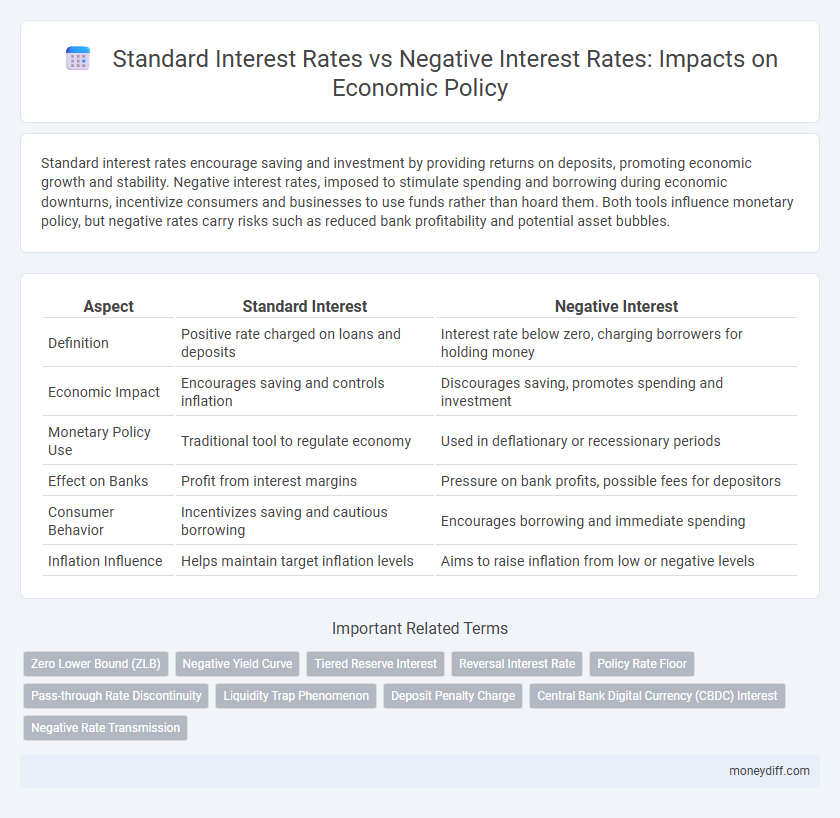

Standard interest rates encourage saving and investment by providing returns on deposits, promoting economic growth and stability. Negative interest rates, imposed to stimulate spending and borrowing during economic downturns, incentivize consumers and businesses to use funds rather than hoard them. Both tools influence monetary policy, but negative rates carry risks such as reduced bank profitability and potential asset bubbles.

Table of Comparison

| Aspect | Standard Interest | Negative Interest |

|---|---|---|

| Definition | Positive rate charged on loans and deposits | Interest rate below zero, charging borrowers for holding money |

| Economic Impact | Encourages saving and controls inflation | Discourages saving, promotes spending and investment |

| Monetary Policy Use | Traditional tool to regulate economy | Used in deflationary or recessionary periods |

| Effect on Banks | Profit from interest margins | Pressure on bank profits, possible fees for depositors |

| Consumer Behavior | Incentivizes saving and cautious borrowing | Encourages borrowing and immediate spending |

| Inflation Influence | Helps maintain target inflation levels | Aims to raise inflation from low or negative levels |

Understanding Standard Interest: Economic Foundations

Standard interest rates represent the cost of borrowing money, reflecting the time value of money and compensating lenders for risk and inflation. Central banks adjust these rates to influence economic activity, promoting growth or controlling inflation by regulating consumer spending and investment. The stability of standard interest rates underpins financial markets and guides expectations for economic policy decisions.

Negative Interest Rates: Concept and Rationale

Negative interest rates represent a monetary policy tool where central banks set nominal interest rates below zero to stimulate economic activity by encouraging borrowing and spending instead of saving. This unconventional approach aims to combat deflation, increase inflation towards target levels, and support economic growth during periods of sluggish demand. Negative interest rates can influence commercial banks to lend more by penalizing excess reserves, thereby enhancing liquidity in financial markets.

