Negative interest rates push banks to lend by charging them for holding excess reserves, stimulating spending and investment during economic downturns. Zero interest rates lower borrowing costs to near-free levels but may be insufficient to encourage additional lending if confidence remains low. Unconventional policies with negative rates can better combat deflationary pressures compared to zero rates, though they risk squeezing bank profitability and financial stability.

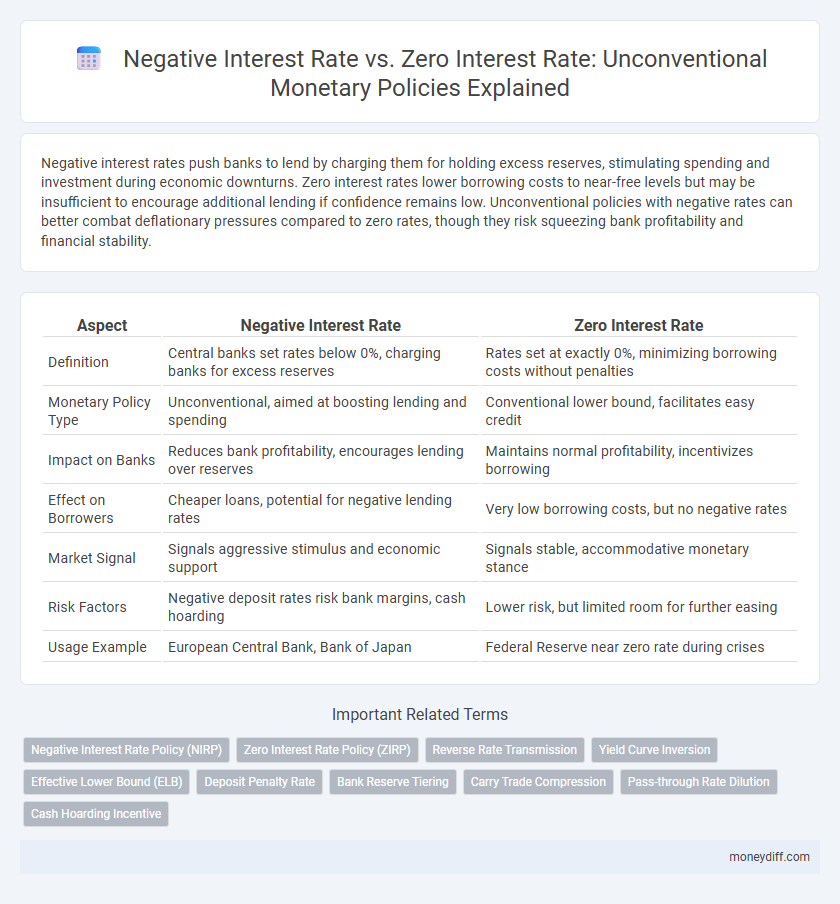

Table of Comparison

| Aspect | Negative Interest Rate | Zero Interest Rate |

|---|---|---|

| Definition | Central banks set rates below 0%, charging banks for excess reserves | Rates set at exactly 0%, minimizing borrowing costs without penalties |

| Monetary Policy Type | Unconventional, aimed at boosting lending and spending | Conventional lower bound, facilitates easy credit |

| Impact on Banks | Reduces bank profitability, encourages lending over reserves | Maintains normal profitability, incentivizes borrowing |

| Effect on Borrowers | Cheaper loans, potential for negative lending rates | Very low borrowing costs, but no negative rates |

| Market Signal | Signals aggressive stimulus and economic support | Signals stable, accommodative monetary stance |

| Risk Factors | Negative deposit rates risk bank margins, cash hoarding | Lower risk, but limited room for further easing |

| Usage Example | European Central Bank, Bank of Japan | Federal Reserve near zero rate during crises |

Understanding Negative and Zero Interest Rates

Negative interest rates occur when central banks set rates below zero, charging commercial banks for holding excess reserves, thereby encouraging lending and investment to stimulate economic activity. Zero interest rates represent a boundary where nominal rates hit near zero, limiting traditional monetary policy tools and prompting central banks to explore unconventional measures. Understanding these policies is crucial for assessing their impact on financial markets, lending behavior, and overall economic stability during periods of economic downturn or low inflation.

