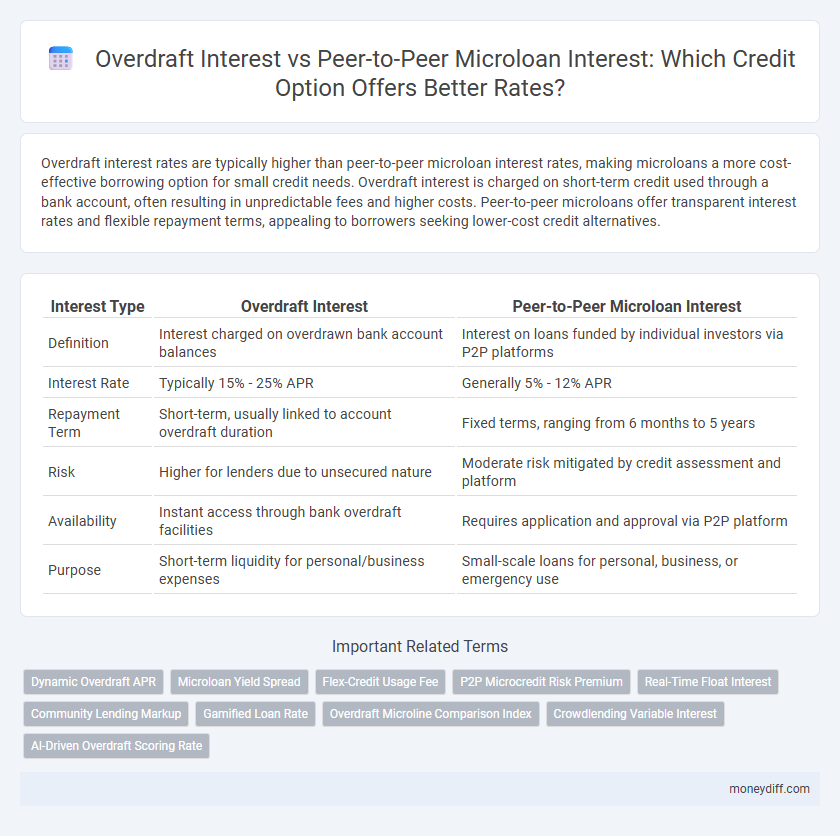

Overdraft interest rates are typically higher than peer-to-peer microloan interest rates, making microloans a more cost-effective borrowing option for small credit needs. Overdraft interest is charged on short-term credit used through a bank account, often resulting in unpredictable fees and higher costs. Peer-to-peer microloans offer transparent interest rates and flexible repayment terms, appealing to borrowers seeking lower-cost credit alternatives.

Table of Comparison

| Interest Type | Overdraft Interest | Peer-to-Peer Microloan Interest |

|---|---|---|

| Definition | Interest charged on overdrawn bank account balances | Interest on loans funded by individual investors via P2P platforms |

| Interest Rate | Typically 15% - 25% APR | Generally 5% - 12% APR |

| Repayment Term | Short-term, usually linked to account overdraft duration | Fixed terms, ranging from 6 months to 5 years |

| Risk | Higher for lenders due to unsecured nature | Moderate risk mitigated by credit assessment and platform |

| Availability | Instant access through bank overdraft facilities | Requires application and approval via P2P platform |

| Purpose | Short-term liquidity for personal/business expenses | Small-scale loans for personal, business, or emergency use |

Understanding Overdraft Interest: Key Concepts

Overdraft interest is typically charged on the negative balance when a bank account holder withdraws more money than available, with rates often ranging from 15% to 20% per annum, reflecting higher risk for lenders. Unlike peer-to-peer microloan interest, which varies based on borrower creditworthiness and platform policies, overdraft interest is fixed by banking institutions and incurs daily compounding fees. Understanding the cost implications of overdraft interest helps consumers avoid excessive charges compared to the potentially lower, but variable, rates found in peer-to-peer lending.

What Is Peer-to-Peer Microloan Interest?

Peer-to-peer microloan interest refers to the rate borrowers pay on small loans funded directly by individual investors through online platforms, bypassing traditional financial institutions. These interest rates often vary based on borrower creditworthiness and platform policies but generally offer more competitive terms than overdraft interest, which is the cost charged by banks when accounts go negative. Peer-to-peer microloan interest supports financial inclusion by providing accessible credit options with transparent pricing mechanisms.

