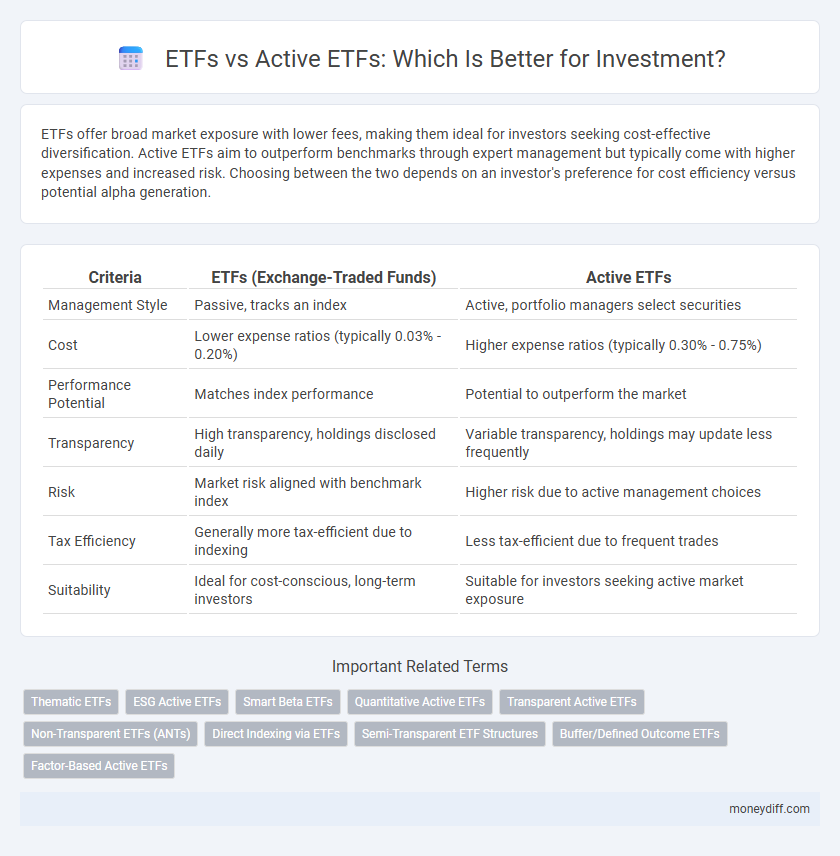

ETFs offer broad market exposure with lower fees, making them ideal for investors seeking cost-effective diversification. Active ETFs aim to outperform benchmarks through expert management but typically come with higher expenses and increased risk. Choosing between the two depends on an investor's preference for cost efficiency versus potential alpha generation.

Table of Comparison

| Criteria | ETFs (Exchange-Traded Funds) | Active ETFs |

|---|---|---|

| Management Style | Passive, tracks an index | Active, portfolio managers select securities |

| Cost | Lower expense ratios (typically 0.03% - 0.20%) | Higher expense ratios (typically 0.30% - 0.75%) |

| Performance Potential | Matches index performance | Potential to outperform the market |

| Transparency | High transparency, holdings disclosed daily | Variable transparency, holdings may update less frequently |

| Risk | Market risk aligned with benchmark index | Higher risk due to active management choices |

| Tax Efficiency | Generally more tax-efficient due to indexing | Less tax-efficient due to frequent trades |

| Suitability | Ideal for cost-conscious, long-term investors | Suitable for investors seeking active market exposure |

Understanding ETFs and Active ETFs

ETFs (Exchange-Traded Funds) offer investors broad market exposure with low expense ratios by tracking an index passively, representing a diversified portfolio of assets. Active ETFs differ by employing portfolio managers who actively select securities aiming to outperform benchmarks, which typically results in higher management fees and potential for greater returns. Understanding the key distinctions in cost structures, management styles, and performance goals between ETFs and Active ETFs helps investors align choices with their investment strategies and risk tolerance.

Key Differences Between ETFs and Active ETFs

ETFs (Exchange-Traded Funds) typically track a passive index, providing broad market exposure with lower management fees and predictable returns, while Active ETFs employ portfolio managers to select securities aiming to outperform benchmarks, resulting in higher fees and greater risk-return variability. Unlike traditional passive ETFs, Active ETFs offer flexibility to adjust holdings based on market conditions but may incur higher trading costs and tax implications due to more frequent portfolio rebalancing. Investors should consider their risk tolerance, cost sensitivity, and investment goals when choosing between the cost-efficiency and transparency of passive ETFs versus the potential for alpha generation and dynamic management found in Active ETFs.

Cost Comparison: ETFs vs Active ETFs

Exchange-traded funds (ETFs) typically offer lower expense ratios compared to active ETFs, as they passively track market indexes and require less management. Active ETFs involve higher costs due to frequent trading and professional management aimed at outperforming benchmarks. Investors seeking cost-efficiency often prefer traditional ETFs, while those prioritizing potential alpha may accept the premium fees of active ETFs.

Performance Analysis: Historical Returns

ETFs typically offer lower expense ratios and track broader market indices, resulting in consistent but market-mirroring historical returns. Active ETFs aim to outperform benchmarks through expert management, but their historical returns show greater variability and often higher fees. Performance analysis reveals that while some active ETFs have outperformed during specific market conditions, many underperform compared to passive ETFs over long-term periods.

Portfolio Diversification with ETFs and Active ETFs

ETFs provide broad portfolio diversification by tracking extensive market indexes, reducing individual asset risk through exposure to multiple sectors. Active ETFs combine diversification benefits with professional management, enabling dynamic adjustments based on market conditions to capture opportunities and mitigate risks. Investors seeking a balance of cost-efficiency and strategic asset allocation often consider both options for robust portfolio diversification.

