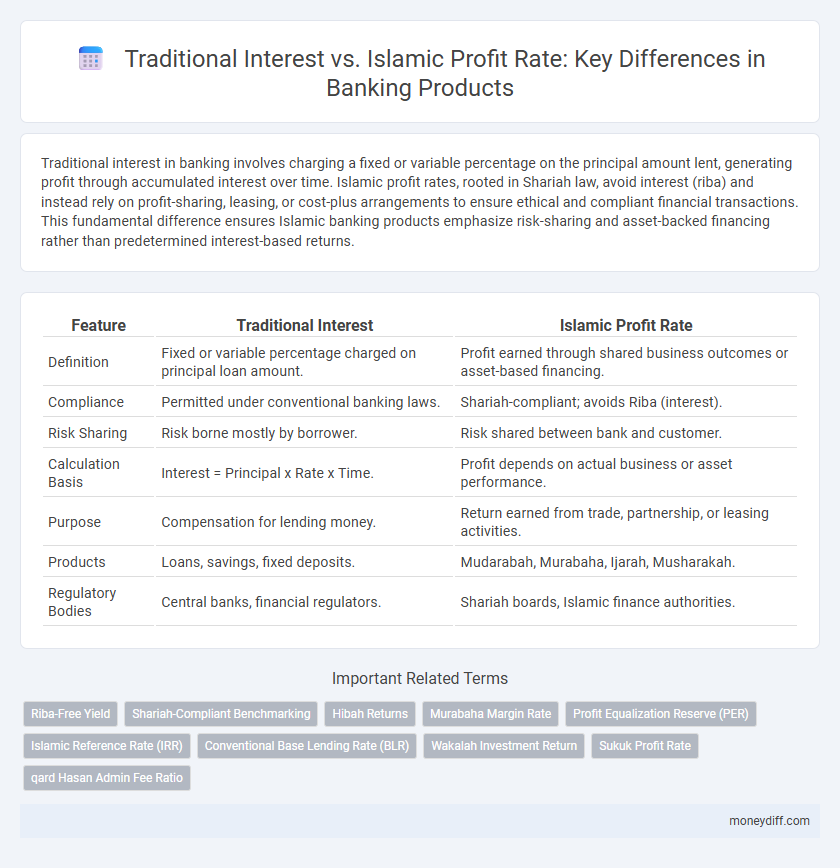

Traditional interest in banking involves charging a fixed or variable percentage on the principal amount lent, generating profit through accumulated interest over time. Islamic profit rates, rooted in Shariah law, avoid interest (riba) and instead rely on profit-sharing, leasing, or cost-plus arrangements to ensure ethical and compliant financial transactions. This fundamental difference ensures Islamic banking products emphasize risk-sharing and asset-backed financing rather than predetermined interest-based returns.

Table of Comparison

| Feature | Traditional Interest | Islamic Profit Rate |

|---|---|---|

| Definition | Fixed or variable percentage charged on principal loan amount. | Profit earned through shared business outcomes or asset-based financing. |

| Compliance | Permitted under conventional banking laws. | Shariah-compliant; avoids Riba (interest). |

| Risk Sharing | Risk borne mostly by borrower. | Risk shared between bank and customer. |

| Calculation Basis | Interest = Principal x Rate x Time. | Profit depends on actual business or asset performance. |

| Purpose | Compensation for lending money. | Return earned from trade, partnership, or leasing activities. |

| Products | Loans, savings, fixed deposits. | Mudarabah, Murabaha, Ijarah, Musharakah. |

| Regulatory Bodies | Central banks, financial regulators. | Shariah boards, Islamic finance authorities. |

Understanding Traditional Interest in Conventional Banking

Traditional interest in conventional banking refers to the fixed or variable percentage charged on principal amounts lent to borrowers, calculated over time to generate profit for financial institutions. This interest model determines loan repayments and deposit earnings, operating on the principle of time value of money without considering the ethical or profit-sharing aspects. Unlike Islamic profit rates, which comply with Shariah law prohibiting interest (riba), conventional interest focuses purely on financial return regardless of underlying business activities.

The Concept of Profit Rate in Islamic Banking

The concept of profit rate in Islamic banking centers on the principle of risk-sharing and asset-backed financing, differing fundamentally from traditional interest-based lending. Islamic financial products calculate profit rates through permissible profit-and-loss sharing contracts such as Mudarabah and Musharakah, where returns are tied to the actual performance of the underlying asset or business. Unlike fixed interest rates, profit rates embody ethical investment and transparency, complying with Shariah law that prohibits Riba (interest).