Overdraft vs Peer-to-Peer Interest: Core Differences

Overdraft interest typically accrues daily at higher rates set by banks, reflecting short-term credit risk, whereas peer-to-peer microloan interest is often fixed or variable based on platform algorithms and borrower credit profiles, generally offering more competitive rates. Overdraft fees can compound quickly due to daily interest and penalty charges, while peer-to-peer loans have structured repayment schedules with transparent interest calculations. Understanding these core differences helps borrowers weigh immediate liquidity needs against longer-term borrowing costs in credit decisions.

Interest Rate Structures: Overdrafts and P2P Loans

Overdraft interest rates typically feature variable, high-cost structures based on daily or monthly usage, often exceeding standard credit rates due to their unsecured, short-term nature. Peer-to-peer microloan interest rates tend to be fixed or tiered, reflecting individual borrower risk profiles assessed by lending platforms, generally offering more competitive rates than overdrafts. Understanding these distinct interest rate frameworks is crucial for borrowers to manage credit costs effectively.

Cost Comparison: Overdraft Fees vs P2P Loan Rates

Overdraft interest rates typically range from 18% to 35% APR, often accompanied by high fixed fees, making them significantly more expensive than peer-to-peer microloan rates, which average between 6% and 15% APR depending on borrower creditworthiness. Overdraft fees can accumulate quickly due to daily charges and penalties, whereas P2P microloans offer structured repayment schedules and lower total interest costs. Choosing P2P microloans over overdrafts can result in substantial savings on credit costs, especially for longer-term borrowing needs.

Flexibility and Repayment Terms Explained

Overdraft interest rates typically fluctuate based on the credit limit utilization and are calculated daily, offering flexible repayment schedules since users can repay anytime without fixed terms. Peer-to-peer microloan interest rates are generally fixed, with predetermined repayment terms ranging from a few months to years, providing structured payment plans but less flexibility. Borrowers seeking adaptable repayment options often prefer overdrafts, while those needing predictable installments may favor P2P microloans.

Impact on Credit Score: Overdrafts vs Peer-to-Peer Loans

Overdraft interest can negatively impact credit scores if the overdraft is not repaid promptly, signaling potential financial distress to credit bureaus. Peer-to-peer microloans reported to credit agencies typically influence credit scores more positively due to structured repayment schedules and consistent payment history. Timely repayments on peer-to-peer loans enhance credit profiles, while prolonged overdrafts risk lowering credit ratings and increasing borrowing costs.

Suitability: When to Use Overdraft, When to Use P2P Loans

Overdraft interest is suitable for short-term, unexpected expenses requiring quick access to funds with immediate repayment flexibility, whereas Peer-to-Peer (P2P) loans are ideal for planned expenses needing larger sums and longer repayment periods. Overdrafts typically have higher interest rates and fees, making them less cost-effective for extended borrowing compared to P2P loans that often offer competitive rates through direct lender-borrower platforms. Choosing between overdraft and P2P loans depends on urgency, loan size, and repayment capacity, ensuring optimal use of credit based on financial needs and interest cost efficiency.

Risk Factors: Defaults, Penalties, and Hidden Charges

Overdraft interest rates typically carry higher penalties and hidden fees, increasing overall borrowing costs when defaults occur, while peer-to-peer microloan interest often involves transparent terms but faces higher default risks due to less stringent credit checks. Lenders in peer-to-peer platforms may charge late fees or escalate interest rates, yet borrowers benefit from more flexible repayment options compared to traditional overdraft facilities. Assessing risk factors such as default frequency, penalty severity, and fee disclosure is crucial for optimizing credit cost efficiency between these two borrowing methods.

Money Management Tips: Choosing the Right Credit Option

Overdraft interest rates often exceed 20%, making them costly for short-term borrowing compared to peer-to-peer microloan interest rates, which typically range from 5% to 15%. Peer-to-peer microloans offer transparent terms and flexible repayment schedules, supporting better money management and avoiding debt spirals caused by high overdraft fees. Choosing peer-to-peer microloans over overdrafts can enhance financial stability by reducing interest expenses and providing clear credit options.

