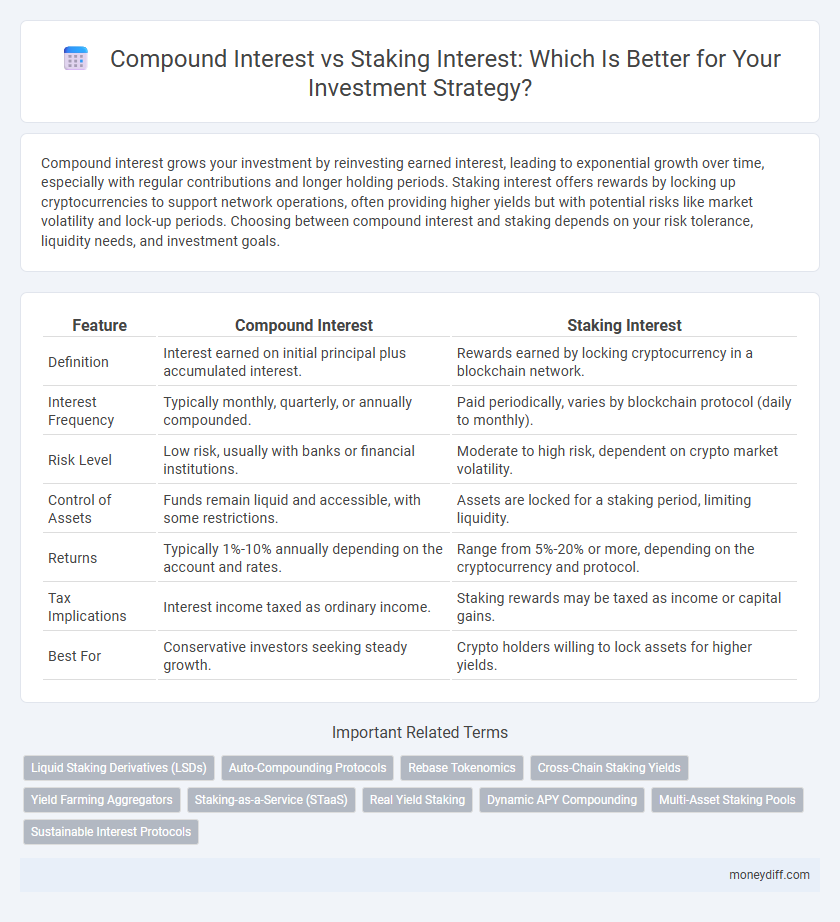

Compound interest grows your investment by reinvesting earned interest, leading to exponential growth over time, especially with regular contributions and longer holding periods. Staking interest offers rewards by locking up cryptocurrencies to support network operations, often providing higher yields but with potential risks like market volatility and lock-up periods. Choosing between compound interest and staking depends on your risk tolerance, liquidity needs, and investment goals.

Table of Comparison

| Feature | Compound Interest | Staking Interest |

|---|---|---|

| Definition | Interest earned on initial principal plus accumulated interest. | Rewards earned by locking cryptocurrency in a blockchain network. |

| Interest Frequency | Typically monthly, quarterly, or annually compounded. | Paid periodically, varies by blockchain protocol (daily to monthly). |

| Risk Level | Low risk, usually with banks or financial institutions. | Moderate to high risk, dependent on crypto market volatility. |

| Control of Assets | Funds remain liquid and accessible, with some restrictions. | Assets are locked for a staking period, limiting liquidity. |

| Returns | Typically 1%-10% annually depending on the account and rates. | Range from 5%-20% or more, depending on the cryptocurrency and protocol. |

| Tax Implications | Interest income taxed as ordinary income. | Staking rewards may be taxed as income or capital gains. |

| Best For | Conservative investors seeking steady growth. | Crypto holders willing to lock assets for higher yields. |

Understanding Compound Interest: Basics and Benefits

Compound interest calculates earnings on both the initial principal and the accumulated interest from previous periods, accelerating investment growth over time. This exponential growth effect significantly increases returns compared to simple interest, making it a powerful tool for long-term wealth accumulation. Understanding compound interest helps investors evaluate opportunities and optimize strategies to maximize portfolio growth.

