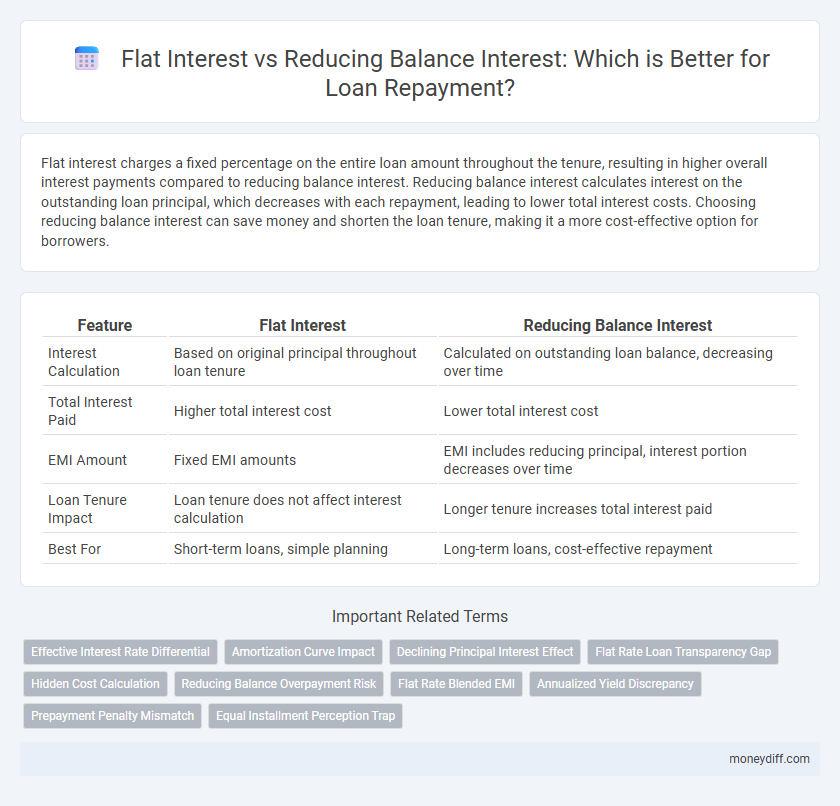

Flat interest charges a fixed percentage on the entire loan amount throughout the tenure, resulting in higher overall interest payments compared to reducing balance interest. Reducing balance interest calculates interest on the outstanding loan principal, which decreases with each repayment, leading to lower total interest costs. Choosing reducing balance interest can save money and shorten the loan tenure, making it a more cost-effective option for borrowers.

Table of Comparison

| Feature | Flat Interest | Reducing Balance Interest |

|---|---|---|

| Interest Calculation | Based on original principal throughout loan tenure | Calculated on outstanding loan balance, decreasing over time |

| Total Interest Paid | Higher total interest cost | Lower total interest cost |

| EMI Amount | Fixed EMI amounts | EMI includes reducing principal, interest portion decreases over time |

| Loan Tenure Impact | Loan tenure does not affect interest calculation | Longer tenure increases total interest paid |

| Best For | Short-term loans, simple planning | Long-term loans, cost-effective repayment |

Understanding Flat Interest and Reducing Balance Interest

Flat interest calculates loan interest on the entire principal amount for the full tenure, resulting in fixed EMI payments that do not decrease over time. Reducing balance interest charges interest on the outstanding loan balance after each repayment, leading to lower interest costs and EMIs that decrease gradually. Understanding these differences helps borrowers choose between simpler flat interest calculations and cost-saving reducing balance methods for loan repayments.

Key Differences Between Flat and Reducing Balance Interest

Flat interest calculates the interest on the entire principal amount throughout the loan tenure, resulting in higher overall interest payments. Reducing balance interest charges interest on the outstanding loan balance after each repayment, leading to decreasing interest amounts over time. The key difference lies in how interest is applied, making reducing balance loans generally more cost-effective for borrowers.

How Flat Interest Works in Loan Repayment

Flat interest in loan repayment calculates interest based on the original principal amount throughout the entire loan tenure, resulting in fixed interest payments each period regardless of the outstanding balance. Borrowers pay the same amount of interest every installment, which often leads to higher total interest costs compared to reducing balance interest. This method simplifies repayment calculations but does not account for the decreasing principal as payments are made.

Calculating Reducing Balance Interest: What You Need to Know

Calculating reducing balance interest involves applying the interest rate on the outstanding principal after each repayment, leading to lower interest costs compared to flat interest. This method reflects the actual loan balance, requiring borrowers to track the principal reduction accurately over time for precise interest calculation. Understanding reducing balance interest helps in evaluating loan repayment schedules and total interest payable effectively.

Pros and Cons of Flat Interest Loans

Flat interest loans offer predictable monthly payments and simpler calculation methods, making budgeting easier for borrowers. However, the main disadvantage is that interest is calculated on the entire principal amount throughout the loan tenure, leading to possibly higher overall interest costs compared to reducing balance loans. This method does not account for the declining loan principal after each repayment, potentially resulting in less cost efficiency for long-term loans.

Advantages and Disadvantages of Reducing Balance Loans

Reducing balance loans calculate interest on the outstanding principal, leading to lower overall interest payments compared to flat interest loans. This method benefits borrowers by decreasing the interest portion with each repayment, resulting in faster principal reduction and potential cost savings. However, the complexity of reducing balance calculations may require more careful financial planning and understanding from the borrower's side.

