Investing in stocks offers high liquidity and the potential for rapid growth, allowing easy portfolio diversification and access to global markets. Fractional real estate provides tangible asset ownership with steady income through rental yields and usually less volatility compared to stocks. Both options present unique risk profiles and returns, making them complementary choices based on individual investment goals and risk tolerance.

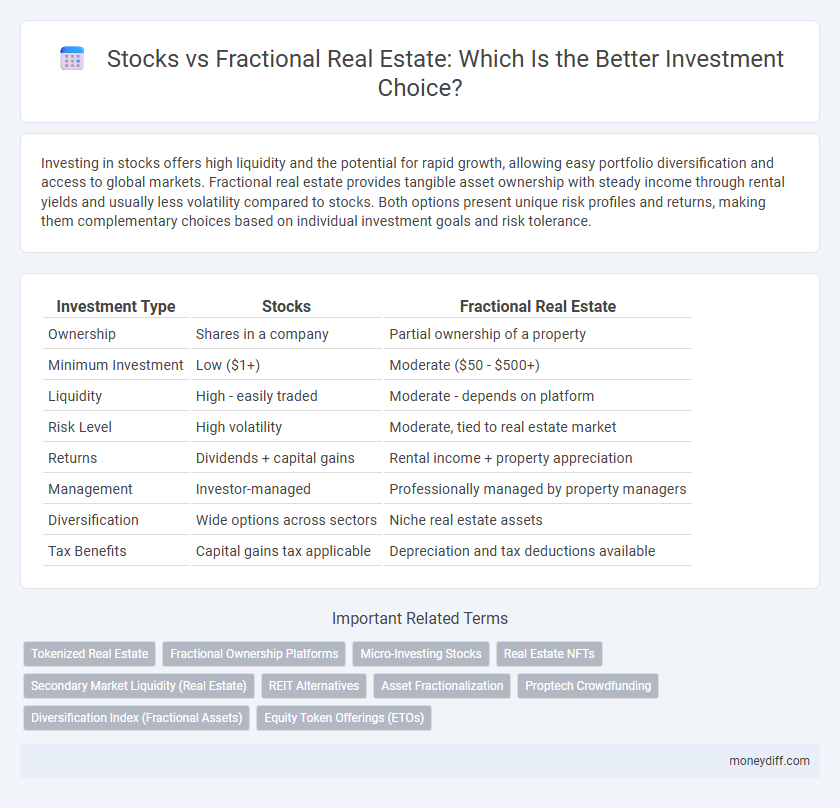

Table of Comparison

| Investment Type | Stocks | Fractional Real Estate |

|---|---|---|

| Ownership | Shares in a company | Partial ownership of a property |

| Minimum Investment | Low ($1+) | Moderate ($50 - $500+) |

| Liquidity | High - easily traded | Moderate - depends on platform |

| Risk Level | High volatility | Moderate, tied to real estate market |

| Returns | Dividends + capital gains | Rental income + property appreciation |

| Management | Investor-managed | Professionally managed by property managers |

| Diversification | Wide options across sectors | Niche real estate assets |

| Tax Benefits | Capital gains tax applicable | Depreciation and tax deductions available |

Introduction to Stocks and Fractional Real Estate Investments

Stocks offer direct ownership in publicly traded companies, providing liquidity and potential for capital appreciation through market price fluctuations and dividends. Fractional real estate investments allow individuals to own a percentage of physical property, combining real estate's tangible asset benefits with lower capital requirements and diversified risk exposure. Both investment types present unique advantages: stocks enable easy portfolio diversification and quick transactions, while fractional real estate provides stable income streams and portfolio inflation hedging.

Understanding Stocks: How Equity Markets Work

Stocks represent ownership shares in publicly traded companies, allowing investors to gain proportional equity and potential dividends based on company performance. Equity markets operate through exchanges like the NYSE and NASDAQ, where shares are bought and sold in real-time, driven by supply, demand, and market sentiment. Understanding market capitalization, price-to-earnings ratios, and dividend yields is essential for evaluating stock investment opportunities compared to fractional real estate options.

What is Fractional Real Estate Investing?

Fractional real estate investing allows individuals to purchase a share of a high-value property, enabling access to real estate markets with lower capital compared to buying whole properties. Unlike traditional stock investments, fractional real estate provides tangible asset backing and potential for rental income along with capital appreciation. Platforms offering fractional real estate make diversification possible by spreading investments across multiple properties, reducing risk tied to any single asset.

Comparing Risk Profiles: Stocks vs Fractional Real Estate

Stocks typically exhibit higher volatility and market risk due to fluctuations in market sentiment, economic indicators, and corporate performance. Fractional real estate investments generally offer lower volatility and a more stable income stream linked to property values and rental yields, though they carry risks like illiquidity and real estate market downturns. Diversifying between stocks and fractional real estate can balance risk exposure, blending growth potential with asset-backed stability.

Liquidity and Accessibility: Which Investment Wins?

Stocks offer superior liquidity, allowing investors to buy and sell shares instantly on public exchanges, which contrasts with fractional real estate investments that often require longer periods to liquidate due to market conditions and transaction complexities. Accessibility favors stocks as well, given lower entry costs and no need for property management, making it easier for investors to diversify their portfolios quickly. Fractional real estate appeals to those looking for tangible asset security but may sacrifice liquidity and ease of access compared to stock investments.

