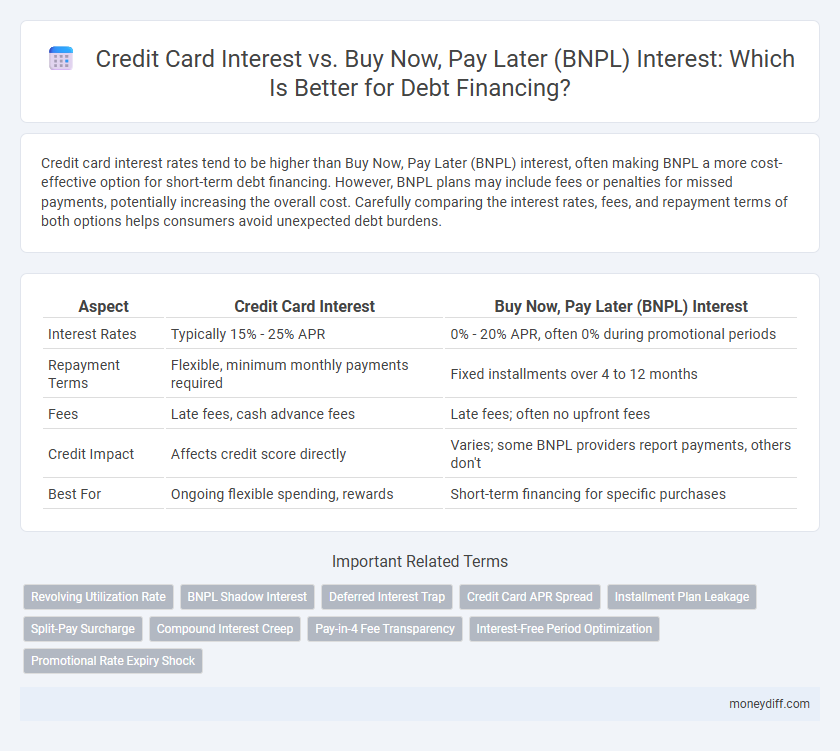

Credit card interest rates tend to be higher than Buy Now, Pay Later (BNPL) interest, often making BNPL a more cost-effective option for short-term debt financing. However, BNPL plans may include fees or penalties for missed payments, potentially increasing the overall cost. Carefully comparing the interest rates, fees, and repayment terms of both options helps consumers avoid unexpected debt burdens.

Table of Comparison

| Aspect | Credit Card Interest | Buy Now, Pay Later (BNPL) Interest |

|---|---|---|

| Interest Rates | Typically 15% - 25% APR | 0% - 20% APR, often 0% during promotional periods |

| Repayment Terms | Flexible, minimum monthly payments required | Fixed installments over 4 to 12 months |

| Fees | Late fees, cash advance fees | Late fees; often no upfront fees |

| Credit Impact | Affects credit score directly | Varies; some BNPL providers report payments, others don't |

| Best For | Ongoing flexible spending, rewards | Short-term financing for specific purchases |

Credit Card Interest Rates: What You Need to Know

Credit card interest rates typically range from 15% to 25% APR, making them one of the more expensive forms of debt financing compared to Buy Now, Pay Later (BNPL) services that often offer interest-free periods or lower rates for short-term repayment. High credit utilization and missed payments can cause credit card interest rates to increase significantly, impacting overall debt cost. Understanding the terms, such as grace periods, compounding frequency, and penalty APRs, is essential for managing credit card debt effectively.

How Buy Now, Pay Later Interest Works

Buy Now, Pay Later (BNPL) interest typically accrues through fixed installment payments spread over a set period, often with zero or low interest if paid on time, unlike credit cards that charge variable interest rates on revolving balances. BNPL platforms impose late fees or higher interest rates if payments are missed, making timely payments crucial to avoid increased debt costs. This structured repayment plan contrasts with the compound interest charged by credit cards, which can accelerate debt accumulation if balances are not promptly paid.

