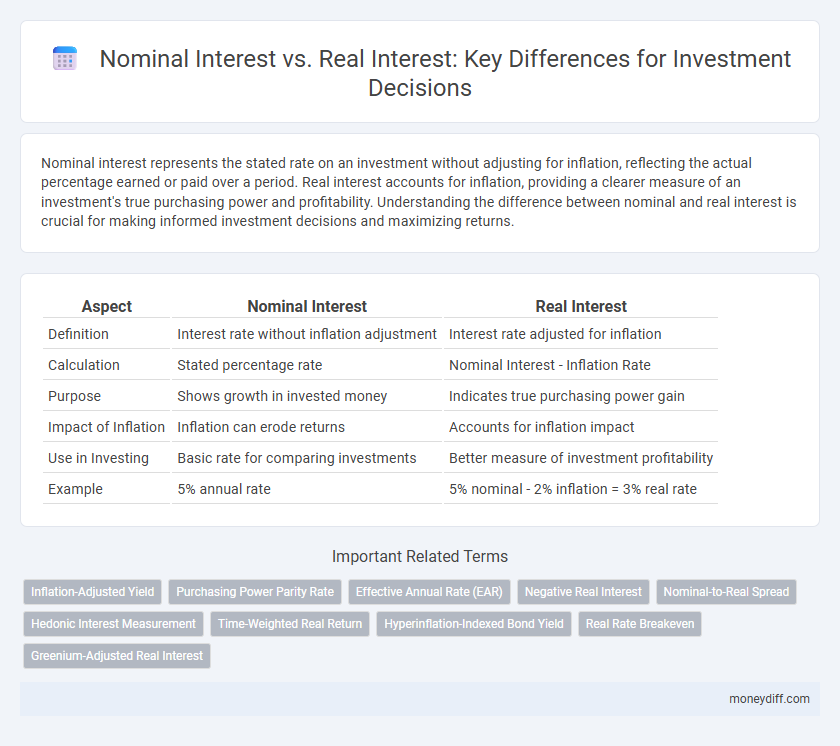

Nominal interest represents the stated rate on an investment without adjusting for inflation, reflecting the actual percentage earned or paid over a period. Real interest accounts for inflation, providing a clearer measure of an investment's true purchasing power and profitability. Understanding the difference between nominal and real interest is crucial for making informed investment decisions and maximizing returns.

Table of Comparison

| Aspect | Nominal Interest | Real Interest |

|---|---|---|

| Definition | Interest rate without inflation adjustment | Interest rate adjusted for inflation |

| Calculation | Stated percentage rate | Nominal Interest - Inflation Rate |

| Purpose | Shows growth in invested money | Indicates true purchasing power gain |

| Impact of Inflation | Inflation can erode returns | Accounts for inflation impact |

| Use in Investing | Basic rate for comparing investments | Better measure of investment profitability |

| Example | 5% annual rate | 5% nominal - 2% inflation = 3% real rate |

Understanding Nominal Interest: The Basics

Nominal interest represents the stated percentage rate on an investment or loan, not accounting for inflation or changes in purchasing power. Investors rely on nominal interest rates to gauge expected earnings before adjusting for economic factors that erode actual returns. Understanding nominal interest is crucial to compare investment options and anticipate future nominal cash flows.

What is Real Interest? Key Concepts Explained

Real interest represents the nominal interest rate adjusted for inflation, reflecting the true purchasing power of investment returns. It indicates the actual growth of an investment by accounting for changes in price levels, which is crucial for making informed financial decisions. Understanding real interest helps investors evaluate the genuine profitability of their portfolios beyond just nominal gains.

Why the Difference Between Nominal and Real Interest Matters

Understanding the difference between nominal and real interest is crucial for investors aiming to preserve purchasing power and achieve accurate returns. Nominal interest reflects the stated rate without inflation adjustment, while real interest accounts for inflation, revealing the true growth of an investment. Ignoring this distinction can lead to overestimating earnings and making poor financial decisions.

Inflation’s Impact on Your Investment Returns

Nominal interest represents the stated return on an investment without adjusting for inflation, while real interest accounts for the inflation rate, reflecting the actual purchasing power gained. Inflation erodes nominal returns by decreasing the value of future cash flows, making real interest the more accurate measure of an investment's profitability. Investors should prioritize real interest rates to assess the true growth of their wealth and safeguard against inflation's diminishing effects.

Calculating Real Interest from Nominal Interest Rates

Calculating real interest from nominal interest rates involves adjusting for inflation to determine the true earning power of an investment. The formula to find real interest is [(1 + nominal interest rate) / (1 + inflation rate)] - 1, which provides a more accurate reflection of purchasing power growth. This adjustment is crucial for investors comparing investment returns over time, allowing them to make informed decisions based on actual gains rather than nominal figures.

Nominal vs Real Interest: Practical Investment Examples

Nominal interest represents the stated rate on an investment without adjusting for inflation, while real interest accounts for inflation's impact on purchasing power. For instance, a bond offering a 6% nominal interest rate with 2% inflation yields a 4% real interest return, reflecting true earnings. Investors focusing on real interest understand the effective growth of their investments, aiding in more accurate financial planning and wealth preservation.

