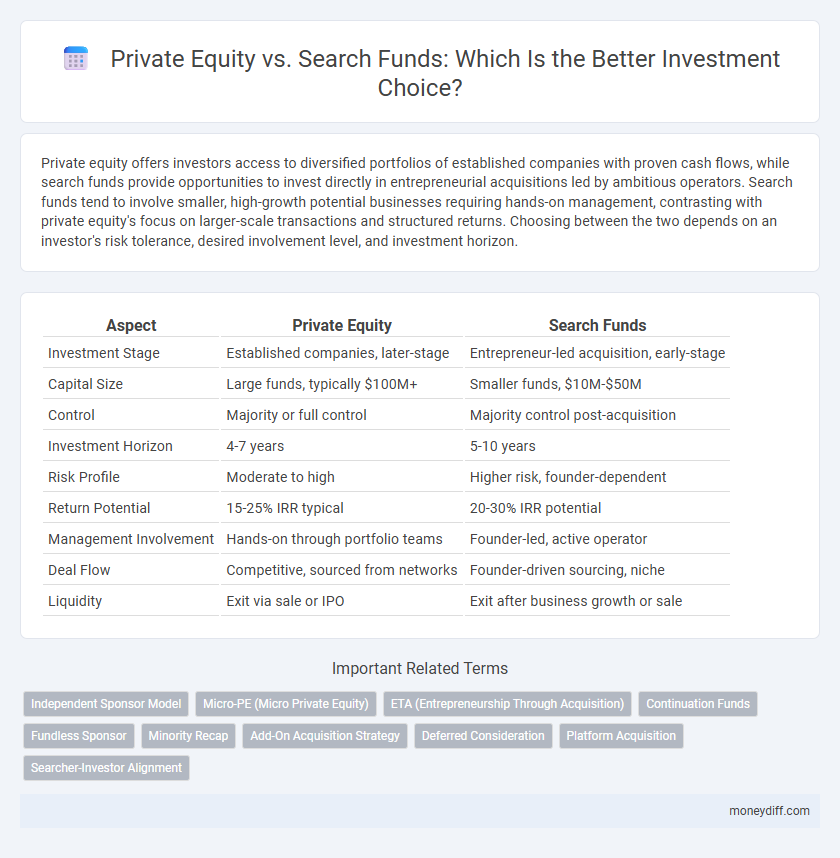

Private equity offers investors access to diversified portfolios of established companies with proven cash flows, while search funds provide opportunities to invest directly in entrepreneurial acquisitions led by ambitious operators. Search funds tend to involve smaller, high-growth potential businesses requiring hands-on management, contrasting with private equity's focus on larger-scale transactions and structured returns. Choosing between the two depends on an investor's risk tolerance, desired involvement level, and investment horizon.

Table of Comparison

| Aspect | Private Equity | Search Funds |

|---|---|---|

| Investment Stage | Established companies, later-stage | Entrepreneur-led acquisition, early-stage |

| Capital Size | Large funds, typically $100M+ | Smaller funds, $10M-$50M |

| Control | Majority or full control | Majority control post-acquisition |

| Investment Horizon | 4-7 years | 5-10 years |

| Risk Profile | Moderate to high | Higher risk, founder-dependent |

| Return Potential | 15-25% IRR typical | 20-30% IRR potential |

| Management Involvement | Hands-on through portfolio teams | Founder-led, active operator |

| Deal Flow | Competitive, sourced from networks | Founder-driven sourcing, niche |

| Liquidity | Exit via sale or IPO | Exit after business growth or sale |

Introduction to Private Equity and Search Funds

Private equity involves pooled capital investments in private companies, aiming for value creation through operational improvements and strategic growth to achieve high returns. Search funds represent an entrepreneurial investment model where investors back individuals or teams to identify, acquire, and operate a single promising business, often targeting smaller, under-the-radar firms. Both offer distinct risk profiles and investment horizons, attracting investors based on their appetite for scale, control, and hands-on management opportunities.

Key Differences Between Private Equity and Search Funds

Private equity typically involves large-scale investments in established companies with the goal of improving operations and achieving significant financial returns, while search funds focus on acquiring a single, often smaller, company led by an entrepreneur-operator. Private equity firms deploy substantial capital from institutional investors, emphasizing diversified portfolios and strategic exits, whereas search funds rely on individual or small group investors supporting the entrepreneur's search and acquisition process. The key differences lie in investment size, management involvement, risk profiles, and the operational control exercised post-investment.

Investment Structures Explained

Private equity investments typically involve pooled capital from multiple investors managed by a firm that acquires controlling stakes in established companies to drive growth or operational improvements. Search funds, in contrast, are investment vehicles where entrepreneurs raise initial capital to locate, acquire, and actively manage a single company, often involving direct investor engagement and alignment. Understanding these structures clarifies risk profiles, governance models, and investor roles within each investment approach.

Risk and Return Profiles

Private equity investments typically offer higher return potential through diversified portfolios but involve substantial market and operational risks due to leverage and scale. Search funds provide concentrated investment exposure with the opportunity for outsized returns by acquiring and growing a single small to medium enterprise, though they carry significant founder and execution risks. Investors must weigh the broader, risk-mitigated returns of private equity against the concentrated, potentially higher reward yet risky nature of search funds for tailored portfolio strategies.

Capital Requirements for Investors

Private equity investments typically require substantial capital commitments, often ranging from $250,000 to several million dollars, limiting access to high-net-worth individuals and institutional investors. Search funds, by contrast, generally demand lower initial investments, starting around $100,000 to $200,000, appealing to smaller investors seeking direct control and involvement. The varying capital requirements significantly impact portfolio diversification and risk exposure strategies for investors choosing between these two asset classes.

