Credit card interest rates are typically higher and compound daily, making short-term borrowing more expensive compared to Buy Now Pay Later (BNPL) options, which often offer interest-free periods or fixed fees. BNPL services provide transparent repayment schedules and can help avoid unpredictable interest accrual, benefiting consumers who pay off balances quickly. However, failing to repay BNPL installments on time can result in late fees and impact credit scores, similar to credit card interest penalties.

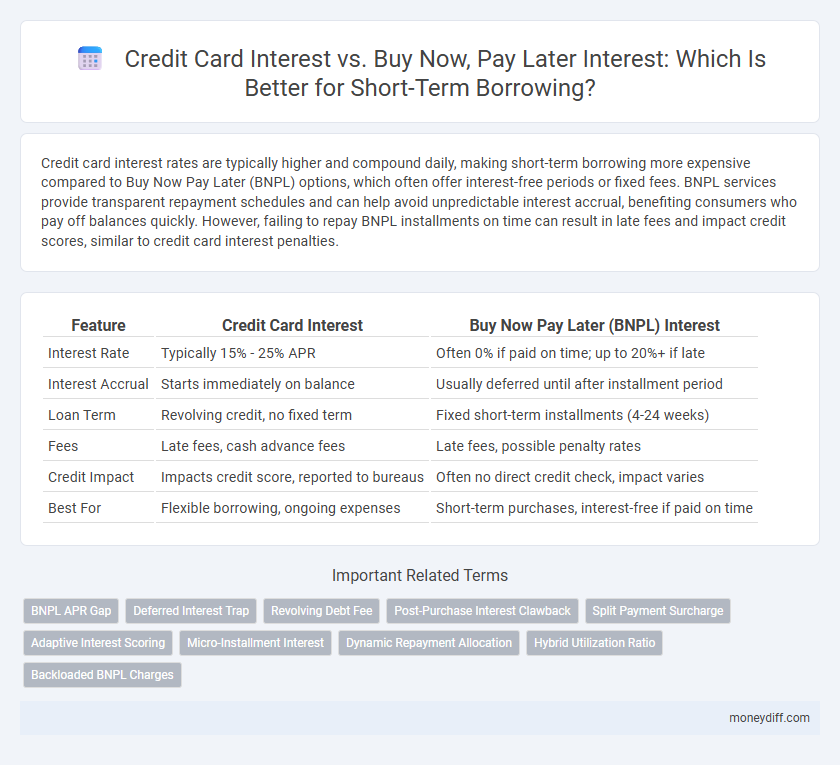

Table of Comparison

| Feature | Credit Card Interest | Buy Now Pay Later (BNPL) Interest |

|---|---|---|

| Interest Rate | Typically 15% - 25% APR | Often 0% if paid on time; up to 20%+ if late |

| Interest Accrual | Starts immediately on balance | Usually deferred until after installment period |

| Loan Term | Revolving credit, no fixed term | Fixed short-term installments (4-24 weeks) |

| Fees | Late fees, cash advance fees | Late fees, possible penalty rates |

| Credit Impact | Impacts credit score, reported to bureaus | Often no direct credit check, impact varies |

| Best For | Flexible borrowing, ongoing expenses | Short-term purchases, interest-free if paid on time |

Understanding Credit Card Interest Rates

Credit card interest rates typically range from 15% to 25% APR, making them costly for short-term borrowing compared to Buy Now Pay Later (BNPL) options that often offer 0% interest for a limited period. Understanding credit card interest involves recognizing how daily periodic rates accumulate, leading to significant compound interest if balances remain unpaid. BNPL services usually charge fees or high interest only after the promotional period ends, presenting a potentially cheaper alternative when managed responsibly.

How Buy Now Pay Later Interest Works

Buy Now Pay Later (BNPL) interest typically works by offering consumers a short-term, interest-free period during which repayments are made in installments; if payments are completed on time, no interest accrues. However, missing a payment or extending the repayment period often triggers high-interest rates or late fees, making BNPL potentially more expensive than standard credit card interest. Unlike credit card interest which compounds monthly on outstanding balances, BNPL interest and fees are primarily penalty-based, emphasizing the importance of adhering to the payment schedule.

