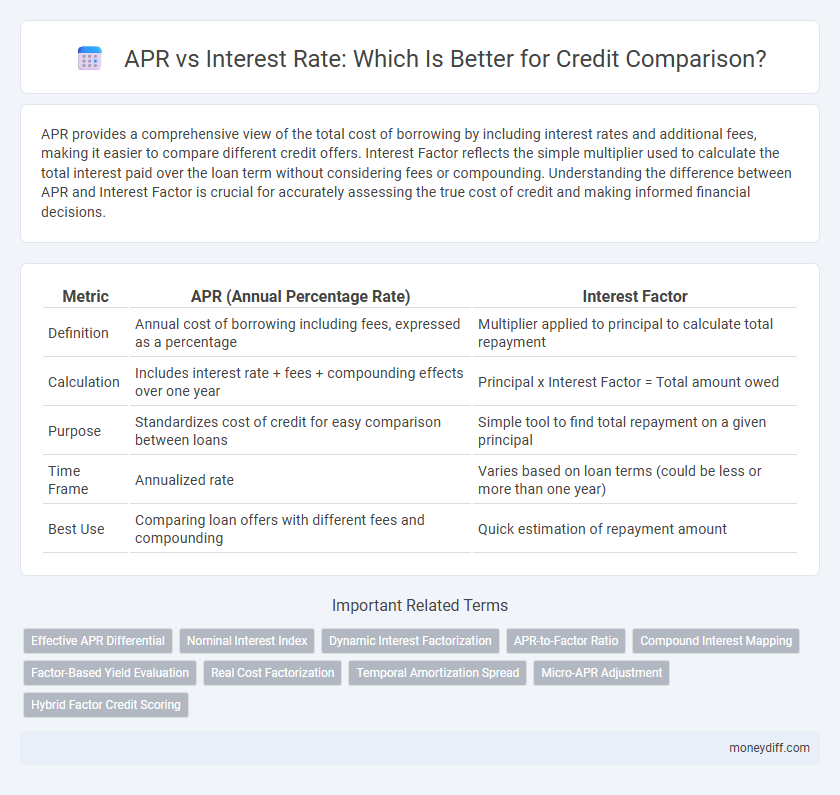

APR provides a comprehensive view of the total cost of borrowing by including interest rates and additional fees, making it easier to compare different credit offers. Interest Factor reflects the simple multiplier used to calculate the total interest paid over the loan term without considering fees or compounding. Understanding the difference between APR and Interest Factor is crucial for accurately assessing the true cost of credit and making informed financial decisions.

Table of Comparison

| Metric | APR (Annual Percentage Rate) | Interest Factor |

|---|---|---|

| Definition | Annual cost of borrowing including fees, expressed as a percentage | Multiplier applied to principal to calculate total repayment |

| Calculation | Includes interest rate + fees + compounding effects over one year | Principal x Interest Factor = Total amount owed |

| Purpose | Standardizes cost of credit for easy comparison between loans | Simple tool to find total repayment on a given principal |

| Time Frame | Annualized rate | Varies based on loan terms (could be less or more than one year) |

| Best Use | Comparing loan offers with different fees and compounding | Quick estimation of repayment amount |

Understanding APR: The True Cost of Credit

APR (Annual Percentage Rate) represents the comprehensive cost of credit, incorporating not only the interest rate but also fees and other charges associated with a loan. The interest factor, often expressed as a simple rate, only reflects the cost of borrowing without considering additional costs, making APR a more accurate measure for credit comparison. Evaluating APR enables consumers to understand the true cost of credit and compare loan offers effectively.

What is Interest Factor?

Interest Factor represents the multiplier used to calculate the total amount payable on a loan based on the principal and the interest rate over a specific period. Unlike the Annual Percentage Rate (APR), which includes fees and provides a broader cost of credit, the Interest Factor strictly reflects the raw interest cost. Understanding the Interest Factor helps borrowers compare loan offers by isolating the pure interest component from additional fees and charges.

How APR and Interest Factor Differ

APR (Annual Percentage Rate) represents the total yearly cost of borrowing, including interest and fees, expressed as a percentage. Interest Factor, in contrast, is a multiplier used to calculate total repayment by applying it directly to the principal amount. APR offers a standardized measure to compare loan costs over a year, while the Interest Factor provides a straightforward way to determine total payments without accounting for the time value of money or additional loan charges.

Why APR Matters in Credit Comparisons

APR represents the total cost of credit on an annual basis, incorporating interest rates and additional fees, providing a comprehensive measure for comparing loan offers. Unlike the interest factor, which only accounts for the interest portion, APR includes all finance charges, making it a more accurate reflection of the true borrowing cost. Understanding APR enables borrowers to make informed decisions by evaluating the real financial impact of different credit options.

The Role of Interest Factor in Loan Assessments

The Interest Factor is a crucial metric in loan assessments, representing the multiplier applied to the principal to determine total repayment amounts. Unlike APR, which expresses the annual cost of borrowing including fees, the Interest Factor focuses strictly on interest accumulation, providing clarity on pure interest expenses. Lenders and borrowers use the Interest Factor to compare loan offers by evaluating how interest compounds over the loan term.

