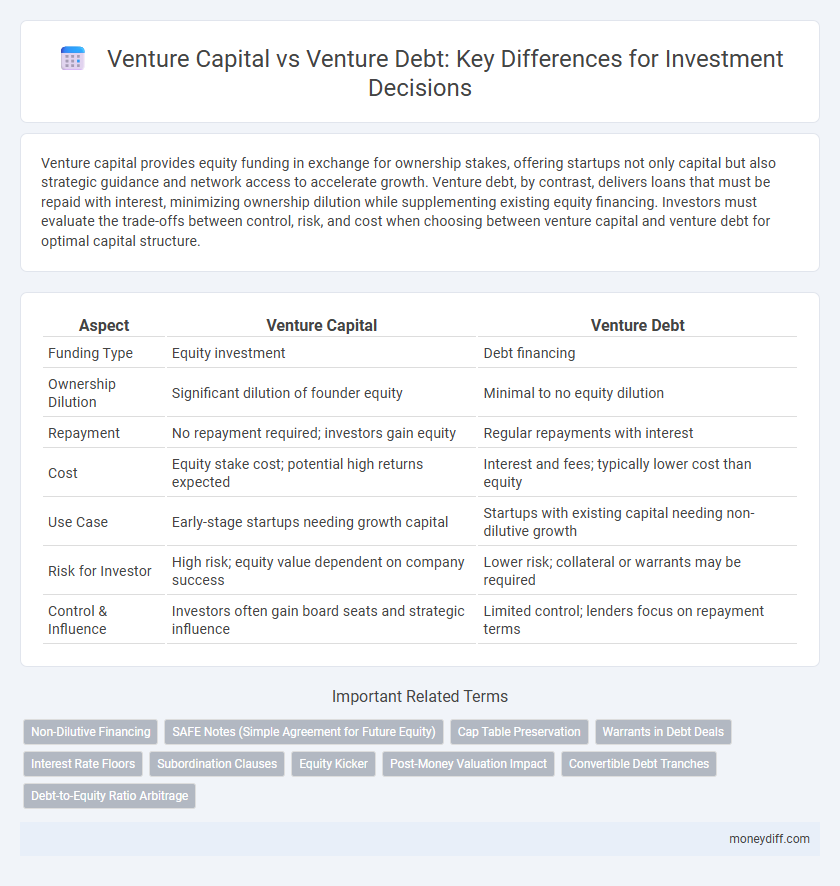

Venture capital provides equity funding in exchange for ownership stakes, offering startups not only capital but also strategic guidance and network access to accelerate growth. Venture debt, by contrast, delivers loans that must be repaid with interest, minimizing ownership dilution while supplementing existing equity financing. Investors must evaluate the trade-offs between control, risk, and cost when choosing between venture capital and venture debt for optimal capital structure.

Table of Comparison

| Aspect | Venture Capital | Venture Debt |

|---|---|---|

| Funding Type | Equity investment | Debt financing |

| Ownership Dilution | Significant dilution of founder equity | Minimal to no equity dilution |

| Repayment | No repayment required; investors gain equity | Regular repayments with interest |

| Cost | Equity stake cost; potential high returns expected | Interest and fees; typically lower cost than equity |

| Use Case | Early-stage startups needing growth capital | Startups with existing capital needing non-dilutive growth |

| Risk for Investor | High risk; equity value dependent on company success | Lower risk; collateral or warrants may be required |

| Control & Influence | Investors often gain board seats and strategic influence | Limited control; lenders focus on repayment terms |

Understanding Venture Capital: An Overview

Venture capital involves equity financing where investors provide capital to startups in exchange for ownership stakes, often focusing on high-growth potential companies in technology and innovation sectors. This type of investment typically includes active involvement from venture capitalists, offering guidance, mentorship, and access to networks to support business growth. Understanding venture capital requires recognizing its role in fueling early-stage development while balancing the dilution of founders' ownership and the expectation of substantial returns.

What is Venture Debt? Key Features Explained

Venture debt is a type of financing provided to early-stage, high-growth startups that complements equity funding by offering capital without significant dilution. Key features include fixed interest rates, warrants or rights to purchase equity, and shorter repayment terms compared to traditional bank loans. This financing option helps startups extend their runway, conserve equity, and achieve milestones before the next equity round.

Venture Capital vs Venture Debt: Core Differences

Venture capital involves equity investment where investors acquire ownership stakes in startups, aiming for high returns through company growth and eventual exit. Venture debt is a form of debt financing that provides startups with capital without diluting equity, often requiring regular repayments and warrants as compensation. The core difference lies in ownership dilution and risk: venture capital dilutes ownership with higher risk exposure, while venture debt preserves equity but imposes financial obligations.

Ideal Business Stages for Venture Capital and Venture Debt

Venture capital is ideal for early-stage startups with high growth potential seeking equity funding to scale operations and develop products, typically during seed to Series A rounds. Venture debt suits more mature companies with steady revenue streams and established business models, often post-Series A or B, looking for non-dilutive capital to extend runway without sacrificing equity. Selecting between venture capital and venture debt depends on the company's growth stage, funding needs, and willingness to dilute ownership.

