Daily compounding interest calculates interest on the principal and accumulated interest every day, leading to faster growth compared to less frequent compounding. Continuous compounding interest takes this concept to the limit by compounding at every possible instant, maximizing returns mathematically. Understanding the frequency of compounding helps investors choose strategies that optimize compound interest benefits over time.

Table of Comparison

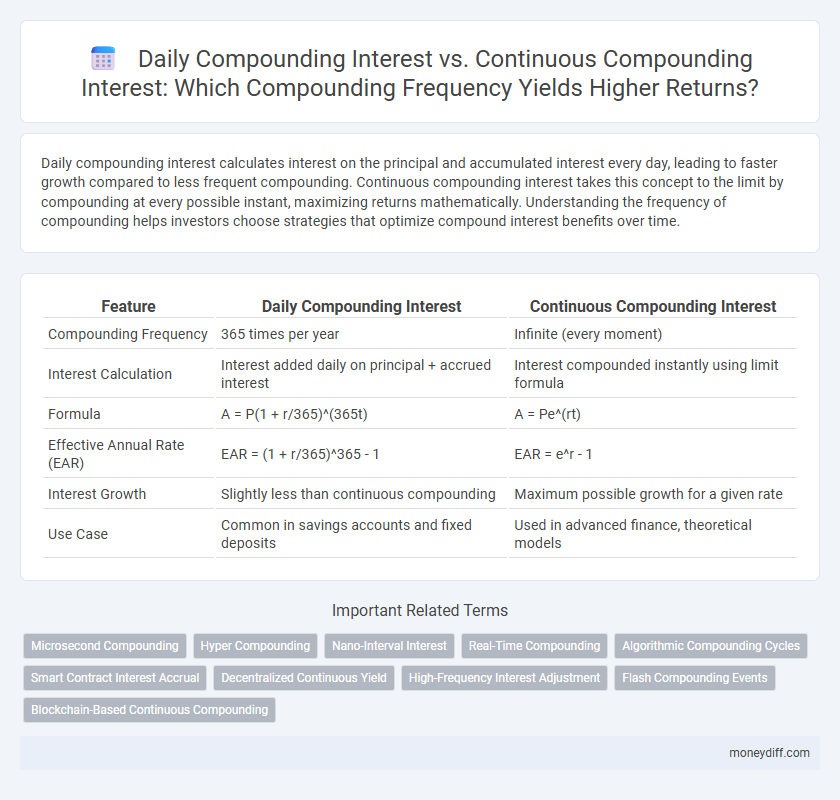

| Feature | Daily Compounding Interest | Continuous Compounding Interest |

|---|---|---|

| Compounding Frequency | 365 times per year | Infinite (every moment) |

| Interest Calculation | Interest added daily on principal + accrued interest | Interest compounded instantly using limit formula |

| Formula | A = P(1 + r/365)^(365t) | A = Pe^(rt) |

| Effective Annual Rate (EAR) | EAR = (1 + r/365)^365 - 1 | EAR = e^r - 1 |

| Interest Growth | Slightly less than continuous compounding | Maximum possible growth for a given rate |

| Use Case | Common in savings accounts and fixed deposits | Used in advanced finance, theoretical models |

Understanding Compounding: Daily vs Continuous Interest

Daily compounding interest calculates interest on the principal and accumulated interest at the end of each day, resulting in slightly higher returns compared to less frequent compounding periods. Continuous compounding interest, based on the mathematical constant e, assumes interest is being compounded an infinite number of times per day, maximizing the growth potential of an investment. Understanding the differences between daily and continuous compounding allows investors to better optimize their returns by selecting the most appropriate compounding frequency for their financial goals.

The Mathematics Behind Compounding Frequencies

Daily compounding interest calculates interest on the initial principal and the accumulated interest from previous days, using 365 compounding periods per year, which results in more precise growth compared to less frequent compounding. Continuous compounding interest, expressed mathematically as A = Pe^(rt), assumes interest is compounded an infinite number of times per year, leading to the maximum possible yield for a given nominal rate r and time t. The key mathematical difference lies in the exponential formula for continuous compounding versus the discrete formula A = P(1 + r/n)^(nt) used in daily compounding, where n equals 365.

How Daily Compounding Interest Works

Daily compounding interest calculates interest on the initial principal and the accumulated interest from previous days, compounding 365 times a year. This frequent compounding period results in higher returns compared to monthly or quarterly compounding, as interest is added to the principal balance every day. The formula used is A = P(1 + r/365)^(365t), where P is principal, r is annual interest rate, and t is time in years.

Continuous Compounding Interest Explained

Continuous compounding interest calculates returns by applying interest an infinite number of times per period, providing a more precise growth model compared to daily compounding. The formula A = P * e^(rt) uses the mathematical constant e to represent continuous growth, capturing exponential accumulation without discrete intervals. This method results in a higher effective interest rate, making it crucial for financial instruments requiring maximum growth efficiency over time.

Key Differences: Daily vs Continuous Compounding

Daily compounding interest calculates interest on the principal balance plus the accumulated interest each day, resulting in 365 compounding periods annually. Continuous compounding interest assumes interest is compounded an infinite number of times per year, using the mathematical constant e, thus providing the maximum possible yield. The key difference lies in frequency and formula application: daily uses discrete compounding periods, while continuous uses a limit-based exponential function for growth.

Impact on Investment Growth: Frequency Matters

Daily compounding interest calculates interest added to the principal every day, accelerating investment growth through frequent interest application. Continuous compounding interest mathematically assumes interest is compounded infinitely often, resulting in the highest possible growth rate by applying interest at every conceivable instant. The frequency of compounding directly influences the investment's future value, with continuous compounding generating slightly greater returns compared to daily compounding, especially over long periods.

