Cash interest provides bond investors with regular, tangible income through periodic coupon payments, enhancing liquidity and predictable cash flow. Payment-in-kind (PIK) interest, on the other hand, accrues as additional bonds or principal, increasing the investor's overall exposure and potentially magnifying returns without immediate cash payouts. Choosing between cash interest and PIK interest depends on the investor's cash flow needs, risk tolerance, and long-term investment objectives.

Table of Comparison

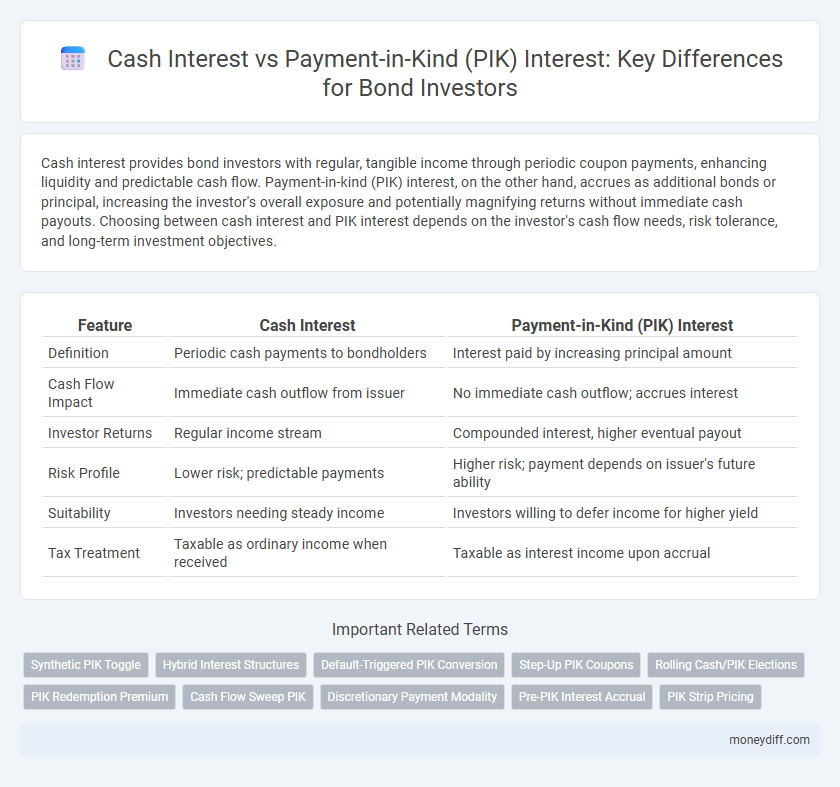

| Feature | Cash Interest | Payment-in-Kind (PIK) Interest |

|---|---|---|

| Definition | Periodic cash payments to bondholders | Interest paid by increasing principal amount |

| Cash Flow Impact | Immediate cash outflow from issuer | No immediate cash outflow; accrues interest |

| Investor Returns | Regular income stream | Compounded interest, higher eventual payout |

| Risk Profile | Lower risk; predictable payments | Higher risk; payment depends on issuer's future ability |

| Suitability | Investors needing steady income | Investors willing to defer income for higher yield |

| Tax Treatment | Taxable as ordinary income when received | Taxable as interest income upon accrual |

Understanding Cash Interest and Payment-in-Kind (PIK) Interest

Cash interest provides bondholders with regular, actual cash payments based on the bond's coupon rate, offering predictable income streams and immediate returns. Payment-in-Kind (PIK) interest, meanwhile, accrues as additional debt or equity instead of cash, allowing issuers to conserve liquidity but increasing the bond's outstanding principal over time. Understanding these differences is crucial for investors balancing cash flow needs against long-term investment growth and risk tolerance.

Key Differences Between Cash Interest and PIK Interest

Cash interest involves periodic, actual cash payments made to bondholders, providing immediate income and liquidity. Payment-in-Kind (PIK) interest accrues by adding the interest amount to the principal balance, increasing the bond's value without immediate cash flow. The key difference lies in cash interest offering regular income, while PIK interest defers payment until maturity or a specified event, affecting cash flow and investment risk profiles.

How Cash Interest Works in Bond Investments

Cash interest in bond investments refers to the regular interest payments made in cash to bondholders, typically on a semi-annual or annual basis. These payments represent a fixed percentage of the bond's face value, providing predictable income streams for investors. Unlike payment-in-kind (PIK) interest, cash interest enhances liquidity and immediate return without compounding the principal.

The Mechanism of Payment-in-Kind Interest

Payment-in-kind (PIK) interest allows bond issuers to pay interest by issuing additional securities rather than cash, preserving liquidity and reducing immediate cash outflows. This mechanism increases the principal amount over time as accrued interest compounds, affecting eventual repayment amounts and investor returns. Investors receive higher risk exposure due to potential dilution and delayed cash payments compared to traditional cash interest bonds.

Pros and Cons of Cash Interest for Investors

Cash interest payments provide investors with immediate and reliable income, enhancing cash flow and liquidity without the need to sell the bond. This type of interest is taxable when received, which may reduce after-tax returns compared to payment-in-kind (PIK) interest that defers tax liability. However, receiving cash interest eliminates reinvestment risk inherent in PIK interest, ensuring predictable returns and simplifying financial planning.

Advantages and Disadvantages of PIK Interest

Payment-in-Kind (PIK) interest allows bond issuers to defer cash payments by issuing additional bonds or increasing the principal, which can improve short-term liquidity but results in higher overall debt levels. PIK interest benefits investors with potentially higher yields and compound interest growth but carries increased risk due to delayed cash flows and amplified credit risk. Compared to cash interest, PIK structures offer financing flexibility but may reduce investor cash income and complicate bond valuation.