Due Diligence Processes Compared

Due diligence in private equity investments involves comprehensive financial analysis, market assessment, and operational reviews to evaluate portfolio companies with established track records. Search funds prioritize due diligence on founder management capabilities, deal sourcing potential, and niche market opportunities, often with less historical data available. Private equity due diligence tends to be more formalized and resource-intensive, whereas search fund due diligence emphasizes adaptability and founder-led assessment.

Management Involvement in Investments

Private equity investments typically involve seasoned management teams with established operational frameworks, whereas search funds rely heavily on entrepreneurs or small management groups actively seeking and running a business. In private equity, management is often seasoned executives hired or retained to optimize portfolio company performance, while search fund entrepreneurs take on direct operational roles, driving growth and strategic decisions. This difference in management involvement impacts investment risk profiles, with search funds offering hands-on leadership but less operational track record compared to experienced private equity managers.

Exit Strategies and Timelines

Private equity investments typically pursue exit strategies within a 4-7 year horizon through mechanisms like initial public offerings (IPOs), strategic sales, or secondary buyouts, leveraging established portfolio companies' growth trajectories. In contrast, search funds emphasize longer investment timelines, often spanning 7-10 years, as entrepreneurs acquire and operate a single business before planning exits primarily via strategic sales or recapitalizations. The choice between private equity and search funds hinges on investors' preferences for liquidity timing, risk tolerance, and managerial involvement in the portfolio company.

Performance Trends and Market Data

Private equity typically demonstrates higher average returns with established funds achieving annualized IRRs of 15-20%, driven by diversified portfolios and mature management structures. Search funds, emerging as a niche alternative, have shown promising performance with average IRRs around 25%, fueled by hands-on leadership and targeted acquisitions of small to medium enterprises. Market data indicates increasing institutional interest in search funds due to lower entry valuations and potential for outsized returns despite higher operational involvement and risk.

Choosing the Right Approach for Your Portfolio

Private equity investments typically involve larger capital commitments and established firms targeting mature companies with proven cash flows, offering scalability and diversified risk. Search funds prioritize acquiring a single, often smaller business, enabling hands-on management and potentially higher growth through operational improvements. Selecting between private equity and search funds depends on your portfolio's risk tolerance, desired involvement level, and investment horizon.

Related Important Terms

Independent Sponsor Model

The Independent Sponsor model in Private Equity offers investors flexible deal-by-deal participation without the need for a permanent fund, contrasting with Search Funds that focus on acquiring and operating a single business over time. Independent Sponsors leverage proprietary deal sourcing and tailored capital structures, providing opportunities for diversified risk and direct management involvement compared to the concentrated equity stake typical in Search Funds.

Micro-PE (Micro Private Equity)

Micro-private equity offers targeted investments in small to mid-sized enterprises, providing higher control and operational involvement compared to search funds that primarily focus on acquiring a single business through extensive search and due diligence. Investors in micro-PE benefit from diversified portfolios and scalable growth opportunities, whereas search funds emphasize founder-led management and long-term value creation in specific companies.

ETA (Entrepreneurship Through Acquisition)

Private Equity firms typically invest larger capital in established companies aiming for significant scale and high financial returns, while Search Funds focus on Entrepreneurship Through Acquisition (ETA) by enabling individual entrepreneurs to acquire and operate smaller, often under-managed businesses. ETA-driven Search Funds offer personalized management and operational involvement, contrasting with Private Equity's preference for hands-off, portfolio-based investment strategies.

Continuation Funds

Continuation funds offer private equity investors a strategic option to extend the holding period of high-performing portfolio companies beyond traditional fund lifespans, optimizing value realization and liquidity timing. Unlike search funds, which focus on acquiring and operating a single company, continuation funds enable the transfer of mature assets into new investment vehicles, enhancing capital efficiency and long-term growth potential.

Fundless Sponsor

Fundless sponsors in private equity often provide flexible, capital-efficient investment solutions by sourcing deals without committed funds, contrasting with traditional search funds that raise dedicated capital upfront for acquisitions. This approach enables fundless sponsors to leverage extensive networks and deal expertise, maximizing returns while minimizing investor capital exposure.

Minority Recap

Minority recapitalizations in private equity typically involve established firms injecting capital to support growth or liquidity while maintaining control, whereas search funds focus on entrepreneurs acquiring and growing a single company with minority investors participating in the value creation. Minority recapitalizations in search funds offer investors exposure to highly entrepreneurial management teams and concentrated company ownership, balancing risk and potential returns differently than diversified private equity portfolios.

Add-On Acquisition Strategy

Private equity firms leverage add-on acquisition strategies to rapidly scale portfolio companies by acquiring complementary businesses, enhancing operational synergies, and increasing market share. Search funds typically pursue add-on acquisitions more selectively, focusing on smaller, niche targets to build value incrementally within a specific industry or geographic region.

Deferred Consideration

Deferred consideration in private equity often involves earn-outs or performance-based payments tied to financial metrics, aligning incentives for long-term value creation. In search funds, deferred consideration typically emerges as contingent payouts based on the acquired company's future cash flows or exit events, optimizing risk-sharing between the entrepreneur and investors.

Platform Acquisition

Private equity firms typically target larger platform acquisitions with established operations and scalable growth potential, leveraging significant capital for operational improvements and strategic expansions. Search funds, by contrast, focus on identifying smaller, niche companies as platform acquisitions, emphasizing entrepreneurial management and hands-on operational involvement to drive value creation.

Searcher-Investor Alignment

Search funds offer superior searcher-investor alignment by structuring incentives that closely tie the entrepreneur's success with investor returns, fostering long-term value creation. Private equity investments often involve less direct operational control by investors, potentially leading to misaligned priorities and shorter investment horizons.

Private Equity vs Search Funds for investment. Infographic

moneydiff.com

moneydiff.com