Key Differences Between Interest and Profit Rate

Traditional interest in banking involves a fixed or variable percentage charged on the principal amount over time, often perceived as a cost of borrowing regardless of business outcomes. Islamic profit rate, based on Shariah principles, reflects a share in actual business profits or losses, emphasizing risk-sharing and ethical investment rather than guaranteed returns. The key difference lies in interest being predetermined and obligatory, while profit rate varies with the success of the underlying asset or enterprise.

Shariah Principles Guiding Islamic Profit Rate

Islamic profit rates in banking are strictly guided by Shariah principles, which prohibit Riba (interest) and emphasize risk-sharing, asset-backed financing, and ethical investments. Unlike traditional interest-based banking that charges a fixed or variable interest rate, Islamic finance structures profit rates through profit-and-loss sharing contracts such as Mudarabah and Murabaha, ensuring compliance with Islamic law. These principles promote fairness and transparency, aligning financial products with moral and social justice values inherent in Shariah.

Comparative Analysis: Conventional Loans vs. Islamic Financing

Conventional loans typically charge interest rates based on principal and time, leading to predictable but potentially high-cost borrowing, while Islamic financing employs profit rates rooted in shared risk and asset-backed agreements, promoting ethical investment. The Islamic profit rate aligns returns with actual business performance, avoiding interest (riba) and ensuring compliance with Shariah principles through structures like Murabaha and Mudarabah. Comparative analysis reveals that Islamic financing emphasizes risk-sharing and asset-backed profits, contrasting with the fixed interest accrual in conventional loans, affecting cost, risk exposure, and financial inclusion.

Transparency and Risk Sharing in Islamic Banking

Islamic banking emphasizes profit rate structures based on risk-sharing and asset-backed transactions rather than traditional interest, promoting transparency in financial dealings. Transparency is enhanced through clear disclosure of profit calculations, ensuring that all parties understand their obligations and expected returns. Risk-sharing mechanisms align the interests of the bank and customers, fostering a partnership approach that differs fundamentally from the fixed interest model in conventional banking.

Impact on Borrowers: Interest Rates vs. Profit Rates

Traditional interest rates impose fixed or variable percentage charges on borrowed capital, often increasing the total repayment amount and potentially burdening borrowers with compounding debt. Islamic profit rates, based on profit-and-loss sharing principles, align the lender's returns with the business outcomes, reducing the risk of exploitation and providing more equitable financial terms. Borrowers under Islamic financing benefit from transparent profit-sharing agreements that can lead to more predictable and fair repayment obligations compared to conventional interest-based loans.

Regulatory Framework for Interest and Profit Rate

Regulatory frameworks governing traditional interest and Islamic profit rates differ significantly, reflecting the foundational principles of each system. Traditional interest rates are regulated by conventional financial authorities emphasizing usury laws and maximum allowed percentages to prevent exploitative lending. In contrast, Islamic finance frameworks comply with Sharia law, prohibiting riba (interest) and enforcing profit-and-loss sharing models under strict regulatory bodies like AAOIFI and IFSB, promoting ethical profit rates aligned with risk-sharing and asset-backed transactions.

Ethical Considerations in Financial Products

Traditional interest-based banking often faces ethical scrutiny due to charges on loans that can lead to debt burdens, whereas Islamic profit rate models align with Sharia principles by promoting risk-sharing and prohibiting exploitative practices. Financial products under Islamic finance emphasize fairness and social justice, ensuring returns are earned through genuine trade and investment activities. These ethical considerations foster trust and transparency, making Islamic profit rate banking a preferred choice for clients seeking morally responsible financial solutions.

Choosing the Right Banking Product for Your Needs

When choosing the right banking product, understanding the difference between traditional interest and Islamic profit rates is crucial to aligning with your financial goals and ethical values. Traditional interest-based products charge a fixed or variable rate on loans, while Islamic banking products use profit-sharing models compliant with Shariah law, avoiding interest charges. Carefully evaluating your tolerance for risk and desire for ethical finance will guide you in selecting products such as fixed deposits with conventional interest or Murabaha and Mudarabah contracts offered by Islamic banks.