Transparency and Holdings Disclosure

ETFs typically offer greater transparency by publishing their holdings daily, allowing investors to track assets and assess risk in real-time. Active ETFs may disclose holdings less frequently, often weekly or monthly, which can obscure portfolio changes and limit immediate insight. Investors seeking full transparency and timely data often prefer traditional ETFs for clearer visibility into underlying assets.

Liquidity Considerations for Investors

ETFs generally offer higher liquidity due to their passive management and broad market exposure, enabling investors to buy and sell shares swiftly at market prices. Active ETFs may exhibit lower liquidity because of narrower holdings and less frequent portfolio changes, potentially leading to wider bid-ask spreads and higher trading costs. Investors should evaluate liquidity metrics such as average daily trading volume and bid-ask spreads when choosing between ETFs and active ETFs to ensure efficient trade execution.

Tax Efficiency of ETFs vs Active ETFs

ETFs generally offer higher tax efficiency compared to Active ETFs due to their unique creation and redemption process, which minimizes capital gains distributions. Active ETFs, while allowing for professional management to potentially outperform the market, often incur higher capital gains taxes because of more frequent portfolio trading. Investors seeking to optimize after-tax returns may prefer traditional ETFs for their ability to limit taxable events.

Choosing the Right ETF Strategy

Choosing the right ETF strategy depends on your investment goals, risk tolerance, and market outlook. Passive ETFs typically offer lower fees and broad market exposure, making them ideal for long-term, cost-effective diversification. Active ETFs aim to outperform benchmarks through professional management, suitable for investors seeking potential alpha and are comfortable with higher costs and increased risk.

ETFs vs Active ETFs: Which Suits Your Investment Goals?

ETFs offer low-cost, passive exposure to broad market indices, ideal for investors seeking diversification and long-term growth with minimal fees. Active ETFs employ professional management to select securities aiming to outperform benchmarks, suitable for investors willing to accept higher costs and risks for potential alpha. Choosing between ETFs and Active ETFs depends on risk tolerance, investment horizon, and preference for market exposure versus active strategy flexibility.

Related Important Terms

Thematic ETFs

Thematic ETFs offer targeted exposure to specific sectors or trends, providing investors with a cost-effective and transparent alternative to actively managed ETFs, which rely on portfolio manager expertise to potentially outperform the market but often come with higher fees. Investors seeking focused thematic strategies should weigh the lower expense ratios and broad market accessibility of passive thematic ETFs against the potential for alpha generation in active thematic ETF management.

ESG Active ETFs

ESG Active ETFs offer a dynamic approach to sustainable investing by allowing portfolio managers to select and actively manage companies based on environmental, social, and governance criteria, potentially enhancing both impact and returns. Unlike passive ESG ETFs that track fixed indices, ESG Active ETFs provide flexibility in adjusting holdings in response to evolving sustainability trends and regulatory changes.

Smart Beta ETFs

Smart Beta ETFs combine the cost-efficiency and transparency of traditional ETFs with strategic, rules-based indexing that targets factors such as value, momentum, and volatility for enhanced risk-adjusted returns. Unlike actively managed ETFs, Smart Beta ETFs use systematic approaches to capture specific market inefficiencies while maintaining lower expense ratios and greater tax efficiency.

Quantitative Active ETFs

Quantitative Active ETFs leverage algorithm-driven strategies to dynamically adjust portfolio allocations, offering the potential for enhanced risk management and alpha generation compared to traditional passive ETFs. These ETFs utilize vast datasets and machine learning models to identify market inefficiencies, providing investors with a systematic yet flexible approach to active management.

Transparent Active ETFs

Transparent Active ETFs offer investors the benefits of traditional active management combined with the daily disclosure of holdings, enhancing transparency and trust compared to conventional active ETFs. These funds enable real-time insight into portfolio composition, allowing investors to assess risks and performance drivers more effectively while maintaining the potential for outperformance through expert asset selection.

Non-Transparent ETFs (ANTs)

Non-Transparent ETFs (ANTs) combine the low-cost, tax-efficient benefits of traditional ETFs with active management strategies, offering investors exposure to skilled portfolio managers without revealing holdings daily, which helps prevent front-running. These hybrid funds aim to optimize returns through active decision-making while maintaining the structural advantages of ETFs, making them a compelling choice for those seeking transparency control and potential alpha generation.

Direct Indexing via ETFs

Direct indexing via ETFs offers personalized portfolio customization by replicating a specific index's performance with tax-efficient advantages, unlike traditional active ETFs that rely on fund managers' stock selections. This approach enhances diversification and cost-effectiveness, providing investors with greater control and potential for optimized after-tax returns.

Semi-Transparent ETF Structures

Semi-transparent ETF structures blend features of both passive and active management by providing periodic disclosure of portfolio holdings, enhancing investor insight and market efficiency. These Semi-Transparent ETFs offer strategic flexibility and potential outperformance while maintaining a level of transparency that mitigates traditional active ETF information asymmetry.

Buffer/Defined Outcome ETFs

Buffer ETFs offer downside protection by limiting losses to a predetermined threshold while capping gains, appealing to risk-averse investors seeking defined outcomes in volatile markets. Active ETFs provide dynamic portfolio management with the potential for higher returns but involve greater risk and fees compared to the structured risk management seen in Buffer ETFs.

Factor-Based Active ETFs

Factor-based active ETFs combine systematic factor investing with active management to potentially enhance returns and manage risk more effectively than traditional passive ETFs. These ETFs leverage quantitative models to select securities based on factors like value, momentum, and quality, offering a dynamic alternative to purely passive ETF strategies.

ETFs vs Active ETFs for investment. Infographic

moneydiff.com

moneydiff.com