Microfinance interest rates tend to be higher due to operational costs and risk management in small-scale lending, whereas social lending interest rates are often lower because they prioritize community benefits and use peer-to-peer platforms to reduce expenses. Small-scale borrowers may find social lending more accessible and affordable, fostering financial inclusion and social impact. Comparing microfinance interest versus social lending interest highlights the balance between sustainability for lenders and affordability for borrowers in micro-loan markets.

Table of Comparison

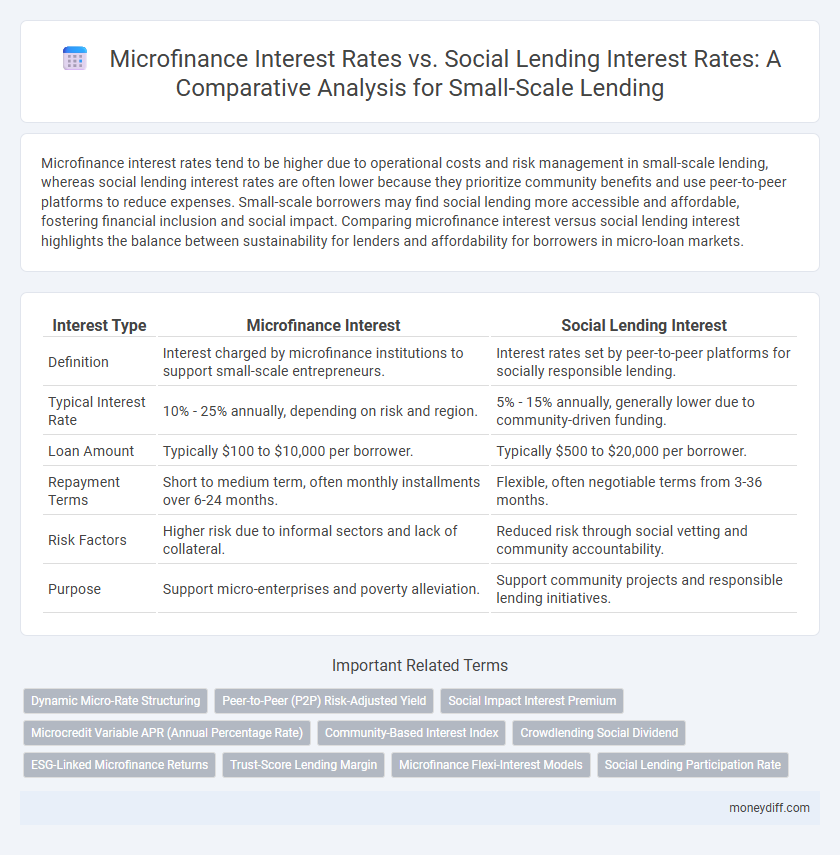

| Interest Type | Microfinance Interest | Social Lending Interest |

|---|---|---|

| Definition | Interest charged by microfinance institutions to support small-scale entrepreneurs. | Interest rates set by peer-to-peer platforms for socially responsible lending. |

| Typical Interest Rate | 10% - 25% annually, depending on risk and region. | 5% - 15% annually, generally lower due to community-driven funding. |

| Loan Amount | Typically $100 to $10,000 per borrower. | Typically $500 to $20,000 per borrower. |

| Repayment Terms | Short to medium term, often monthly installments over 6-24 months. | Flexible, often negotiable terms from 3-36 months. |

| Risk Factors | Higher risk due to informal sectors and lack of collateral. | Reduced risk through social vetting and community accountability. |

| Purpose | Support micro-enterprises and poverty alleviation. | Support community projects and responsible lending initiatives. |

Understanding Microfinance Interest Rates

Microfinance interest rates typically reflect higher risk profiles of underserved borrowers and operational costs of small-scale lending institutions, often ranging between 15% to 30% annually. Social lending interest rates, by contrast, tend to be lower due to community-based trust models and non-profit motivations, usually falling between 5% and 15%. Understanding microfinance interest rates involves analyzing factors such as borrower credit risk, loan size, term duration, and institutional overhead to balance accessibility with financial sustainability.

