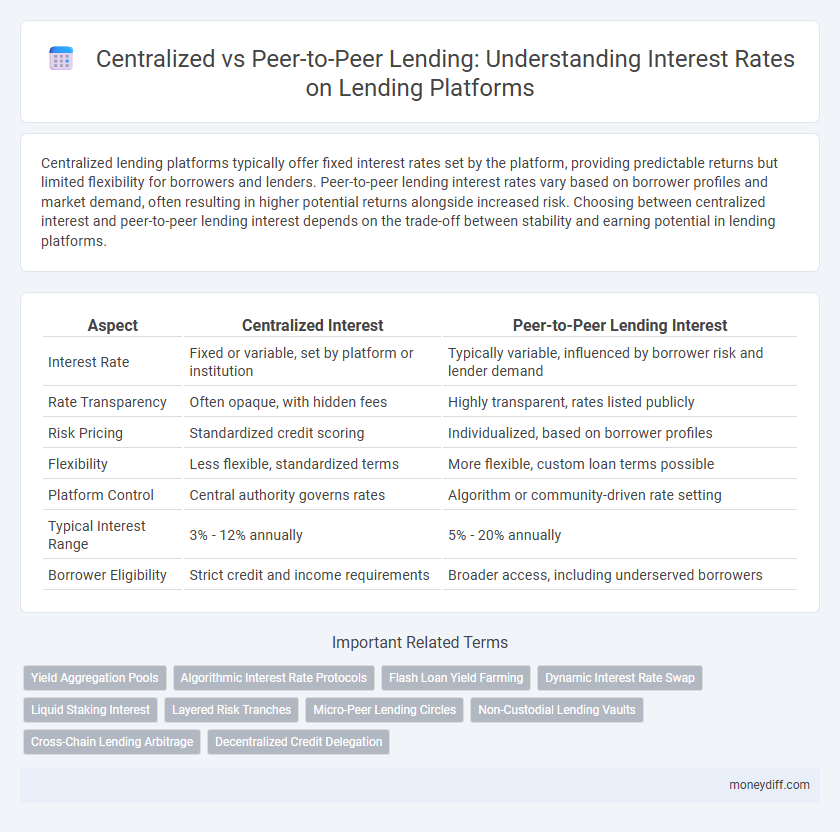

Centralized lending platforms typically offer fixed interest rates set by the platform, providing predictable returns but limited flexibility for borrowers and lenders. Peer-to-peer lending interest rates vary based on borrower profiles and market demand, often resulting in higher potential returns alongside increased risk. Choosing between centralized interest and peer-to-peer lending interest depends on the trade-off between stability and earning potential in lending platforms.

Table of Comparison

| Aspect | Centralized Interest | Peer-to-Peer Lending Interest |

|---|---|---|

| Interest Rate | Fixed or variable, set by platform or institution | Typically variable, influenced by borrower risk and lender demand |

| Rate Transparency | Often opaque, with hidden fees | Highly transparent, rates listed publicly |

| Risk Pricing | Standardized credit scoring | Individualized, based on borrower profiles |

| Flexibility | Less flexible, standardized terms | More flexible, custom loan terms possible |

| Platform Control | Central authority governs rates | Algorithm or community-driven rate setting |

| Typical Interest Range | 3% - 12% annually | 5% - 20% annually |

| Borrower Eligibility | Strict credit and income requirements | Broader access, including underserved borrowers |

Understanding Centralized vs Peer-to-Peer Lending Platforms

Centralized lending platforms set interest rates based on overall market trends and risk assessments determined by the platform's algorithms, often leading to standardized rates for borrowers. Peer-to-peer lending platforms enable direct negotiation of interest rates between individual lenders and borrowers, creating more personalized rates reflective of specific credit risks and lender preferences. Understanding these differences helps investors and borrowers optimize returns and costs by choosing the model that best matches their risk tolerance and financial goals.

