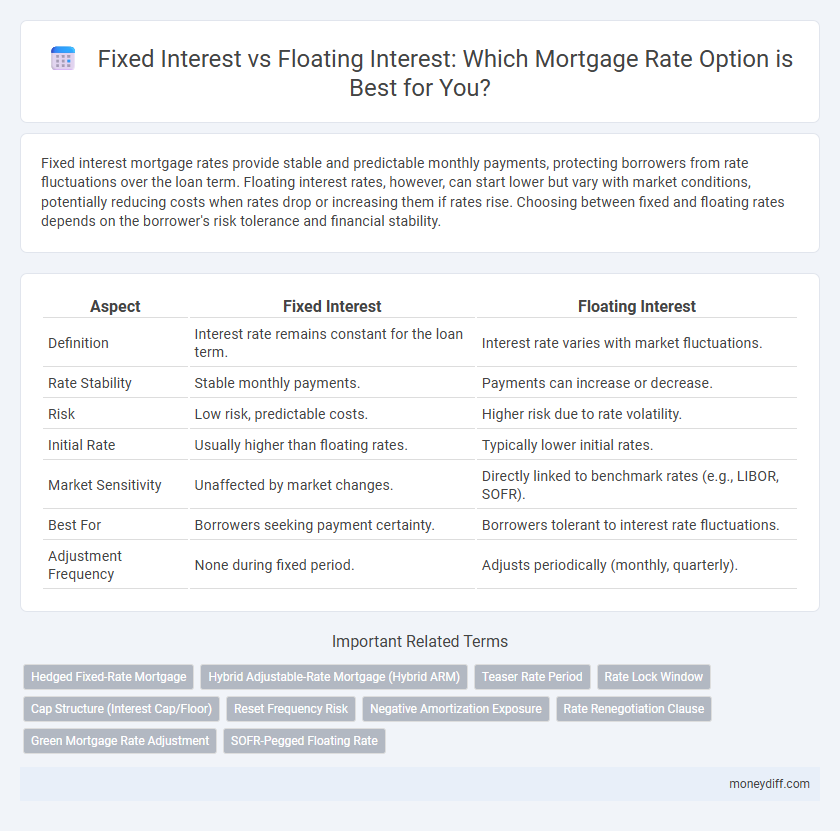

Fixed interest mortgage rates provide stable and predictable monthly payments, protecting borrowers from rate fluctuations over the loan term. Floating interest rates, however, can start lower but vary with market conditions, potentially reducing costs when rates drop or increasing them if rates rise. Choosing between fixed and floating rates depends on the borrower's risk tolerance and financial stability.

Table of Comparison

| Aspect | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant for the loan term. | Interest rate varies with market fluctuations. |

| Rate Stability | Stable monthly payments. | Payments can increase or decrease. |

| Risk | Low risk, predictable costs. | Higher risk due to rate volatility. |

| Initial Rate | Usually higher than floating rates. | Typically lower initial rates. |

| Market Sensitivity | Unaffected by market changes. | Directly linked to benchmark rates (e.g., LIBOR, SOFR). |

| Best For | Borrowers seeking payment certainty. | Borrowers tolerant to interest rate fluctuations. |

| Adjustment Frequency | None during fixed period. | Adjusts periodically (monthly, quarterly). |

Understanding Fixed vs Floating Interest Rates

Fixed interest rates on mortgages provide predictable monthly payments by locking in a constant rate for the loan term, reducing exposure to market fluctuations. Floating interest rates, also known as variable rates, fluctuate with benchmark indexes like the prime rate or LIBOR, potentially lowering costs when rates drop but increasing payments if rates rise. Understanding the trade-offs between stability and potential savings is crucial for selecting the mortgage option that aligns with your financial situation and risk tolerance.

Key Differences Between Fixed and Floating Mortgage Rates

Fixed mortgage rates offer stability with a consistent interest rate throughout the loan term, shielding borrowers from market fluctuations and enabling predictable monthly payments. Floating mortgage rates, also known as variable rates, fluctuate based on benchmark indexes such as the prime rate or LIBOR, which can result in lower initial payments but potential increases over time. Key differences include interest rate predictability, risk exposure to market changes, and impact on long-term financial planning.

Pros and Cons of Fixed Interest Mortgages

Fixed interest mortgages offer predictable monthly payments, making budgeting easier for homeowners by providing stability against market fluctuations. These loans are advantageous in a low-rate environment as they lock in favorable rates, protecting borrowers from future rate increases. However, fixed interest mortgages typically have higher initial rates than floating options and lack flexibility, potentially resulting in higher overall costs if interest rates decline.

Advantages and Disadvantages of Floating Interest Mortgages

Floating interest mortgages offer the advantage of potentially lower initial rates, allowing borrowers to benefit from market rate fluctuations and reduce overall repayment costs when interest rates decline. However, the main disadvantage lies in payment unpredictability, as rising interest rates can significantly increase monthly installments and long-term expenses, creating budgeting challenges. Borrowers with floating interest mortgages should have financial flexibility and a tolerance for risk to manage potential increases in interest rates effectively.

Impact of Market Trends on Mortgage Rate Choices

Fixed interest mortgage rates provide stability by locking in a set rate regardless of market fluctuations, making them ideal during periods of rising interest rates or economic uncertainty. Floating interest rates fluctuate with market benchmarks such as the LIBOR or SOFR, often resulting in lower initial rates but increased risk if market trends push rates upward. Market trends including inflation rates, central bank policies, and economic growth forecasts significantly influence borrowers' choices between fixed and floating mortgage rates.