Potential Returns: Stocks Compared to Fractional Real Estate

Stocks offer higher liquidity and the potential for rapid capital gains driven by market volatility and corporate growth, often yielding average annual returns between 7% and 10%. Fractional real estate investments typically provide more stable, long-term returns through rental income and property appreciation, averaging around 6% to 8% annually but with lower market risk. The choice between stocks and fractional real estate depends on an investor's risk tolerance, desired liquidity, and investment horizon, with stocks favoring growth potential and fractional real estate emphasizing steady income.

Diversification Opportunities in Both Assets

Stocks offer diversification through access to various sectors, industries, and geographies, enabling investors to spread risk across multiple companies and markets. Fractional real estate allows diversification within the property market by investing in different locations and types of real estate assets, such as residential, commercial, or industrial properties. Combining stocks with fractional real estate can enhance portfolio diversification, balancing market volatility and providing exposure to both equity growth and tangible asset value.

Costs, Fees, and Tax Considerations

Stocks typically incur brokerage fees averaging 0.5% to 1.0% per trade, with dividend taxes ranging from 15% to 30% depending on investor status, while fractional real estate investments often charge platform fees between 0.5% and 2% annually plus property management costs. Real estate fractional ownership can offer depreciation benefits and capital gains tax deferral through 1031 exchanges, which are not available for stock investors. Evaluating the total cost of ownership, including transaction fees, ongoing expenses, and tax implications, is essential for optimizing investment returns in either asset class.

Investor Suitability: Which Option Fits Your Goals?

Stocks offer high liquidity and potential for rapid growth, making them suitable for investors seeking short-term gains and active portfolio management. Fractional real estate provides stable, long-term income through property appreciation and rental yields, fitting investors focused on passive income and diversification. Evaluating risk tolerance, investment horizon, and income needs helps determine whether stocks or fractional real estate aligns better with individual financial goals.

Future Trends: Stocks and Fractional Real Estate Innovations

Stocks are increasingly integrated with AI-driven analytics, enabling more precise market predictions and personalized portfolio management. Fractional real estate investment platforms are adopting blockchain technology to enhance transparency, reduce transaction costs, and facilitate global access to property markets. These innovations indicate a convergence of technology improving liquidity and accessibility in both asset classes, shaping future investment landscapes.

Related Important Terms

Tokenized Real Estate

Tokenized real estate offers fractional investment opportunities with blockchain-enabled liquidity and reduced entry barriers compared to traditional stocks, allowing investors to own verifiable digital shares of valuable properties. This innovation enhances portfolio diversification by combining real asset stability with the ease of trading typical of stock markets.

Fractional Ownership Platforms

Fractional real estate ownership platforms enable investors to purchase partial shares of properties, offering diversified exposure and tangible asset backing compared to traditional stocks. These platforms reduce entry barriers with lower minimum investments and provide potential passive income through rental yields, distinguishing them from the volatility and liquidity of stock markets.

Micro-Investing Stocks

Micro-investing in stocks offers low entry costs and high liquidity, enabling investors to buy fractional shares of major companies with minimal capital. In contrast, fractional real estate investments provide exposure to tangible assets with potential passive income but generally require longer holding periods and have lower liquidity compared to stock micro-investments.

Real Estate NFTs

Real Estate NFTs offer investors fractional ownership in tangible properties through blockchain technology, providing liquidity and transparency that traditional stocks lack. Unlike stocks, which represent shares in a company, Real Estate NFTs directly tie investment value to physical assets, allowing diversification in real estate markets with lower entry barriers.

Secondary Market Liquidity (Real Estate)

Fractional real estate investments typically offer lower secondary market liquidity compared to stocks, as real estate shares often require longer holding periods and involve fewer buyers and sellers. Stocks benefit from vast, active exchanges enabling rapid trade execution and price transparency, making them more liquid for investors needing quick access to funds.

REIT Alternatives

Stocks offer liquidity and ease of trading, while fractional real estate through REIT alternatives provides diversified exposure to property markets with potential for steady income and lower volatility. REIT alternatives often feature stabilized cash flows from commercial assets, making them appealing for investors seeking real estate returns without direct property management.

Asset Fractionalization

Asset fractionalization enables investors to diversify portfolios by acquiring partial ownership in real estate through fractional shares, providing liquidity and lower entry costs compared to traditional whole-property investments. Stocks offer high liquidity and ease of trading, yet fractional real estate combines tangible asset security with potential for stable income streams and long-term appreciation.

Proptech Crowdfunding

Proptech crowdfunding enables investors to access fractional real estate opportunities, offering diversification and tangible asset backing alongside potential income streams. Compared to stocks, this approach reduces market volatility exposure while providing participation in high-growth real estate markets through digital platforms.

Diversification Index (Fractional Assets)

Fractional real estate offers a higher diversification index by allowing investors to hold small shares in multiple properties, reducing risk compared to traditional stock portfolios often concentrated in fewer sectors. This fractional asset approach enhances portfolio stability and can provide steady income streams, complementing the volatility typically seen in stock investments.

Equity Token Offerings (ETOs)

Equity Token Offerings (ETOs) enable investors to acquire fractional real estate assets through blockchain technology, providing enhanced liquidity and lower entry costs compared to traditional stock investments. Unlike stocks, ETOs offer direct ownership in real estate properties with transparent, programmable equity rights, attracting investors seeking diversified portfolios and innovative asset classes.

Stocks vs Fractional Real Estate for investment. Infographic

moneydiff.com

moneydiff.com