The Rationale Behind Unconventional Monetary Policies

Negative interest rates incentivize banks to lend more by charging them for holding excess reserves, aiming to stimulate economic activity when traditional policies fail. Zero interest rate policies maintain borrowing costs at the lowest feasible level to encourage consumption and investment without pushing rates into negative territory. Both approaches seek to combat deflationary pressures and boost demand during severe economic downturns when conventional monetary tools have limited effectiveness.

Mechanisms of Negative Interest Rate Policy (NIRP)

Negative Interest Rate Policy (NIRP) functions by incentivizing banks to lend more by charging them for holding excess reserves, which contrasts with zero interest rates that simply reduce borrowing costs without penalizing reserves. This mechanism encourages increased credit flow and spending by decreasing the opportunity cost of holding cash and deposits. NIRP also aims to weaken the currency and boost inflation by promoting higher asset prices and consumption through reduced incentives to save.

Implementation of Zero Interest Rate Policy (ZIRP)

Zero Interest Rate Policy (ZIRP) involves central banks setting nominal interest rates at or near 0% to stimulate economic growth during downturns. Implementation of ZIRP reduces borrowing costs, encourages investment and consumption, and aims to counter deflationary pressures without the risks associated with negative rates, such as bank profitability erosion or cash hoarding. This policy often serves as a precursor to more unconventional measures like quantitative easing when traditional monetary tools reach their limits.

Comparative Economic Impacts: NIRP vs. ZIRP

Negative Interest Rate Policy (NIRP) often stimulates lending and spending by imposing a cost on excess reserves, potentially boosting inflation more aggressively than Zero Interest Rate Policy (ZIRP), which simply sets rates at or near zero to encourage borrowing. NIRP can enhance bank liquidity and promote investment, but risks financial sector profitability and asset bubbles, whereas ZIRP tends to support gradual economic recovery with lower risk of market distortions. Empirical studies suggest NIRP yields stronger short-term demand effects but introduces greater uncertainty in banking stability compared to the more conventional ZIRP framework.

Banking Sector Effects Under NIRP and ZIRP

Negative interest rates in unconventional monetary policies compel banks to pay for holding excess reserves, squeezing net interest margins and pressuring profitability. Zero interest rate policies maintain near-zero yields, reducing loan rates but preserving some margin, supporting bank lending capacity without outright losses. Under NIRP, banks often tighten credit conditions and reduce risk-taking, whereas ZIRP encourages lending while maintaining balance sheet stability.

Impact on Consumer and Business Borrowing

Negative interest rates incentivize consumers and businesses to increase borrowing by effectively reducing the cost of loans below zero, encouraging spending and investment. Zero interest rates stabilize borrowing costs at minimal levels, promoting access to credit without penalizing lenders excessively. Both policies aim to stimulate economic activity, but negative rates may risk distorting financial markets and savings behavior more than zero rates.

Challenges and Risks of Negative and Zero Rates

Negative interest rates challenge financial institutions by compressing net interest margins, leading to reduced profitability and potential risk-taking behaviors. Zero interest rates limit monetary policy effectiveness, constraining central banks' ability to stimulate economic growth during downturns. Both negative and zero rates can distort asset prices, encourage excessive borrowing, and increase vulnerability to financial instability.

Global Case Studies: NIRP and ZIRP in Action

Negative Interest Rate Policy (NIRP) has been implemented in countries like Japan, Switzerland, and the Eurozone, where central banks pushed rates below zero to stimulate borrowing and investment during prolonged economic stagnation. In contrast, Zero Interest Rate Policy (ZIRP) was prominently used in the United States and the United Kingdom following the 2008 financial crisis to encourage lending without the risks of negative yields. Global case studies reveal that while NIRP can compress bank profit margins and potentially distort financial markets, ZIRP tends to support gradual recovery with fewer side effects, highlighting the trade-offs central banks face in unconventional monetary policy frameworks.

