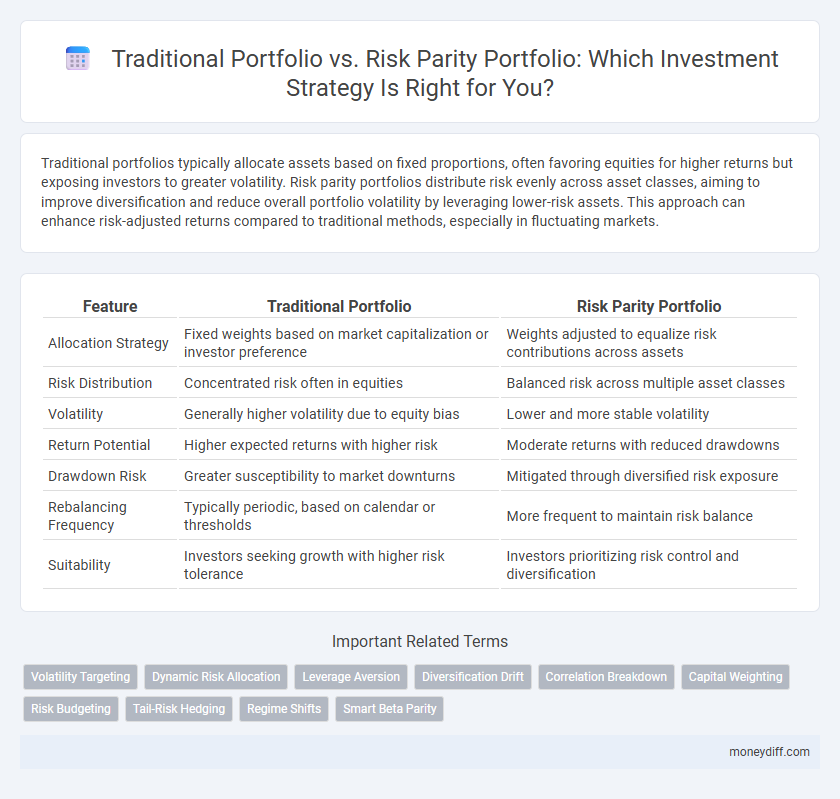

Traditional portfolios typically allocate assets based on fixed proportions, often favoring equities for higher returns but exposing investors to greater volatility. Risk parity portfolios distribute risk evenly across asset classes, aiming to improve diversification and reduce overall portfolio volatility by leveraging lower-risk assets. This approach can enhance risk-adjusted returns compared to traditional methods, especially in fluctuating markets.

Table of Comparison

| Feature | Traditional Portfolio | Risk Parity Portfolio |

|---|---|---|

| Allocation Strategy | Fixed weights based on market capitalization or investor preference | Weights adjusted to equalize risk contributions across assets |

| Risk Distribution | Concentrated risk often in equities | Balanced risk across multiple asset classes |

| Volatility | Generally higher volatility due to equity bias | Lower and more stable volatility |

| Return Potential | Higher expected returns with higher risk | Moderate returns with reduced drawdowns |

| Drawdown Risk | Greater susceptibility to market downturns | Mitigated through diversified risk exposure |

| Rebalancing Frequency | Typically periodic, based on calendar or thresholds | More frequent to maintain risk balance |

| Suitability | Investors seeking growth with higher risk tolerance | Investors prioritizing risk control and diversification |

Understanding Traditional Portfolio Strategies

Traditional portfolio strategies typically allocate assets based on fixed percentages across stocks, bonds, and cash to balance risk and return according to investor goals and market conditions. These portfolios often emphasize diversification within asset classes but may underperform during extreme market stress due to concentration in risk factors like equity market volatility. Understanding the limitations of traditional allocations highlights the importance of exploring approaches like risk parity, which aims to distribute risk more evenly across assets to enhance portfolio resilience.

What is a Risk Parity Portfolio?

