Bank interest offers a stable and low-risk return, typically guaranteed by federal insurance, making it ideal for conservative investors. Peer-to-peer lending interest rates are often higher, reflecting the increased risk of borrower default, but they provide an opportunity for greater returns through diversified loan portfolios. Evaluating your risk tolerance and investment goals is crucial when choosing between the steady reliability of bank interest and the potentially lucrative, yet riskier, peer-to-peer lending interest.

Table of Comparison

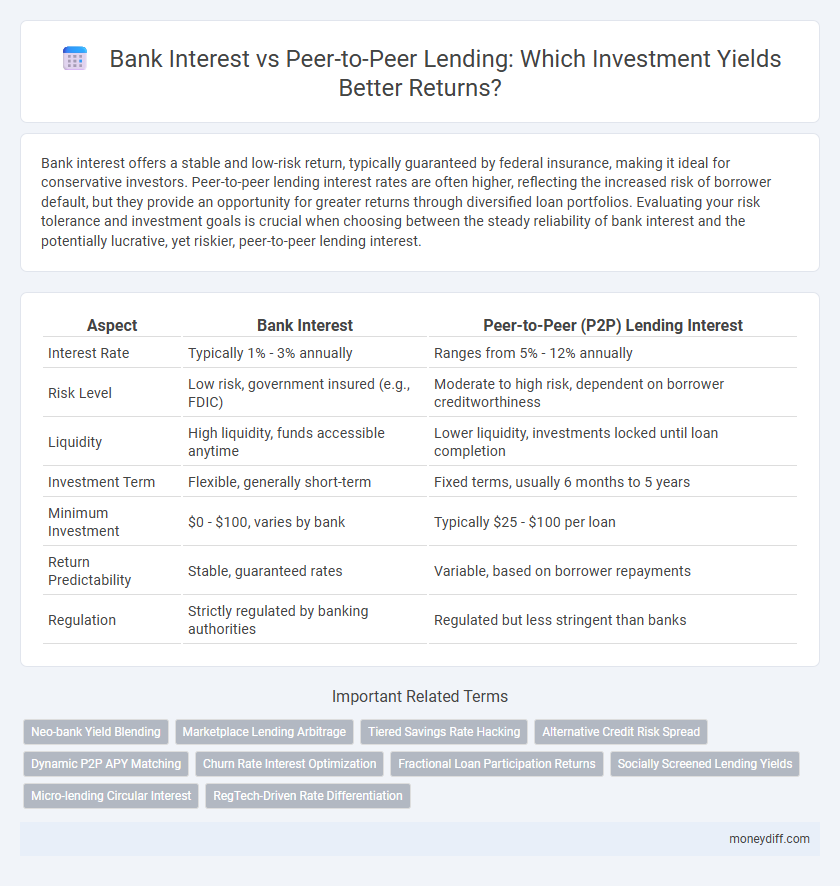

| Aspect | Bank Interest | Peer-to-Peer (P2P) Lending Interest |

|---|---|---|

| Interest Rate | Typically 1% - 3% annually | Ranges from 5% - 12% annually |

| Risk Level | Low risk, government insured (e.g., FDIC) | Moderate to high risk, dependent on borrower creditworthiness |

| Liquidity | High liquidity, funds accessible anytime | Lower liquidity, investments locked until loan completion |

| Investment Term | Flexible, generally short-term | Fixed terms, usually 6 months to 5 years |

| Minimum Investment | $0 - $100, varies by bank | Typically $25 - $100 per loan |

| Return Predictability | Stable, guaranteed rates | Variable, based on borrower repayments |

| Regulation | Strictly regulated by banking authorities | Regulated but less stringent than banks |

Understanding Bank Interest: Traditional Investment Overview

Bank interest typically offers a fixed or variable return based on savings accounts or fixed deposits, providing a low-risk investment with predictable income. Traditional banks calculate interest rates using central bank rates, inflation, and credit demand, resulting in generally lower yields compared to alternative investments. Understanding bank interest's stability and regulation helps investors assess its suitability for conservative portfolio strategies.

Peer-to-Peer Lending Interest: How Does It Work?