Impact of Cash vs PIK Interest on Bond Yields

Cash interest payments provide bond investors with immediate liquidity, directly affecting the bond's yield by delivering consistent cash flows throughout the investment period. Payment-in-Kind (PIK) interest, paid in additional bonds rather than cash, increases the bond's principal value, resulting in higher yields but delayed cash returns, often reflecting greater risk. The choice between cash and PIK interest influences yield calculations, with cash interest typically lowering yield volatility, while PIK interest enhances yield through compound growth but increases credit and reinvestment risk.

Risk Considerations for Cash and PIK Interest Bonds

Cash interest bonds provide regular fixed income payments, reducing reinvestment risk while enhancing liquidity for investors. Payment-in-kind (PIK) interest bonds defer interest payments by adding accrued interest to the principal, increasing credit risk and potential for default during economic downturns. Investors in PIK bonds face higher volatility and must assess issuer solvency carefully due to less frequent cash flows and reliance on future repayment.

Tax Implications of Cash and PIK Interest Payments

Cash interest payments on bonds are taxable as ordinary income in the year they are received, creating immediate tax liability for investors. Payment-in-Kind (PIK) interest, often accrued and added to the principal, defers tax liability until the interest is received in cash or the bond matures, potentially resulting in higher overall tax rates if the investor is pushed into a higher tax bracket. Understanding the timing and tax treatment of cash versus PIK interest is essential for bond investors to optimize after-tax returns and manage cash flow effectively.

Choosing Between Cash and PIK Interest Bonds: Investor Strategies

Investors choosing between cash interest and payment-in-kind (PIK) interest bonds consider liquidity needs and yield expectations; cash interest bonds provide regular income through periodic interest payments, enhancing cash flow stability. PIK interest bonds accumulate interest by increasing the principal, offering higher yield potential but with deferred cash flow, appealing to investors willing to accept reinvestment risk. Portfolio diversification strategies balance cash flow demands and capital appreciation goals by integrating both bond types based on market conditions and risk tolerance.

Related Important Terms

Synthetic PIK Toggle

Synthetic PIK Toggle bonds offer investors the flexibility to switch between cash interest payments and payment-in-kind interest, enhancing cash flow management while maintaining accrued interest value. This feature optimizes yield by allowing issuers to conserve cash during tight liquidity periods without defaulting, making Synthetic PIK Toggles attractive in volatile credit markets.

Hybrid Interest Structures

Hybrid interest structures in bond investments combine cash interest and payment-in-kind (PIK) interest, allowing issuers to pay a portion of interest in cash and the remainder in additional securities, optimizing cash flow management. Investors benefit from enhanced yield potential while accepting increased risk and complexity due to deferred cash payments and compounded interest accrual.

Default-Triggered PIK Conversion

Default-triggered Payment-in-Kind (PIK) interest conversion allows issuers to defer cash interest payments by issuing additional bonds or equity, reducing immediate cash outflow during financial distress. This mechanism increases accrued debt principal, impacting bondholders' recovery rates and overall risk profile compared to traditional cash interest payments.

Step-Up PIK Coupons

Step-up Payment-in-Kind (PIK) coupons offer bond investors a higher yield by accruing interest in additional bonds instead of cash, increasing the overall bond principal over time. Cash interest provides regular income through periodic payments, while step-up PIK coupons enhance returns by compounding interest, making them attractive in low-cash-flow environments or for issuers prioritizing liquidity preservation.

Rolling Cash/PIK Elections

Rolling Cash/PIK elections in bond investments allow issuers to alternate between paying interest in cash or in additional bonds, providing flexibility in managing cash flow and debt obligations. This strategy impacts yield calculations, investor returns, and bond valuation by balancing immediate liquidity with deferred interest accrual.

PIK Redemption Premium

Cash interest provides bondholders with regular, tangible income through periodic payments, while Payment-in-Kind (PIK) interest allows issuers to pay interest by increasing the principal amount, deferring cash outflows. The PIK redemption premium represents the additional amount paid upon redemption of PIK bonds, compensating investors for the deferred cash interest and often resulting in a higher total return compared to standard cash interest bonds.

Cash Flow Sweep PIK

Cash interest provides regular cash payments to investors, boosting immediate liquidity, while payment-in-kind (PIK) interest accrues as additional bonds or principal, preserving cash flow for issuers during tight financial periods. A cash flow sweep PIK structure prioritizes using excess cash flow to reduce outstanding PIK interest, optimizing debt servicing without immediate cash outlays.

Discretionary Payment Modality

Cash interest provides bondholders with regular, predictable cash payments based on the bond's coupon rate, enhancing liquidity and immediate income streams. Payment-in-kind (PIK) interest allows issuers to defer cash payments by issuing additional bonds or increasing principal, offering discretionary payment flexibility but potentially increasing overall debt burden.

Pre-PIK Interest Accrual

Pre-PIK interest accrual involves accumulating interest on a bond investment in the form of additional securities rather than cash payments, enhancing compounding returns over time. Cash interest payments provide immediate income but reduce reinvestment potential, while Pre-PIK structures delay cash flow and increase the principal balance, impacting bond valuation and yield calculations.

PIK Strip Pricing

Cash interest provides periodic payments to investors, while Payment-in-Kind (PIK) interest accrues by increasing the principal amount, impacting the bond's yield and valuation. PIK strip pricing isolates the value of embedded PIK interest payments, enabling investors to accurately assess the bond's cash flow structure and risk-return profile.

Cash Interest vs Payment-in-Kind Interest for bond investments Infographic

moneydiff.com

moneydiff.com