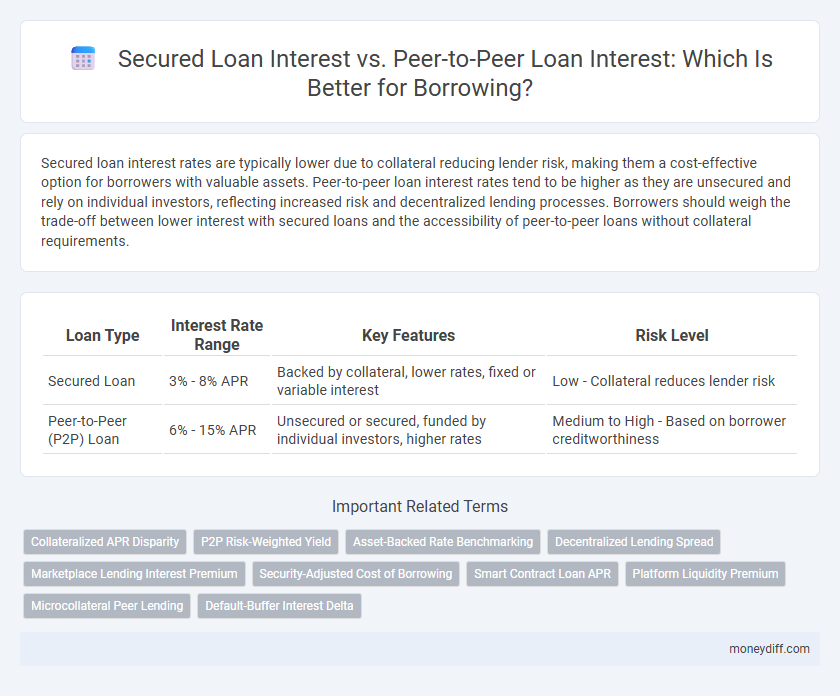

Secured loan interest rates are typically lower due to collateral reducing lender risk, making them a cost-effective option for borrowers with valuable assets. Peer-to-peer loan interest rates tend to be higher as they are unsecured and rely on individual investors, reflecting increased risk and decentralized lending processes. Borrowers should weigh the trade-off between lower interest with secured loans and the accessibility of peer-to-peer loans without collateral requirements.

Table of Comparison

| Loan Type | Interest Rate Range | Key Features | Risk Level |

|---|---|---|---|

| Secured Loan | 3% - 8% APR | Backed by collateral, lower rates, fixed or variable interest | Low - Collateral reduces lender risk |

| Peer-to-Peer (P2P) Loan | 6% - 15% APR | Unsecured or secured, funded by individual investors, higher rates | Medium to High - Based on borrower creditworthiness |

Understanding Secured Loan Interest: Basics and Key Features

Secured loan interest rates are typically lower than peer-to-peer loan interest because they are backed by collateral, reducing lender risk. The interest is often fixed or variable, depending on the loan agreement, and is influenced by factors like credit score, loan amount, and collateral value. Borrowers should evaluate key features such as repayment terms, penalties, and how the collateral impacts overall loan cost before choosing a secured loan.

Peer-to-Peer Loan Interest Rates: What Borrowers Need to Know

Peer-to-peer loan interest rates typically range between 6% and 36%, depending on the borrower's creditworthiness and loan terms, often making them higher than secured loan interest rates which can be as low as 3%. Borrowers with strong credit profiles may secure lower rates through peer-to-peer platforms compared to traditional secured loans but face higher risk of rate variability. Understanding the detailed fee structure and platform-specific underwriting criteria is crucial for borrowers to evaluate overall loan affordability on peer-to-peer lending sites.

Risk Factors: How They Influence Secured vs P2P Loan Interest

Secured loan interest rates tend to be lower due to collateral reducing lender risk, whereas peer-to-peer loan interest rates are higher to compensate for the unsecured nature and potential default risk. Risk factors such as credit score, loan amount, and economic conditions can significantly influence P2P interest rates, causing greater variability compared to secured loans. Lenders in secured loans have recourse to assets, lowering default risk and resulting in more stable and predictable interest rates.

Collateral Requirements and Their Impact on Secured Loan Interest

Secured loan interest rates are generally lower due to the collateral requirements, which reduce the lender's risk by offering assets as security against default. In contrast, peer-to-peer loan interest rates tend to be higher because these loans are often unsecured, relying on the borrower's creditworthiness instead of physical collateral. The presence of collateral directly impacts the interest rate by providing lenders with a safety net, leading to more favorable terms for borrowers in secured loans.

P2P Lending: Interest Calculation and Borrower Criteria

Peer-to-peer (P2P) lending interest rates are often calculated based on borrower credit profiles, loan terms, and platform risk assessments, typically resulting in competitive rates compared to secured loans. P2P platforms use algorithms to assess borrower creditworthiness, incorporating factors like credit score, income stability, and debt-to-income ratio. Borrowers with strong financial credentials may secure lower interest rates, while those with higher risk profiles face increased rates to offset potential defaults.

Comparing Average Interest Rates: Secured Loans vs P2P Loans

Secured loans typically feature lower average interest rates, often ranging from 4% to 8%, due to the collateral reducing lender risk. Peer-to-peer (P2P) loan interest rates usually vary between 6% and 12%, reflecting higher risk and less regulation. Borrowers with strong credit profiles can benefit from secured loans' cost-effectiveness, while P2P loans provide alternative access but at generally higher borrowing costs.

Credit Score Implications for Secured and Peer-to-Peer Loan Interest

Secured loan interest rates are generally lower due to collateral reducing lender risk, positively influencing credit scores if repayments are made timely. Peer-to-peer loan interest rates tend to be higher, reflecting greater risk and variable credit scoring impacts depending on borrower behavior and platform policies. Timely repayments on either loan type can improve credit scores, but defaults on peer-to-peer loans may have a more immediate negative effect due to less lender flexibility.

