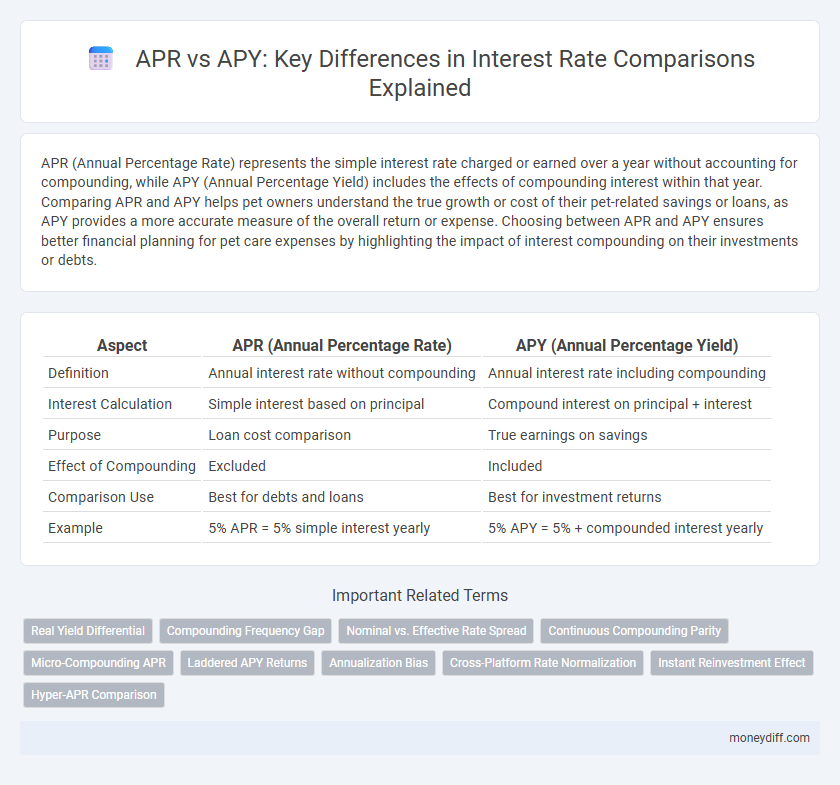

APR (Annual Percentage Rate) represents the simple interest rate charged or earned over a year without accounting for compounding, while APY (Annual Percentage Yield) includes the effects of compounding interest within that year. Comparing APR and APY helps pet owners understand the true growth or cost of their pet-related savings or loans, as APY provides a more accurate measure of the overall return or expense. Choosing between APR and APY ensures better financial planning for pet care expenses by highlighting the impact of interest compounding on their investments or debts.

Table of Comparison

| Aspect | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | Annual interest rate without compounding | Annual interest rate including compounding |

| Interest Calculation | Simple interest based on principal | Compound interest on principal + interest |

| Purpose | Loan cost comparison | True earnings on savings |

| Effect of Compounding | Excluded | Included |

| Comparison Use | Best for debts and loans | Best for investment returns |

| Example | 5% APR = 5% simple interest yearly | 5% APY = 5% + compounded interest yearly |

Understanding APR vs APY: Key Definitions

APR (Annual Percentage Rate) represents the yearly interest charged on a loan without accounting for compounding within the year, while APY (Annual Percentage Yield) includes the effects of compounding interest, providing a more accurate measure of the actual earning or cost over time. Comparing APR and APY is crucial for evaluating loan offers or investment returns, as APY reflects the true financial impact by incorporating compounding frequency. Understanding these definitions helps consumers make informed decisions about borrowing costs and investment gains.

How APR and APY Are Calculated

APR (Annual Percentage Rate) represents the yearly interest charged on a loan or earned on an investment without accounting for compounding within the year, calculated as the simple interest rate multiplied by the number of periods per year. APY (Annual Percentage Yield) includes the effects of compound interest, calculated by taking the periodic interest rate, compounding it over the number of periods in a year, and expressing the total effective annual rate. This means APY always reflects a higher or equal percentage than APR when compounding occurs, providing a more accurate measure of real earnings or costs.

The Impact of Compounding on Interest Rates

APR represents the annual interest rate without accounting for compounding periods, while APY reflects the effective annual rate including the impact of compounding. Compounding frequency significantly influences APY, causing it to be higher than APR when interest compounds multiple times per year. Understanding this difference is essential for accurately comparing loan or investment returns and assessing the true cost or yield.

APR vs APY: Which Reflects True Borrowing Costs?

APR (Annual Percentage Rate) represents the nominal interest rate plus certain fees, providing a straightforward cost of borrowing without accounting for compounding within the year. APY (Annual Percentage Yield) includes the effect of intra-year compounding, offering a more accurate measure of the actual interest earned or paid over time. When comparing loan costs, APR reveals up-front borrowing expenses, whereas APY reflects the true financial impact by incorporating compounding, making APY a better indicator of real borrowing costs.

When to Use APR for Rate Comparison

APR (Annual Percentage Rate) should be used for rate comparison when evaluating loans or credit products because it reflects the total yearly cost of borrowing, including fees and interest. It provides a clear picture of the actual cost to the borrower, making it easier to compare different loan offers. APR is less suitable for investment returns where compounding interest is a key factor.

