio flexibility and provides early investors an exit pathway, making it an attractive alternative to conventional venture capital funding cycles.

Venture DAOs

Venture DAOs leverage decentralized governance to pool capital from diverse investors, offering a transparent and community-driven alternative to traditional venture capital funding. Unlike crowdfunding, Venture DAOs enable dynamic decision-making and token-based incentives, enhancing investor engagement and aligning interests with startup growth.

Crowdsourced Due Diligence

Crowdsourced due diligence in crowdfunding harnesses the collective expertise and diverse perspectives of a broad investor base, increasing transparency and reducing the risk of overlooking critical investment flaws compared to traditional venture capital evaluations. This decentralized approach enables rapid validation of business models and market potential, democratizing access to investment opportunities while potentially improving decision accuracy through aggregated community feedback.

Venture Capital vs Crowdfunding for investment. Infographic

moneydiff.com

moneydiff.com