Peer-to-peer (P2P) lending interest rates typically offer higher returns compared to traditional bank interest due to direct borrowing between individuals without intermediary banks. Investors earn interest by funding loans on P2P platforms, where borrowers repay with principal and interest over agreed terms, generating regular income. Risk assessments and borrower credit profiles on these platforms influence the interest rates, balancing potential returns with default risks.

Risk Comparison: Bank Deposits vs P2P Lending

Bank deposits offer low-risk investment with fixed interest rates guaranteed by insurance schemes, ensuring capital protection and predictable returns. Peer-to-peer lending provides higher interest rates but carries increased risk due to borrower default potential and lack of government-backed guarantees. Investors must weigh the security of bank interest against the variable, risk-adjusted yields in P2P lending platforms.

Interest Rates: Banks vs Peer-to-Peer Platforms

Bank interest rates for savings accounts typically range between 0.01% and 1.5%, reflecting lower risk and government insurance protection. Peer-to-peer lending platforms offer higher interest rates, often between 5% and 12%, compensating investors for increased risk and lack of traditional safeguards. The significant spread in interest rates makes P2P lending an attractive option for investors seeking higher returns but willing to accept higher default risk.

Liquidity Factors: Withdrawing from Banks and P2P Investments

Bank interest accounts typically offer higher liquidity, allowing investors to withdraw funds quickly without penalties or lengthy processing times. Peer-to-peer lending interest, while often providing higher returns, tends to have lower liquidity since investments are locked in for fixed loan terms, making early withdrawals difficult or impossible. Evaluating liquidity factors is crucial for investors prioritizing access to capital alongside earning interest.

Capital Security: FDIC Insurance vs P2P Protections

Bank interest offers the security of FDIC insurance, protecting deposits up to $250,000 per account holder in the event of bank failure. Peer-to-peer (P2P) lending lacks FDIC coverage, exposing investors to higher risk, but platforms often implement borrower vetting and reserve funds to mitigate defaults. Assessing capital security is crucial when choosing between bank interest and P2P lending interest for investment strategies.

Minimum Investment Requirements: Banks vs P2P Lending

Banks typically require higher minimum investment amounts, often starting at $1,000 or more for savings accounts or CDs, while peer-to-peer lending platforms allow investors to begin with as little as $25 per loan. This lower entry threshold in P2P lending provides greater accessibility and diversification opportunities across multiple loans. Investors seeking to maximize capital efficiency often prefer P2P lending for its flexibility in minimum investment requirements compared to traditional banking products.

Returns and Yield Potential in P2P vs Bank Accounts

Bank interest rates typically offer lower returns, often ranging from 0.01% to 1.5% annually, reflecting their low-risk, insured nature. Peer-to-peer lending platforms can yield significantly higher returns, with average interest rates between 5% and 12%, due to higher borrower risk and lack of deposit insurance. Investors seeking greater yield potential may prefer P2P lending for enhanced returns, but should consider the increased default risk and less liquidity compared to traditional bank accounts.

Diversification Strategies: Blending Bank and P2P Investments

Diversifying investment portfolios by blending bank interest accounts with peer-to-peer (P2P) lending interest leverages the stability of traditional savings and the higher returns potential from P2P platforms. Banks typically offer lower, guaranteed interest rates, providing risk-averse investors with capital safety, while P2P lending delivers variable interest rates influenced by borrower credit risk, enhancing portfolio yield. Integrating both strategies balances liquidity, risk, and return, optimizing overall growth through diversified fixed-income sources.

Choosing the Right Option: Bank Interest or P2P Lending for Your Portfolio

Bank interest offers consistent, low-risk returns with government-backed security, making it ideal for conservative investors. Peer-to-peer lending interest provides higher potential yields by directly funding borrowers, but it carries increased default risk and less liquidity. Balancing stability and growth potential depends on your risk tolerance, investment horizon, and portfolio diversification goals.

Related Important Terms

Neo-bank Yield Blending

Neo-bank yield blending leverages the higher interest rates of peer-to-peer lending combined with the stability and regulatory oversight of traditional bank interest accounts to optimize investment returns. This hybrid approach maximizes income by allocating funds dynamically between low-risk bank interest and higher-risk, higher-yield P2P lending opportunities based on market conditions.

