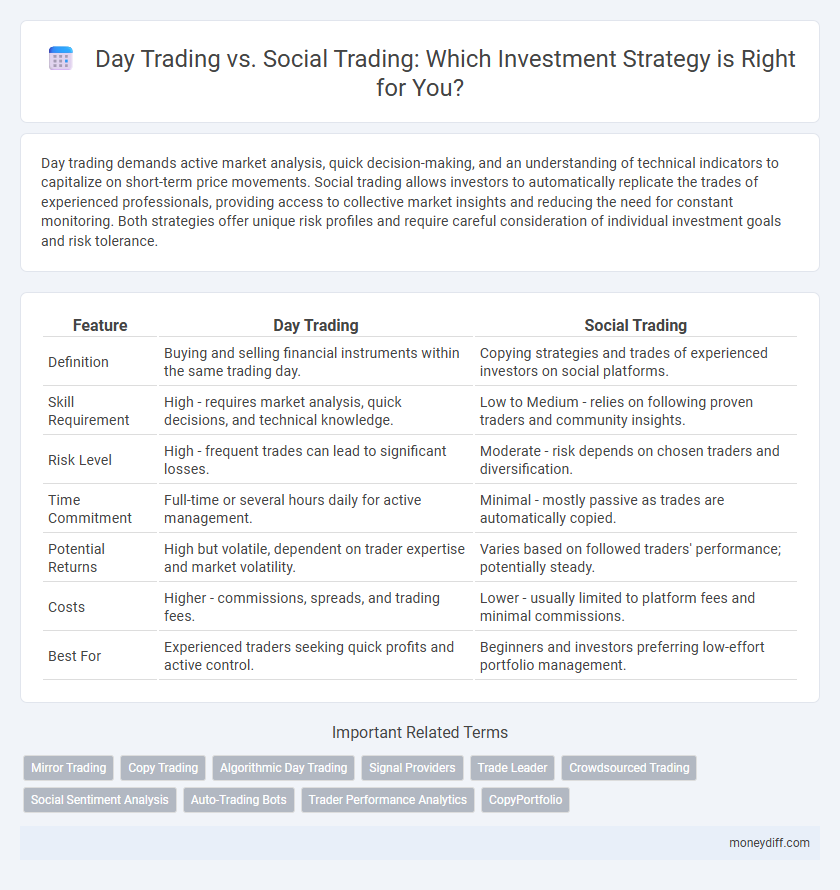

Day trading demands active market analysis, quick decision-making, and an understanding of technical indicators to capitalize on short-term price movements. Social trading allows investors to automatically replicate the trades of experienced professionals, providing access to collective market insights and reducing the need for constant monitoring. Both strategies offer unique risk profiles and require careful consideration of individual investment goals and risk tolerance.

Table of Comparison

| Feature | Day Trading | Social Trading |

|---|---|---|

| Definition | Buying and selling financial instruments within the same trading day. | Copying strategies and trades of experienced investors on social platforms. |

| Skill Requirement | High - requires market analysis, quick decisions, and technical knowledge. | Low to Medium - relies on following proven traders and community insights. |

| Risk Level | High - frequent trades can lead to significant losses. | Moderate - risk depends on chosen traders and diversification. |

| Time Commitment | Full-time or several hours daily for active management. | Minimal - mostly passive as trades are automatically copied. |

| Potential Returns | High but volatile, dependent on trader expertise and market volatility. | Varies based on followed traders' performance; potentially steady. |

| Costs | Higher - commissions, spreads, and trading fees. | Lower - usually limited to platform fees and minimal commissions. |

| Best For | Experienced traders seeking quick profits and active control. | Beginners and investors preferring low-effort portfolio management. |

Understanding Day Trading: Basics and Strategies

Day trading involves buying and selling financial instruments within the same trading day to capitalize on short-term market fluctuations, requiring quick decision-making and technical analysis skills. Key strategies include scalping, momentum trading, and swing trading, which rely on recognizing market patterns and utilizing tools like candlestick charts and volume indicators. Success in day trading demands strict risk management, including setting stop-loss orders and maintaining disciplined trade execution to minimize potential losses.

Social Trading Explained: How It Works

Social trading allows investors to replicate the trades of experienced traders by following their strategies on dedicated platforms, enabling real-time sharing of market insights and performance data. This investment approach leverages collective intelligence and transparency, helping users make informed decisions without requiring deep market expertise. By participating in social trading networks, investors benefit from community-driven analyses, automated trade copying, and reduced individual research efforts.

Key Differences Between Day Trading and Social Trading

Day trading involves actively buying and selling financial instruments within the same trading day, requiring strong market analysis skills and quick decision-making. Social trading allows investors to replicate the trades of experienced traders by following their profiles on platforms like eToro, promoting a more passive investment approach. Key differences include the level of personal involvement, risk management strategies, and the reliance on individual expertise versus community-driven insights.

Risk Levels: Comparing Day Trading and Social Trading

Day trading involves high risk due to rapid decision-making and market volatility, often leading to significant financial losses if not managed carefully. Social trading offers comparatively lower risk by allowing investors to follow and replicate expert traders' strategies, providing a sense of shared knowledge and reduced personal responsibility. However, both methods require thorough research and risk management as past performance is not always indicative of future results.

Required Skills for Success in Each Approach

Day trading demands advanced analytical skills, rapid decision-making, and a deep understanding of technical indicators to capitalize on short-term market movements effectively. Social trading requires strong social awareness, the ability to evaluate and follow expert traders' strategies, and proficiency in using social trading platforms for informed investment choices. Success in day trading hinges on individual discipline and market expertise, while social trading relies on community insights and collaborative learning.

