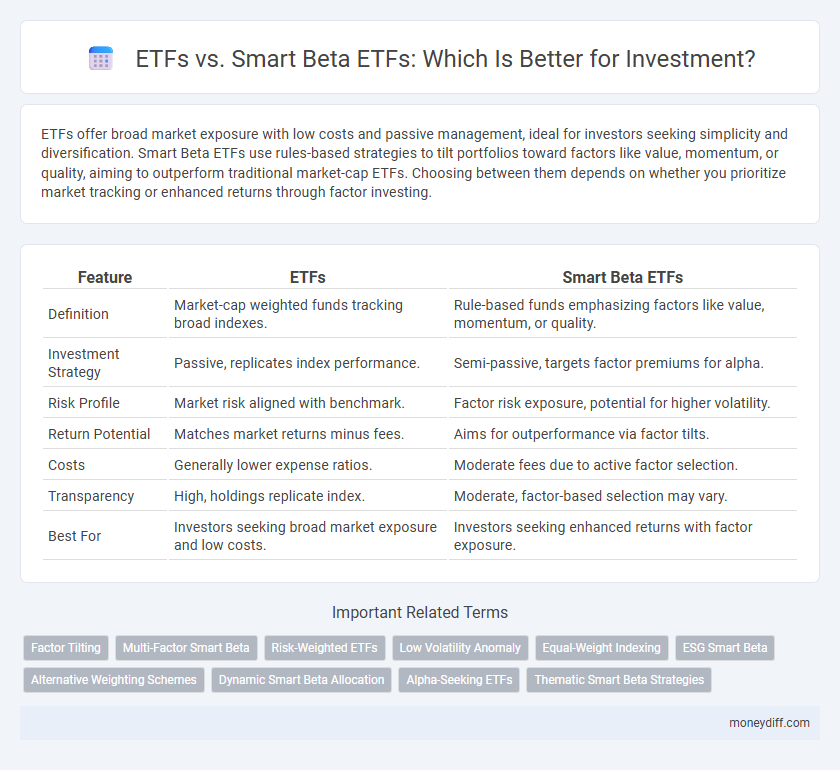

ETFs offer broad market exposure with low costs and passive management, ideal for investors seeking simplicity and diversification. Smart Beta ETFs use rules-based strategies to tilt portfolios toward factors like value, momentum, or quality, aiming to outperform traditional market-cap ETFs. Choosing between them depends on whether you prioritize market tracking or enhanced returns through factor investing.

Table of Comparison

| Feature | ETFs | Smart Beta ETFs |

|---|---|---|

| Definition | Market-cap weighted funds tracking broad indexes. | Rule-based funds emphasizing factors like value, momentum, or quality. |

| Investment Strategy | Passive, replicates index performance. | Semi-passive, targets factor premiums for alpha. |

| Risk Profile | Market risk aligned with benchmark. | Factor risk exposure, potential for higher volatility. |

| Return Potential | Matches market returns minus fees. | Aims for outperformance via factor tilts. |

| Costs | Generally lower expense ratios. | Moderate fees due to active factor selection. |

| Transparency | High, holdings replicate index. | Moderate, factor-based selection may vary. |

| Best For | Investors seeking broad market exposure and low costs. | Investors seeking enhanced returns with factor exposure. |

Introduction to ETFs and Smart Beta ETFs

Exchange-Traded Funds (ETFs) offer diversified exposure to broad market indices with low expense ratios and high liquidity. Smart Beta ETFs apply alternative weighting strategies such as factor investing--momentum, value, or low volatility--to enhance returns or reduce risk compared to traditional market-cap weighted ETFs. Investors seeking tailored risk-return profiles often consider Smart Beta ETFs for strategic portfolio complement alongside core ETF holdings.

Key Differences Between Traditional ETFs and Smart Beta ETFs

Traditional ETFs typically track market-cap weighted indexes, offering broad exposure with passive management and lower fees. Smart Beta ETFs use alternative weighting methodologies like fundamental, equal, or volatility weighting to enhance returns or reduce risk by targeting specific factors. Investors choose Smart Beta ETFs to achieve tailored exposure and potentially outperform traditional market indexes through strategic factor investments.