Flexibility and Terms: Interest Differences Explained

Secured loans typically feature lower interest rates due to collateral reducing lender risk, offering predictable repayment terms with fixed or variable rates over set periods. Peer-to-peer loans often have higher interest rates reflecting increased lender risk and platform fees, but provide greater flexibility in loan amounts and repayment schedules tailored to borrower needs. Understanding these interest rate differences is crucial for choosing the right borrowing option based on financial goals and risk tolerance.

Hidden Costs and Fees: Total Borrowing Cost Analysis

Secured loan interest rates typically appear lower but often include hidden costs such as appraisal fees, late payment penalties, and insurance requirements that increase the total borrowing cost. Peer-to-peer loan interest rates may seem higher but usually have more transparent fee structures, making it easier to calculate the overall repayment amount without unexpected charges. Evaluating total costs involves analyzing origination fees, prepayment penalties, and potential collateral loss to determine the true financial impact of each loan type.

Choosing the Best Interest Rate: Secured vs Peer-to-Peer Loans

Secured loan interest rates typically range from 3% to 7%, leveraging collateral such as property to offer lower and more stable rates. Peer-to-peer loan interest rates vary widely between 6% and 15%, depending on borrower credit profiles and platform risk assessments, often resulting in higher costs. Comparing the effective annual percentage rates (APR) and factoring in loan terms and fees is essential for selecting the best borrowing option.

Related Important Terms

Collateralized APR Disparity

Secured loans typically offer lower APRs due to collateral reducing lender risk, often ranging from 3% to 8%, while peer-to-peer loans, lacking collateral, exhibit higher APRs around 6% to 12% to compensate for increased default risk. The collateralized APR disparity highlights that borrowers with valuable assets secure cheaper financing, whereas unsecured peer-to-peer lending demands premium interest rates to balance credit exposure.

P2P Risk-Weighted Yield

Secured loan interest rates typically average between 5% and 10%, reflecting lower risk due to collateral backing, whereas peer-to-peer (P2P) loan interest rates often range from 8% to 15%, compensating for higher default risks. P2P risk-weighted yields account for borrower credit quality and platform defaults, resulting in a net return that can significantly exceed secured loan interest but with increased volatility and credit exposure.

Asset-Backed Rate Benchmarking

Secured loan interest rates typically align with asset-backed rate benchmarks such as LIBOR or SOFR, reflecting lower risk due to collateral pledges, whereas peer-to-peer loan interest rates are often higher and influenced by borrower credit profiles and platform-specific risk assessments. Benchmarking these interest rates against asset-backed indices provides borrowers with insights into cost efficiency and risk exposure when choosing between secured loans and peer-to-peer lending options.

Decentralized Lending Spread

Secured loan interest rates typically range from 4% to 8%, leveraging collateral to minimize lender risk and reduce borrowing costs. Peer-to-peer loan interest rates, influenced by decentralized lending spreads, can vary widely from 6% to 15%, reflecting borrower credit risk and platform-driven market dynamics.

Marketplace Lending Interest Premium

Secured loan interest rates typically range from 3% to 7%, reflecting lower risk due to collateral backing, while peer-to-peer (P2P) loan interest rates often span 6% to 12%, driven by higher default risk and marketplace lending interest premiums. Marketplace lending platforms incorporate risk-based pricing models, resulting in interest premiums that compensate investors for credit risk and platform operational costs compared to traditional secured loans.

Security-Adjusted Cost of Borrowing

Secured loan interest rates typically range from 3% to 7%, reflecting lower risk due to collateral backing, which reduces the security-adjusted cost of borrowing for borrowers. Peer-to-peer loan interest rates often vary between 6% and 12%, incorporating higher risk premiums since these loans lack collateral, increasing the security-adjusted borrowing cost compared to traditional secured loans.

Smart Contract Loan APR

Secured loan interest rates typically range from 4% to 12% APR, leveraging collateral to reduce lender risk, whereas peer-to-peer loan interest can vary widely from 6% to 30% APR, depending on borrower credit and platform risk models. Smart contract loans on blockchain platforms offer transparent, automated APR calculations often between 5% and 15%, reducing intermediaries and enabling faster, trustless borrowing with programmable terms.

Platform Liquidity Premium

Secured loan interest rates are generally lower due to the collateral that decreases lender risk, while peer-to-peer loan interest often incorporates a platform liquidity premium reflecting the ease of converting loans to cash on the platform. This liquidity premium compensates investors for potential delays in loan repayment or secondary market trading, typically resulting in higher interest costs for borrowers on peer-to-peer platforms compared to traditional secured loans.

Microcollateral Peer Lending

Secured loan interest rates typically range from 4% to 10%, leveraging collateral to reduce lender risk, while peer-to-peer (P2P) loan interest for microcollateral peer lending often varies between 8% and 15%, reflecting higher risk and flexible underwriting criteria. Microcollateral peer lending platforms utilize small, digital or physical collateral to enable faster, accessible borrowing with competitive rates compared to traditional secured loans, appealing to underserved borrowers seeking efficient credit solutions.

Default-Buffer Interest Delta

Secured loan interest rates typically incorporate a lower default-buffer interest delta due to collateral reducing lender risk, averaging around 3-5% above base rates, whereas peer-to-peer loan interest rates factor higher default-buffer margins, often ranging from 7-12%, reflecting unsecured risk profiles. This elevated default-buffer interest delta in P2P loans compensates lenders for credit risk variability and borrower default probability, impacting overall borrowing costs.

Secured Loan Interest vs Peer-to-Peer Loan Interest for borrowing. Infographic

moneydiff.com

moneydiff.com