When APY Matters Most for Savers

APY (Annual Percentage Yield) matters most for savers because it accounts for compound interest, showing the true earnings on a savings account over a year. Unlike APR (Annual Percentage Rate), which only reflects simple interest, APY provides a more accurate comparison of interest rates when interest compounds multiple times per year. Savers should prioritize APY to gauge the actual growth potential of their deposits, especially with high-frequency compounding accounts.

Common APR and APY Mistakes to Avoid

Confusing APR (Annual Percentage Rate) with APY (Annual Percentage Yield) leads to inaccurate interest comparisons because APR excludes compounding while APY includes it, reflecting true earnings. Many mistakenly compare nominal APR rates instead of effective APY, resulting in underestimating or overestimating investment returns or loan costs. Avoid this by always calculating or requesting APY for savings and investment products to understand the actual annual growth or expense.

Comparing Loan Offers: APR in Practice

APR (Annual Percentage Rate) reflects the true cost of borrowing by including interest and fees, making it essential for comparing loan offers accurately. APY (Annual Percentage Yield) shows the effective interest earned on investments, factoring in compound interest, thus it is less relevant for loans. When evaluating loans, APR provides a comprehensive metric to assess the overall cost, enabling borrowers to make informed decisions between competing offers.

Maximizing Returns: APY for Savings Accounts

APY (Annual Percentage Yield) accurately reflects the total earnings on savings accounts by including compound interest, making it essential for maximizing returns. APR (Annual Percentage Rate) only shows the simple interest rate without compounding, which can underestimate actual earnings. Using APY allows savers to compare rates effectively and choose accounts that grow their money faster over time.

Making Smart Financial Choices: APR vs APY

APR (Annual Percentage Rate) represents the interest charged or earned annually without compounding, making it ideal for understanding loan costs and credit offers. APY (Annual Percentage Yield) includes compounding effects, reflecting the actual return on investments or savings over a year, crucial for comparing deposit accounts. Evaluating both APR and APY enables smarter financial decisions by accurately assessing borrowing expenses against investment growth potential.

Related Important Terms

Real Yield Differential

APR interest reflects the nominal annual rate without compounding, while APY includes the effect of compounding, providing a more accurate measure of real yield differential for investment comparison. Understanding the difference between APR and APY is crucial for evaluating true returns, as APY reveals the actual percentage earned or paid over a year considering interest compounding frequency.

Compounding Frequency Gap

APR interest represents the annual rate without accounting for compounding within the year, while APY interest reflects the effective annual rate including the impact of compounding frequency. The compounding frequency gap significantly influences the difference between APR and APY, as more frequent compounding periods increase the APY, resulting in higher overall returns compared to the nominal APR.

Nominal vs. Effective Rate Spread

APR (Annual Percentage Rate) represents the nominal interest rate without accounting for compounding, while APY (Annual Percentage Yield) reflects the effective interest rate including compounding effects, providing a more accurate measure of actual earnings or costs. The spread between nominal APR and effective APY highlights the impact of compounding frequency on overall interest, crucial for comparing loan or investment options.

Continuous Compounding Parity

APR interest represents the annual rate without accounting for compounding effects, while APY interest includes compound interest, reflecting the true annual yield. Continuous compounding parity occurs when the effective interest rate from continuous compounding equals the APY calculated from discrete compounding periods, providing a precise basis for comparing different interest rates.

Micro-Compounding APR

Micro-compounding APR calculates interest on a more frequent basis within the annual period, resulting in a more accurate reflection of growth compared to traditional APR, which does not include compounding effects. APY interest explicitly incorporates compound interest, providing a higher effective yield by accounting for interest-on-interest accumulation.

Laddered APY Returns

Laddered APY returns offer compounded interest benefits over APR rates, maximizing earnings by reinvesting interest at varying maturities to optimize growth. Unlike APR, which represents simple annual interest without compounding, APY reflects true annual yield, making laddered APY strategies more effective for higher, sustained returns.

Annualization Bias

APR interest represents the simple annual rate without compounding effects, which can lead to an annualization bias when comparing rates. APY interest accounts for compounding periods within the year, providing a more accurate measure of the effective annual rate and a better comparison tool for true investment returns.

Cross-Platform Rate Normalization

APR (Annual Percentage Rate) represents the yearly interest without compounding, while APY (Annual Percentage Yield) includes compounding effects, making APY a more accurate measure for cross-platform rate normalization. Comparing rates using APY standardizes the evaluation by reflecting the true earning potential or cost of interest across different financial products and platforms.

Instant Reinvestment Effect

APR (Annual Percentage Rate) reflects the simple interest earned or paid over a year without accounting for compounding periods, while APY (Annual Percentage Yield) incorporates the effect of compound interest by assuming instant reinvestment of earnings. This instant reinvestment effect in APY results in a higher effective return compared to APR when interest compounds more frequently than annually.

Hyper-APR Comparison

APR interest represents the annual rate charged without compounding effects, while APY interest includes compound interest, providing a more accurate reflection of actual earnings or costs. Hyper-APR comparison highlights the stark differences in yield when high-frequency compounding dramatically boosts APY beyond the nominal APR rate.

APR Interest vs APY Interest for rate comparison. Infographic

moneydiff.com

moneydiff.com