Simple interest on savings provides a straightforward way to earn predictable returns, calculated only on the original principal amount. Negative interest, by contrast, means savers could pay a fee to keep money in the bank, reducing the total savings over time. Understanding these differences is crucial for making informed decisions about where to store and grow your money safely.

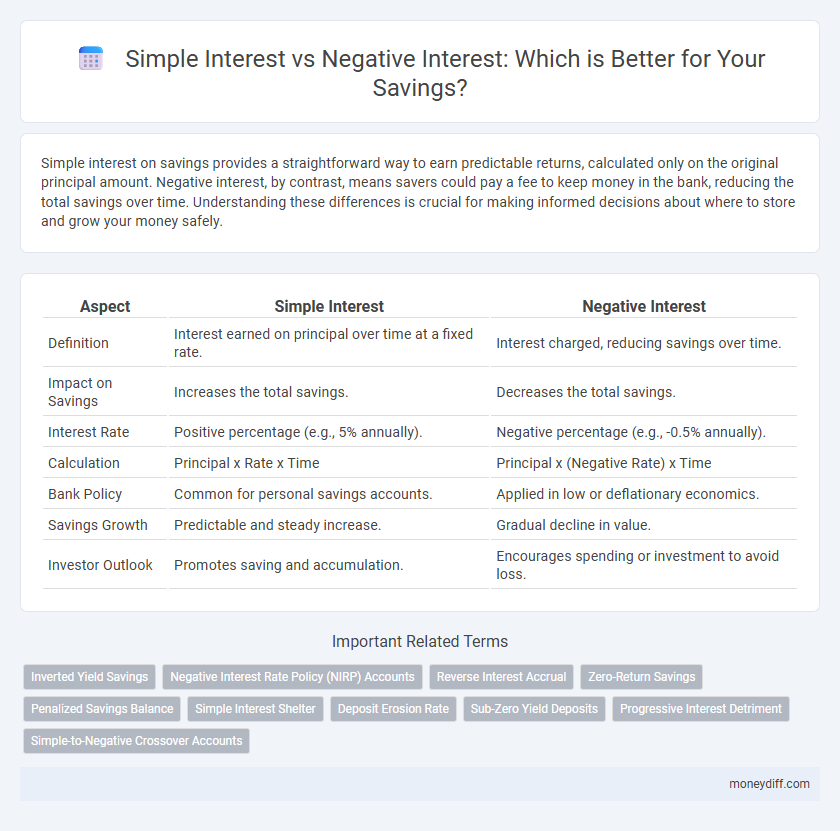

Table of Comparison

| Aspect | Simple Interest | Negative Interest |

|---|---|---|

| Definition | Interest earned on principal over time at a fixed rate. | Interest charged, reducing savings over time. |

| Impact on Savings | Increases the total savings. | Decreases the total savings. |

| Interest Rate | Positive percentage (e.g., 5% annually). | Negative percentage (e.g., -0.5% annually). |

| Calculation | Principal x Rate x Time | Principal x (Negative Rate) x Time |

| Bank Policy | Common for personal savings accounts. | Applied in low or deflationary economics. |

| Savings Growth | Predictable and steady increase. | Gradual decline in value. |

| Investor Outlook | Promotes saving and accumulation. | Encourages spending or investment to avoid loss. |

Understanding Simple Interest: The Basics

Simple interest calculates earnings on the original principal amount, ignoring any previous interest accrued, making it straightforward for savings growth. Negative interest occurs when banks charge depositors for holding money, effectively reducing the principal over time and discouraging traditional saving. Understanding simple interest helps savers evaluate predictable growth, while recognizing negative interest highlights risks of value erosion in certain economic conditions.

What is Negative Interest?

Negative interest occurs when banks charge savers for holding their deposits, effectively reducing the principal amount over time instead of increasing it through earnings. Unlike simple interest, which adds a fixed percentage to the original sum based on the principal and rate, negative interest rates result in a deduction from the initial balance. This concept is designed to encourage spending and investment rather than saving, contrasting traditional positive interest that incentivizes accumulation of savings.

How Simple Interest Benefits Savers

Simple interest provides savers with predictable and transparent earnings based on the original principal, making it easier to calculate and plan finances. This straightforward interest calculation ensures that savers receive consistent returns over the savings period without the complexity of compounding effects. Compared to negative interest rates, which reduce the principal amount over time, simple interest preserves the initial deposit's value while generating steady income.

The Impact of Negative Interest Rates on Savings

Negative interest rates on savings accounts effectively charge depositors for holding money, reducing the overall value of their savings over time. Unlike simple interest, where the principal grows linearly based on a fixed rate, negative interest causes gradual erosion of capital, discouraging traditional saving. This phenomenon motivates consumers to seek alternative investments or spend more to avoid losses, impacting overall financial behavior and economic stability.

Calculating Simple Interest: A Step-by-Step Guide

Calculating simple interest involves multiplying the principal amount by the interest rate and the time period in years (Interest = Principal x Rate x Time). This straightforward formula helps savers understand the exact earnings on their deposits without compounding effects. In contrast, negative interest rates reduce the principal over time, leading to potential losses instead of gains on savings accounts.