How Interest Rates Differ: Centralized vs P2P Lending

Interest rates in centralized lending platforms are typically influenced by institutional risk assessments, fixed operational costs, and regulatory requirements, often resulting in higher or more stable rates for borrowers. Peer-to-peer (P2P) lending interest rates vary significantly due to direct matches between individual lenders and borrowers, reflecting credit risk, market demand, and platform-specific algorithms. P2P platforms often offer competitive rates that are lower than traditional banks for high-credit borrowers but can be higher for riskier profiles, highlighting a dynamic and personalized interest rate environment.

Risk Factors in Centralized and Peer-to-Peer Lending

Risk factors in centralized lending platforms include borrower default risk managed through credit assessments and collateral requirements, while centralized entities face operational and regulatory risks. Peer-to-peer lending carries higher credit risk due to less stringent borrower vetting, with investors directly exposed to individual defaults and platform insolvency. Liquidity risk is more pronounced in P2P lending because of limited secondary markets, contrasting with more robust liquidity options in centralized platforms.

Interest Rate Determination: Centralized Institutions vs P2P Marketplaces

Centralized institutions determine interest rates based on macroeconomic indicators, credit scores, and regulatory guidelines, leading to standardized rates across broad borrower categories. Peer-to-peer lending platforms use dynamic pricing driven by real-time market demand, individual borrower risk assessments, and lender risk tolerance, often resulting in more personalized and competitive interest rates. This decentralized approach enables flexible rates that can better reflect the borrower's creditworthiness than traditional centralized models.

Lender Returns: Comparing Centralized and P2P Platforms

Centralized lending platforms typically offer lower but more stable interest rates due to risk pooling and institutional management, resulting in consistent lender returns. Peer-to-peer (P2P) lending platforms often provide higher interest rates by directly connecting borrowers with lenders, though returns can be more variable due to borrower credit risk. Comparing lender returns, P2P platforms potentially yield greater profits but require careful credit assessment, whereas centralized platforms emphasize reliability and reduced default risk.

Borrower Experience: Accessing Interest Rates on Both Models

Borrowers on centralized lending platforms often encounter fixed or tiered interest rates determined by the platform's policies and credit risk assessments, ensuring predictable repayment terms but limited rate negotiation. In peer-to-peer lending, borrowers access a diverse range of individualized interest rates set through direct negotiations or competitive bidding among lenders, allowing more flexible and potentially lower rates based on credit profiles. The borrower experience in peer-to-peer lending typically involves enhanced transparency and faster access to market-driven rates compared to centralized systems.

Regulation and Security: Safeguarding Lenders’ Interests

Centralized lending platforms operate under strict regulatory frameworks that enforce borrower credit checks and secure fund custody, enhancing lender protection through compliance with financial laws and consumer protection mandates. Peer-to-peer lending relies on decentralized mechanisms with varied regulatory oversight, often incorporating smart contracts and blockchain technology to automate interest distribution and reduce fraud risk. Security measures in centralized systems include insured accounts and dispute resolution services, whereas peer-to-peer platforms emphasize transparency and cryptographic safeguards to maintain lender confidence.

Platform Fees and Their Impact on Net Interest

Centralized lending platforms typically charge higher platform fees, which directly reduce net interest earned by lenders and increase borrowing costs for recipients. Peer-to-peer lending platforms often feature lower fees, allowing borrowers to repay less interest and lenders to retain a greater portion of the interest earned. The fee structure significantly influences overall returns and affordability in both centralized and peer-to-peer lending markets.

Market Volatility: Effects on Centralized and P2P Interest Rates

Market volatility significantly impacts interest rates in both centralized and peer-to-peer (P2P) lending platforms, with centralized platforms often adjusting rates more rapidly due to their reliance on traditional financial market indices. In contrast, P2P lending interest rates tend to be more stable but can experience sudden shifts based on borrower credit risk assessments and investor demand fluctuations. This disparity highlights the importance of risk pricing models in P2P platforms versus algorithm-driven rate adjustments in centralized systems during volatile market conditions.

Future Trends: Innovations in Lending Interest Models

Future trends in lending interest models emphasize adaptive algorithms and blockchain integration, which enhance transparency and personalized interest rates in peer-to-peer lending platforms. Centralized interest models are increasingly incorporating AI-driven risk assessments to optimize returns while reducing default rates. Innovations such as tokenized interest payments and dynamic rate adjustments based on real-time market data are reshaping the lending landscape, making interest rates more competitive and accessible.