Related Important Terms

Dynamic Overdraft APR

Dynamic Overdraft APR fluctuates based on market rates and borrower credit profiles, often resulting in higher interest charges compared to Peer-to-Peer microloan interest, which typically offers fixed or lower rates due to direct lending between individuals. This variability in overdraft interest can increase the overall cost of credit, making peer-to-peer microloans a potentially more affordable financing option for borrowers seeking predictable repayment terms.

Microloan Yield Spread

Microloan yield spread typically surpasses overdraft interest rates, reflecting higher returns from peer-to-peer lending platforms driven by increased borrower risk and platform fees. Unlike overdraft interest, which is often fixed and regulated, microloan yields fluctuate based on loan term, creditworthiness, and peer investment demand.

Flex-Credit Usage Fee

Overdraft interest rates typically exceed those of peer-to-peer microloans, with overdrafts often charging 15-20% APR compared to microloan rates averaging 6-12%, making Flex-Credit usage fees a critical factor for cost-conscious borrowers. Flex-Credit usage fees, charged per transaction or as a percentage of the borrowed amount, can increase the effective interest cost, highlighting the importance of comparing total borrowing expenses rather than nominal rates alone.

P2P Microcredit Risk Premium

Peer-to-peer microloan interest rates generally incorporate a higher risk premium compared to overdraft interest due to the increased credit risk and lack of traditional collateral in microcredit lending. This risk premium compensates investors for potential defaults, reflecting borrower creditworthiness, loan size, and platform-specific risk management practices.

Real-Time Float Interest

Overdraft interest rates typically range from 18% to 35% annually, often calculated daily on the overdrawn balance, while peer-to-peer microloan interest averages between 6% and 15%, influenced by borrower credit profiles and lending platform algorithms. Real-time float interest in peer-to-peer lending allows lenders to earn accrued interest from the moment funds are allocated, optimizing returns compared to the fixed, retroactive calculation in overdraft scenarios.

Community Lending Markup

Overdraft interest rates typically exceed peer-to-peer microloan interest due to traditional banking fees and risk premiums, whereas community lending markups in P2P microloans are often more transparent and lower, fostering affordable credit access. Emphasizing community lending markup allows borrowers to benefit from reduced costs and supports a more equitable credit ecosystem compared to conventional overdraft penalties.

Gamified Loan Rate

Gamified loan rates for overdraft interest typically fluctuate based on user behavior and credit utilization patterns, encouraging responsible spending through rewards and penalties. Peer-to-peer microloan interest leverages social lending dynamics with competitive, borrower-specific rates enhanced by gamified risk assessments and community-driven incentives.

Overdraft Microline Comparison Index

Overdraft interest rates typically range between 18% to 36% APR, reflecting the high cost of short-term credit tied to bank policies and customer risk profiles, while peer-to-peer microloan interest rates vary widely from 6% to 25% APR depending on platform risk assessments and borrower creditworthiness. The Overdraft Microline Comparison Index highlights that overdraft fees often accumulate faster than peer-to-peer microloan interest, making microloans a more cost-effective option for managing small, short-term credit needs.

Crowdlending Variable Interest

Overdraft interest rates typically range from 18% to 35% APR in conventional banking, often fixed and influenced by creditworthiness, while peer-to-peer microloan interest through crowdlending platforms tends to offer variable rates between 6% and 15%, driven by individual borrower risk profiles and market demand. Crowdlending variable interest adjusts dynamically based on platform algorithms assessing borrower credit scores, loan duration, and investor risk tolerance, providing more flexible borrowing costs compared to traditional overdraft fees.

AI-Driven Overdraft Scoring Rate

AI-driven overdraft scoring rates utilize machine learning algorithms to assess credit risk more accurately than traditional methods, often resulting in lower interest rates compared to conventional overdraft fees. Peer-to-peer microloan interest rates vary widely based on individual borrower profiles and platform algorithms but typically remain higher due to increased risk and lack of centralized underwriting.

Overdraft Interest vs Peer-to-Peer Microloan Interest for credit. Infographic

moneydiff.com

moneydiff.com