Systematic Investment Plans (SIPs) offer disciplined and regular investment in mutual funds, promoting wealth accumulation over time with the benefit of rupee cost averaging. Goal-based investing tailors asset allocation and investment strategies to achieve specific financial objectives within a defined timeframe, enhancing the relevance and effectiveness of portfolio management. Choosing between SIP and goal-based investing depends on individual risk tolerance, investment horizon, and clarity of financial goals, with many investors benefiting from integrating both approaches for optimized wealth creation.

Table of Comparison

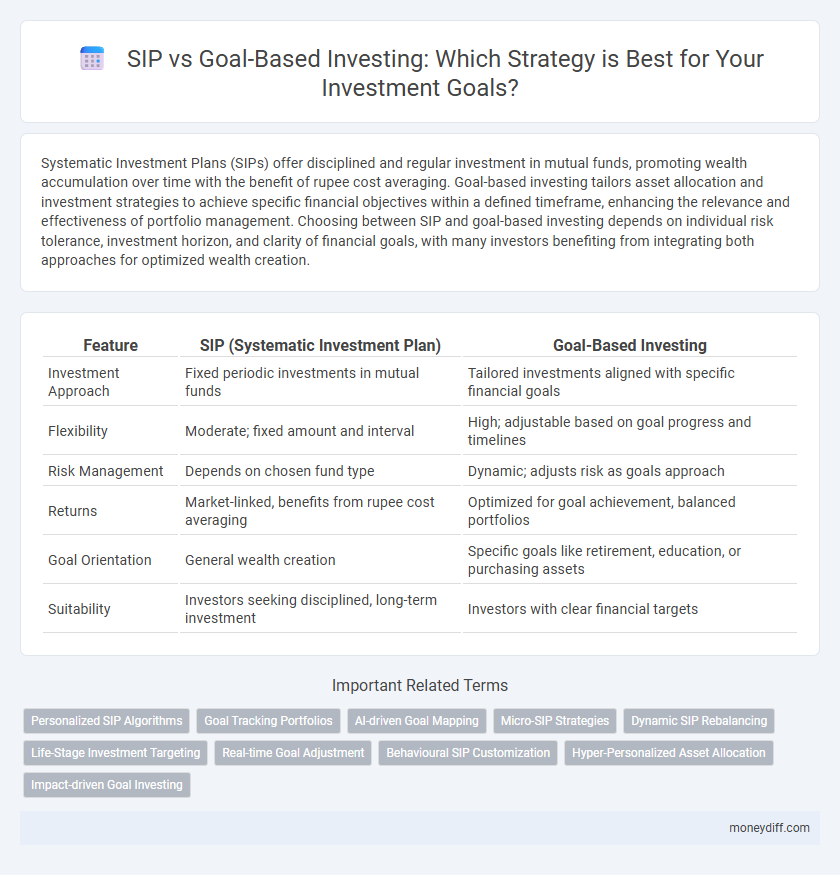

| Feature | SIP (Systematic Investment Plan) | Goal-Based Investing |

|---|---|---|

| Investment Approach | Fixed periodic investments in mutual funds | Tailored investments aligned with specific financial goals |

| Flexibility | Moderate; fixed amount and interval | High; adjustable based on goal progress and timelines |

| Risk Management | Depends on chosen fund type | Dynamic; adjusts risk as goals approach |

| Returns | Market-linked, benefits from rupee cost averaging | Optimized for goal achievement, balanced portfolios |

| Goal Orientation | General wealth creation | Specific goals like retirement, education, or purchasing assets |

| Suitability | Investors seeking disciplined, long-term investment | Investors with clear financial targets |

Understanding SIP and Goal-Based Investing

Systematic Investment Plans (SIP) enable disciplined, periodic investments in mutual funds, promoting rupee cost averaging and wealth accumulation over time. Goal-Based Investing aligns investment strategies with specific financial objectives, optimizing asset allocation to meet targeted timelines and risk profiles. Understanding the differences helps investors choose between consistent SIP contributions and flexible, goal-oriented planning for better financial outcomes.