Policy Objectives: Why Implement Different Interest Rates?

Standard interest rates aim to control inflation and stimulate economic growth by influencing borrowing and spending behaviors, making them essential tools for maintaining financial stability. Negative interest rates encourage banks to lend more by penalizing excess reserves, thereby boosting investment and consumption during economic slowdowns. Policymakers implement these differing rates to balance economic growth, manage inflation, and stabilize financial markets under varying economic conditions.

Economic Growth: Impact of Standard vs Negative Rates

Standard interest rates encourage saving and increase capital availability, fostering investment and long-term economic growth. Negative interest rates aim to stimulate spending and lending by penalizing cash holdings, which can boost short-term economic activity but may undermine financial institution profitability. The net effect on economic growth depends on the balance between increased consumption and reduced bank stability, with potential risks if negative rates persist over extended periods.

Central Bank Strategies: Choosing the Right Interest Tool

Central banks strategically adjust standard interest rates to stimulate or cool economic activity, using rate hikes to control inflation and rate cuts to encourage borrowing and investment. Negative interest rate policies, though unconventional, aim to spur growth by penalizing excess reserves and encouraging banks to lend more aggressively during periods of economic stagnation. Choosing between standard and negative interest tools depends on prevailing economic conditions, inflation targets, and the central bank's mandate to maintain financial stability and support sustainable growth.

Inflation Control: Effects of Standard and Negative Rates

Standard interest rates help control inflation by increasing borrowing costs, which reduces consumer spending and slows price increases. Negative interest rates encourage banks to lend more by charging them to hold excess reserves, aiming to boost economic activity and prevent deflation. Both approaches influence inflation dynamics, with standard rates tightening monetary conditions and negative rates attempting to stimulate demand in low-inflation environments.

Financial Market Responses to Interest Rate Policies

Standard interest rates typically encourage saving and moderate borrowing, leading to controlled inflation and steady economic growth, while negative interest rates aim to stimulate spending and investment by penalizing excess reserves, often resulting in volatile financial market reactions. Financial markets respond to standard interest adjustments with predictable shifts in bond yields and currency values, whereas negative interest rates can cause unusual asset price behavior and increased risk-taking due to diminished returns on traditional safe investments. Central banks closely monitor these responses to calibrate policy decisions that balance economic stability and market confidence.

Consumer Behavior: Borrowing and Saving Trends

Standard interest rates encourage consumers to save by offering positive returns on deposits, while promoting borrowing primarily when rates are low to finance purchases or investments. Negative interest rates, implemented by some central banks to stimulate the economy, discourage saving due to potential losses on deposits and incentivize borrowing as the cost of loans effectively decreases. This shift influences consumer behavior by accelerating consumption and investment, aiming to boost economic activity during periods of low inflation or recession.

Risks and Challenges of Negative Interest Policies

Negative interest rate policies (NIRPs) pose significant risks including reduced bank profitability, which can lead to tighter credit conditions and financial instability. Such policies may also encourage excessive risk-taking by investors seeking higher yields, potentially inflating asset bubbles. Additionally, prolonged negative rates can weaken consumer savings incentives, undermining long-term economic growth and financial security.

Global Case Studies: Successes and Consequences

Standard interest policies have driven economic growth in countries like the United States and Germany by incentivizing investment and savings, contributing to financial stability and robust GDP expansion. Negative interest rates, implemented in Japan and the Eurozone, aimed to combat deflation and stimulate borrowing, yet often resulted in reduced bank profitability and risks to financial market stability. These global case studies highlight that while standard interest rates support traditional economic mechanisms, negative interest environments present mixed outcomes, necessitating nuanced policy considerations for sustainable economic health.

