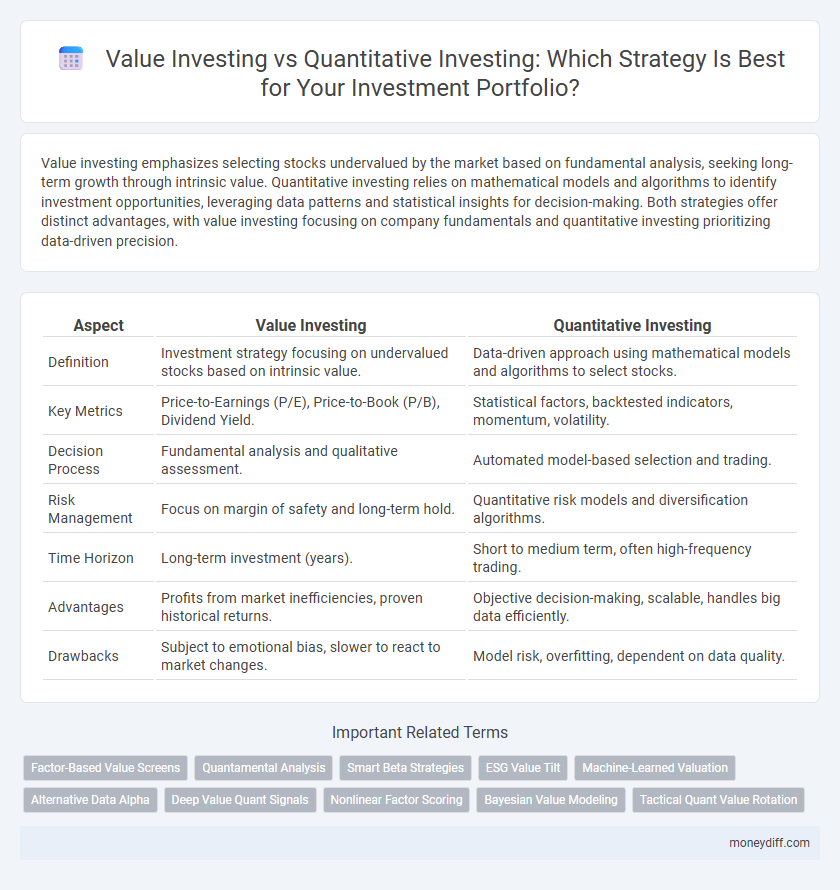

Value investing emphasizes selecting stocks undervalued by the market based on fundamental analysis, seeking long-term growth through intrinsic value. Quantitative investing relies on mathematical models and algorithms to identify investment opportunities, leveraging data patterns and statistical insights for decision-making. Both strategies offer distinct advantages, with value investing focusing on company fundamentals and quantitative investing prioritizing data-driven precision.

Table of Comparison

| Aspect | Value Investing | Quantitative Investing |

|---|---|---|

| Definition | Investment strategy focusing on undervalued stocks based on intrinsic value. | Data-driven approach using mathematical models and algorithms to select stocks. |

| Key Metrics | Price-to-Earnings (P/E), Price-to-Book (P/B), Dividend Yield. | Statistical factors, backtested indicators, momentum, volatility. |

| Decision Process | Fundamental analysis and qualitative assessment. | Automated model-based selection and trading. |

| Risk Management | Focus on margin of safety and long-term hold. | Quantitative risk models and diversification algorithms. |

| Time Horizon | Long-term investment (years). | Short to medium term, often high-frequency trading. |

| Advantages | Profits from market inefficiencies, proven historical returns. | Objective decision-making, scalable, handles big data efficiently. |

| Drawbacks | Subject to emotional bias, slower to react to market changes. | Model risk, overfitting, dependent on data quality. |

Introduction to Value Investing and Quantitative Investing

Value investing focuses on analyzing a company's fundamentals, such as earnings, cash flow, and book value, to identify undervalued stocks with long-term growth potential. Quantitative investing employs mathematical models and algorithms to evaluate large datasets, aiming to identify patterns and trends for systematic trading decisions. Both strategies offer distinct approaches: value investing relies on qualitative judgment and intrinsic value assessment, while quantitative investing emphasizes data-driven, automated processes.

