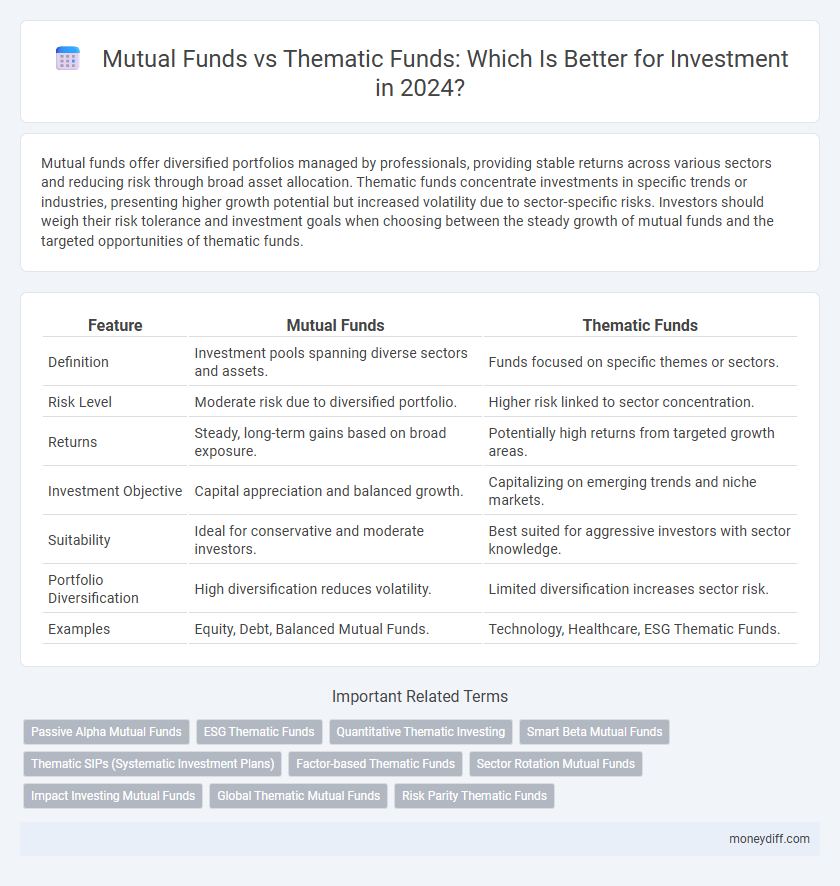

Mutual funds offer diversified portfolios managed by professionals, providing stable returns across various sectors and reducing risk through broad asset allocation. Thematic funds concentrate investments in specific trends or industries, presenting higher growth potential but increased volatility due to sector-specific risks. Investors should weigh their risk tolerance and investment goals when choosing between the steady growth of mutual funds and the targeted opportunities of thematic funds.

Table of Comparison

| Feature | Mutual Funds | Thematic Funds |

|---|---|---|

| Definition | Investment pools spanning diverse sectors and assets. | Funds focused on specific themes or sectors. |

| Risk Level | Moderate risk due to diversified portfolio. | Higher risk linked to sector concentration. |

| Returns | Steady, long-term gains based on broad exposure. | Potentially high returns from targeted growth areas. |

| Investment Objective | Capital appreciation and balanced growth. | Capitalizing on emerging trends and niche markets. |

| Suitability | Ideal for conservative and moderate investors. | Best suited for aggressive investors with sector knowledge. |

| Portfolio Diversification | High diversification reduces volatility. | Limited diversification increases sector risk. |

| Examples | Equity, Debt, Balanced Mutual Funds. | Technology, Healthcare, ESG Thematic Funds. |

Understanding Mutual Funds: A Comprehensive Overview

Mutual funds pool capital from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering risk mitigation through professional management. Unlike thematic funds, which concentrate on specific sectors or trends, mutual funds provide broader market exposure and asset class diversification. This comprehensive approach helps investors balance potential returns with risk tolerance, making mutual funds a foundational choice for long-term investment strategies.