Key Differences Between SIP and Goal-Based Investing

Systematic Investment Plan (SIP) involves regular, fixed investments in mutual funds focusing on rupee cost averaging and disciplined investing, whereas Goal-Based Investing customizes asset allocation based on specific financial objectives like buying a house or retirement. SIP prioritizes consistent contributions over time without specific target timelines, while Goal-Based Investing adjusts risk and investment strategy to meet defined goals within set periods. The key difference lies in SIP's methodical approach to market volatility versus Goal-Based Investing's personalized strategy aligned with investor-defined outcomes.

Benefits of SIP in Wealth Creation

Systematic Investment Plans (SIP) enable disciplined, regular investments that harness the power of compounding to accelerate wealth creation over time. SIPs offer rupee cost averaging, reducing the impact of market volatility and providing a balanced approach to long-term portfolio growth. This method ensures consistent asset accumulation, making it ideal for investors aiming at structured, gradual wealth enhancement aligned with financial goals.

Advantages of Goal-Based Investing

Goal-based investing aligns investment strategies with specific financial objectives, enhancing risk management and portfolio customization. It facilitates disciplined saving by setting clear targets, boosting investor motivation and clarity. This method improves asset allocation over time, optimizing returns tailored to individual goals rather than generic benchmarks.

Risk Factors in SIP vs Goal-Based Strategies

Systematic Investment Plans (SIPs) primarily expose investors to market volatility and interest rate fluctuations, influencing returns based on periodic investments in mutual funds. Goal-based investing incorporates personalized risk tolerance and time horizons, allowing diversified asset allocation to mitigate potential losses and align investment risks with specific financial objectives. Understanding risk factors in SIPs versus goal-based strategies enables investors to balance market uncertainties against targeted investment outcomes effectively.

Customization: SIP Plans vs Goal-Oriented Portfolios

Systematic Investment Plans (SIP) offer flexibility through fixed periodic investments, allowing investors to build wealth gradually regardless of market conditions. Goal-based investing customizes portfolios specifically to individual financial objectives, time horizons, and risk tolerance, enabling targeted asset allocation and periodic adjustments. While SIPs emphasize disciplined saving, goal-oriented portfolios prioritize aligning investments directly with personal milestones like retirement or education funding.

Aligning Investments to Financial Goals

Systematic Investment Plans (SIPs) offer a disciplined approach to investing by enabling regular contributions regardless of market conditions, promoting wealth accumulation over time. Goal-based investing prioritizes tailoring investment strategies to specific financial objectives, such as retirement, education, or buying a home, ensuring asset allocation aligns with the timeline and risk tolerance. Aligning investments to financial goals enhances portfolio efficiency, minimizes unnecessary risks, and increases the likelihood of achieving targeted outcomes.

Which Approach Offers Better Flexibility?

SIP (Systematic Investment Plan) offers consistent investment discipline but may lack the adaptability to adjust contributions or withdrawal timelines frequently. Goal-based investing provides greater flexibility by allowing investors to tailor portfolios according to specific financial objectives, risk tolerance, and changing life circumstances. This adaptability makes goal-based investing more suitable for dynamic financial planning and reacting to evolving market conditions.

Performance Tracking: SIP vs Goal-Based Investing

Systematic Investment Plans (SIP) offer consistent performance tracking through periodic investments and regular portfolio reviews, enabling investors to monitor returns against market benchmarks easily. Goal-Based Investing emphasizes aligning portfolio performance with specific financial objectives and time horizons, allowing for customized progress tracking and adjustments based on goal achievement metrics. Comparing both, SIP provides a disciplined approach with measurable returns, while Goal-Based Investing focuses on outcome-oriented performance evaluation tailored to individual investor targets.