Social Lending: Defining Interest Structures

Social lending interest structures often emphasize transparency and affordability, typically featuring lower fixed or variable rates compared to microfinance loans, which may include higher rates due to operational costs. These interest mechanisms are designed to balance lender returns with borrower capacity, fostering financial inclusion for small-scale entrepreneurs. Social lending platforms frequently implement community-based assessments to tailor interest rates, enhancing accessibility and promoting sustainable lending practices.

Key Differences in Interest Calculation

Microfinance interest rates are typically calculated using fixed or reducing balance methods, often involving higher percentages due to administrative costs and risk factors associated with underserved borrowers. Social lending interest tends to utilize peer-to-peer platforms where interest rates are usually lower and more flexible, reflecting social impact objectives rather than profit maximization. The key difference lies in the purpose-driven rate structure in social lending versus the economically driven rates in microfinance, influencing overall affordability and borrower accessibility.

Cost of Borrowing in Microfinance vs Social Lending

Microfinance interest rates typically range between 15% and 30% annually, reflecting the higher operational costs and risk management involved in small-scale lending. Social lending platforms often offer lower interest rates, averaging 5% to 12%, due to their reliance on peer-to-peer funding and reduced overhead expenses. The cost of borrowing through microfinance is generally higher but provides greater accessibility, whereas social lending emphasizes affordability and community-driven support.

Factors Influencing Microfinance Interest Levels

Microfinance interest levels are primarily influenced by higher operational costs, borrower risk profiles, and the need for sustainability in underserved markets. In contrast, social lending interest rates tend to be lower due to peer-to-peer funding models and emphasis on community impact rather than profit maximization. Geographic location, loan size, and repayment terms also play critical roles in determining the interest differences between microfinance and social lending.

Social Lending: Flexible Interest for Small Borrowers

Social lending offers flexible interest rates tailored to the repayment capacities of small-scale borrowers, often resulting in lower financial strain compared to the fixed, higher rates typical of microfinance institutions. This adaptability supports economic empowerment by enabling access to affordable credit without rigid repayment schedules. Social lending platforms leverage peer-to-peer networks to reduce costs and pass on savings as competitive interest rates, fostering inclusivity in underserved communities.

Transparency in Microfinance and Social Lending Rates

Microfinance interest rates typically range from 15% to 30%, reflecting operational costs and credit risk in small-scale lending, while social lending interest rates are often lower, around 5% to 15%, emphasizing affordability and community support. Transparency in microfinance involves clear disclosure of fees, interest calculations, and repayment terms, reducing borrower uncertainty and preventing exploitative practices. Social lending platforms prioritize transparent communication by publishing standardized rates and offering detailed borrower profiles, fostering trust and informed decision-making among lenders and borrowers.

Impact of Interest Rates on Borrower Repayment

Microfinance interest rates are typically higher than social lending interest rates due to the operational costs and risks involved in serving small-scale borrowers. Higher microfinance rates can lead to increased repayment pressure, sometimes causing borrower stress and potential default. In contrast, social lending interest rates are usually lower, fostering better borrower affordability and enhancing repayment reliability in small-scale lending contexts.

Comparative Outcomes: Microfinance vs Social Lending

Microfinance interest rates typically range from 15% to 30%, reflecting the higher operational costs and risk management of small-scale lending institutions. Social lending interest rates are often lower, between 5% and 15%, due to community-driven models and reduced overheads, which can enhance borrower affordability and financial inclusion. Comparative outcomes show that while microfinance provides broader access to credit, social lending fosters stronger social capital and lower default rates through peer accountability.

Choosing the Best Lending Option for Small-Scale Needs

Microfinance interest rates typically range from 15% to 30% annually, reflecting the operational costs and risk management inherent to small-scale lending institutions. Social lending interest rates often fall between 5% and 15%, leveraging community trust and peer-to-peer networks to reduce costs. Selecting the best lending option depends on factors such as repayment flexibility, interest transparency, and the borrower's credit profile to optimize affordability and access.