Comparing APR: Credit Cards vs. BNPL

Credit cards typically carry an average APR ranging from 15% to 25%, while Buy Now, Pay Later (BNPL) services often offer interest-free periods but may impose APRs between 20% and 30% after that window expires. Consumers should carefully compare credit card APRs against BNPL post-promotion rates to assess true borrowing costs. Evaluating these interest rates helps in choosing the most cost-effective debt financing option.

Payment Terms: Flexibility and Pitfalls

Credit card interest rates typically range from 15% to 25% APR, offering flexible payment terms but risking high compound interest if balances remain unpaid. Buy Now, Pay Later (BNPL) services often provide short-term, interest-free periods but impose steep fees and interest upon missed or late payments, reducing overall flexibility. Consumers must evaluate payment schedules and potential penalties to avoid accumulating costly debt in both financing options.

Interest Accumulation: Which Costs More Over Time?

Credit card interest typically accrues daily based on the average daily balance, leading to compounding costs that can significantly increase debt over time. Buy Now, Pay Later (BNPL) plans often offer interest-free periods or fixed fees but may incur high interest rates or penalties if payments are missed or extended. Over extended periods, credit card interest generally results in higher overall costs due to compounding, whereas BNPL can be cheaper if paid within agreed terms but becomes costly with delays.

Minimum Payments: Credit Card vs. BNPL Risk

Credit card interest accrues immediately on the outstanding balance, often resulting in higher costs if only minimum payments are made, which typically cover mainly interest and fees rather than principal reduction. Buy Now, Pay Later (BNPL) plans usually offer interest-free periods but can impose steep penalties or high-interest rates if payments are missed or extended, increasing the risk of escalating debt. Consumers making minimum payments on credit cards face the risk of prolonged debt cycles, whereas BNPL's structured installments can mitigate long-term interest but may lead to sudden financial strain if not managed properly.

Fees and Penalties: Hidden Costs to Watch Out For

Credit card interest rates typically range from 15% to 25% annually, with late payment fees up to $40, making total costs potentially high over time. Buy Now, Pay Later (BNPL) services often advertise zero upfront interest but impose steep late fees and penalty charges that can exceed 25% of the unpaid balance. Consumers must scrutinize fee schedules and penalty structures closely to avoid hidden costs that undermine the apparent savings of BNPL compared to traditional credit card debt financing.

Impact on Credit Score: Credit Card vs. BNPL Debt

Credit card interest accumulation can significantly increase credit utilization ratio, adversely affecting credit scores by signaling higher risk to lenders. Buy Now, Pay Later (BNPL) services often report less frequently to credit bureaus, potentially minimizing immediate credit score impact but posing risks of unnoticed debt buildup. Consistent BNPL defaults may lead to sudden credit score drops if reported, whereas credit card interest directly correlates with ongoing score fluctuations due to revolving balances.

Choosing the Best Debt Financing Option

Credit card interest rates typically range from 15% to 25% APR, making them more costly for long-term debt financing compared to Buy Now, Pay Later (BNPL) programs, which often offer 0% interest for promotional periods. BNPL solutions enhance affordability by deferring payments without immediate interest accrual but may impose late fees and higher rates post-promotion. Evaluating your repayment capacity, interest duration, and fee structures helps select the optimal debt financing option between credit cards and BNPL services.

Strategies to Minimize Interest with Credit or BNPL

To minimize interest costs when using credit cards or Buy Now, Pay Later (BNPL) options for debt financing, prioritize paying balances in full before the due date to avoid high credit card APRs or BNPL deferred interest. Utilize cards with 0% introductory APR offers or select BNPL plans with no interest fees if paid within the promotional period. Regularly monitor spending limits and repayment schedules to prevent interest accrual and maintain a healthy credit score.

Related Important Terms

Revolving Utilization Rate

Credit card interest rates typically range from 15% to 25%, directly impacting your revolving utilization rate and increasing overall debt costs if balances are not paid in full monthly. Buy Now, Pay Later services often offer lower or zero interest for short-term periods but can lead to higher revolving utilization and potential fees if payments are missed or extended beyond the interest-free window.