Choosing the Right Investment Approach for You

Systematic Investment Plans (SIP) offer disciplined, regular contributions ideal for long-term wealth accumulation, leveraging rupee cost averaging to reduce market volatility impact. Goal-based investing prioritizes aligning investments with specific financial objectives, optimizing asset allocation and risk tolerance to ensure targets are achievable within set timelines. Selecting the right approach depends on your financial goals, risk appetite, and investment horizon, balancing consistency with tailored strategy for maximum returns.

Related Important Terms

Personalized SIP Algorithms

Personalized SIP algorithms tailor systematic investment plans to individual financial goals, risk tolerance, and time horizons, enhancing portfolio optimization compared to traditional SIP approaches. Goal-based investing leverages these algorithms to dynamically adjust contributions and asset allocation, ensuring alignment with evolving investment objectives for higher efficiency and targeted wealth accumulation.

Goal Tracking Portfolios

Goal-Based Investing prioritizes personalized goal tracking portfolios that align investments with specific financial milestones, enhancing commitment and measurable progress. Unlike traditional SIPs, which focus on regular contributions regardless of objectives, goal tracking portfolios dynamically adjust asset allocation to optimize returns and minimize risk based on the investor's timeline and target.

AI-driven Goal Mapping

AI-driven goal mapping enhances goal-based investing by tailoring portfolios to individual financial objectives and risk profiles, optimizing asset allocation dynamically over time. Unlike traditional SIP, which emphasizes fixed periodic investments, this approach leverages machine learning algorithms to adjust contributions and strategies, maximizing returns aligned with specific investment goals.

Micro-SIP Strategies

Micro-SIP strategies enable investors to start systematic investment plans with minimal amounts, democratizing access to mutual funds and fostering disciplined savings aligned with realistic financial goals. Unlike traditional Goal-Based Investing that sets rigid targets, Micro-SIP offers flexible, low-capital entry points optimizing compound growth potential while reducing market timing risks.

Dynamic SIP Rebalancing

Dynamic SIP Rebalancing optimizes Systematic Investment Plans by adjusting asset allocation based on market conditions and goal progress, enhancing returns while managing risk. This approach outperforms traditional static SIP methods and aligns closely with Goal-Based Investing principles to achieve specific financial objectives efficiently.

Life-Stage Investment Targeting

Life-stage investment targeting through SIP (Systematic Investment Plan) offers disciplined, periodic investments that adjust risk according to an investor's age and financial goals. Goal-based investing prioritizes specific aims like buying a house or retirement, customizing asset allocation to meet these targets within defined timeframes.

Real-time Goal Adjustment

SIP offers disciplined, periodic investments, while goal-based investing allows real-time goal adjustment, enabling investors to modify contributions and asset allocations as financial objectives or market conditions change. Real-time goal adjustment enhances flexibility and alignment with dynamic personal goals, optimizing long-term wealth accumulation.

Behavioural SIP Customization

Behavioral SIP customization enhances goal-based investing by tailoring systematic investment plans according to individual risk tolerance, spending habits, and financial goals, optimizing investment outcomes through personalized asset allocation. This approach reduces impulsive decisions and aligns investments with long-term objectives, improving consistency and portfolio resilience in volatile markets.

Hyper-Personalized Asset Allocation

Hyper-personalized asset allocation in SIP (Systematic Investment Plan) allows investors to tailor contributions based on individual financial goals, risk tolerance, and time horizon, enhancing portfolio efficiency compared to generic goal-based investing. This approach leverages data-driven insights and dynamic adjustments, optimizing asset distribution to meet specific targets while minimizing market volatility impact.

Impact-driven Goal Investing

Impact-driven Goal Investing prioritizes aligning investments with specific social or environmental objectives, ensuring that portfolio allocations directly contribute to measurable positive outcomes while pursuing financial returns. Unlike traditional SIPs that focus primarily on systematic market exposure and wealth accumulation, impact-driven strategies integrate ESG criteria and stakeholder values to achieve purposeful, goal-oriented growth.

SIP vs Goal-Based Investing for investment. Infographic

moneydiff.com

moneydiff.com