Protecting Your Investments from Inflation Erosion

Nominal interest represents the stated return on an investment without adjusting for inflation, while real interest accounts for inflation's impact, reflecting the true purchasing power of earnings. Protecting your investments from inflation erosion requires focusing on real interest rates to ensure that returns outpace rising prices. Strategies such as investing in inflation-protected securities or assets with returns tied to inflation can help maintain the value of your investment portfolio over time.

Choosing Investments: When to Focus on Nominal or Real Returns

Nominal interest reflects the percentage increase in money invested without adjusting for inflation, providing a straightforward measure of returns, while real interest accounts for inflation, indicating the true purchasing power gained. Investors should focus on nominal returns when evaluating short-term investments or when inflation is low and stable, as it offers a clear snapshot of gains. For long-term investments or periods of high inflation, prioritizing real interest ensures that returns exceed inflation, preserving actual wealth growth.

Common Mistakes Investors Make with Interest Rates

Investors often confuse nominal interest rates with real interest rates, leading to overestimations of actual returns when ignoring inflation. Failing to account for inflation risk can erode purchasing power despite seemingly high nominal yields on investments such as bonds or savings accounts. Accurately calculating real interest rates by subtracting inflation expectations is crucial for assessing genuine investment growth.

Maximizing Portfolio Growth: Applying Real Interest Insights

Maximizing portfolio growth requires focusing on real interest rates, which adjust nominal interest rates for inflation, reflecting true purchasing power gains. Understanding the difference between nominal and real interest helps investors make informed decisions by prioritizing returns that outpace inflation. Consistently targeting investments with positive real interest rates enhances long-term wealth accumulation and protects against erosion from rising prices.

Related Important Terms

Inflation-Adjusted Yield

Nominal interest represents the stated return on an investment without accounting for inflation, while real interest reflects the inflation-adjusted yield that shows the true purchasing power of returns. Investors should prioritize real interest rates to evaluate the actual growth of their investments amid changing inflation rates.

Purchasing Power Parity Rate

Nominal interest rates represent the percentage return on investments without adjusting for inflation, while real interest rates account for inflation, reflecting the true increase in purchasing power. The Purchasing Power Parity (PPP) rate helps investors compare real returns across countries by adjusting nominal rates for differences in inflation, ensuring investment decisions consider the relative value of currencies and cost of living.

Effective Annual Rate (EAR)

Nominal interest represents the stated annual rate without adjusting for inflation, while real interest accounts for inflation, reflecting the true purchasing power of investment returns. The Effective Annual Rate (EAR) provides a more accurate measure by incorporating the effects of compounding periods within a year, making it essential for comparing nominal and real interest rates in investment decisions.

Negative Real Interest

Negative real interest occurs when nominal interest rates fall below the inflation rate, eroding the purchasing power of investment returns. Investors facing negative real interest must seek alternative assets or strategies to preserve capital value and achieve positive real gains.

Nominal-to-Real Spread

The nominal-to-real interest spread measures the difference between nominal interest rates and inflation-adjusted real interest rates, providing investors insight into the true purchasing power of returns. Understanding this spread is crucial for evaluating investment performance and making informed decisions in inflationary environments.

Hedonic Interest Measurement

Nominal interest rates represent the stated return on investments without adjusting for inflation, while real interest rates account for purchasing power changes, offering a more accurate measure of investment profitability. Hedonic interest measurement further refines this analysis by adjusting nominal interest for quality changes in investment assets, ensuring precise evaluation of true economic returns.

Time-Weighted Real Return

Nominal interest rates represent the stated return on investments without adjusting for inflation, while real interest rates reflect the time-weighted real return by accounting for purchasing power changes over the investment period. Time-weighted real return is crucial for accurately comparing investment performance, as it isolates the effect of inflation and removes the impact of external cash flows.

Hyperinflation-Indexed Bond Yield

Nominal interest rates on hyperinflation-indexed bonds reflect the total return including inflation expectations, while real interest rates account for the inflation-adjusted yield, providing investors a clearer measure of purchasing power gains. During periods of hyperinflation, real interest rates on these bonds often remain positive even when nominal yields appear high, offering critical protection against currency devaluation.

Real Rate Breakeven

Real rate breakeven represents the interest rate at which the nominal return on an investment equals the inflation rate, ensuring the investor's purchasing power remains unchanged. Understanding this breakeven point helps investors distinguish between nominal interest, which includes inflation, and real interest, which reflects true growth after adjusting for inflation.

Greenium-Adjusted Real Interest

Greenium-adjusted real interest rates account for the premium investors pay for sustainable assets, reflecting lower nominal interest rates minus inflation and the greenium discount. This measure provides a more accurate assessment of true investment returns by incorporating environmental factors that affect asset valuation and risk.

Nominal Interest vs Real Interest for investments. Infographic

moneydiff.com

moneydiff.com