What Are Thematic Funds? Key Features Explained

Thematic funds invest in companies aligned with specific themes or trends, such as clean energy, technology, or healthcare innovation, targeting focused growth opportunities. These funds offer sector-specific exposure, allowing investors to capitalize on emerging market dynamics while managing risk through diversified stock selections within the chosen theme. Unlike traditional mutual funds, which spread investments across various sectors, thematic funds concentrate assets to capture high growth potential linked to particular economic or social changes.

Core Differences: Mutual Funds vs Thematic Funds

Mutual funds invest across diversified sectors and asset classes to reduce risk and achieve balanced growth, while thematic funds concentrate on specific themes or trends like technology, healthcare, or clean energy. Thematic funds typically offer higher return potential but with increased volatility and sector-specific risk compared to mutual funds' broader market exposure. Investors seeking steady, diversified growth prefer mutual funds, whereas those targeting high-growth opportunities aligned with macroeconomic trends often select thematic funds.

Risk Factors: Evaluating Risk in Mutual and Thematic Funds

Mutual funds generally offer diversified portfolios, spreading risk across various asset classes and sectors, which reduces volatility for investors. Thematic funds concentrate investments in specific themes or sectors, leading to higher risk due to sector-specific fluctuations and market cycles. Evaluating risk in these funds requires analyzing sector exposure, market conditions, and the investor's risk tolerance to align with financial goals.

Historical Performance: Comparing Returns Over Time

Mutual funds have historically delivered consistent long-term returns through diversified portfolios, reducing risk and providing steady growth. Thematic funds, focused on specific sectors or trends, tend to offer higher fluctuations but can outperform during favorable market cycles tied to their investment themes. Analyzing past performance reveals mutual funds generally maintain stability, while thematic funds show variable returns aligned with economic shifts and emerging opportunities.

Portfolio Diversification: Which Fund Offers Better Balance?

Mutual funds provide broader portfolio diversification by investing across various sectors, asset classes, and geographic regions, reducing overall investment risk. Thematic funds concentrate on specific themes or industries, offering higher growth potential but increased volatility due to sector-specific exposure. For investors seeking balanced risk and diversified returns, mutual funds generally deliver better portfolio stability compared to thematic funds.

Suitability: Who Should Invest in Mutual or Thematic Funds?

Mutual funds suit investors seeking diversified, lower-risk portfolios managed by professionals, ideal for long-term wealth accumulation and conservative investment goals. Thematic funds attract risk-tolerant investors aiming to capitalize on specific industry trends or sectors, offering higher growth potential but with increased volatility. Investors should assess risk appetite, investment horizon, and market knowledge before choosing between diversified mutual funds and concentrated thematic funds.

Costs and Fees: Expense Ratios and Charges

Mutual funds typically have lower expense ratios ranging from 0.5% to 1.5%, while thematic funds often charge higher fees between 1.2% and 2.5% due to specialized portfolio management and research costs. Investors should carefully evaluate front-end loads, exit loads, and transaction fees associated with each type, as thematic funds may impose higher charges to maintain thematic exposure. Cost efficiency directly impacts net returns, making expense ratios and additional charges critical factors in fund selection for cost-conscious investors.

Tax Implications for Mutual vs Thematic Fund Investors

Mutual funds often benefit from more favorable tax treatment due to their diversified portfolio structure, allowing investors to optimize capital gains distributions and utilize long-term capital gains tax rates. Thematic funds, which concentrate investments around specific sectors or trends, may trigger higher short-term capital gains and result in more frequent taxable events because of increased portfolio churn and concentrated risk. Understanding these tax implications helps investors make informed choices aligned with their financial goals and tax efficiency preferences.

Making the Right Choice: Mutual or Thematic Funds for Your Goals

Mutual funds offer diversified portfolios managed by professionals, making them suitable for investors seeking balanced risk and steady growth. Thematic funds concentrate investments in specific sectors or trends, providing higher growth potential but with increased volatility and sector-specific risk. Choosing between mutual and thematic funds depends on your risk tolerance, investment horizon, and financial goals to ensure alignment with your long-term objectives.