Comparing APR vs Interest Factor: Pros and Cons

APR reflects the total annual cost of a loan including fees, providing a clear comparison across different credit offers, while the Interest Factor represents the raw cost of borrowing without additional charges, offering simplicity in calculation. APR's comprehensive approach helps borrowers understand the true expense but can be more complex to interpret, whereas Interest Factor's straightforward nature allows quick assessments but may underestimate total costs. Choosing between APR and Interest Factor depends on the need for thorough cost evaluation versus ease of comparison in credit analysis.

Calculating APR for Effective Money Management

Calculating APR (Annual Percentage Rate) provides a comprehensive view of credit costs by incorporating both interest rates and additional fees, offering a true measure of the loan's total expense. Unlike the Interest Factor, which solely reflects the accumulation of interest over time, APR captures the overall cost, enabling more accurate credit comparisons. Understanding APR is essential for effective money management, as it reveals the actual financial impact of borrowing and supports informed decision-making when selecting credit options.

Interest Factor Calculation: Steps and Examples

Interest Factor calculation involves dividing the total interest paid on a loan by the principal amount, providing a straightforward metric to compare credit options. For example, if a $10,000 loan accrues $1,200 in interest over one year, the Interest Factor is 0.12, or 12%. This calculation helps borrowers understand the actual cost of credit beyond the Annual Percentage Rate (APR) by isolating the interest expense relative to the loan principal.

Which Metric Should You Use for Credit Comparison?

APR (Annual Percentage Rate) provides a comprehensive measure of credit costs by including interest rates, fees, and other charges, making it more accurate for comparing loan offers. Interest Factor, calculated as the ratio of total repayment to the principal, simplifies cost evaluation but may overlook additional fees and charges embedded in loans. For effective credit comparison, APR is the preferred metric as it reflects the true cost of borrowing and enables a transparent side-by-side analysis of credit products.

Key Tips for Evaluating Credit Offers Using APR and Interest Factor

APR provides a comprehensive measure of credit cost by including interest rates and fees, offering a clearer comparison across credit offers. Interest Factor represents the total interest charged over the loan term, useful for understanding the exact cost in dollar terms. Key tips for evaluation include comparing APRs for true cost clarity and using Interest Factor to gauge total interest impact before finalizing credit decisions.

Related Important Terms

Effective APR Differential

The Effective APR Differential measures the true cost difference between two credit offers by factoring in both the annual percentage rate (APR) and compounding frequency, providing a more accurate comparison than the nominal interest rate alone. Calculating the Effective APR Differential helps consumers identify which loan yields lower overall interest expenses, optimizing credit decision-making.

Nominal Interest Index

The Nominal Interest Index provides a baseline rate excluding compounding effects, while the APR (Annual Percentage Rate) incorporates fees and compounding for a comprehensive credit cost comparison. Evaluating both APR and Nominal Interest Index improves accuracy in assessing total loan expenses and effective interest rates.

Dynamic Interest Factorization

The Annual Percentage Rate (APR) provides a standardized measure of borrowing costs over a year, while the Interest Factor offers a dynamic, period-specific metric reflecting actual interest accrual that is essential for precise credit comparison through Dynamic Interest Factorization. This method optimizes loan evaluations by adjusting interest calculations based on payment timing and principal changes, enabling more accurate cost assessments than static APR values.

APR-to-Factor Ratio

The APR-to-Factor Ratio effectively compares loan costs by translating the Annual Percentage Rate (APR) into an interest factor, revealing the true cost of credit beyond nominal rates. This metric enables borrowers to assess financing options with greater precision, highlighting the impact of compounding and fees embedded within the APR.

Compound Interest Mapping

APR measures the total yearly cost of credit, including compound interest and fees, while the Interest Factor specifically represents the growth multiplier of the principal due to compound interest over the loan term. Mapping compound interest through the Interest Factor allows borrowers to quantify the exponential cost impact beyond the APR's nominal rate for precise credit comparisons.

Factor-Based Yield Evaluation

The Interest Factor provides a straightforward measure of the total cost of credit by expressing the ratio of repayment to the principal, allowing for easy comparison across loan options. Unlike APR, which incorporates fees and compounding effects, Factor-Based Yield Evaluation focuses on the pure interest cost, enabling borrowers to assess the true financial impact of different credit offers.

Real Cost Factorization

APR provides a comprehensive measure of the real cost of credit by including interest rates, fees, and other charges, enabling accurate comparison across loan products. The Interest Factor isolates the pure cost of borrowing through the nominal interest rate, but fails to reflect additional expenses, making APR the superior metric for real cost factorization.

Temporal Amortization Spread

APR reflects the annual cost of credit, incorporating fees and interest, while the Interest Factor calculates the total interest paid over the loan term without fees. Temporal amortization spread significantly impacts the Interest Factor by distributing interest payments unevenly over time, affecting the effective cost perception in credit comparisons.

Micro-APR Adjustment

Micro-APR adjustment refines credit comparison by accurately reflecting the true cost of borrowing beyond the basic APR, incorporating fees, compounding periods, and payment schedules. This granular approach provides a more precise interest factor, enabling consumers to make better-informed decisions when evaluating loan offers.

Hybrid Factor Credit Scoring

Hybrid Factor Credit Scoring integrates APR and Interest Factor by combining the annual percentage rate's comprehensive cost view with the Interest Factor's focus on loan balance dynamics, offering a nuanced and precise credit comparison metric. This method enhances borrowers' ability to evaluate credit offers by factoring in both fixed and variable cost components, improving decision accuracy in credit assessments.

APR vs Interest Factor for credit comparison Infographic

moneydiff.com

moneydiff.com