How Fixed and Floating Rates Affect Your Mortgage Repayments

Fixed interest rates provide predictable mortgage repayments by locking in a set rate for the loan term, offering stability against market fluctuations. Floating interest rates, tied to benchmark rates like the central bank's base rate, cause repayments to vary with market conditions, potentially lowering costs when rates fall but increasing them when rates rise. Understanding these dynamics helps homeowners choose between consistent budgeting with fixed rates or the potential savings and risks of floating rates.

Risk Factors: Choosing Between Fixed and Floating Rates

Fixed interest mortgage rates offer predictable monthly payments, reducing financial risk during market fluctuations but may result in higher initial costs compared to floating rates. Floating interest rates can start lower and adjust with market conditions, potentially lowering costs when rates decline but exposing borrowers to payment increases if rates rise. Evaluating personal risk tolerance and economic outlook is crucial when choosing between fixed and floating mortgage interest options.

Suitability: Which Mortgage Interest Rate Fits Your Financial Goals?

Fixed interest rates offer predictable monthly payments, making them suitable for borrowers seeking financial stability and long-term budgeting certainty. Floating interest rates fluctuate with market conditions, potentially lowering costs when rates decline but increasing risks when rates rise, fitting those comfortable with variable expenses and aiming to capitalize on market trends. Choosing between fixed and floating interest hinges on your risk tolerance, financial goals, and capacity to absorb interest rate fluctuations.

Long-term Costs of Fixed vs Floating Rate Mortgages

Fixed interest rates provide stability in monthly payments, protecting borrowers from market fluctuations and potential rate hikes over the mortgage term, which can result in predictable long-term costs. Floating interest rates often start lower than fixed rates, but their variability exposes borrowers to rising costs if market rates increase, potentially leading to higher total mortgage expenses. Long-term financial planning for mortgages requires weighing the risk of increased payments with floating rates against the security and fixed repayment amounts offered by fixed interest loans.

Tips for Deciding Between Fixed and Floating Interest Rates

Evaluate your financial stability and market conditions to decide between fixed and floating mortgage interest rates. Fixed interest rates provide predictable monthly payments and protection from rate increases, ideal for long-term budgeting. Floating rates often start lower and can decrease with market trends but carry the risk of rising payments, suitable for borrowers comfortable with some variability.

Related Important Terms

Hedged Fixed-Rate Mortgage

Hedged fixed-rate mortgages combine the security of fixed interest rates with the flexibility of floating rates by using financial derivatives to limit rate exposure while allowing some benefit from rate decreases. This approach helps borrowers manage risk more effectively compared to traditional fixed or floating interest mortgages, providing predictable payments with potential cost savings in a fluctuating interest rate environment.

Hybrid Adjustable-Rate Mortgage (Hybrid ARM)

Hybrid Adjustable-Rate Mortgages (Hybrid ARMs) combine the stability of fixed interest rates for an initial period, typically 3, 5, 7, or 10 years, with the flexibility of floating interest rates thereafter, adjusting periodically based on market indexes such as the LIBOR or SOFR. This mortgage type offers borrowers initial low fixed payments followed by variable rates, balancing predictability and potential savings compared to purely fixed or floating interest mortgage options.

Teaser Rate Period

Fixed interest rates provide predictable monthly mortgage payments during the teaser rate period, often lasting 6 to 12 months, while floating interest rates can fluctuate based on market conditions, potentially increasing payments after the initial teaser period ends. Borrowers should carefully evaluate the duration and terms of the teaser rate period to determine the most cost-effective option between fixed and floating interest for their mortgage.

Rate Lock Window

Fixed interest mortgages offer a stable rate throughout the loan term, providing predictability and protection during the rate lock window, typically lasting 30 to 60 days. Floating interest rates fluctuate with market changes after the lock window expires, potentially lowering costs but increasing uncertainty for borrowers.

Cap Structure (Interest Cap/Floor)

Fixed interest mortgage rates offer predictability with set payments, while floating interest rates fluctuate based on benchmarks but often include cap structures like interest rate caps and floors to limit maximum and minimum payment variations. These caps protect borrowers by preventing rates from rising above a specified ceiling or falling below a floor, balancing risk and affordability in variable-rate mortgage agreements.

Reset Frequency Risk

Fixed interest mortgage rates provide stability by locking in a consistent rate for the loan term, eliminating the risk of rate increases during the period. Floating interest rates carry reset frequency risk, as rates adjust periodically based on market fluctuations, potentially leading to higher monthly payments when resets occur.

Negative Amortization Exposure

Fixed interest mortgage rates provide predictable monthly payments that prevent negative amortization, whereas floating interest rates can fluctuate, potentially causing monthly payments to fall short of the interest accrued and increasing the loan balance over time. Negative amortization exposure in floating rate mortgages creates higher financial risk for borrowers due to unpaid interest being added to the principal.

Rate Renegotiation Clause

Fixed interest mortgage rates offer stability with unchanged payments, while floating interest rates fluctuate based on market conditions. A rate renegotiation clause in floating interest loans allows borrowers to adjust terms periodically, providing flexibility to benefit from lower rates without the commitment of a fixed rate.

Green Mortgage Rate Adjustment

Green mortgage rate adjustments typically apply a fixed interest rate that remains stable for the loan term, providing predictable payments while incentivizing energy-efficient home improvements. Floating interest rates fluctuate with market benchmarks, potentially increasing costs but allowing borrowers to benefit from rate decreases linked to environmental performance improvements.

SOFR-Pegged Floating Rate

SOFR-pegged floating rates adjust periodically based on the Secured Overnight Financing Rate, offering potential savings when market rates decline compared to fixed interest mortgage rates that remain constant throughout the loan term. Borrowers choosing SOFR-based floating rates benefit from transparent, market-driven interest adjustments but face uncertainty and possible rate increases aligned with the Federal Reserve's monetary policy shifts.

Fixed Interest vs Floating Interest for mortgage rates. Infographic

moneydiff.com

moneydiff.com