How ETFs Work: Basics for Investors

Exchange-traded funds (ETFs) provide investors with diversified exposure by tracking an index, sector, commodity, or asset class, allowing shares to be bought and sold on stock exchanges like individual stocks. Smart Beta ETFs differ by using alternative weighting strategies based on factors such as value, momentum, or volatility, aiming to enhance returns or reduce risk compared to traditional market-cap-weighted ETFs. Understanding these structures enables investors to select ETFs aligning with their investment goals and risk tolerance.

Understanding Smart Beta Strategies

Smart Beta ETFs combine the advantages of passive investing with strategic factor tilts to enhance returns or reduce risk by targeting specific investment factors such as value, momentum, or volatility. Unlike traditional ETFs that track market-cap weighted indexes, Smart Beta strategies employ alternative weighting methods to optimize portfolio exposure based on empirical research. Understanding these methodologies enables investors to tailor their asset allocation to specific financial goals and market conditions.

Performance Comparison: ETFs vs Smart Beta ETFs

Smart Beta ETFs often outperform traditional ETFs by systematically targeting factors such as value, momentum, and low volatility, which can enhance risk-adjusted returns. Standard ETFs typically replicate market-cap-weighted indices, resulting in broader market exposure but potentially lower alpha generation. Performance analysis over multiple market cycles shows Smart Beta ETFs can deliver superior returns and reduced drawdowns, especially in volatile environments.

Risk Factors in ETFs and Smart Beta ETFs

ETFs generally offer broad market exposure with risk factors tied to overall market volatility and sector concentration, while Smart Beta ETFs introduce factors such as value, momentum, or low volatility to target specific risk premiums. Risk factors in Smart Beta ETFs include factor timing risk, style drift, and higher turnover that can increase transaction costs and tax implications. Investors must evaluate their risk tolerance and investment horizon to choose between the passive diversification of traditional ETFs and the factor-based strategies of Smart Beta ETFs.

Costs and Fees: Choosing Between ETFs and Smart Beta ETFs

ETFs typically offer lower expense ratios compared to Smart Beta ETFs due to their passive management style, which minimizes trading and operational costs. Smart Beta ETFs often involve higher fees as they use rules-based strategies to select and weight securities, requiring more frequent rebalancing and complex model management. Investors should weigh the potential for enhanced returns against the increased costs when deciding between standard ETFs and Smart Beta ETFs.

Portfolio Diversification with ETFs and Smart Beta ETFs

ETFs offer broad market exposure and efficient portfolio diversification by tracking traditional indices with low expense ratios, enabling investors to reduce unsystematic risk. Smart Beta ETFs enhance diversification by employing factor-based strategies such as value, momentum, or quality, aiming to improve risk-adjusted returns through systematic selection and weighting criteria. Incorporating both ETFs and Smart Beta ETFs can optimize portfolio construction by blending market-cap exposure with factor-driven alpha generation.

Who Should Invest in Smart Beta ETFs?

Investors seeking a balanced approach between passive and active management benefit from Smart Beta ETFs, as they offer rules-based strategies targeting factors like value, momentum, or volatility to potentially enhance returns and reduce risks. Those with a moderate risk tolerance aiming for diversification beyond market-cap-weighted indices find Smart Beta ETFs suitable for capturing specific investment factors while maintaining cost efficiency. Investors looking to tilt their portfolios toward systematic factor exposure without the higher fees of active management are ideal candidates for Smart Beta ETFs.

Conclusion: Which ETF Option is Right for Your Investment Goals?

Choosing between traditional ETFs and Smart Beta ETFs depends on your investment goals, risk tolerance, and desire for active factor exposure. Traditional ETFs offer broad market diversification with lower fees, ideal for passive investors seeking market returns. Smart Beta ETFs use systematic strategies to target factors like value, momentum, or volatility, potentially enhancing returns but with increased complexity and risk, better suited for investors aiming to outperform the market through factor-based investing.