A Risk Parity Portfolio allocates assets based on risk contribution, aiming to balance volatility across all investments rather than focusing on capital allocation like traditional portfolios. This approach reduces the impact of any single asset's risk, often leading to more stable returns during market fluctuations. By equalizing risk exposure, risk parity portfolios can enhance diversification and improve risk-adjusted performance compared to traditional equity-heavy allocations.

Key Differences Between Traditional and Risk Parity Portfolios

Traditional portfolios typically allocate assets based on fixed proportions, often emphasizing equities for higher returns, resulting in uneven risk distribution across asset classes. Risk parity portfolios allocate capital to balance risk equally among assets, aiming to reduce volatility and improve diversification by leveraging lower-risk assets more heavily. This approach often leads to more stable returns, especially in volatile markets, compared to the concentrated risk in traditional portfolios.

Asset Allocation in Traditional vs Risk Parity Portfolios

Traditional portfolios typically allocate assets based on fixed proportions, often emphasizing equities and bonds according to investor risk tolerance. Risk parity portfolios allocate assets by balancing the risk contribution of each asset class, resulting in a more diversified risk exposure. This method often increases allocations to lower-volatility assets like bonds while reducing equity concentration, aiming for more stable returns across varying market conditions.

Risk Management Approaches Compared

Traditional portfolios typically allocate assets based on fixed percentages, often emphasizing equities and bonds, which can lead to imbalance during market volatility. Risk parity portfolios distribute risk equally across asset classes by adjusting allocations according to volatility and correlation, aiming for improved diversification and steady returns. This approach enhances risk management by minimizing concentration risk and potentially reducing drawdowns compared to traditional strategies.

Historical Performance Analysis

Historical performance analysis reveals that Traditional Portfolios often exhibit higher volatility due to concentrated asset allocations, while Risk Parity Portfolios achieve more stable returns by balancing risk contributions across asset classes. Over multiple market cycles, Risk Parity strategies have demonstrated superior drawdown control and improved risk-adjusted returns compared to traditional equity-heavy portfolios. Empirical data from 1970 to 2020 highlights that Risk Parity portfolios consistently deliver lower standard deviation and higher Sharpe ratios, emphasizing their effectiveness in diversified investment management.

Volatility and Drawdown Considerations

Traditional portfolios often concentrate heavily on equities, leading to higher volatility and larger drawdowns during market downturns. Risk parity portfolios allocate assets based on equalizing risk contributions, typically resulting in lower overall volatility and reduced drawdown severity. Empirical studies show risk parity strategies can enhance risk-adjusted returns by minimizing portfolio variance and improving drawdown control compared to traditional asset-weighted allocations.

Suitability for Different Investor Profiles

Traditional portfolios, typically weighted heavily in equities, suit investors with high risk tolerance seeking growth through market appreciation. Risk parity portfolios, balancing risk contributions across asset classes like bonds, equities, and commodities, appeal to conservative investors aiming for steady returns with lower volatility. High-net-worth individuals and institutional investors often prefer risk parity strategies for diversification, while younger investors with longer time horizons might lean towards traditional equity-focused portfolios.

Costs and Implementation Challenges

Traditional portfolios often incur higher transaction costs due to frequent rebalancing and concentrated asset allocations, while risk parity portfolios emphasize equal risk contribution, potentially reducing turnover expenses. Implementing risk parity requires sophisticated risk modeling and continuous monitoring, which can increase operational complexity compared to traditional methods. Cost efficiency in risk parity strategies is influenced by leverage requirements, margin costs, and the need for advanced technology infrastructure.

Future Trends in Portfolio Construction

Future trends in portfolio construction emphasize increased adoption of risk parity strategies due to their superior risk-adjusted returns and diversification benefits compared to traditional portfolios. Traditional portfolios heavily weighted in equities and fixed income face challenges from rising market volatility and low-interest-rate environments, making risk parity's balanced risk allocation across asset classes more resilient. Advances in algorithmic modeling and big data analytics further enhance the customization and dynamic adjustment of risk parity portfolios, positioning them as a key evolution in long-term investment frameworks.