Profit Potential: Day Trading Versus Social Trading

Day trading offers high profit potential through rapid buying and selling of securities, capitalizing on short-term market fluctuations with frequent trades throughout the day. Social trading enables investors to mimic strategies of experienced traders, potentially reducing risk but often yielding more moderate returns compared to the aggressive nature of day trading. Profitability in day trading depends on market volatility and trader skill, whereas social trading profits align closely with the performance of selected lead traders.

Time Commitment and Lifestyle Considerations

Day trading requires intense time commitment, often demanding several hours daily to monitor markets and execute trades, making it suitable for investors with flexible schedules and high risk tolerance. Social trading offers a more passive investment approach, allowing individuals to follow and replicate strategies from experienced traders, fitting seamlessly into busy lifestyles with limited time for market analysis. Choosing between these methods depends on one's availability and desired level of engagement in investment decisions.

Costs and Fees: What Investors Should Know

Day trading typically incurs higher costs due to frequent trades, including commissions, spreads, and potential platform fees, which can significantly reduce profits. Social trading often involves lower direct fees, but investors should be aware of performance fees, subscription costs, and potential profit-sharing arrangements with successful traders. Understanding these cost structures is crucial for investors to optimize returns and manage risks effectively in both investment strategies.

Choosing the Right Platform for Your Trading Style

Selecting the appropriate platform for day trading or social trading significantly impacts investment outcomes by aligning tools with your trading style and risk tolerance. Day trading platforms must offer high-speed executions, advanced charting features, and real-time market data for precise, rapid decisions. Social trading platforms emphasize community engagement, allowing investors to follow and replicate experienced traders' strategies, which benefits those seeking collaborative insights and less time-intensive management.

Which Is Best for You: Day Trading or Social Trading?

Day trading requires active market monitoring, rapid decision-making, and a deep understanding of technical analysis, making it suitable for experienced investors with high risk tolerance. Social trading allows investors to mirror strategies of successful traders, offering a more hands-off approach ideal for beginners or those seeking diversified portfolio management. Choosing between day trading and social trading depends on your investment goals, time availability, and appetite for risk.

Related Important Terms

Mirror Trading

Mirror trading allows investors to automatically replicate the trades of experienced day traders, enabling portfolio diversification without requiring in-depth market knowledge. This strategy combines real-time decision-making of day trading with the social aspect of copying expert strategies, offering a balanced approach to capitalizing on market volatility.

Copy Trading

Copy trading allows investors to replicate the trades of successful day traders, leveraging their expertise without requiring constant market analysis. This strategy offers a practical alternative to traditional day trading by minimizing risk through diversified follower portfolios and real-time trade synchronization.

Algorithmic Day Trading

Algorithmic day trading leverages advanced algorithms and real-time data analysis to execute high-frequency trades, optimizing profit margins by minimizing human error and emotional bias. In contrast, social trading relies on following and copying expert traders, which may introduce delays and less precision compared to the instantaneous execution capabilities of algorithmic strategies.

Signal Providers

Signal providers in day trading offer real-time, technical analysis-based trade alerts that require active decision-making and quick execution, targeting experienced investors seeking short-term gains. Social trading platforms aggregate these signals with community-driven insights and copy-trading features, enabling less experienced investors to mirror successful traders' strategies without extensive market knowledge.

Trade Leader

Trade leaders in social trading platforms provide valuable insights and real-time strategies, enabling investors to replicate successful trades without extensive market analysis. Unlike day trading, which requires constant market monitoring and quick decision-making, following trade leaders offers a more passive approach with potential for steady returns based on expert performance.

Crowdsourced Trading

Crowdsourced trading leverages the collective intelligence of a community, enabling investors to replicate successful day traders' strategies in real time, thereby reducing reliance on individual expertise and enhancing decision-making accuracy. This approach contrasts with traditional day trading by offering diversified insights and social validation, which can improve performance and mitigate risks through collaborative investment signals.

Social Sentiment Analysis

Social sentiment analysis leverages real-time data from social media platforms to gauge collective investor emotions and trends, providing day traders with actionable insights that traditional day trading strategies often overlook. By integrating social sentiment signals, investors can enhance decision-making accuracy, reduce risks, and better anticipate market movements compared to relying solely on technical charts and historical price patterns.

Auto-Trading Bots

Auto-trading bots enhance day trading by executing rapid, data-driven trades based on real-time market analysis, maximizing profit opportunities through speed and precision. In social trading, automated bots replicate strategies from experienced investors, allowing users to benefit from collective expertise while minimizing manual intervention and emotional decision-making.

Trader Performance Analytics

Day trading relies on individual trader performance analytics such as win rate, average return per trade, and risk-reward ratio to optimize decision-making and maximize profits. Social trading platforms enhance performance transparency by providing real-time analytics on top traders' strategies, consistency, and historic returns, enabling investors to follow and replicate successful trades.

CopyPortfolio

CopyPortfolio offers a strategic advantage in social trading by enabling investors to replicate diversified portfolios managed by experts, reducing the risks associated with day trading's high volatility and intensive time commitment. Utilizing CopyPortfolio allows for automated, data-driven investment decisions aligned with market trends, contrasting sharply with the speculative nature and rapid transaction frequency typical of day trading.

Day Trading vs Social Trading for investment. Infographic

moneydiff.com

moneydiff.com