APR (Annual Percentage Rate) represents the yearly interest rate charged or earned without factoring in compounding within the year. APY (Annual Percentage Yield) includes the effects of compounding, showing the true amount of interest earned or paid over a year. For deposit accounts, APY provides a more accurate measure of actual earnings, making it essential for comparing different savings options.

Table of Comparison

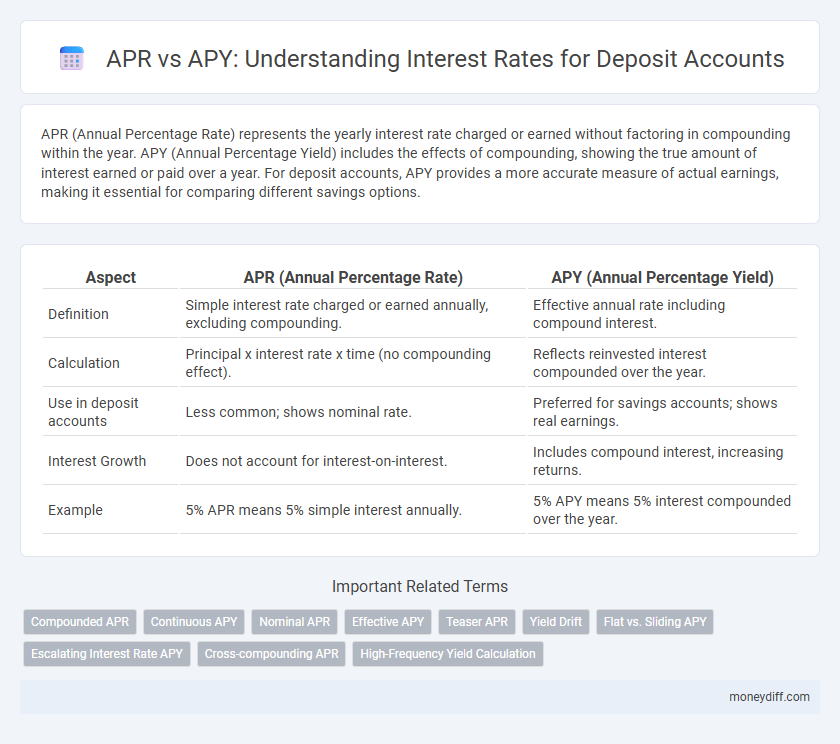

| Aspect | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | Simple interest rate charged or earned annually, excluding compounding. | Effective annual rate including compound interest. |

| Calculation | Principal x interest rate x time (no compounding effect). | Reflects reinvested interest compounded over the year. |

| Use in deposit accounts | Less common; shows nominal rate. | Preferred for savings accounts; shows real earnings. |

| Interest Growth | Does not account for interest-on-interest. | Includes compound interest, increasing returns. |

| Example | 5% APR means 5% simple interest annually. | 5% APY means 5% interest compounded over the year. |

Understanding APR and APY: Key Definitions

APR (Annual Percentage Rate) represents the yearly interest rate charged on deposits or loans, excluding compounding effects. APY (Annual Percentage Yield) includes compound interest, reflecting the total earned or paid over a year. Understanding the distinction between APR and APY is essential for accurately comparing deposit account returns and making informed financial decisions.

How APR Works for Deposit Accounts

APR for deposit accounts represents the annualized interest rate without accounting for compounding within the year, reflecting the simple interest earned on the principal. It is calculated by multiplying the periodic interest rate by the number of periods in a year, offering a straightforward measure of interest but potentially underestimating actual earnings. Depositors should compare APR with APY, which includes compounding effects, to understand the true yield on their savings.

APY Explained: Compounding Interest Benefits

APY (Annual Percentage Yield) reflects the total interest earned on a deposit account, including the effects of compounding, which allows interest to be earned on previously accumulated interest. Unlike APR (Annual Percentage Rate), which simply states the yearly interest rate without factoring in compounding, APY provides a more accurate measure of the actual return on investment. Compounding frequency--daily, monthly, or quarterly--directly influences the APY, making it a key factor in maximizing savings growth over time.

APR vs. APY: What’s the Real Difference?

APR (Annual Percentage Rate) represents the simple interest rate on deposit accounts without accounting for compounding effects, while APY (Annual Percentage Yield) includes the impact of interest compounding over a year, providing a more accurate measure of earned interest. Understanding the difference between APR and APY is crucial for comparing savings accounts and investment products, as APY typically reflects a higher effective return. Banks and financial institutions often advertise APY to highlight potential earnings, making it the preferred metric for assessing the true profitability of deposit accounts.

Calculating Interest: APR Versus APY Methods

APR (Annual Percentage Rate) calculates interest without compounding, representing the simple annual cost or return on deposit accounts. APY (Annual Percentage Yield) includes the effect of compounding interest, showing the actual annual return earned. Comparing APR and APY helps investors understand the true earning potential of deposit accounts by factoring in how often interest is applied within the year.