Marketplace Lending Arbitrage

Bank interest rates typically range from 0.01% to 1.5% annually, offering low-risk but minimal returns, whereas peer-to-peer lending interest rates often fall between 5% and 12%, providing higher yields with greater risk exposure; marketplace lending arbitrage exploits this spread by leveraging low-cost bank loans to fund higher-yield P2P investments, enhancing portfolio returns through interest rate differentials. Investors must carefully assess credit risk, platform reliability, and liquidity constraints inherent in P2P lending to optimize arbitrage strategies while minimizing potential defaults.

Tiered Savings Rate Hacking

Tiered savings rate hacking maximizes bank interest by strategically moving funds across tiers to capture higher rates, often limited by thresholds and decreasing returns; peer-to-peer lending interest offers potentially higher yields through direct borrower funding but carries elevated credit risk and liquidity challenges. Investors balancing tiered savings accounts with diversified P2P portfolios can optimize returns while managing safety and access to capital.

Alternative Credit Risk Spread

Bank interest rates typically offer lower returns due to minimal credit risk, while peer-to-peer lending interest rates provide higher yields by factoring in alternative credit risk spreads that compensate investors for the increased risk of borrower default. Investors seeking enhanced returns must evaluate the risk premium embedded in peer-to-peer lending interest rates, which reflects borrower creditworthiness beyond traditional bank assessments.

Dynamic P2P APY Matching

Dynamic P2P APY matching offers flexible interest rates often surpassing traditional bank interest, driven by real-time market demand and borrower credit profiles in peer-to-peer lending platforms. Investors benefit from optimized returns through algorithmic adjustments that align with borrower risk, contrasting with fixed, lower yields commonly provided by banks.

Churn Rate Interest Optimization

Bank interest rates typically offer lower returns with minimal risk, leading to higher churn rates as investors seek better yields elsewhere; peer-to-peer lending interest, by contrast, delivers higher potential returns through direct borrower lending, but requires active churn rate optimization to balance borrower defaults with investor retention and maximize portfolio growth. Effective churn rate interest optimization in P2P lending involves leveraging data-driven credit scoring and dynamic interest adjustments to sustain investor engagement while managing default risks.

Fractional Loan Participation Returns

Bank interest rates typically offer lower, fixed returns with minimal risk due to FDIC insurance, whereas peer-to-peer lending interest, especially through fractional loan participation, can deliver higher, variable returns by diversifying investments across multiple borrowers. Fractional loan participation in P2P platforms mitigates default risk while enhancing potential yield, making it a compelling alternative to traditional bank interest for investors seeking optimized income streams.

Socially Screened Lending Yields

Socially screened lending yields in peer-to-peer (P2P) platforms often outperform traditional bank interest rates by targeting investments in socially responsible projects, delivering higher returns typically ranging from 5% to 12%, compared to bank savings accounts averaging below 1%. Investors prioritizing ethical impact can leverage P2P lending to achieve both competitive financial gains and positive social outcomes, emphasized by rigorous screening processes that mitigate risk and enhance portfolio sustainability.

Micro-lending Circular Interest

Bank interest rates typically offer lower, fixed returns with minimal risk, while peer-to-peer lending interest, especially in micro-lending circular models, provides higher yields by recycling funds within a borrower-lender network, enhancing capital efficiency and promoting financial inclusion. Micro-lending circular interest leverages continuous reinvestment cycles to maximize portfolio growth and sustain liquidity, making it an attractive alternative for investors seeking higher returns in emerging markets.

RegTech-Driven Rate Differentiation

Bank interest rates typically reflect regulatory compliance and risk assessments enforced by RegTech solutions, ensuring standardized returns for depositors. Peer-to-peer lending interest rates, powered by advanced RegTech algorithms, offer differentiated, risk-adjusted yields by directly connecting investors with borrowers, enabling dynamic rate optimization and enhanced transparency.

Bank Interest vs Peer-to-Peer Lending Interest for investing Infographic

moneydiff.com

moneydiff.com