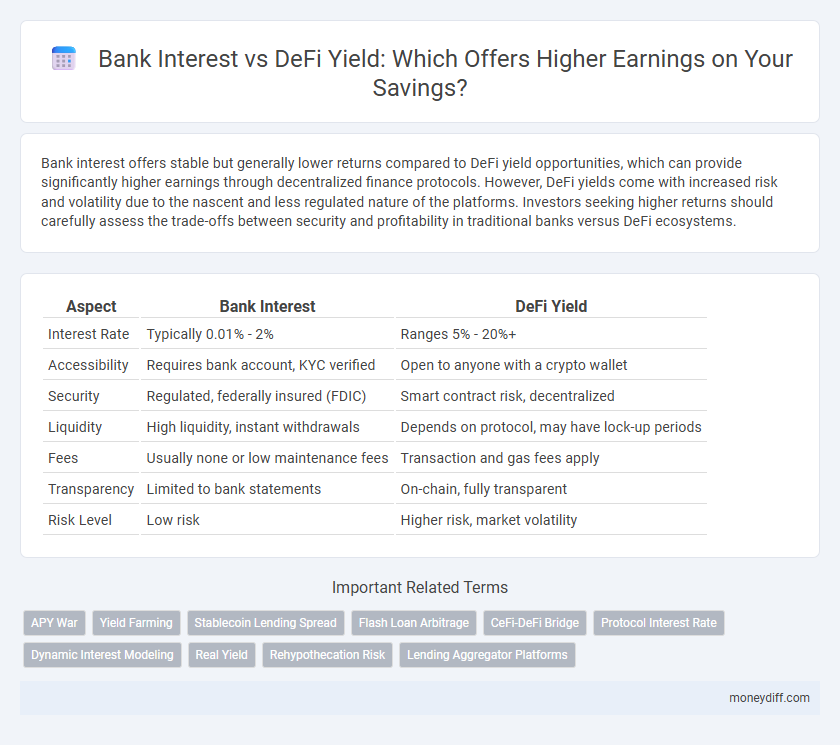

Bank interest offers stable but generally lower returns compared to DeFi yield opportunities, which can provide significantly higher earnings through decentralized finance protocols. However, DeFi yields come with increased risk and volatility due to the nascent and less regulated nature of the platforms. Investors seeking higher returns should carefully assess the trade-offs between security and profitability in traditional banks versus DeFi ecosystems.

Table of Comparison

| Aspect | Bank Interest | DeFi Yield |

|---|---|---|

| Interest Rate | Typically 0.01% - 2% | Ranges 5% - 20%+ |

| Accessibility | Requires bank account, KYC verified | Open to anyone with a crypto wallet |

| Security | Regulated, federally insured (FDIC) | Smart contract risk, decentralized |

| Liquidity | High liquidity, instant withdrawals | Depends on protocol, may have lock-up periods |

| Fees | Usually none or low maintenance fees | Transaction and gas fees apply |

| Transparency | Limited to bank statements | On-chain, fully transparent |

| Risk Level | Low risk | Higher risk, market volatility |

Understanding Bank Interest: Traditional Savings Explained

Bank interest in traditional savings accounts is a fixed or variable percentage paid by financial institutions on deposited funds, typically ranging from 0.01% to 1.5% annually depending on the bank and account type. This interest is often compounded daily, monthly, or yearly, providing consistent, low-risk returns insured by government agencies like the FDIC. Understanding these mechanisms is crucial for comparing traditional bank interest rates with potentially higher but riskier DeFi yield opportunities.

What is DeFi Yield? A Primer on Decentralized Finance Earnings

DeFi yield represents earnings generated through decentralized finance platforms that leverage blockchain technology to facilitate lending, borrowing, and liquidity provision without intermediaries like banks. Unlike traditional bank interest, which is typically fixed and regulated, DeFi yields fluctuate based on smart contract protocols, market demand, and token incentives, often resulting in higher potential returns. Investors gain access to diverse financial products such as yield farming, staking, and liquidity pools, enabling more dynamic and transparent income streams compared to conventional bank interest rates.

Key Differences: Bank Interest vs DeFi Yield

Bank interest typically offers fixed, regulated returns with lower risk and predictable earnings due to government insurance and centralized oversight. DeFi yield, on the other hand, provides variable, often higher returns by leveraging decentralized protocols and smart contracts but comes with increased risk from market volatility and potential smart contract vulnerabilities. Understanding these key differences helps investors balance security and opportunity in their earnings strategy.

Risk Assessment: Security in Banks vs DeFi Platforms

Bank interest rates offer predictable earnings with robust security measures regulated by federal agencies like the FDIC, ensuring depositor protection up to $250,000 per account. DeFi platforms provide higher yield potentials through decentralized protocols but carry significant risks including smart contract vulnerabilities, lack of regulatory oversight, and exposure to market volatility. Investors prioritizing security should assess the reliability of underlying technology, audit transparency, and risk mitigation strategies when comparing traditional bank interest to DeFi yields.

Earnings Potential: Comparing Returns on Savings

Bank interest rates typically range from 0.01% to 2%, offering steady but low returns on savings accounts and fixed deposits. DeFi platforms provide significantly higher yields, often between 5% and 20%, by leveraging decentralized lending, liquidity mining, and staking protocols. While DeFi yields present greater earnings potential, they come with increased risks such as smart contract vulnerabilities and market volatility compared to traditional bank interest.

Liquidity and Accessibility: Where is Your Money Freer?

Bank interest typically offers lower returns but higher liquidity and accessibility through insured accounts and easy withdrawal options. DeFi yield platforms provide potentially higher earnings with flexible liquidity features like instant swaps and staking, yet they often involve smart contract risks and less regulatory protection. Evaluating where your money is freer depends on balancing guaranteed access versus the opportunity for greater, but less secure, capital fluidity in decentralized protocols.