What Is Staking Interest in the Crypto World?

Staking interest in the crypto world refers to the rewards earned by participating in a blockchain network's proof-of-stake consensus mechanism, where investors lock up their cryptocurrency to validate transactions and secure the network. This method generates passive income distinct from traditional compound interest, as staking rewards depend on network factors like staking duration, total staked coins, and the blockchain's inflation rate. Staking offers potential higher yields but carries unique risks, such as token lock-up periods and price volatility, compared to the guaranteed, algorithmically compounded returns in conventional finance.

Compound Interest vs. Staking Interest: Key Differences

Compound interest reinvests earnings to generate exponential growth by calculating interest on both principal and accumulated interest, typically used in traditional savings and investment accounts. Staking interest involves locking cryptocurrency funds in a blockchain network to support operations like validation, earning rewards based on the staked amount and network rules, which may vary in risk and return rates. Unlike compound interest's predictable growth model, staking interest depends on blockchain performance, token price fluctuations, and network incentives, offering potential higher yields with associated volatility.

Risk Factors: Traditional Investments vs. Crypto Staking

Compound interest in traditional investments offers predictable returns with minimal risk due to regulatory oversight and stable financial instruments like savings accounts and bonds. Crypto staking interest, while potentially higher, exposes investors to market volatility, regulatory uncertainty, and platform security risks such as smart contract vulnerabilities and hacking incidents. Diversifying between these options helps balance growth potential against the inherent risks associated with each investment type.

Earning Potential: Comparing Growth Calculations

Compound interest calculates growth by reinvesting earned interest, leading to exponential growth over time through regularly compounding periods. Staking interest typically involves locking cryptocurrency assets to support network operations, generating rewards that may compound but often depend on blockchain-specific protocols and market volatility. Evaluating earning potential requires comparing compound interest's predictable, formula-driven growth against staking's variable returns influenced by factors like token inflation rates and network participation incentives.

Liquidity and Flexibility: Access to Your Funds

Compound interest investments generally offer higher liquidity, allowing investors to withdraw or reinvest earnings frequently without penalties, enhancing flexibility in managing funds. Staking interest often involves locking assets for a fixed period, which restricts access and reduces liquidity, though it may provide higher returns during the lock-up. Evaluating the trade-off between immediate access to funds and potential yield is essential when choosing between compound interest and staking strategies.

Security Concerns: Bank Accounts vs. Blockchain Wallets

Bank accounts offer compound interest with regulatory protections, FDIC insurance, and fraud monitoring that enhance investor security. Blockchain wallets used for staking interest face risks from hacking, private key theft, and less regulatory oversight, making security measures like hardware wallets and multi-factor authentication critical. Investors must weigh the trade-off between traditional safety and potential higher rewards in decentralized finance environments.

Tax Implications of Compound and Staking Interest

Compound interest in traditional investments is typically subject to annual income tax on the interest earned, which can reduce net returns depending on the investor's tax bracket. Staking interest earned from cryptocurrencies may face different tax treatments, often classified as either ordinary income or capital gains, varying by jurisdiction and the nature of the staking rewards. Understanding the specific tax regulations governing compound interest and staking interest is crucial for optimizing after-tax investment returns and ensuring compliance with local tax laws.

Choosing the Best Strategy for Your Financial Goals

Compound interest maximizes investment growth by reinvesting earned interest, leveraging exponential gains over time, ideal for long-term financial goals. Staking interest offers regular, sometimes higher, returns by participating in blockchain networks, suitable for investors seeking passive income with moderate risk. Selecting the best strategy depends on risk tolerance, investment horizon, and liquidity needs, ensuring alignment with personal financial objectives.