Impact on Total Loan Repayment: Flat vs Reducing Balance

Flat interest calculates interest on the entire principal amount throughout the loan tenure, resulting in higher total repayment compared to reducing balance interest, which charges interest only on the outstanding loan balance. Reducing balance interest significantly lowers total interest payments as the principal reduces with each installment. Borrowers save more with reducing balance loans, making them a cost-effective option for long-term repayments.

Which Option Saves More Money Over Time?

Reducing balance interest saves more money over time compared to flat interest because it calculates interest on the outstanding principal amount, which decreases with each repayment. Flat interest charges interest on the entire principal throughout the loan tenure, resulting in higher total interest payments. Borrowers choosing reducing balance loans benefit from lower overall interest costs and improved affordability during the repayment period.

Choosing the Best Interest Calculation for Your Financial Goals

Flat interest on loans calculates interest on the entire principal amount throughout the loan tenure, leading to higher total interest payments. Reducing balance interest computes interest on the outstanding loan balance, decreasing over time and resulting in lower overall interest costs. Choosing reducing balance interest aligns better with long-term financial goals due to cost efficiency and faster principal reduction.

Common Mistakes When Comparing Flat and Reducing Balance Interest

Common mistakes when comparing flat interest and reducing balance interest include misunderstanding how interest is calculated over the loan tenure, leading to inaccurate cost assessments. Flat interest applies to the entire principal amount throughout the loan period, while reducing balance interest decreases as the principal is repaid, resulting in higher actual costs under flat interest. Borrowers often overlook the effect of compounding and amortization schedules, causing confusion about the true financial impact of each interest type.

Related Important Terms

Effective Interest Rate Differential

Flat interest calculates interest on the entire principal throughout the loan tenure, resulting in a higher Effective Interest Rate (EIR) compared to Reducing Balance Interest, which applies interest only on the outstanding principal, decreasing over time. The EIR differential reflects the true cost disparity, with reducing balance loans offering lower overall interest expenses and more accurate cost representation for borrowers.

Amortization Curve Impact

Flat interest calculates interest on the entire principal throughout the loan tenure, resulting in uniform monthly payments and a linear amortization curve. Reducing balance interest decreases the interest portion over time as it is computed on the outstanding principal, causing an accelerated principal repayment and a convex amortization curve that reduces total interest paid.

Declining Principal Interest Effect

Flat interest calculates interest on the original loan amount throughout the tenure, resulting in higher overall interest payments, whereas reducing balance interest applies interest on the declining principal after each repayment, significantly lowering the total interest paid. The declining principal interest effect ensures borrowers pay less interest over time as the outstanding loan balance decreases, making reducing balance loans more cost-effective.

Flat Rate Loan Transparency Gap

Flat interest loans often obscure true borrowing costs due to interest being calculated on the full principal throughout the loan term, unlike reducing balance interest which recalculates on the diminishing principal, leading to clearer cost transparency. Borrowers frequently underestimate total interest payments under flat rate schemes, creating a significant transparency gap that impacts informed financial decisions.

Hidden Cost Calculation

Flat interest calculates interest on the entire principal amount throughout the loan tenure, often resulting in higher overall interest payments due to unaccounted principal reduction. Reducing balance interest method recalculates interest on the outstanding loan balance after each repayment, providing a more transparent and often lower effective interest cost by reflecting true loan amortization.

Reducing Balance Overpayment Risk

Reducing balance interest calculates interest on the outstanding loan amount after each repayment, significantly lowering the total interest paid and minimizing overpayment risk compared to flat interest loans that charge interest on the entire principal throughout the loan term. This method enhances cost efficiency by aligning interest charges with the actual payable amount, making reducing balance interest a preferred choice for borrowers aiming to reduce financial burden and avoid unnecessary expenses.

Flat Rate Blended EMI

Flat interest on loans calculates interest on the entire principal amount throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance interest, which applies interest on the outstanding principal after each EMI. Flat rate blended EMI combines fixed principal and interest components into equal monthly payments, offering simplicity but often leading to higher total interest costs than reducing balance EMI methods.

Annualized Yield Discrepancy

Flat interest calculates interest on the entire principal throughout the loan tenure, resulting in a higher annualized yield compared to reducing balance interest, which charges interest on the diminishing loan balance each period. This discrepancy causes borrowers to pay more overall with flat interest, making reducing balance interest a more cost-effective and transparent option for loan repayment.

Prepayment Penalty Mismatch

Flat interest loans typically calculate interest on the entire principal for the loan tenure, resulting in higher overall costs despite early repayments, while reducing balance loans adjust interest based on the outstanding principal, lowering interest charges as repayments progress. Prepayment penalties often mismatch with the actual interest savings in flat interest loans, causing borrowers to pay disproportionate fees compared to reducing balance loans where penalties align more closely with mutual benefit.

Equal Installment Perception Trap

Flat interest loans calculate interest on the original principal throughout the loan tenure, leading to a higher effective interest rate despite equal monthly installments. Reducing balance interest charges interest on the outstanding loan amount, resulting in lower total interest payments even though monthly installments remain constant, exposing the equal installment perception trap.

Flat Interest vs Reducing Balance Interest for loan repayment Infographic

moneydiff.com

moneydiff.com