Comparing Short-Term Borrowing Costs

Credit card interest rates typically range from 15% to 25% annually, making them relatively expensive for short-term borrowing compared to Buy Now Pay Later (BNPL) services, which often offer interest-free periods of 30 to 90 days. While BNPL options can provide zero or low-interest financing if payments are made on time, missed payments may lead to high penalty fees, impacting overall cost efficiency. Evaluating the effective annual interest rate and fee structures is essential to compare the true cost of short-term borrowing between credit cards and BNPL options.

Fees and Hidden Charges: Credit Cards vs BNPL

Credit card interest rates often come with transparent fees, including annual fees and late payment penalties, but can escalate quickly with high APRs if balances are not paid in full. Buy Now Pay Later (BNPL) services frequently advertise zero interest but may impose hidden charges such as late fees, account reinstatement fees, or increased prices for deferred payments. Consumers should carefully compare the total cost of borrowing, factoring in these fees and potential interest accumulation for short-term financing decisions.

Minimum Payments Explained

Credit card interest accrues daily on the outstanding balance if minimum payments, typically 2-3% of the balance, are not paid in full, causing longer-term debt and higher total costs. Buy Now Pay Later (BNPL) services often offer interest-free periods but may impose steep fees or high interest rates after the promotional window ends, making it crucial to understand the payment schedule. Minimum payments on credit cards may extend debt payoff, while BNPL plans usually require fixed installments, impacting short-term borrowing costs differently.

When Does Interest Start Accruing?

Credit card interest typically begins accruing immediately after the purchase if the balance is not paid in full by the due date, leading to daily compounding interest charges. Buy Now Pay Later (BNPL) options often offer an interest-free period, with interest starting to accrue only after the promotional period or payment deadline is missed. Understanding these timing differences in interest accrual is crucial for minimizing borrowing costs in short-term credit use.

Impact on Credit Score: Credit Cards vs BNPL

Credit card interest can significantly impact your credit score as revolving balances increase credit utilization ratio, a key factor in credit scoring models. Buy Now Pay Later (BNPL) services typically report less frequently or not at all to credit bureaus, resulting in less immediate effect on credit scores but potential negative impact if payments are missed. Maintaining timely payments on both credit cards and BNPL plans is essential to preserving a healthy credit profile during short-term borrowing.

Choosing the Best Option for Short-Term Needs

Credit card interest rates typically range from 15% to 25% APR, making them costly for short-term borrowing if not paid off quickly, whereas Buy Now Pay Later (BNPL) services often offer interest-free periods but can impose high fees and interest after the promotional window expires. Evaluating the exact repayment timeline, fees, and potential penalties is crucial in selecting the best short-term financing option. Prioritizing zero-interest BNPL plans with clear payment schedules can minimize borrowing costs compared to traditional credit card interest accrual.

Common Traps and How to Avoid Them

Credit card interest often compounds daily, leading to higher costs if balances are not paid in full each month, while Buy Now Pay Later (BNPL) services may appear interest-free but can include hidden fees and late charges that accumulate quickly. Common traps include misunderstanding the true annual percentage rate (APR) on credit cards and missing payment deadlines in BNPL plans, resulting in unexpected debt. To avoid these pitfalls, consumers should carefully read terms, set reminders for payments, and evaluate the total cost of borrowing before choosing either option for short-term financing.

Tips for Managing Short-Term Debt Wisely

Credit card interest rates typically range from 15% to 25% APR, making them a costly option for short-term borrowing compared to Buy Now Pay Later (BNPL) plans, which often offer 0% interest for a fixed repayment period. To manage short-term debt wisely, prioritize paying off high-interest credit card balances first while taking advantage of interest-free BNPL offers to spread out payments without additional cost. Always track repayment deadlines to avoid late fees and escalating interest charges that can quickly increase overall debt.

Related Important Terms

BNPL APR Gap

Buy Now Pay Later (BNPL) services typically offer lower APRs for short-term borrowing compared to traditional credit card interest rates, often creating a significant BNPL APR gap. This gap stems from BNPL providers targeting consumers with interest-free or minimal-interest installment plans, while credit cards charge average APRs ranging between 15% and 25%.