Future Trends: Evolving Interest Models in Finance

Compound interest relies on reinvesting earned interest to generate exponential growth over time, making it a time-tested strategy for traditional investments. Staking interest, emerging from blockchain and decentralized finance (DeFi), offers variable yields based on network participation and token economics, reflecting a shift towards more dynamic, programmable interest models. Future trends indicate increasing integration of AI and smart contracts to optimize both compound and staking returns, enhancing transparency and personalized investment strategies.

Related Important Terms

Liquid Staking Derivatives (LSDs)

Compound interest generates returns by reinvesting earned interest, leading to exponential growth over time, whereas staking interest, particularly through Liquid Staking Derivatives (LSDs), allows investors to earn staking rewards while maintaining liquidity by trading or using the staked assets in DeFi applications. LSDs blend the benefits of compound interest's growth potential with the flexibility of liquid assets, enhancing capital efficiency and unlocking additional yield opportunities in cryptocurrency investments.

Auto-Compounding Protocols

Auto-compounding protocols enhance investment growth by automatically reinvesting staking rewards, leveraging the power of compounding interest without manual intervention. These protocols optimize returns compared to traditional compound interest by continuously accumulating and reinvesting earnings in decentralized finance (DeFi) platforms, maximizing yield efficiency over time.

Rebase Tokenomics

Compound interest accelerates investment growth by reinvesting earned interest, while staking interest in rebase tokenomics automatically adjusts token balances to reflect rewards, enhancing passive income through protocol-driven supply increases. Rebase tokens optimize long-term gains by aligning staking rewards with network performance, unlike traditional compound interest which depends on user action for reinvestment.

Cross-Chain Staking Yields

Cross-chain staking yields leverage assets across multiple blockchain networks, often providing higher and more diverse returns compared to traditional compound interest investments limited to a single platform. By enabling compounded rewards through staking on interoperable chains, investors can optimize portfolio growth with enhanced security and liquidity options.

Yield Farming Aggregators

Yield farming aggregators optimize staking interest by automatically reallocating assets across DeFi protocols to maximize returns, often surpassing traditional compound interest rates through strategic liquidity provision and reward harvesting. These platforms leverage algorithmic strategies and multi-protocol integration, driving superior yield optimization compared to standard compound interest methods in conventional investments.

Staking-as-a-Service (STaaS)

Staking-as-a-Service (STaaS) platforms offer investors the advantage of earning staking interest by delegating cryptocurrencies to validate blockchain transactions, typically yielding higher returns than traditional compound interest from savings or fixed deposits. Unlike compound interest, which accrues through reinvested earnings over time, staking interest benefits from blockchain network rewards and token appreciation, making STaaS a compelling choice for passive income generation in the crypto investment space.

Real Yield Staking

Real yield staking offers investors higher effective returns compared to traditional compound interest by distributing rewards through protocol-native assets that increase in value over time. Unlike compound interest, which reinvests principal and earned interest at a fixed rate, real yield staking leverages continuous token appreciation and network incentives to maximize long-term investment growth.

Dynamic APY Compounding

Dynamic APY compounding enhances investment growth by adjusting the annual percentage yield based on staking duration and market conditions, often resulting in higher effective returns compared to static compound interest. Unlike fixed-rate compound interest, staking interest leverages blockchain protocols to continuously reinvest rewards, maximizing yield through algorithm-driven interest recalibration.

Multi-Asset Staking Pools

Multi-Asset Staking Pools offer diversified rewards by combining various cryptocurrencies, enhancing potential returns beyond traditional compound interest found in single-asset investments. Leveraging staking interest within these pools maximizes yield through network incentives and token appreciation, providing a strategic advantage over conventional compounding methods focused solely on interest accumulation.

Sustainable Interest Protocols

Compound interest leverages the reinvestment of earnings to exponentially grow investment value over time, while staking interest in sustainable interest protocols generates rewards by securing and validating blockchain networks with lower environmental impact. Sustainable interest protocols prioritize energy efficiency and transparency, offering a responsible alternative that balances profitability with ecological preservation.

Compound Interest vs Staking Interest for investments. Infographic

moneydiff.com

moneydiff.com