Related Important Terms

Zero Lower Bound (ZLB)

Standard interest rates set above zero facilitate monetary policy effectiveness by incentivizing lending and consumption, whereas negative interest rates aim to stimulate economic activity when rates hit the Zero Lower Bound (ZLB), a critical threshold where conventional policy tools lose traction. The ZLB constrains central banks' ability to lower rates further, prompting the use of negative rates to encourage spending and investment, though their long-term economic impact remains debated among policymakers.

Negative Yield Curve

Negative interest rates, implemented as an unconventional monetary policy, encourage borrowing and spending by penalizing bank reserves, aiming to stimulate economic growth during downturns. A negative yield curve, reflecting negative interest rates on short-term government bonds, signals market expectations of prolonged economic weakness and potential deflation, challenging traditional investment strategies and impacting financial institutions' profitability.

Tiered Reserve Interest

Tiered reserve interest allows central banks to apply different interest rates on reserve balances, distinguishing between standard positive interest on required reserves and negative interest on excess reserves, influencing banks' lending behavior and liquidity management. This policy tool aims to stimulate economic activity by discouraging excess reserve holdings through negative rates while maintaining a standard positive rate to ensure stability of essential reserves.

Reversal Interest Rate

Standard interest rates stimulate economic growth by encouraging borrowing and investment, while negative interest rates aim to counter deflation and boost spending by charging banks to hold excess reserves; the Reversal Interest Rate marks the critical threshold where further rate cuts undermine bank profitability, causing lending to contract and reversing the intended monetary stimulus. Understanding the Reversal Interest Rate is vital for policymakers to avoid counterproductive effects in negative interest rate environments, ensuring economic stability and effective financial intermediation.

Policy Rate Floor

Standard interest rates set a positive policy rate floor that encourages saving and controls inflation, while negative interest rates push the floor below zero to stimulate borrowing and spending during economic downturns. Central banks assess the trade-offs between these approaches to balance economic growth with financial stability.

Pass-through Rate Discontinuity

Standard interest rates typically exhibit a smooth pass-through rate to borrowing costs, whereas negative interest rates often cause a discontinuity in pass-through, leading to asymmetric effects on loan pricing and financial markets. This pass-through rate discontinuity challenges conventional monetary policy transmission, complicating credit allocation and economic stimulus efforts.

Liquidity Trap Phenomenon

Standard interest rates stimulate borrowing and investment, promoting economic growth, while negative interest rates aim to discourage savings and increase spending during deflationary pressures. The liquidity trap phenomenon occurs when nominal interest rates approach zero, rendering traditional monetary policy ineffective and prompting central banks to resort to unconventional measures like negative interest to boost liquidity and demand.

Deposit Penalty Charge

Standard interest rates encourage saving by offering positive returns on deposits, while negative interest rates impose a deposit penalty charge, effectively reducing the value of saved funds to stimulate spending and investment. Deposit penalty charges under negative interest policies deter excessive cash hoarding and aim to boost economic activity during periods of low inflation or recession.

Central Bank Digital Currency (CBDC) Interest

Standard interest rates influence borrowing costs and savings incentives, directly affecting inflation and economic growth, while negative interest rates, particularly in Central Bank Digital Currency (CBDC) applications, aim to stimulate spending by penalizing holding digital cash, encouraging liquidity circulation. Implementing negative interest on CBDC offers central banks a precise tool for real-time monetary policy adjustments, promoting economic stabilization during deflationary periods.

Negative Rate Transmission

Negative interest rate policies (NIRP) decrease borrowing costs below zero, incentivizing banks to lend more and stimulate economic activity by discouraging hoarding of excess reserves. Standard interest rates, conversely, influence economic policy by setting positive borrowing costs that guide inflation expectations and savings behavior, while negative rate transmission aims to enhance liquidity and counter deflationary pressures during economic downturns.

Standard Interest vs Negative Interest for economic policy. Infographic

moneydiff.com

moneydiff.com