Why APY Matters for Savings Growth

APY (Annual Percentage Yield) reflects the real rate of return on deposit accounts by accounting for compound interest, unlike APR (Annual Percentage Rate), which only shows simple interest. This compounding effect makes APY a more accurate measure of savings growth over time, highlighting the true earning potential of accounts such as savings or money market deposits. Understanding APY helps depositors compare different accounts effectively and maximize their interest earnings.

When to Consider APR Interest in Deposit Accounts

APR interest is useful when evaluating the simple interest earned on deposit accounts without compounding, providing a straightforward measure of annual return. It is crucial to consider APR when comparing fixed-rate certificates or bonds where interest is paid once yearly. Investors seeking clear comparisons of nominal returns should prioritize APR to understand earnings before the effects of compound interest reflected in APY.

Comparing Deposit Offers: Look Beyond APR

When comparing deposit accounts, focusing solely on APR can be misleading since APR represents the nominal interest rate without accounting for compounding frequency. APY provides a more accurate measure by including compounding effects, reflecting the true annual return on the deposit. Evaluating APY allows depositors to identify higher-yield accounts and maximize interest earnings over time.

Common Misconceptions About APR and APY

APR represents the annual percentage rate that reflects the simple interest charged or earned, excluding the effects of compounding, while APY (annual percentage yield) accounts for compound interest over one year, offering a more comprehensive measure of actual earnings or costs. A common misconception is treating APR and APY as interchangeable, leading to underestimating true returns or expenses on deposit accounts. Understanding that APY provides a more accurate depiction of annual interest growth ensures better financial decision-making regarding savings and investment products.

Choosing the Right Deposit Account Based on APY

APY (Annual Percentage Yield) reflects the total interest earned on a deposit account, including compound interest, making it a more accurate measure than APR (Annual Percentage Rate) for assessing returns. Choosing a deposit account with a higher APY ensures maximum earnings, especially when interest compounds frequently, such as daily or monthly. Review the APY offered by banks or credit unions to compare deposit products effectively, prioritizing those with transparent compounding schedules and no hidden fees.

Related Important Terms

Compounded APR

Compounded APR (Annual Percentage Rate) reflects the interest earned on a deposit account when interest is calculated on both the initial principal and the accumulated interest over multiple compounding periods within a year. Unlike APY (Annual Percentage Yield), which always includes the effect of compounding for a true annual return, compounded APR shows the nominal interest rate before compounding effects, highlighting the importance of compounding frequency in maximizing deposit growth.

Continuous APY

Continuous APY represents the effective annual yield calculated with an infinite number of compounding periods, resulting in higher returns compared to standard APR, which does not account for compounding within the year. Depositors benefit more from Continuous APY in savings or deposit accounts as interest compounds in real-time, maximizing earnings over time.

Nominal APR

Nominal APR represents the simple interest rate applied annually without accounting for compounding, making it a straightforward indicator of deposit account returns. APY, on the other hand, reflects the real rate of return by incorporating compounding effects, thus providing a more accurate measure of interest earnings over time.

Effective APY

APR (Annual Percentage Rate) represents the simple interest rate without accounting for compounding, while APY (Annual Percentage Yield) reflects the effective interest earned after compounding is considered, making APY a more accurate measure of the true return on deposit accounts. Effective APY increases with the frequency of compounding periods, enabling depositors to gauge the actual growth potential of their investments over one year.

Teaser APR

Teaser APR offers an initially low annual percentage rate to attract depositors but does not account for compound interest, unlike APY, which reflects the true annual yield by incorporating compounding effects. Understanding the difference between APR and APY is crucial for accurately comparing the potential earnings on deposit accounts.

Yield Drift

APR interest reflects the simple annual rate without accounting for compounding, while APY interest includes the effect of compounding, resulting in a higher effective yield. Yield drift occurs when the difference between APY and APR leads to misestimating the actual returns on deposit accounts over time.

Flat vs. Sliding APY

APR interest on deposit accounts reflects the flat annual rate without compounding, whereas APY interest accounts for compounding effects, providing a sliding, more accurate yield on savings. Flat APR calculations may underestimate earnings compared to sliding APY, which dynamically adjusts based on compounding frequency and timing throughout the year.

Escalating Interest Rate APY

Escalating Interest Rate APY on deposit accounts offers a compounding advantage over fixed APR by increasing yield as the interest rate rises, resulting in higher overall returns for savers. Unlike APR, which reflects simple interest without compounding effects, APY accounts for interest-on-interest, making escalating rates a powerful mechanism to maximize deposit growth over time.

Cross-compounding APR

APR interest represents the annual percentage rate without accounting for compounding, while APY interest includes the effect of compounding, providing a true measure of the annual return. Cross-compounding APR occurs when interest is compounded using different periods or rates within the year, resulting in a more accurate and often higher effective yield than a standard APR calculation.

High-Frequency Yield Calculation

APR interest reflects the simple annual rate without accounting for compound interest, while APY interest includes the effect of compounding frequency, providing a more accurate measure of actual earnings on deposit accounts. High-frequency yield calculation in APY considers daily or monthly compounding periods, resulting in higher effective returns compared to APR's straightforward interest calculation.

APR Interest vs APY Interest for deposit accounts. Infographic

moneydiff.com

moneydiff.com