Regulatory Protections: FDIC vs Smart Contracts

Bank interest earnings benefit from FDIC insurance, which guarantees deposits up to $250,000, ensuring principal protection and reducing counterparty risk. DeFi yield opportunities rely on smart contracts that automate transactions without intermediaries but lack formal regulatory safeguards, exposing investors to smart contract vulnerabilities and potential hacks. Understanding the risk profiles and regulatory protections is crucial when comparing traditional bank interest versus DeFi yield strategies for earnings.

Hidden Costs: Fees and Fine Print in Both Systems

Bank interest rates often appear straightforward but can be undermined by hidden fees such as maintenance costs and early withdrawal penalties, significantly reducing net earnings. DeFi yield opportunities, while typically offering higher returns, come with complex smart contract risks, gas fees, and platform-specific charges that can erode profits unexpectedly. Careful examination of fine print and transaction costs is essential in both systems to accurately assess true profitability.

Inflation Impact: Preserving Wealth with Interest and Yields

Bank interest rates often fail to outpace inflation, reducing real returns and eroding wealth over time. DeFi yields, powered by decentralized finance protocols, frequently offer higher nominal returns that can better preserve purchasing power amid rising inflation. However, DeFi carries risks such as smart contract vulnerabilities and market volatility that should be weighed against traditional banking security.

Future Trends: Evolving Landscape of Banking and DeFi Earnings

Bank interest rates remain relatively stable but modest, offering predictable returns with regulatory protection, while DeFi yield protocols exhibit higher volatility and potential for substantial gains through decentralized finance mechanisms. Future trends indicate increasing integration of blockchain technology within traditional banking systems, driving innovation in hybrid financial products that blend conventional interest with DeFi-style yield farming. Advancements in smart contract security and interoperability promise enhanced transparency, user control, and diversified earnings options, reshaping the landscape of banking and DeFi income streams.

Related Important Terms

APY War

Bank interest rates typically range from 0.01% to 2% APY, offering stable but low returns, whereas DeFi platforms frequently advertise APYs exceeding 10%, driven by liquidity mining and protocol incentives. The APY war in Decentralized Finance compels traditional banks to reconsider competitive yields, although DeFi yields carry higher risks due to market volatility and smart contract vulnerabilities.

Yield Farming

Yield farming in DeFi platforms offers significantly higher returns compared to traditional bank interest rates, often exceeding double-digit annual percentage yields (APYs) due to the utilization of liquidity pools and staking mechanisms. While bank interest rates typically range below 5%, yield farming leverages decentralized finance protocols to maximize earnings by providing liquidity or participating in governance tokens, though it carries higher risk and volatility.

Stablecoin Lending Spread

Stablecoin lending spreads in DeFi often surpass traditional bank interest rates by leveraging lower overhead and higher demand for liquidity, resulting in superior earnings on deposited assets. This increased yield potential is driven by algorithmic protocols that optimize lending rates dynamically, contrasting with the fixed and typically lower interest returns offered by conventional banks.

Flash Loan Arbitrage

Bank interest rates typically offer low, stable returns averaging around 0.5-2% annually, while DeFi yield through flash loan arbitrage can generate significantly higher profits by exploiting price discrepancies across decentralized exchanges in a single transaction without upfront capital. Flash loan arbitrage leverages instant, uncollateralized loans on DeFi platforms like Aave or dYdX, enabling traders to capture arbitrage opportunities efficiently with minimal risk exposure compared to traditional banking interest earnings.

CeFi-DeFi Bridge

CeFi-DeFi bridges enable users to leverage traditional bank interest rates while accessing higher yield opportunities in decentralized finance platforms, optimizing earnings through decentralized liquidity pools and staking protocols. This integration mitigates the limitations of centralized finance by providing transparency, enhanced security, and greater return potential compared to conventional bank savings or fixed deposits.

Protocol Interest Rate

Protocol interest rates in DeFi platforms often surpass traditional bank interest rates, offering users higher potential earnings through decentralized lending and staking mechanisms. Unlike fixed bank interest, DeFi protocol rates fluctuate based on supply and demand dynamics, providing variable yields that can maximize returns in optimized market conditions.

Dynamic Interest Modeling

Dynamic interest modeling in DeFi platforms adapts yield rates based on real-time supply and demand metrics, often resulting in higher and more volatile earnings compared to traditional bank interest, which typically offers fixed and lower returns. This model leverages algorithmic adjustments to optimize investor profits, contrasting with banks' static interest frameworks constrained by regulatory and market factors.

Real Yield

Bank interest typically offers lower rates ranging from 0.01% to 1.5% annually, reflecting minimal risk and traditional savings mechanisms. DeFi yield protocols can deliver real yield exceeding 5% to 20% by leveraging blockchain-based lending, staking, and liquidity mining, although they carry higher volatility and smart contract risk.

Rehypothecation Risk

Bank interest provides stable earnings backed by regulatory safeguards but often offers lower returns compared to DeFi yield, which can be significantly higher yet involves rehypothecation risk due to the reuse of deposited assets in decentralized protocols. This rehypothecation risk increases the chance of asset loss or reduced liquidity if counterparties fail or protocol vulnerabilities are exploited.

Lending Aggregator Platforms

Lending aggregator platforms in DeFi offer interest rates significantly higher than traditional bank interest, often exceeding 5-10% APY compared to the sub-1% average from banks. These platforms optimize yield by pooling funds across multiple protocols, reducing risk and maximizing returns through diversified lending strategies.

Bank Interest vs DeFi Yield for earnings. Infographic

moneydiff.com

moneydiff.com