Deferred Interest Trap

Credit card interest typically compounds daily, leading to higher costs if balances aren't paid in full, while Buy Now Pay Later (BNPL) plans often advertise deferred interest that kicks in retroactively if payments are missed, trapping consumers in unexpected debt. Understanding the Deferred Interest Trap is crucial, as failing to meet BNPL payment deadlines can result in the entire purchase amount accruing interest from the original transaction date.

Revolving Debt Fee

Credit card interest typically accumulates daily on revolving debt balances and can result in higher long-term fees compared to Buy Now Pay Later (BNPL) plans, which often charge fixed fees or zero interest for short-term borrowing if paid on time. Revolving debt fees on credit cards may lead to compounding interest, increasing the overall repayment amount beyond the initial purchase, while BNPL services generally avoid such compounding costs but may impose late fees if payments are missed.

Post-Purchase Interest Clawback

Credit card interest often accrues immediately after the grace period, resulting in significant post-purchase interest clawback if balances are not paid in full, whereas Buy Now Pay Later (BNPL) plans typically offer interest-free periods but may impose retroactive interest or fees if payments are missed or delayed. Understanding the terms of post-purchase interest clawback is crucial when comparing short-term borrowing costs between credit cards and BNPL services.

Split Payment Surcharge

Credit card interest for short-term borrowing often includes a split payment surcharge, which increases the total cost by applying fees when payments are divided across billing cycles. Buy Now Pay Later (BNPL) plans typically avoid such surcharges, offering interest-free or low-interest options that reduce upfront financial burden compared to credit cards.

Adaptive Interest Scoring

Credit card interest rates typically range from 15% to 25% APR, accumulating daily and compounding monthly, while Buy Now Pay Later (BNPL) services often offer interest-free periods but impose high late fees and deferred interest that can exceed credit card rates. Adaptive Interest Scoring uses real-time data analytics and machine learning algorithms to assess individual repayment behavior, enabling personalized interest rates that optimize cost-efficiency and risk management for short-term borrowing.

Micro-Installment Interest

Credit card interest rates for short-term borrowing typically range from 15% to 25% APR, often compounding daily and accruing high costs on unpaid balances; in contrast, Buy Now Pay Later (BNPL) services offering micro-installments often feature interest-free periods or significantly lower interest rates, making BNPL a cost-effective alternative for managing small, short-term purchases. Consumers should evaluate the annual percentage rate (APR), repayment terms, and potential fees associated with BNPL micro-installments versus the compounding interest and fees of credit card borrowing to optimize short-term financing costs.

Dynamic Repayment Allocation

Credit card interest typically accumulates daily based on the outstanding balance and can be minimized with dynamic repayment allocation strategies that target high-interest charges first, optimizing short-term borrowing costs. Buy Now Pay Later (BNPL) interest often involves fixed fees or zero-interest promotional periods but lacks flexible repayment allocation, potentially resulting in higher overall costs if payments are not managed promptly.

Hybrid Utilization Ratio

Credit card interest rates often range from 15% to 25% APR, applying immediate interest accumulation on unpaid balances, whereas Buy Now Pay Later (BNPL) services typically offer interest-free periods before charging rates comparable to credit cards if payments are missed. The Hybrid Utilization Ratio, measuring the combined usage of credit cards and BNPL options relative to credit limits or approved spending, critically impacts consumer credit scores and short-term borrowing costs.

Backloaded BNPL Charges

Credit card interest typically accumulates daily on the outstanding balance, resulting in transparent compounding costs, whereas Buy Now Pay Later (BNPL) services often feature backloaded interest charges that can sharply increase the total repayment amount if payments are missed or delayed. This backloaded structure in BNPL plans obscures the true cost of borrowing early on, potentially leading to higher effective interest rates and unexpected financial strain compared to the more straightforward interest accrual of credit cards.

Credit Card Interest vs Buy Now Pay Later Interest for short-term borrowing Infographic

moneydiff.com

moneydiff.com