Related Important Terms

Dynamic Micro-Rate Structuring

Dynamic micro-rate structuring in microfinance interest optimizes loan affordability by adjusting rates based on borrower risk profiles, repayment capacity, and market conditions, enhancing financial inclusion for small-scale lending. Social lending interest often offers lower, fixed rates driven by community trust and social impact goals, contrasting with microfinance's variable approach designed to balance sustainability and accessibility.

Peer-to-Peer (P2P) Risk-Adjusted Yield

Microfinance interest rates generally range between 15% to 30%, reflecting higher operational costs and borrower risk, while social lending interest rates tend to be lower, typically between 5% and 12%, appealing to socially conscious investors. Peer-to-peer (P2P) platforms optimize risk-adjusted yield by diversifying small-scale loans across multiple borrowers, balancing default risk with competitive returns.

Social Impact Interest Premium

Social lending interest rates typically include a Social Impact Interest Premium that reflects the added value of positive community outcomes and enhanced borrower support, unlike standard microfinance interest which primarily focuses on financial sustainability and risk mitigation. This premium incentivizes sustainable loans that promote social welfare, making social lending more favorable for small-scale borrowers aiming for long-term empowerment and economic inclusion.

Microcredit Variable APR (Annual Percentage Rate)

Microcredit Variable APR rates in microfinance typically range from 10% to 30%, reflecting the operational costs and risks associated with small-scale lending to underserved populations. Social lending interest often undercuts traditional microfinance rates, sometimes offering fixed APRs below 10%, emphasizing accessibility and community support over profit maximization.

Community-Based Interest Index

Microfinance interest rates for small-scale lending typically range from 15% to 30%, reflecting administrative costs and risk factors, while social lending interest rates often remain below 10%, emphasizing affordable borrowing within community support frameworks. The Community-Based Interest Index highlights how social lending leverages local trust networks to reduce default risk and lower interest rates, promoting sustainable economic development in underserved populations.

Crowdlending Social Dividend

Microfinance interest rates typically range from 10% to 30%, reflecting administrative costs and risk management, whereas social lending via crowdlending platforms often offers lower interest rates around 5% to 15%, enhanced by social dividend models that share profits with investors. Crowdlending social dividend incentivizes community investment by providing small-scale lenders both financial returns and social impact, optimizing cost-efficiency and fostering inclusive economic growth.

ESG-Linked Microfinance Returns

Microfinance interest rates typically range from 15% to 30%, reflecting operational costs and risk factors, while social lending interest rates are often lower, around 5% to 15%, due to their ESG-linked focus on social impact and sustainability. ESG-linked microfinance returns prioritize environmental, social, and governance criteria, balancing financial performance with positive community outcomes and enhanced long-term value for investors.

Trust-Score Lending Margin

Microfinance interest rates typically range between 15% to 30%, reflecting higher operational costs and risk factors for small-scale lending, whereas social lending interest rates often leverage trust-score lending margins to reduce rates to 5% to 15%. Trust-score lending margins quantify borrower reliability through behavioral data, enabling lower risk assessments and more favorable interest terms in social lending platforms.

Microfinance Flexi-Interest Models

Microfinance flexi-interest models offer adjustable interest rates based on borrowers' repayment capacity and loan performance, enhancing affordability compared to fixed rates in traditional social lending. These models prioritize financial inclusion by tailoring interest to client risk profiles while promoting sustainable lending for small-scale entrepreneurs.

Social Lending Participation Rate

Social lending participation rate significantly influences the average interest rates, often resulting in lower microfinance interest compared to traditional small-scale lending due to peer-to-peer risk sharing and reduced overhead costs. Higher social lending participation correlates with increased borrower trust and repayment rates, which drives competitive, affordable interest rates for small entrepreneurs.

Microfinance Interest vs Social Lending Interest for small-scale lending. Infographic

moneydiff.com

moneydiff.com