A high-yield savings app offers significantly higher interest rates compared to traditional savings accounts, enabling investors to grow their funds faster while maintaining liquidity and low risk. These apps often provide user-friendly interfaces, automated savings features, and instant access to funds, making them a practical choice for maximizing returns on emergency savings or short-term goals. Traditional savings accounts, while more accessible through brick-and-mortar banks, typically yield lower returns and may lack the innovative tools available in digital platforms.

Table of Comparison

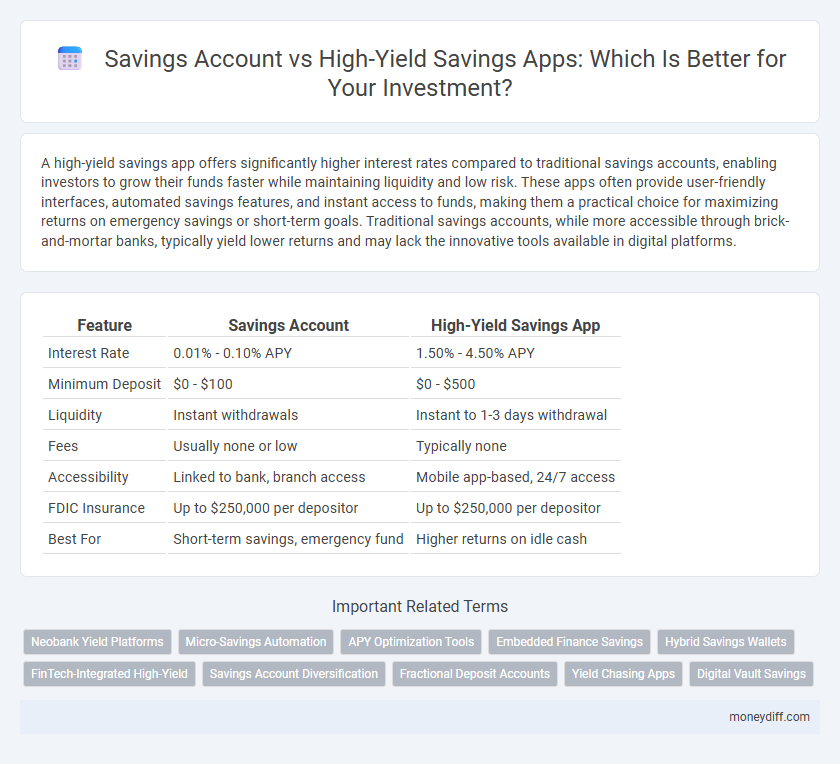

| Feature | Savings Account | High-Yield Savings App |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.50% - 4.50% APY |

| Minimum Deposit | $0 - $100 | $0 - $500 |

| Liquidity | Instant withdrawals | Instant to 1-3 days withdrawal |

| Fees | Usually none or low | Typically none |

| Accessibility | Linked to bank, branch access | Mobile app-based, 24/7 access |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Best For | Short-term savings, emergency fund | Higher returns on idle cash |

Overview: Savings Accounts vs High-Yield Savings Apps

Savings accounts typically offer lower interest rates, around 0.01% to 0.10% APY, providing liquidity and security for short-term savings. High-yield savings apps deliver significantly higher APYs, often between 3% and 5%, leveraging digital platforms to minimize overhead costs and pass savings to users. Investors prioritizing growth with low risk benefit more from high-yield savings apps due to better compound interest potential compared to traditional savings accounts.

Key Features Comparison

Savings accounts typically offer lower interest rates around 0.01% to 0.10%, providing easy access to funds with FDIC insurance up to $250,000. High-yield savings apps feature competitive APYs ranging from 3% to 5%, automated savings tools, and mobile notifications for better financial management. Both options ensure liquidity, but high-yield apps maximize growth potential with enhanced digital features tailored for savers seeking higher returns.

Interest Rates: Traditional vs High-Yield

Traditional savings accounts typically offer interest rates ranging from 0.01% to 0.10%, providing minimal growth on deposits. High-yield savings apps, on the other hand, offer significantly higher rates, often between 4% and 5% APY, enabling faster accumulation of interest. Investors seeking better returns should consider the impact of these differential rates on their long-term savings growth and overall investment strategy.

Accessibility and Convenience

High-yield savings apps offer superior accessibility and convenience compared to traditional savings accounts by enabling users to manage funds directly from their smartphones with intuitive interfaces and real-time notifications. These apps often provide seamless integration with multiple bank accounts, allowing for faster transfers and automated savings features that enhance user experience. Traditional savings accounts may require in-person visits or limited online services, which can restrict immediate access and slower transaction times.

Safety and Security Considerations

Savings accounts at traditional banks are insured by the FDIC up to $250,000 per depositor, ensuring robust protection against bank failures. High-yield savings apps, often partnering with FDIC-insured banks, extend similar federal insurance but require verifying app partnerships and encryption standards for data security. Evaluating the platform's regulatory compliance, cybersecurity measures, and transparency is essential for safeguarding investment funds while aiming for higher returns.