Core Principles of Value Investing

Value investing centers on identifying undervalued stocks by analyzing fundamental financial metrics such as price-to-earnings ratio, book value, and intrinsic value to achieve long-term capital appreciation. This approach relies heavily on qualitative assessments of a company's management, competitive advantage, and market position, contrasting with quantitative investing's dependence on algorithm-driven data patterns and statistical models. By focusing on core principles such as margin of safety and the discipline of patience, value investing aims to minimize risk while maximizing returns through deep fundamental analysis.

Fundamentals of Quantitative Investing

Quantitative investing relies on data-driven models and statistical analysis to identify investment opportunities, focusing on metrics like earnings growth, price-to-earnings ratios, and volatility to optimize portfolio performance. This approach leverages algorithms and machine learning to analyze large datasets, minimizing human bias and improving risk management. Compared to value investing, which emphasizes intrinsic stock value and qualitative assessment, quantitative investing prioritizes empirical evidence and systematic execution for consistent returns.

Historical Performance: Value vs Quant

Historical performance data reveals that value investing, characterized by selecting undervalued stocks based on fundamental analysis, has delivered consistent long-term returns, particularly during market recoveries. Quantitative investing, leveraging algorithm-driven models and large datasets, often outperforms during volatile or short-term market phases by rapidly adapting to market signals. Empirical studies indicate that combining value metrics with quantitative strategies can enhance portfolio resilience and optimize risk-adjusted returns over multiple market cycles.

Risk Management Approaches Compared

Value investing emphasizes risk management through thorough fundamental analysis, identifying undervalued assets with strong financial health and long-term growth potential to minimize downside risk. Quantitative investing relies on algorithmic models and statistical methods to assess risk dynamically, incorporating large datasets and real-time market conditions to optimize portfolio diversification and limit exposure to volatility. Both approaches aim to control risk, but value investing prioritizes qualitative judgment while quantitative investing leverages data-driven precision for systematic risk assessment.

Key Metrics in Value and Quantitative Strategies

Value investing emphasizes key metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to identify undervalued stocks with strong fundamentals. Quantitative investing relies on data-driven models using factors like earnings momentum, volatility, and liquidity to optimize portfolio construction and risk management. Both strategies prioritize metrics that enhance prediction accuracy and portfolio returns but differ in their reliance on qualitative judgment versus algorithmic analysis.

Behavioral Biases: How Each Approach Mitigates Them

Value investing mitigates behavioral biases by focusing on intrinsic company fundamentals, encouraging disciplined analysis over emotional decision-making, thereby reducing overconfidence and herd mentality. Quantitative investing addresses biases through algorithm-driven models that systematically process vast datasets, minimizing human errors and emotional influences such as loss aversion and confirmation bias. Both approaches promote rational investment choices but differ in their methods of overcoming psychological pitfalls inherent to market behavior.

Tools and Technologies Utilized in Each Strategy

Value investing relies heavily on fundamental analysis tools such as financial statement software, discounted cash flow calculators, and qualitative assessment frameworks to identify undervalued stocks. Quantitative investing utilizes advanced technologies including algorithmic trading platforms, machine learning models, and big data analytics to systematically analyze vast datasets and execute trades. Each strategy demands distinct technological expertise, with value investing focusing on qualitative insights and quantitative investing emphasizing computational power and statistical rigor.

Pros and Cons of Value and Quantitative Investing

Value investing emphasizes thorough fundamental analysis to identify undervalued stocks with strong long-term potential, offering the advantage of investing based on intrinsic company value but risks misjudging market sentiments and enduring prolonged periods of underperformance. Quantitative investing utilizes mathematical models and algorithms to analyze large datasets for pattern recognition and diversification, enabling faster, data-driven decisions but depends heavily on the accuracy of models and may overlook qualitative factors. Both strategies present unique pros and cons, where value investing offers depth and insight but slower adaptability, while quantitative investing provides speed and scalability alongside model risk and potential overfitting.

Which Approach Suits Your Investment Goals?