Related Important Terms

Riba-Free Yield

Traditional interest-based banking calculates returns using fixed or variable interest rates, often leading to compound interest accumulation and potential ethical concerns related to Riba. Islamic profit rates employ Sharia-compliant methods such as profit-sharing and trading-based returns, ensuring a Riba-free yield that aligns with Islamic finance principles promoting risk-sharing and asset-backed transactions.

Shariah-Compliant Benchmarking

Traditional interest in banking products is based on a fixed or variable percentage charged on loans, whereas Islamic profit rates adhere to Shariah-compliant benchmarking that avoids riba by sharing risk and profit through contracts like Murabaha and Mudarabah. Islamic finance utilizes benchmarks such as the Islamic Interbank Benchmark Rate (IIBR) or Commodity Murabaha Rate (CMR) to ensure profit rates align with ethical and religious principles, promoting profit-and-loss sharing instead of guaranteed interest returns.

Hibah Returns

Traditional interest in banking products involves predetermined fixed or variable rates paid to depositors or charged on loans, reflecting time value of money concepts. Islamic profit rate, particularly in Hibah returns, offers non-obligatory gifts from banks to customers, emphasizing profit-sharing and ethical financial principles without guaranteed interest payments.

Murabaha Margin Rate

Traditional interest rates in banking products are calculated based on fixed or variable interest percentages applied to the principal loan amount, often resulting in compound interest over time. In contrast, the Islamic Profit Rate for Murabaha transactions is derived from a predetermined margin rate incorporated into the sale price, complying with Sharia principles by avoiding interest (riba) and focusing on profit earned through asset sale.

Profit Equalization Reserve (PER)

The Profit Equalization Reserve (PER) in Islamic banking mitigates profit rate fluctuations by smoothing returns for depositors, contrasting with traditional interest systems where fixed or variable interest rates generate predictable but interest-based yields. PER ensures compliance with Shariah principles by avoiding predetermined interest, aligning profit distribution with actual business performance rather than interest accrual.

Islamic Reference Rate (IRR)

Traditional interest involves a fixed or variable percentage charged on borrowed funds, often leading to compounding debt, whereas the Islamic Profit Rate is based on Sharia-compliant principles that avoid interest (riba) and emphasize profit-and-loss sharing. The Islamic Reference Rate (IRR) serves as a benchmark for pricing Islamic banking products, reflecting market-driven profit rates aligned with ethical finance, enhancing transparency and stability within Islamic financial markets.

Conventional Base Lending Rate (BLR)

The Conventional Base Lending Rate (BLR) serves as the benchmark for calculating interest on loans in traditional banking, directly influencing the borrower's repayment amount through fixed or variable interest charges. Islamic finance replaces interest with a profit rate, adhering to Sharia principles by linking returns to asset performance rather than predetermined interest, ensuring risk-sharing and ethical compliance in banking products.

Wakalah Investment Return

Traditional interest involves fixed or variable rates paid on loans or deposits, generating income through predetermined percentages, whereas Islamic profit rates, such as those in Wakalah investment returns, are based on profit-sharing mechanisms aligned with Shariah principles, emphasizing risk-sharing and ethical investing. Wakalah contracts appoint agents to manage investments, distributing returns proportionally to actual profits earned, thus avoiding interest (riba) and promoting transparency in Islamic banking products.

Sukuk Profit Rate

Traditional interest in banking involves a fixed or variable interest rate applied to loans, generating profit primarily through interest payments, whereas Islamic finance prohibits interest (riba) and instead utilizes profit-sharing mechanisms like Sukuk, which offer returns based on asset-backed investments and profit rates aligned with Shariah principles. Sukuk profit rates vary depending on the underlying assets' performance, ensuring ethical investment and risk-sharing between issuer and investor, differentiating them fundamentally from conventional interest-bearing products.

qard Hasan Admin Fee Ratio

Traditional interest banking products typically charge a fixed or variable interest rate on loans, generating profit directly from the borrowed principal, whereas Islamic banking employs a profit rate structure, such as the Qard Hasan admin fee ratio, which allows for an interest-free loan with a permissible administrative fee to cover operational costs without violating Shariah principles. The Qard Hasan admin fee ratio is carefully regulated to ensure transparency and fairness, aligning with Islamic finance ethics by avoiding exploitative interest and emphasizing risk-sharing and ethical profit earning.

Traditional Interest vs Islamic Profit Rate for banking products Infographic

moneydiff.com

moneydiff.com