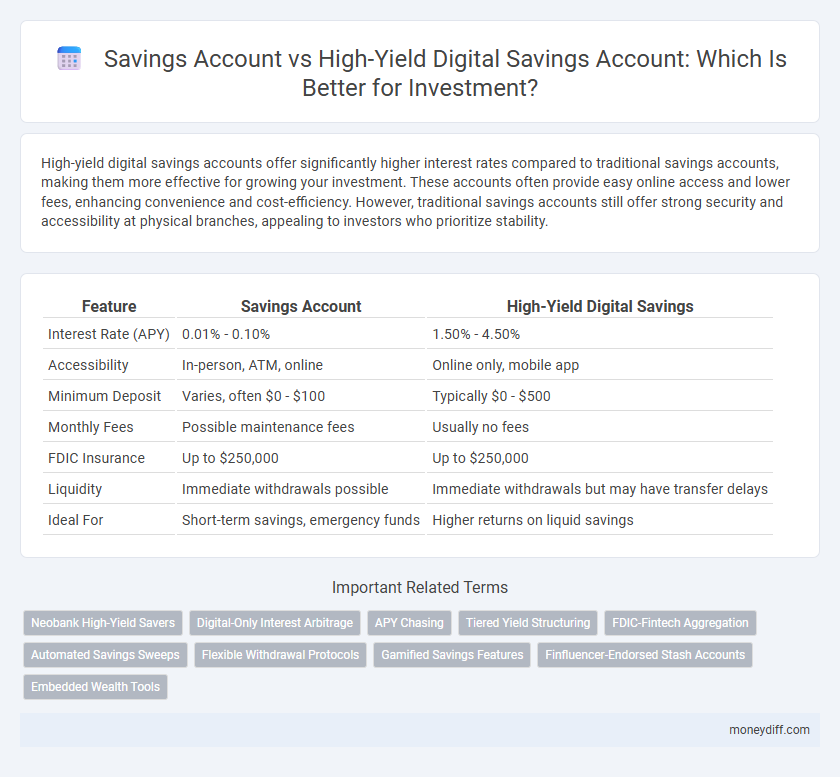

High-yield digital savings accounts offer significantly higher interest rates compared to traditional savings accounts, making them more effective for growing your investment. These accounts often provide easy online access and lower fees, enhancing convenience and cost-efficiency. However, traditional savings accounts still offer strong security and accessibility at physical branches, appealing to investors who prioritize stability.

Table of Comparison

| Feature | Savings Account | High-Yield Digital Savings |

|---|---|---|

| Interest Rate (APY) | 0.01% - 0.10% | 1.50% - 4.50% |

| Accessibility | In-person, ATM, online | Online only, mobile app |

| Minimum Deposit | Varies, often $0 - $100 | Typically $0 - $500 |

| Monthly Fees | Possible maintenance fees | Usually no fees |

| FDIC Insurance | Up to $250,000 | Up to $250,000 |

| Liquidity | Immediate withdrawals possible | Immediate withdrawals but may have transfer delays |

| Ideal For | Short-term savings, emergency funds | Higher returns on liquid savings |

Understanding Savings Accounts: Basics and Benefits

Savings accounts offer a secure way to store funds with easy access and government-backed protection, typically through FDIC insurance. They provide a low-risk option with modest interest rates, ideal for emergency funds or short-term savings goals. Understanding these basics helps investors weigh the trade-offs between stability and potential higher returns found in high-yield digital savings options.

What Are High-Yield Digital Savings Accounts?

High-yield digital savings accounts offer significantly higher interest rates compared to traditional savings accounts, often reaching 3-5% annual percentage yield (APY), leveraging online platforms with lower overhead costs. These accounts provide enhanced liquidity and easy access through mobile apps, making them attractive for investors seeking safety and growth without market risks. Unlike conventional banks, high-yield digital accounts are typically provided by online-only financial institutions insured by the FDIC, ensuring federal protection up to $250,000 per depositor.

Comparing Interest Rates: Traditional vs Digital Savings

Traditional savings accounts typically offer interest rates ranging from 0.01% to 0.10%, significantly lower than high-yield digital savings accounts, which can provide rates between 3.5% and 5.0%, depending on the financial institution. The higher interest rates in digital savings accounts result from lower overhead costs and streamlined online operations, enhancing compounding investment growth. Investors seeking better returns with minimal risk often prefer digital savings options for maximizing interest earnings on liquid funds.

Accessibility and Convenience: Which Is Easier to Manage?

High-yield digital savings accounts often provide greater accessibility through mobile apps and 24/7 online management, enabling investors to monitor and adjust their savings effortlessly. Traditional savings accounts, typically tied to brick-and-mortar banks, may have limited access hours and require in-person visits for some transactions, reducing convenience. Investors seeking ease of management usually prefer digital platforms for seamless transfers, instant balance updates, and automated savings features.

Safety and Security: Protecting Your Investment

Savings accounts at traditional banks are insured by the FDIC up to $250,000, offering a high level of security and protection against bank failures. High-yield digital savings accounts, often backed by FDIC-insured partner banks, provide similar safety while delivering better interest rates, enhancing investment growth without compromising security. Investors should verify FDIC insurance coverage and ensure digital platforms have robust cybersecurity measures to protect personal and financial information.