Related Important Terms

Factor Tilting

Smart Beta ETFs offer targeted exposure through factor tilting by systematically emphasizing specific investment factors like value, momentum, or low volatility, enhancing returns and managing risk compared to traditional market-cap-weighted ETFs. Factor tilting in Smart Beta ETFs leverages data-driven strategies to capitalize on persistent market anomalies, providing investors with a customizable approach to outperform broad market benchmarks.

Multi-Factor Smart Beta

Multi-Factor Smart Beta ETFs enhance traditional ETFs by systematically combining several investment factors such as value, momentum, and quality to optimize returns and manage risk more effectively. These ETFs use transparent, rules-based strategies that aim to outperform market-cap weighted ETFs by capturing diverse sources of alpha while maintaining lower costs and increased diversification.

Risk-Weighted ETFs

Risk-weighted ETFs allocate portfolio assets based on the volatility or risk level of individual securities, aiming to minimize overall portfolio risk compared to traditional market-cap-weighted ETFs. Smart Beta ETFs incorporate risk-weighted methodologies by rebalancing asset weights according to factors such as volatility, value, or momentum, offering a hybrid approach between passive indexing and active risk management.

Low Volatility Anomaly

Smart Beta ETFs targeting the Low Volatility Anomaly systematically select and weight stocks with lower price fluctuations to achieve better risk-adjusted returns compared to traditional market-cap-weighted ETFs. These ETFs capitalize on the tendency of low-volatility stocks to outperform, offering investors a strategic approach to mitigate portfolio risk while enhancing long-term growth potential.

Equal-Weight Indexing

Equal-weight indexing within ETFs provides diversified exposure by assigning identical weights to each constituent, enhancing performance potential in smaller-cap stocks compared to market-cap-weighted smart beta ETFs. Smart beta ETFs incorporating equal-weight strategies systematically rebalance to maintain balance, mitigating concentration risk and improving return consistency across various market conditions.

ESG Smart Beta

ESG Smart Beta ETFs combine environmental, social, and governance criteria with factor-based investing strategies to deliver enhanced risk-adjusted returns and improved sustainability profiles compared to traditional ETFs. Their systematic approach targets specific factors such as value, momentum, or low volatility while integrating ESG metrics, attracting investors seeking both financial performance and responsible investment outcomes.

Alternative Weighting Schemes

Smart Beta ETFs utilize alternative weighting schemes such as fundamental factors, equal weighting, or volatility-based methods to potentially enhance risk-adjusted returns compared to traditional market-cap weighted ETFs. These strategies aim to capture specific risk premia and provide diversification by deviating from standard capitalization-based allocations.

Dynamic Smart Beta Allocation

Dynamic Smart Beta Allocation ETFs blend traditional index strategies with factor-based investing to optimize risk-adjusted returns through adaptive weighting. These funds outperform conventional ETFs by systematically adjusting factor exposures like value, momentum, and volatility in response to market conditions, enhancing portfolio diversification and potential alpha generation.

Alpha-Seeking ETFs

Alpha-seeking ETFs aim to outperform traditional market benchmarks by utilizing smart beta strategies that blend passive and active management, focusing on factors such as value, momentum, and quality to generate higher alpha. Compared to conventional ETFs, smart beta ETFs offer targeted exposure to specific risk premia, potentially enhancing returns while maintaining lower costs and increased transparency.

Thematic Smart Beta Strategies

Thematic Smart Beta ETFs combine traditional smart beta approaches with thematic investing, targeting specific trends such as clean energy, technology innovation, or demographic shifts to capture sector-specific growth while managing risk through factor-based weighting. These ETFs offer a strategic advantage over conventional ETFs by exploiting factor premiums like value, momentum, or quality within high-conviction themes, enhancing portfolio diversification and potential returns.

ETFs vs Smart Beta ETFs for investment. Infographic

moneydiff.com

moneydiff.com