Related Important Terms

Yield Aggregation Pools

Centralized interest rates on lending platforms tend to be more stable due to fixed liquidity sources and risk assessments, whereas peer-to-peer lending interest rates fluctuate dynamically based on borrower profiles and individual lender requirements. Yield aggregation pools optimize returns by automatically reallocating funds across multiple peer-to-peer loans, maximizing interest earnings through diversification and real-time rate adjustments.

Algorithmic Interest Rate Protocols

Algorithmic interest rate protocols dynamically adjust lending rates based on real-time supply and demand metrics, optimizing yield efficiency in peer-to-peer lending platforms compared to the fixed or centrally determined rates found in centralized interest systems. These protocols leverage smart contracts and decentralized oracle data to ensure transparent, market-driven interest rates that better reflect borrower risk and lender liquidity preferences.

Flash Loan Yield Farming

Centralized lending platforms typically offer fixed interest rates with less flexibility but higher security, while peer-to-peer lending allows borrowers and lenders to negotiate variable rates, often resulting in higher yields. Flash loan yield farming leverages rapid, unsecured loans in decentralized protocols, enabling users to maximize interest returns by exploiting arbitrage and liquidity mining opportunities within a single transaction.

Dynamic Interest Rate Swap

Dynamic interest rate swaps in lending platforms enable borrowers to shift between centralized interest rates dictated by traditional institutions and peer-to-peer lending interest rates driven by real-time market demand, optimizing capital costs. This mechanism enhances flexibility by aligning lending costs with fluctuating risk profiles and liquidity conditions across both centralized and decentralized frameworks.

Liquid Staking Interest

Centralized lending platforms typically offer fixed or variable interest rates on liquid staking, often ranging between 5-12%, influenced by platform risk assessments and user demand. Peer-to-peer lending interest rates for liquid staking fluctuate widely, from 8-20%, driven by direct borrower-lender negotiations and market liquidity conditions.

Layered Risk Tranches

Centralized interest rates on lending platforms typically reflect a uniform risk assessment, while peer-to-peer lending interest rates are segmented into layered risk tranches, allowing investors to choose loans based on specific risk and return profiles. This tranching system enhances risk distribution by categorizing borrowers into different risk levels, thereby facilitating more precise interest rate optimization and targeted capital allocation.

Micro-Peer Lending Circles

Micro-Peer Lending Circles often offer more competitive interest rates compared to centralized platforms due to reduced overhead and direct borrower-lender relationships, enhancing affordability for participants. These circles leverage community trust and social collateral, resulting in lower default rates and more personalized interest terms than traditional centralized lending models.

Non-Custodial Lending Vaults

Non-custodial lending vaults on peer-to-peer lending platforms offer competitive interest rates by directly connecting borrowers and lenders, eliminating intermediaries that typically drive up centralized interest costs. This model enhances transparency and efficiency, enabling lenders to earn higher yields while borrowers benefit from reduced interest payments compared to traditional centralized lending platforms.

Cross-Chain Lending Arbitrage

Cross-chain lending arbitrage exploits interest rate discrepancies between centralized and peer-to-peer lending platforms, leveraging blockchain interoperability to maximize returns. By synchronizing asset transfers across multiple chains, investors can capitalize on higher peer-to-peer lending interest rates while utilizing liquidity from centralized platforms to optimize arbitrage efficiency.

Decentralized Credit Delegation

Centralized interest rates on lending platforms are often determined by a central authority, leading to fixed or algorithmically controlled rates, whereas peer-to-peer lending interest is set through direct negotiations between borrowers and lenders, reflecting real-time market demand. Decentralized credit delegation enhances peer-to-peer lending by enabling users to delegate credit lines without intermediaries, increasing liquidity and personalized interest rates based on decentralized trust protocols.

Centralized Interest vs Peer-to-Peer Lending Interest for lending platforms. Infographic

moneydiff.com

moneydiff.com