Future Outlook for Unconventional Interest Rate Policies

Negative interest rates present challenges such as reduced bank profitability and potential distortions in financial markets, while zero interest rates limit traditional monetary policy tools' effectiveness. The future outlook for unconventional interest rate policies indicates a growing preference for targeted fiscal measures and central bank tools like yield curve control to complement low or negative rates. Market expectations suggest a cautious normalization path, balancing inflation control with economic growth amid persistent uncertainty.

Related Important Terms

Negative Interest Rate Policy (NIRP)

Negative Interest Rate Policy (NIRP) compels banks to pay interest on reserves held at central banks, incentivizing increased lending and stimulating economic activity during deflationary periods. Unlike zero interest rate policies, NIRP aims to discourage hoarding of cash and boost inflation expectations by creating a cost for holding excess liquidity.

Zero Interest Rate Policy (ZIRP)

Zero Interest Rate Policy (ZIRP) maintains nominal interest rates near zero to stimulate economic growth by encouraging borrowing and investment without the risks associated with negative interest rates, such as bank profitability erosion or reduced lending incentives. Unlike negative interest rates, ZIRP avoids penalizing depositors and maintains financial sector stability while still promoting liquidity and consumer spending in unconventional monetary policy frameworks.

Reverse Rate Transmission

Negative interest rates incentivize banks to lend more by charging them for holding excess reserves, enhancing reverse rate transmission through increased credit flow and economic stimulus, whereas zero interest rates may limit this mechanism as banks face no cost for hoarding liquidity, potentially dampening the effectiveness of unconventional monetary policies. Empirical studies indicate that negative rates can accelerate reverse transmission by encouraging risk-taking and investment more aggressively than zero rates, although the impact varies by financial institution resilience and market conditions.

Yield Curve Inversion

Negative interest rates push short-term yields below zero, causing an unusual yield curve inversion that signals deeper economic distress compared to zero interest rates, which flatten but rarely invert the curve as aggressively. Yield curve inversion under negative rates often reflects market expectations of prolonged monetary easing and recession risk, complicating conventional policy expectations.

Effective Lower Bound (ELB)

Negative interest rates allow central banks to push below the zero interest rate bound, offering more room to stimulate economic activity when conventional policy rates are at or near zero. The Effective Lower Bound (ELB) represents the limit where further rate cuts lose efficacy, making negative rates a critical tool for unconventional monetary policies to support inflation and growth.

Deposit Penalty Rate

Deposit penalty rates in negative interest rate policies impose charges on banks holding excess reserves, incentivizing lending and spending, while zero interest rate policies maintain neutral deposit costs, limiting financial institution penalties and potentially reducing economic stimulus. The use of negative rates directly discourages reserve hoarding, fostering liquidity, whereas zero rates mainly prevent tightening but lack the punitive mechanism to actively drive credit expansion.

Bank Reserve Tiering

Negative interest rates incentivize banks to minimize excess reserves by imposing costs on holdings, while zero interest rates maintain neutrality without penalizing reserve accumulation. Bank reserve tiering in negative rate environments allows central banks to exempt a portion of reserves from negative charges, mitigating adverse effects on bank profitability and lending incentives.

Carry Trade Compression

Negative interest rates reduce carry trade incentives by eroding interest rate differentials, leading to compressions in carry trade profitability and altering capital flows. Zero interest rates maintain minimal returns but allow for more stable interest rate arbitrage compared to negative rates, which can discourage traditional carry trade strategies.

Pass-through Rate Dilution

Negative interest rates often lead to lower pass-through rate dilution compared to zero interest rates by encouraging banks to maintain lending rates above negative policy rates, preserving credit transmission. Zero interest rate policies risk higher pass-through rate dilution as banks' lending margins compress, reducing the effectiveness of unconventional monetary stimulus.

Cash Hoarding Incentive

Negative interest rates discourage cash hoarding by imposing costs on holding money in banks, incentivizing spending and investment to stimulate economic activity, whereas zero interest rates lack this punitive effect, often resulting in households and businesses retaining cash instead of deploying it into the economy. Central banks using negative interest rates aim to break the zero lower bound constraint, reducing the appeal of liquidity hoarding that commonly occurs under zero interest rate policies.

Negative Interest Rate vs Zero Interest Rate for unconventional policies. Infographic

moneydiff.com

moneydiff.com