Fees and Account Requirements

High-yield savings apps often offer significantly higher interest rates compared to traditional savings accounts, but they may require minimum deposits or balance thresholds that, if not met, could lead to fees. Traditional savings accounts generally have fewer account requirements and lower fees, making them accessible for investors seeking a no-frills option. Investors should evaluate the fee structures and account minimums closely to optimize returns without incurring unnecessary costs.

Mobile Experience and Digital Tools

High-yield savings apps offer a superior mobile experience with intuitive interfaces and real-time tracking, providing investors with seamless access to their funds and performance insights. These apps integrate advanced digital tools such as automated savings plans, personalized alerts, and detailed analytics, enhancing decision-making and optimizing growth potential. Traditional savings accounts often lack these mobile-centric features, limiting convenience and real-time financial management for tech-savvy investors.

Deposit and Withdrawal Flexibility

Savings accounts offer basic deposit and withdrawal flexibility with unlimited transactions and easy access through banks, while high-yield savings apps often provide enhanced flexibility through mobile platforms and faster fund transfers. High-yield savings apps may impose limits on the number of free withdrawals per month but compensate with higher interest rates and seamless digital management. Choosing between the two depends on the importance of transaction convenience versus maximizing returns through elevated interest earnings.

Suitability for Investment Goals

High-yield savings apps offer significantly higher interest rates compared to traditional savings accounts, making them more suitable for short-term investment goals that prioritize liquidity and growth. Traditional savings accounts provide stability and easy access to funds but typically yield lower returns, which may not meet aggressive investment objectives. Choosing between the two depends on the desired balance between risk tolerance, access to funds, and expected return on investment.

Making the Right Choice for Your Money

Choosing between a traditional savings account and a high-yield savings app depends on your financial goals and liquidity needs. High-yield savings apps typically offer interest rates several times higher than standard bank savings accounts, maximizing passive income on your cash reserves. Evaluate fees, accessibility, and security features to ensure your money grows safely while remaining easy to access when needed.

Related Important Terms

Neobank Yield Platforms

Neobank yield platforms offer high-yield savings apps with interest rates significantly surpassing traditional savings accounts, providing investors with better returns and enhanced liquidity. These digital-first platforms leverage technology to reduce overhead costs, passing savings on to customers through competitive APYs often exceeding 4%, outperforming typical bank savings rates below 1%.

Micro-Savings Automation

Micro-savings automation in high-yield savings apps leverages technology to round up everyday transactions and deposit spare change into accounts with significantly higher interest rates than traditional savings accounts, maximizing passive investment growth. These apps provide a seamless, automated approach to investment by enabling consistent, small deposits that compound over time, outperforming the static returns of standard savings accounts.

APY Optimization Tools

High-yield savings apps leverage advanced APY optimization tools that automatically shift funds to accounts offering the best interest rates, significantly improving returns compared to traditional savings accounts with fixed, often lower APYs. These apps also provide real-time analytics and automated compounding features that maximize earnings through strategic allocation and interest rate monitoring.

Embedded Finance Savings

Embedded finance savings solutions integrate high-yield savings apps directly into platforms, offering seamless access to higher interest rates compared to traditional savings accounts that often yield lower returns. This integration enhances user experience by enabling instant deposits, automated transfers, and real-time financial insights, maximizing investment growth potential through efficient, tech-driven savings strategies.

Hybrid Savings Wallets

Hybrid savings wallets combine the low-risk benefits of traditional savings accounts with the superior interest rates of high-yield savings apps, offering an optimized investment strategy for liquidity and growth. These wallets leverage advanced algorithms to allocate funds dynamically, maximizing returns while ensuring easy access to cash and enhanced portfolio diversification.

FinTech-Integrated High-Yield

FinTech-integrated high-yield savings apps offer significantly higher annual percentage yields (APYs) compared to traditional savings accounts, leveraging real-time data analytics and automated financial tools to optimize returns and liquidity. These platforms often provide seamless integration with investment portfolios, enabling users to maximize interest earnings while maintaining flexible access to funds.

Savings Account Diversification

Savings account diversification spreads funds across multiple accounts and financial institutions to reduce risk and maintain liquidity while optimizing interest earnings. Incorporating high-yield savings apps enhances diversification by offering higher interest rates and seamless access to multiple accounts, boosting overall portfolio stability and growth potential.

Fractional Deposit Accounts

Fractional deposit accounts in high-yield savings apps offer investors the advantage of investing smaller amounts more frequently compared to traditional savings accounts, enhancing portfolio diversification and compounding interest efficiency. These apps leverage automation and higher interest rates, enabling fractional deposits to grow wealth faster while maintaining liquidity and low risk.

Yield Chasing Apps

Yield chasing apps offer significantly higher interest rates than traditional savings accounts, often exceeding 4% APY compared to banks that typically provide less than 1% APY. These high-yield savings platforms leverage advanced algorithms and lower overhead costs to maximize returns, making them an attractive choice for investors seeking enhanced growth on their liquid assets.

Digital Vault Savings

Digital Vault Savings offers a high-yield savings app that significantly outperforms traditional savings accounts by providing competitive interest rates and enhanced security features through blockchain technology. Investors benefit from instant access, real-time transaction tracking, and FDIC insurance protection, making Digital Vault Savings a superior choice for maximizing returns on low-risk capital.

Savings Account vs High-Yield Savings App for investment. Infographic

moneydiff.com

moneydiff.com