When Do Banks Apply Negative Interest Rates?

Banks apply negative interest rates on savings primarily during periods of prolonged economic downturn or deflation, aiming to discourage hoarding cash and stimulate spending. This policy often emerges when central banks set negative benchmark rates, causing commercial banks to pass these costs onto depositors. Unlike simple interest, where savers earn a fixed percentage on their deposits, negative interest means account holders effectively pay to keep money in the bank, reducing their overall savings.

Comparing Earnings: Simple vs. Negative Interest

Simple interest generates earnings by applying a fixed percentage rate to the principal amount, resulting in predictable and positive growth over time for savings accounts. Negative interest, on the other hand, imposes a cost on the deposited funds, effectively reducing the principal and eroding the savings instead of increasing them. Comparing earnings, simple interest increases the value of savings steadily, while negative interest diminishes the account balance, potentially turning growth into loss.

Risks and Downsides of Negative Interest for Savers

Negative interest rates on savings accounts erode the principal amount, leading to financial losses over time instead of growth. Savers face increased risks as their deposits diminish in value, undermining the primary goal of preserving capital. Banks may impose fees or reduce interest payouts, further exacerbating the downsides compared to traditional simple interest where earnings accrue predictably.

Adapting Your Savings Strategy in a Negative Interest Environment

Adapting your savings strategy in a negative interest environment requires shifting focus from traditional simple interest accounts to alternative investment options that offer positive returns or capital preservation. Negative interest rates, which effectively reduce the principal amount over time, diminish the benefits of conventional savings accounts, making instruments like inflation-protected securities or dividend-paying stocks more attractive. Prioritizing a diversified portfolio helps mitigate losses and sustain wealth growth despite unfavorable nominal interest rates.

Future Trends: Will Negative Interest Become the Norm?

Simple interest offers predictable growth for savings by applying a fixed rate to the principal, ensuring steady accumulation over time. Negative interest rates, where depositors pay banks to hold their money, challenge traditional saving models and could discourage savings if widely adopted. Future trends suggest central banks might increasingly use negative interest rates to stimulate economic activity, potentially making them a norm in low-inflation or recessionary environments.

Related Important Terms

Inverted Yield Savings

Inverted yield savings occur when simple interest rates on savings accounts fall below zero, effectively charging depositors for holding money instead of rewarding them with positive returns. This negative interest environment incentivizes consumers to seek alternative investment vehicles that offer real growth potential beyond conventional savings accounts.

Negative Interest Rate Policy (NIRP) Accounts

Negative Interest Rate Policy (NIRP) accounts charge depositors a fee for holding savings, effectively reducing their principal over time, contrasting with traditional simple interest accounts that provide a fixed percentage gain on deposits. This unprecedented monetary approach aims to stimulate spending and investment by discouraging banks and individuals from hoarding cash, fundamentally altering saving behavior in low or negative rate environments.

Reverse Interest Accrual

Simple interest calculates earnings based on the original principal amount without compounding, providing predictable growth for savings accounts. Negative interest, often seen in reverse interest accrual scenarios, reduces the principal over time, effectively charging savers for holding funds and potentially eroding savings instead of growing them.

Zero-Return Savings

Simple interest on savings provides a predictable, positive return based on the principal amount, while negative interest results in a loss, effectively charging account holders for holding funds. Zero-return savings accounts neither earn interest nor incur fees, preserving the principal without growth or decline, making them a neutral option compared to the financial implications of positive or negative interest rates.

Penalized Savings Balance

Simple interest calculates earnings on the principal amount, providing predictable growth to savings, whereas negative interest rates impose a penalty on savings balances by effectively charging depositors for holding funds. Penalized savings balances under negative interest diminish over time, discouraging hoarding and encouraging spending or investment to avoid erosion of capital.

Simple Interest Shelter

Simple interest provides a fixed percentage return on savings, ensuring predictable growth without compounding effects. In contrast, negative interest rates erode savings by charging fees, making simple interest shelter essential for protecting principal value and preserving capital stability.

Deposit Erosion Rate

Simple interest on savings provides a fixed, predictable return calculated solely on the initial principal, preserving capital value over time. Negative interest causes a deposit erosion rate where the principal decreases, effectively penalizing savers by reducing their capital balance instead of growing it.

Sub-Zero Yield Deposits

Simple interest on savings provides a predictable, fixed return based on the principal over time, ensuring stable growth of funds. Negative interest rates, or sub-zero yield deposits, effectively reduce the principal value by charging depositors fees, discouraging hoarding and incentivizing spending or investment.

Progressive Interest Detriment

Simple interest provides a fixed percentage return on savings, ensuring predictable growth over time, whereas negative interest charges savers for holding funds, leading to a progressive interest detriment that erodes the principal value. This detrimental impact intensifies with prolonged savings periods, causing a compounding loss that diminishes overall wealth accumulation.

Simple-to-Negative Crossover Accounts

Simple interest accounts earn a fixed percentage on the principal, offering predictable returns for savers. Negative interest crossover accounts impose charges once rates dip below zero, effectively reducing deposited funds instead of growing them.

Simple Interest vs Negative Interest for savings. Infographic

moneydiff.com

moneydiff.com