Practical Examples: Calculating Daily and Continuous Interest

Calculating daily compounding interest involves applying the formula A = P(1 + r/365)^(365t), where interest is added every day, making it highly effective for short-term investments with frequent compounding intervals. Continuous compounding interest uses the formula A = Pe^(rt), representing the theoretical maximum frequency where interest accrues constantly, ideal for modeling exponential growth in financial and actuarial applications. For example, a $10,000 investment at 5% annual interest compounded daily for one year results in approximately $10,512.67, whereas continuous compounding yields about $10,512.71, illustrating minimal but impactful differences over the same period.

Pros and Cons of Daily Compounding

Daily compounding interest calculates interest every day, allowing investors to earn interest on previously accrued interest frequently, which can significantly enhance returns over time. However, its complexity increases the need for precise calculation, and it may incur higher administrative costs compared to less frequent compounding methods. While daily compounding offers more accurate growth tracking, it may yield slightly lower returns than continuous compounding, which compounds interest instantly and continuously.

Advantages and Disadvantages of Continuous Compounding

Continuous compounding interest calculates interest at every possible instant, maximizing the growth potential of investments compared to daily compounding, which compounds interest 365 times per year. The advantage of continuous compounding lies in its ability to yield the highest possible return by constantly adding earned interest to the principal, making it ideal for long-term investments. However, the complexity of formulas and assumptions about constant rates may pose challenges for practical financial calculations and short-term interest applications.

Which Compounding Frequency Is Best for Your Money?

Daily compounding interest calculates interest on the principal and accumulated interest every day, maximizing returns more than monthly or quarterly compounding. Continuous compounding interest theoretically compounds infinitely, leading to the highest possible growth rate, expressed mathematically as A = Pe^(rt). Choosing between daily and continuous compounding depends on the investment duration and amount, with continuous compounding offering optimal growth for long-term, high-value investments.

Related Important Terms

Microsecond Compounding

Microsecond compounding interest, an ultra-high-frequency variant of continuous compounding, accelerates interest accumulation by calculating growth at intervals shorter than a microsecond, surpassing traditional daily compounding methods in precision and potential returns. This hyper-frequent compounding leverages advanced computational capabilities to maximize investment yield through nearly instantaneous interest reinvestment.

Hyper Compounding

Daily compounding interest calculates interest on the initial principal and the accumulated interest each day, resulting in faster growth compared to monthly or yearly compounding. Continuous compounding interest represents the theoretical limit of compounding frequency, maximizing hyper compounding effects by applying interest an infinite number of times per day, thus yielding the highest possible return on investment.

Nano-Interval Interest

Daily compounding interest calculates interest on the principal plus accumulated interest once every 24 hours, while continuous compounding interest assumes interest is compounded an infinite number of times per day, effectively at every possible instant. Nano-interval interest, a concept extending continuous compounding, implies interest accrual at nanosecond intervals, maximizing compounding frequency and resulting in near-theoretical maximum interest growth over time.

Real-Time Compounding

Daily compounding interest calculates interest by adding it to the principal every day, resulting in slightly higher returns compared to less frequent compounding intervals. Continuous compounding interest mathematically models interest being added an infinite number of times per day, effectively providing the highest possible yield by maximizing the frequency of real-time compounding.

Algorithmic Compounding Cycles

Daily compounding interest calculates interest based on the principal and accumulated interest every day, resulting in discrete compounding cycles, whereas continuous compounding interest applies an algorithmic approach that treats compounding as an instant, infinite-frequency process modeled by the exponential function e^(rt). The algorithmic compounding cycles for continuous compounding optimize growth by simulating a limit where the compounding interval approaches zero, offering a mathematically precise maximum return compared to finite daily intervals.

Smart Contract Interest Accrual

Daily compounding interest calculates and adds interest to the principal at the end of each day, enabling frequent accrual that benefits smart contracts by reducing the gap between interest calculations. Continuous compounding interest uses mathematical limits to accrue interest at every possible instant, maximizing returns on smart contract balances through seamless and constant growth without discrete intervals.

Decentralized Continuous Yield

Daily compounding interest calculates earnings based on interest added every 24 hours, while continuous compounding interest mathematically applies interest at every possible instant, maximizing growth potential. In decentralized continuous yield protocols, this real-time interest accrual model enhances user returns by leveraging blockchain's constant state updates and automated smart contract execution.

High-Frequency Interest Adjustment

Daily compounding interest calculates interest on the principal plus accumulated interest at the end of each day, resulting in frequent but discrete adjustments. Continuous compounding interest mathematically models interest being added at every possible instant, maximizing growth by treating compounding frequency as infinitely high.

Flash Compounding Events

Daily compounding interest calculates interest based on the principal and accumulated interest added at the end of each day, resulting in discrete compounding events that maximize growth over time. Continuous compounding interest, modeled by the formula A = Pe^(rt), assumes an infinite number of flash compounding events occurring instantaneously, leading to the highest possible accumulation by effectively compounding interest every moment.

Blockchain-Based Continuous Compounding

Blockchain-based continuous compounding interest leverages decentralized ledger technology to calculate interest in real-time, offering a higher frequency of compounding compared to traditional daily compounding methods. This approach maximizes returns by continuously updating the principal value, eliminating time gaps inherent in daily compounding calculations and enhancing transparency and security through smart contracts.

Daily Compounding Interest vs Continuous Compounding Interest for frequency of compounding. Infographic

moneydiff.com

moneydiff.com