Traditional loan interest rates typically range from 6% to 12%, depending on credit score and lender policies, often involving extensive paperwork and longer approval times. Crowdlending platform rates usually fall between 4% and 10%, offering faster access to funds by connecting borrowers directly with multiple investors online. Borrowers benefit from competitive rates and streamlined processes, while investors gain opportunities to diversify and earn attractive returns.

Table of Comparison

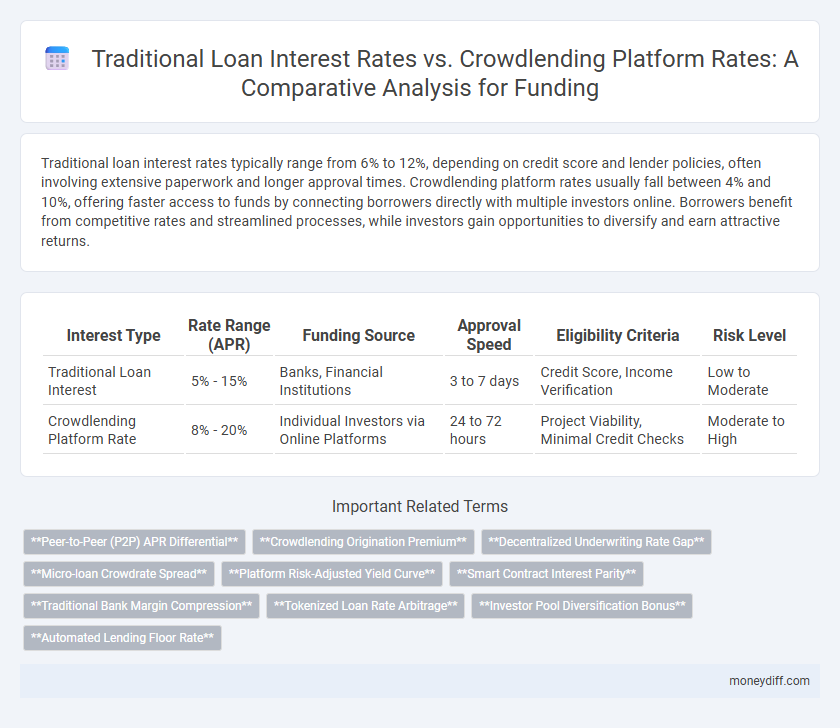

| Interest Type | Rate Range (APR) | Funding Source | Approval Speed | Eligibility Criteria | Risk Level |

|---|---|---|---|---|---|

| Traditional Loan Interest | 5% - 15% | Banks, Financial Institutions | 3 to 7 days | Credit Score, Income Verification | Low to Moderate |

| Crowdlending Platform Rate | 8% - 20% | Individual Investors via Online Platforms | 24 to 72 hours | Project Viability, Minimal Credit Checks | Moderate to High |

Understanding Traditional Loan Interest Structures

Traditional loan interest structures typically involve fixed or variable rates based on credit scores and collateral, often including additional fees like origination and prepayment penalties. These loans rely on centralized financial institutions, leading to stricter qualification criteria and longer approval processes. Compared to crowdlending platforms, traditional loans generally offer predictable payment schedules but less flexibility and higher overall costs.

How Crowdlending Platforms Set Interest Rates

Crowdlending platforms set interest rates by assessing borrower credit risk through advanced algorithms and market demand dynamics, often resulting in more competitive and transparent rates compared to traditional loans. Unlike banks that use fixed criteria and regulatory benchmarks, these platforms adjust rates based on investor appetite and borrower profiles in real-time. This flexible approach helps match borrowers with suitable investors while optimizing expected returns and minimizing default risk.

Key Differences Between Bank Loans and Crowdlending Rates

Traditional bank loans typically feature fixed or variable interest rates determined by credit scores, collateral, and market conditions, often resulting in higher costs due to added administrative fees and stricter risk assessments. Crowdlending platforms usually offer more competitive rates by pooling smaller investments from multiple lenders, reducing overhead and enabling faster access to funds with flexible repayment terms. Key differences include transparency of rates, risk distribution among investors, and accessibility for borrowers with varying credit profiles.

Factors Influencing Traditional Loan Interest

Traditional loan interest rates are influenced by credit score, loan amount, and repayment term, with higher risk profiles leading to increased rates. Economic factors such as central bank policies and inflation rates also play critical roles in determining interest percentages. Lenders assess borrower stability and collateral quality to mitigate potential losses, ultimately affecting the final interest charged.

Determinants of Crowdlending Platform Rates

Crowdlending platform rates are influenced by factors such as borrower creditworthiness, platform operational costs, and the level of risk diversification among funded projects. Unlike traditional loan interest rates set by banks based on centralized risk assessments, crowdlending rates reflect crowd-sourced risk evaluation and market competition within the platform. Loan duration, borrower profile, and platform fee structures further determine the final interest rates offered on crowdlending sites.

Comparing Approval Processes: Traditional Loans vs Crowdlending

Traditional loan interest rates often reflect stringent approval processes involving credit checks, income verification, and collateral assessment, resulting in longer wait times and higher rejection rates. Crowdlending platforms streamline approval by leveraging peer assessments and digital verification, enabling faster access to funds with competitive or lower rates. This efficient, transparent process benefits borrowers seeking quick financing without extensive bureaucracy, contrasting with traditional banks' rigorous criteria.