Fees and Minimum Balance Requirements

High-yield digital savings accounts typically offer lower fees and do not require a minimum balance, making them more accessible for investors seeking cost-effective options. Traditional savings accounts often impose monthly maintenance fees and higher minimum balance requirements, which can reduce overall returns. Choosing a high-yield digital savings option can maximize interest earnings by minimizing expenses associated with fees and balance thresholds.

Digital Innovations in Savings Accounts

High-yield digital savings accounts leverage innovative algorithms and mobile platforms to offer interest rates significantly above traditional savings accounts, maximizing growth on investments with minimal risk. These digital solutions provide real-time balance updates, automated savings tools, and enhanced security features using encryption and biometric authentication. Investors benefit from seamless access, higher yields, and integrated financial management, making digital savings accounts a competitive alternative in the evolving investment landscape.

Earning Potential: Maximizing Returns on Savings

High-yield digital savings accounts offer significantly higher interest rates, often 10 to 20 times greater than traditional savings accounts, enhancing earning potential and accelerating wealth growth. FDIC insurance on both account types ensures safety while maximizing returns through compounding interest in high-yield options. Investors seeking liquidity and competitive yields benefit from leveraging digital platforms' low overhead costs that translate into superior annual percentage yields (APYs).

Suitability for Different Financial Goals

Savings accounts offer stability and easy access, making them suitable for short-term goals or emergency funds. High-yield digital savings accounts provide higher interest rates ideal for medium-term goals, such as saving for a major purchase or building a larger emergency fund. Investors seeking growth should match account choices with their time horizon and risk tolerance to optimize returns and liquidity.

Choosing the Right Savings Account for Your Investment Strategy

Choosing the right savings account for your investment strategy requires comparing traditional savings accounts with high-yield digital savings alternatives to maximize returns and liquidity. High-yield digital savings accounts often offer interest rates up to 5 times higher than conventional accounts, enhancing compound growth potential with minimal risk. Prioritize accounts with FDIC insurance and low fees to ensure security while optimizing your investment's earning capacity over time.

Related Important Terms

Neobank High-Yield Savers

Neobank high-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, amplifying investment growth through compound interest over time. These digital savings products provide seamless access, low fees, and enhanced liquidity, making them an attractive option for investors seeking flexible yet profitable short-term investment solutions.

Digital-Only Interest Arbitrage

High-yield digital savings accounts typically offer interest rates 3 to 5 times higher than traditional savings accounts, leveraging digital-only platforms to minimize overhead costs and maximize returns through interest arbitrage. Investors seeking optimal liquidity and enhanced yield often prefer digital savings for their superior compounding benefits and seamless online access.

APY Chasing

High-yield digital savings accounts offer significantly higher APYs compared to traditional savings accounts, often ranging between 3.00% and 4.50%, maximizing interest earnings on investments without increased risk. Investors focusing on APY chasing benefit from these digital options that leverage advanced technology to reduce overhead costs and pass savings directly to account holders.

Tiered Yield Structuring

High-yield digital savings accounts utilize tiered yield structuring to offer increasing interest rates based on account balances, often delivering significantly higher returns compared to traditional savings accounts with flat interest rates. This tiered approach maximizes investment growth by rewarding larger deposits with superior rates, enhancing overall savings efficiency.

FDIC-Fintech Aggregation

A traditional savings account, insured by the FDIC, offers low-risk, steady interest rates typically below 0.5%, while high-yield digital savings accounts provided by fintech aggregators often feature competitive rates exceeding 3%, leveraging technology to optimize returns and maintain FDIC insurance through partner banks. Fintech platforms aggregate options from multiple FDIC-insured institutions, enabling investors to diversify savings efficiently while maximizing yield and ensuring federal protection on deposits up to $250,000 per institution.

Automated Savings Sweeps

Automated savings sweeps in high-yield digital savings accounts enable investors to maximize returns by automatically transferring funds from checking accounts into higher interest-bearing savings, ensuring consistent growth compared to traditional savings accounts with lower APYs. This automation reduces the risk of missed contributions and takes full advantage of compounding interest, optimizing investment liquidity and capital preservation.

Flexible Withdrawal Protocols

High-yield digital savings accounts offer more flexible withdrawal protocols compared to traditional savings accounts, allowing investors easier access to funds without penalties or extended waiting periods. This enhanced liquidity supports dynamic investment strategies by enabling timely capital reallocation in response to market opportunities.

Gamified Savings Features

High-yield digital savings accounts enhance investment strategies by incorporating gamified savings features that motivate consistent contributions and accelerate wealth accumulation through rewards and progress tracking. These platforms leverage behavioral economics to increase user engagement, outperforming traditional savings accounts in both interest yield and user experience.

Finfluencer-Endorsed Stash Accounts

Stash accounts, endorsed by leading Finfluencers, offer significantly higher interest rates compared to traditional savings accounts, combining user-friendly digital platforms with competitive APYs often exceeding 4%. These high-yield digital savings accounts provide investors with both liquidity and better growth potential, making them a preferred choice for maximizing passive income on idle funds.

Embedded Wealth Tools

High-yield digital savings accounts integrate embedded wealth tools such as automated budgeting, real-time spending analytics, and personalized investment recommendations, offering a more dynamic approach to growing savings compared to traditional savings accounts. These platforms leverage AI-driven insights to optimize interest earnings and facilitate seamless transitions to diversified investment portfolios, enhancing financial growth potential.

Savings Account vs High-Yield Digital Savings for investment. Infographic

moneydiff.com

moneydiff.com