Related Important Terms

Volatility Targeting

Traditional portfolios often allocate assets based on fixed proportions without adjusting for market volatility, potentially leading to unbalanced risk exposure during turbulent periods. Risk parity portfolios emphasize volatility targeting by dynamically weighting assets to equalize risk contribution, enhancing portfolio stability and improving risk-adjusted returns over time.

Dynamic Risk Allocation

Dynamic risk allocation in Traditional Portfolios typically relies on fixed asset weights, leading to potential imbalances during market volatility, whereas Risk Parity Portfolios systematically adjust exposure based on asset volatility and correlations, aiming to equalize risk contribution across assets. Empirical studies show Risk Parity strategies often achieve more stable risk-adjusted returns and improved diversification benefits compared to traditional market-cap-weighted allocations.

Leverage Aversion

Traditional portfolios often rely on fixed asset allocations without leveraging, which may limit returns during low-volatility periods, whereas risk parity portfolios use leverage to balance risk contributions across assets, potentially enhancing risk-adjusted returns. Leverage aversion, the reluctance to use borrowed funds due to perceived risks, can hinder investors from adopting risk parity strategies despite their theoretical efficiency in diversifying risk and improving portfolio performance.

Diversification Drift

Traditional portfolios often suffer from diversification drift as asset weights deviate due to varying returns, increasing concentration risk over time. Risk parity portfolios systematically rebalance to maintain equal risk contribution, effectively minimizing diversification drift and enhancing risk-adjusted returns.

Correlation Breakdown

Traditional portfolios, often weighted heavily towards equities, face significant risks during correlation breakdowns when asset correlations increase unexpectedly, reducing diversification benefits. Risk parity portfolios allocate based on equal risk contributions, enhancing resilience by maintaining balanced exposure across asset classes even when correlations spike during market stress.

Capital Weighting

Traditional portfolios typically rely on capital weighting, allocating assets based on market capitalization which can lead to concentration in overvalued sectors. Risk parity portfolios distribute risk evenly across assets by adjusting weights inversely proportional to volatility, enhancing diversification and potentially improving risk-adjusted returns.

Risk Budgeting

Risk budgeting in Traditional Portfolios typically allocates capital based on asset class weightings, often resulting in concentrated risk exposures, while Risk Parity Portfolios distribute risk evenly across assets by leveraging volatility and correlation data to optimize diversification. This approach in Risk Parity enhances risk-adjusted returns and reduces drawdowns by systematically balancing contributions to portfolio risk rather than capital allocation.

Tail-Risk Hedging

Traditional portfolios typically allocate assets based on fixed proportions, exposing investors to significant tail-risk during market downturns, whereas risk parity portfolios diversify risk by balancing volatility contributions across asset classes, enhancing tail-risk hedging and improving downside protection. Empirical studies show that risk parity strategies reduce portfolio drawdowns and deliver more stable risk-adjusted returns in extreme market conditions compared to conventional allocation methods.

Regime Shifts

Traditional portfolios, typically weighted by market capitalization, often underperform during market regime shifts due to concentrated risk exposure, whereas risk parity portfolios diversify risk allocation evenly across asset classes, enhancing resilience to changing economic conditions. Risk parity's balanced risk approach adjusts dynamically to volatility and correlations, providing more stable returns across different market environments compared to traditional equity-bond allocations.

Smart Beta Parity

Smart Beta Parity enhances traditional portfolio construction by balancing risk contributions across asset classes, reducing volatility while aiming for higher risk-adjusted returns. This approach diversifies beyond market capitalization weighting, optimizing exposure to factors such as value, momentum, and low volatility within a risk parity framework.

Traditional Portfolio vs Risk Parity Portfolio for Investment. Infographic

moneydiff.com

moneydiff.com