Risk Assessment in Traditional Loans Versus Crowdlending

Risk assessment in traditional loans involves rigorous credit checks, extensive financial documentation, and reliance on established credit scores to evaluate borrower reliability. Crowdlending platforms employ alternative data analytics, peer reviews, and social proof mechanisms, which can introduce higher volatility but enable quicker funding decisions. The difference in risk models directly influences interest rates, with traditional loans often offering lower rates due to stringent evaluation and crowdlending rates reflecting higher risk premiums.

Borrower Profiles and Interest Rate Impacts

Traditional loan interest rates typically vary based on borrower credit scores, income stability, and collateral, often resulting in higher rates for riskier profiles. Crowdlending platform rates tend to be more flexible, reflecting real-time market demand and investor risk appetite, benefiting borrowers with moderate credit by providing competitive or lower interest costs. This dynamic impacts funding accessibility and affordability, influencing borrower decisions between established financial institutions and peer-to-peer lending ecosystems.

Pros and Cons: Traditional Loan Interest vs Crowdlending Rates

Traditional loan interest rates typically range from 5% to 12%, offering borrowers predictable repayment schedules and access to established financial institutions. Crowdlending platform rates often vary between 8% and 15%, providing faster funding and increased accessibility for small businesses but with higher risk and less regulatory oversight. Traditional loans benefit from lower interest rates and strong consumer protections, while crowdlending offers flexibility and speed at the cost of potentially higher interest and variability in terms.

Choosing the Right Funding Source: Loan or Crowdlending?

Traditional loan interest rates typically range from 6% to 20%, depending on creditworthiness and loan terms, while crowdlending platform rates often vary between 8% and 15%, reflecting higher risk shared among multiple investors. Borrowers with strong credit profiles may benefit from lower fixed rates offered by banks, whereas startups and small businesses might access quicker, flexible funding through crowdlending despite slightly higher costs. Evaluating factors such as loan amount, repayment period, and approval speed is crucial to selecting the most cost-effective and suitable funding source.

Related Important Terms

Peer-to-Peer (P2P) APR Differential

Peer-to-peer (P2P) APRs on crowdlending platforms typically range between 5% and 12%, significantly lower than traditional loan interest rates, which often exceed 15% for comparable credit profiles. This APR differential underscores the cost-efficiency and accessibility advantages of crowdlending funding over conventional bank loans.

Crowdlending Origination Premium

Crowdlending origination premiums often result in higher effective interest costs compared to traditional loan rates due to fees charged for platform services and investor risk. These premiums, typically ranging between 1% to 5%, reflect the added convenience and access to diverse funding sources that crowdlending platforms provide.

Decentralized Underwriting Rate Gap

Traditional loan interest rates often reflect centralized underwriting criteria, resulting in higher costs due to increased risk premiums and operational overhead. Crowdlending platforms leverage decentralized underwriting, narrowing the rate gap by directly connecting investors and borrowers, which reduces interest rates through efficient risk assessment and lower administrative expenses.

Micro-loan Crowdrate Spread

Micro-loan crowdlending platforms often offer interest rates significantly lower than traditional loan interest, with spreads varying between 2% to 5%, enhancing affordability for small borrowers. This micro-loan crowdrate spread reflects reduced intermediary costs and tailored risk assessment, driving competitive funding advantages over conventional financial institutions.

Platform Risk-Adjusted Yield Curve

Traditional loan interest rates typically reflect fixed risk premiums and borrower credit profiles, whereas crowdlending platform rates are dynamically adjusted through platform risk-adjusted yield curves that incorporate real-time data on borrower defaults, sector-specific risks, and investor risk tolerance to optimize returns. This risk-adjusted yield curve enables crowdlending platforms to offer more competitive, market-responsive interest rates by aligning funding costs with the aggregated risk assessments across diverse borrower segments.

Smart Contract Interest Parity

Smart Contract Interest Parity ensures that interest rates on crowdlending platforms align competitively with traditional loan interest rates by automating rate adjustments through blockchain technology. This parity enhances transparency and reduces funding costs, making decentralized lending a viable alternative to conventional loans.

Traditional Bank Margin Compression

Traditional bank interest rates often reflect significant margin compression due to regulatory pressures and operational costs, resulting in narrower profit spreads. Crowdlending platform rates typically offer more competitive funding costs by directly connecting borrowers and lenders, bypassing traditional intermediation fees.

Tokenized Loan Rate Arbitrage

Tokenized loan rate arbitrage exploits discrepancies between traditional loan interest rates, which typically range from 4% to 12%, and higher-yield crowdlending platform rates often exceeding 15%, enabling investors to optimize returns by reallocating capital through blockchain-based smart contracts. This arbitrage mechanism leverages the transparency and efficiency of tokenized assets to minimize friction and capitalize on interest rate differentials across decentralized and conventional financing channels.

Investor Pool Diversification Bonus

Traditional loan interest rates typically reflect limited investor pool diversification, resulting in more uniform risk profiles and potentially lower returns. Crowdlending platforms offer an investor pool diversification bonus by attracting multiple investors with varied risk appetites, which can enhance funding flexibility and potentially increase overall return rates.

Automated Lending Floor Rate

Automated lending floor rates in crowdlending platforms typically offer more competitive and transparent interest benchmarks compared to traditional loan interest rates, which often include higher margins due to manual underwriting and bank overheads. These automated systems use real-time data and algorithmic risk assessments to dynamically adjust rates, minimizing lender risk and maximizing borrower affordability.

Traditional Loan Interest vs Crowdlending Platform Rate for funding. Infographic

moneydiff.com

moneydiff.com