Pros and Cons of Venture Capital Investments

Venture capital investments provide startups with significant equity funding, allowing access to expertise and networks from experienced investors, which can accelerate growth. However, they often require owners to relinquish a substantial portion of control and ownership, potentially leading to dilution of founder equity. The long-term equity stake expectation and pressure for high returns can create significant strategic constraints for growing companies.

Advantages and Disadvantages of Venture Debt Financing

Venture debt financing offers startups access to capital without diluting equity, preserving ownership and control for founders compared to traditional venture capital. Its advantages include lower cost than equity financing and flexibility in use, while disadvantages involve the obligation of regular debt repayments, potential covenants, and the risk of default impacting future funding rounds. This financing option suits companies with predictable revenue streams but limited access to equity markets or those seeking to extend runway between equity raises.

Ownership Dilution: VC vs Venture Debt

Venture Capital involves equity financing that leads to significant ownership dilution as investors receive shares in exchange for their capital. Venture Debt, on the other hand, provides non-dilutive capital, allowing founders to retain majority ownership while leveraging debt instruments with fixed repayment terms. This distinction is critical for startups aiming to preserve equity control during early growth stages.

Risk Profiles in Venture Capital and Venture Debt

Venture capital involves higher risk as it requires equity investment in early-stage startups with uncertain revenue streams and potential for significant dilution. Venture debt offers a lower-risk alternative by providing loans secured by company assets or future revenues, minimizing ownership dilution but requiring consistent repayment regardless of business performance. Understanding these distinct risk profiles helps investors balance growth potential against financial stability and downside protection.

Choosing the Right Path: Strategic Considerations

Selecting between venture capital and venture debt hinges on a startup's growth stage, capital needs, and risk tolerance. Venture capital offers equity funding with strategic support and no repayment obligation but entails ownership dilution. Venture debt provides non-dilutive financing with fixed repayment terms, suitable for extending runway without relinquishing control but requires strong cash flow and creditworthiness.

Case Studies: Successful Companies Using VC and Venture Debt

Successful companies like Airbnb and Uber leveraged venture capital to accelerate growth through significant equity funding, enabling rapid market expansion and product development. In contrast, firms such as WeWork and Peloton utilized venture debt to extend their runway without diluting ownership, balancing operational costs while preparing for larger funding rounds. Case studies highlight venture capital's role in high-growth scalability and venture debt's strategic use for cash flow management in emerging businesses.

Related Important Terms

Non-Dilutive Financing

Venture debt provides startups with non-dilutive financing options that preserve equity while offering flexible repayment terms typically ranging from 12 to 36 months. Unlike venture capital, which involves equity stakes and potential ownership dilution, venture debt supplements growth capital without sacrificing control or triggering shareholder dilution events.

SAFE Notes (Simple Agreement for Future Equity)

Venture capital typically involves equity financing through instruments like SAFE notes, which convert to equity during future funding rounds, providing investors potential ownership without immediate repayment obligations. Venture debt offers non-dilutive funding secured by company assets or future revenue, often complementing equity by extending runway while preserving ownership stakes.

Cap Table Preservation

Venture capital dilutes ownership by exchanging equity for funding, impacting cap table structure and investor control. Venture debt provides capital without significant equity dilution, preserving founders' ownership stakes and maintaining a cleaner cap table.

Warrants in Debt Deals

Venture debt often includes warrants, which provide lenders with equity upside potential alongside interest payments, enhancing returns without immediate equity dilution for startups. Unlike pure equity financing, these warrants serve as a hybrid instrument, balancing risk and reward by aligning investor incentives with company growth.

Interest Rate Floors

Venture debt often features interest rate floors that protect lenders against falling benchmark rates, typically ranging from 4% to 8%, ensuring minimum returns regardless of market fluctuations. In contrast, venture capital investments do not involve interest rate floors as they are equity-based, with returns driven by company growth rather than fixed interest payments.

Subordination Clauses

Subordination clauses in venture capital agreements generally prioritize investor claims during liquidation, offering higher security but diluting founder control. Venture debt often includes subordination terms placing lender claims behind senior debt yet ahead of equity, balancing risk while preserving founders' ownership.

Equity Kicker

Venture debt typically includes an equity kicker, allowing lenders to obtain warrants or options to purchase equity, aligning their returns with the startup's growth without immediate dilution for founders. This hybrid instrument complements venture capital by providing non-dilutive capital while offering upside potential tied to the company's valuation and performance.

Post-Money Valuation Impact

Venture capital typically dilutes ownership by exchanging equity for capital, directly impacting the post-money valuation through increased share count and investor stake. Venture debt provides non-dilutive financing, preserving ownership levels and resulting in a higher effective post-money valuation compared to equivalent equity raises.

Convertible Debt Tranches

Convertible debt tranches in venture capital provide startups with flexible funding that can convert into equity during future financing rounds, balancing risk for investors and preserving cash flow for companies. Venture debt, often structured with convertible features, offers debt capital with potential equity upside, reducing dilution compared to pure equity financing while delivering a hybrid risk-return profile.

Debt-to-Equity Ratio Arbitrage

Venture debt offers startups a way to optimize their capital structure by increasing leverage while minimizing equity dilution, effectively enhancing the debt-to-equity ratio arbitrage for investors. This allows companies to extend their runway and achieve growth milestones with less equity sacrifice compared to traditional venture capital funding.

Venture Capital vs Venture Debt for investment. Infographic

moneydiff.com

moneydiff.com