Value investing focuses on selecting undervalued stocks based on fundamental analysis and intrinsic value assessment, making it suitable for long-term investors seeking stable growth. Quantitative investing relies on algorithm-driven models and statistical data to identify patterns and execute trades, appealing to investors prioritizing speed, diversification, and data-backed decisions. Choosing between these approaches depends on your risk tolerance, investment horizon, and preference for manual analysis versus automated strategies.

Related Important Terms

Factor-Based Value Screens

Factor-based value screens leverage financial metrics such as price-to-earnings and price-to-book ratios to identify undervalued stocks, forming the core of value investing strategies aimed at long-term capital appreciation. Quantitative investing incorporates these value factors into algorithm-driven models that systematically select securities, optimizing portfolio construction through data-driven factor analysis and risk control.

Quantamental Analysis

Quantamental analysis combines quantitative data models with qualitative insights to enhance investment decisions, blending the systematic rigor of quantitative investing with the fundamental strengths of value investing. This hybrid approach leverages statistical algorithms and financial statement analysis to identify undervalued stocks with strong growth potential and reduced risk exposure.

Smart Beta Strategies

Smart Beta strategies blend Value Investing's focus on undervalued assets with Quantitative Investing's data-driven models, aiming to capture market inefficiencies through systematic factor exposure. By targeting factors such as value, momentum, and quality, Smart Beta enhances portfolio returns while managing risk more effectively than traditional market-cap-weighted approaches.

ESG Value Tilt

Value investing emphasizes selecting undervalued stocks with strong ESG metrics to achieve sustainable long-term growth, while quantitative investing leverages algorithms to systematically identify ESG value tilt opportunities across diverse portfolios, enhancing risk-adjusted returns. Integrating ESG factors into both strategies aligns investments with ethical standards and market resilience, attracting socially conscious investors seeking consistent alpha generation.

Machine-Learned Valuation

Machine-learned valuation integrates advanced algorithms and large datasets to optimize investment decisions, contrasting traditional value investing's reliance on fundamental financial metrics and qualitative analysis. Quantitative investing leveraging machine learning enhances predictive accuracy by identifying complex patterns and market inefficiencies that human analysts may overlook.

Alternative Data Alpha

Value investing relies on fundamental analysis to identify undervalued stocks with strong financial metrics, while quantitative investing leverages algorithms and alternative data alpha, such as social media sentiment and satellite imagery, to uncover non-traditional market insights. Incorporating alternative data alpha enhances quantitative strategies by providing unique signals that traditional value metrics may miss, driving more informed investment decisions.

Deep Value Quant Signals

Deep value quant signals leverage algorithmic analysis of financial metrics such as low price-to-book ratios, high earnings yield, and strong cash flow to identify undervalued stocks with high potential returns. This quantitative approach enhances traditional value investing by systematically uncovering hidden opportunities within vast datasets, optimizing portfolio performance through data-driven decision-making.

Nonlinear Factor Scoring

Value investing emphasizes fundamental analysis to identify undervalued securities based on intrinsic financial metrics, while quantitative investing leverages algorithms and data-driven models to score factors nonlinearly, capturing complex patterns in market behavior. Nonlinear factor scoring enhances portfolio construction by integrating multiple variables that may interact in unpredictable ways, improving prediction accuracy and risk management over traditional linear models.

Bayesian Value Modeling

Bayesian Value Modeling integrates probabilistic reasoning with traditional value investing, offering dynamic adjustments to intrinsic value estimates based on new data. This approach contrasts with quantitative investing's reliance on fixed algorithms by incorporating Bayesian inference to manage uncertainty and enhance decision-making accuracy in stock selection.

Tactical Quant Value Rotation

Tactical Quant Value Rotation combines the fundamental principles of value investing with quantitative models to identify undervalued stocks exhibiting strong financial metrics such as low price-to-earnings ratios and high return on equity. This investment strategy uses algorithmic analysis to systematically rotate portfolios toward sectors or stocks demonstrating superior value signals, aiming to enhance returns while managing risk through disciplined, data-driven asset allocation.

Value Investing vs Quantitative Investing for investment. Infographic

moneydiff.com

moneydiff.com