BNPL Shadow Interest

Credit card interest rates typically range from 15% to 25% APR, directly impacting the overall cost of debt financing, whereas Buy Now, Pay Later (BNPL) services often advertise zero upfront interest but embed shadow interest through fees, late penalties, or higher prices, effectively increasing the total repayment amount. The opaque nature of BNPL shadow interest presents risks for consumers who underestimate the true cost compared to transparent credit card interest, making debt management and financing decisions critical in avoiding unexpected expenses.

Deferred Interest Trap

Credit card interest rates typically range from 15% to 25% APR, often compounding daily, which can quickly escalate debt if balances are not paid in full. Buy Now, Pay Later (BNPL) plans may advertise zero interest upfront but commonly include deferred interest traps where interest accrues retroactively if the balance is not settled within the promotional period, leading to unexpected high costs.

Credit Card APR Spread

Credit card interest rates typically have a higher Annual Percentage Rate (APR) spread compared to Buy Now, Pay Later (BNPL) plans, which often offer promotional interest-free periods but can escalate to higher penalties if missed. The wider APR spread in credit cards reflects risk-adjusted pricing based on creditworthiness and revolving balances, making it crucial for consumers to understand how these differences impact overall debt financing costs.

Installment Plan Leakage

Credit card interest rates typically range from 15% to 25% annually, often compounding monthly and leading to significant cost escalation for revolving balances, while Buy Now, Pay Later (BNPL) services usually offer interest-free periods but impose high late fees and variable interest post-grace period, creating installment plan leakage through missed payments and unanticipated charges. This leakage exacerbates debt financing costs by shifting the burden from upfront interest to incremental penalties, undermining the perceived affordability of BNPL compared to traditional credit card financing.

Split-Pay Surcharge

Credit card interest rates typically range from 15% to 25% APR, often applied monthly to outstanding balances, while Buy Now, Pay Later (BNPL) plans may charge zero interest but impose a split-pay surcharge averaging 5% to 10% of the purchase price, resulting in higher effective costs for deferred payments. Consumers comparing debt financing options should evaluate total repayment amounts, including credit card compound interest and BNPL split-pay surcharges, to determine the most affordable borrowing method.

Compound Interest Creep

Credit card interest often compounds daily, leading to exponential growth in debt through compound interest creep, whereas Buy Now, Pay Later (BNPL) plans typically offer interest-free periods but may incur high fees and interest once deferred payments become overdue. Understanding the impact of compound interest on credit card balances is crucial for managing long-term financing costs compared to the generally simpler, but potentially costly, BNPL structures.

Pay-in-4 Fee Transparency

Credit card interest rates typically range from 15% to 25% APR, often resulting in cumulative high costs for revolving balances, whereas Buy Now, Pay Later (BNPL) services like Pay-in-4 offer transparent fee structures with little to no interest if payments are made on time. Pay-in-4's fixed installment fees enhance cost predictability and reduce the risk of hidden charges compared to variable credit card interest, making it a clearer option for short-term debt financing.

Interest-Free Period Optimization

Credit card interest rates typically range from 15% to 25% APR, with an interest-free period averaging 20 to 55 days, allowing users to optimize short-term debt without immediate cost when balances are paid in full. Buy Now, Pay Later (BNPL) schemes often offer zero-interest periods spanning 30 to 60 days but may impose high late fees or jump interest rates afterward, making strategic repayment essential for minimizing overall financing costs.

Promotional Rate Expiry Shock

Credit card interest rates often rise sharply after the promotional period ends, causing an interest rate shock that significantly increases debt servicing costs. Buy Now, Pay Later plans may offer interest-free installments initially but can impose high interest rates or fees once the promotional period expires, leading to unexpected financial burdens.

Credit Card Interest vs Buy Now, Pay Later Interest for debt financing Infographic

moneydiff.com

moneydiff.com