Related Important Terms

Passive Alpha Mutual Funds

Passive Alpha Mutual Funds combine the diversification benefits of mutual funds with strategic sector or thematic exposures designed to outperform traditional benchmarks. Compared to thematic funds focused narrowly on specific trends, Passive Alpha Mutual Funds offer a balanced approach by blending low-cost index strategies with targeted alpha generation, optimizing risk-adjusted returns for long-term investors.

ESG Thematic Funds

ESG Thematic Funds prioritize investments in companies demonstrating strong environmental, social, and governance practices, offering targeted exposure to sustainable sectors compared to traditional Mutual Funds. These funds align with investors seeking to integrate responsible investing principles with potential for long-term growth in emerging green industries.

Quantitative Thematic Investing

Quantitative thematic investing leverages data-driven models to identify high-conviction themes, offering targeted exposure compared to traditional mutual funds that typically emphasize diversified asset allocation. Thematic funds focus on specific sectors or trends, such as technology or sustainability, enabling investors to capitalize on emerging market opportunities with precision and systematic risk management.

Smart Beta Mutual Funds

Smart Beta Mutual Funds combine the benefits of passive investing with strategic factor-based selection to outperform traditional market-cap-weighted mutual funds, offering a more efficient risk-return profile compared to thematic funds that focus narrowly on specific sectors or themes. These funds optimize exposure to style factors such as value, momentum, and volatility, providing diversified investment opportunities without the concentrated risks inherent in thematic investing.

Thematic SIPs (Systematic Investment Plans)

Thematic SIPs focus on specific sectors or trends, offering targeted growth opportunities aligned with themes like technology, healthcare, or sustainability, which can lead to higher returns but with increased risk due to sector concentration. Mutual funds provide diversified exposure across various sectors and asset classes, balancing risk while offering steady growth, making thematic SIPs suitable for investors seeking focused, high-growth potential within a disciplined investment framework.

Factor-based Thematic Funds

Factor-based thematic funds combine targeted investment themes with factor investing strategies, aiming to enhance returns by selecting securities based on specific risk factors such as value, momentum, or low volatility within a thematic focus. Unlike traditional mutual funds that diversify broadly, these funds concentrate on sectors or trends aligned with factors that historically drive performance, offering investors a more systematic approach to capitalizing on market themes.

Sector Rotation Mutual Funds

Sector Rotation Mutual Funds strategically shift investments across industry sectors to capitalize on economic cycles, offering dynamic exposure compared to Thematic Funds that focus on specific trends or themes. These funds optimize portfolio diversification by adapting to market conditions, enhancing risk-adjusted returns for investors seeking tactical asset allocation.

Impact Investing Mutual Funds

Impact investing mutual funds focus on generating measurable social and environmental benefits alongside financial returns by investing in companies aligned with specific sustainability goals. Unlike thematic funds that target sector-specific trends, impact mutual funds prioritize investments based on ESG criteria and positive societal impact, appealing to investors seeking responsible wealth growth.

Global Thematic Mutual Funds

Global Thematic Mutual Funds concentrate on specific trends or sectors worldwide, offering targeted exposure to innovation, technology, or sustainability themes, which can outperform broader Mutual Funds during market shifts. These funds provide diversified international access while leveraging thematic growth drivers, making them suitable for investors seeking focused yet globally diversified investment opportunities.

Risk Parity Thematic Funds

Risk parity thematic funds diversify investment risk by balancing asset allocations across themes such as technology, healthcare, and renewable energy, reducing volatility compared to traditional thematic funds. Mutual funds typically offer broader diversification across sectors, but risk parity thematic funds strategically manage thematic exposure to optimize risk-adjusted returns in volatile markets.

Mutual Funds vs Thematic Funds for investment. Infographic

moneydiff.com

moneydiff.com