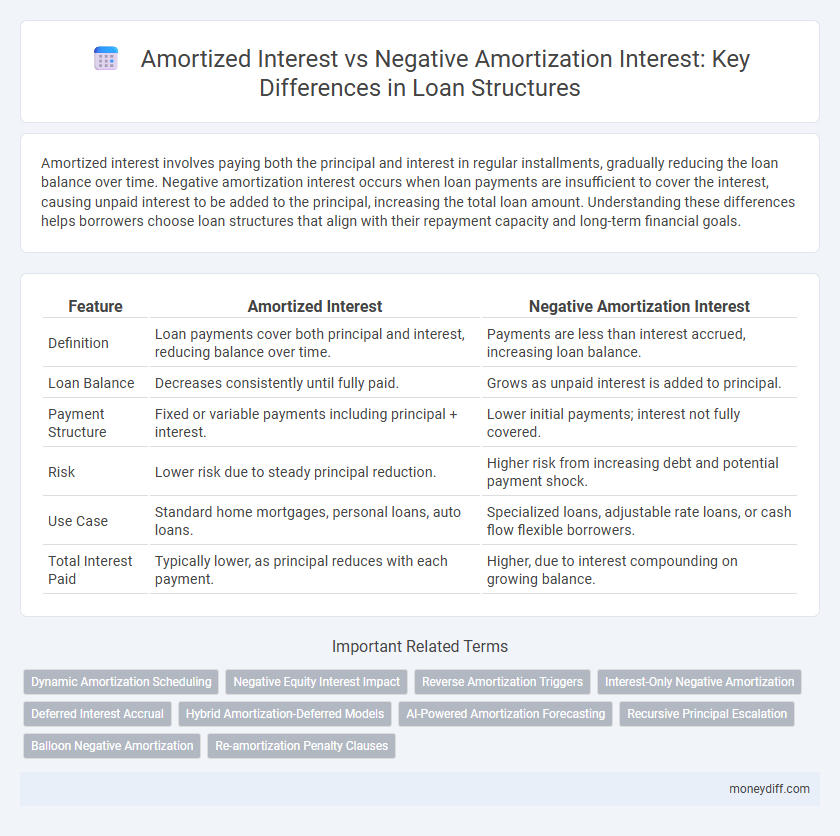

Amortized interest involves paying both the principal and interest in regular installments, gradually reducing the loan balance over time. Negative amortization interest occurs when loan payments are insufficient to cover the interest, causing unpaid interest to be added to the principal, increasing the total loan amount. Understanding these differences helps borrowers choose loan structures that align with their repayment capacity and long-term financial goals.

Table of Comparison

| Feature | Amortized Interest | Negative Amortization Interest |

|---|---|---|

| Definition | Loan payments cover both principal and interest, reducing balance over time. | Payments are less than interest accrued, increasing loan balance. |

| Loan Balance | Decreases consistently until fully paid. | Grows as unpaid interest is added to principal. |

| Payment Structure | Fixed or variable payments including principal + interest. | Lower initial payments; interest not fully covered. |

| Risk | Lower risk due to steady principal reduction. | Higher risk from increasing debt and potential payment shock. |

| Use Case | Standard home mortgages, personal loans, auto loans. | Specialized loans, adjustable rate loans, or cash flow flexible borrowers. |

| Total Interest Paid | Typically lower, as principal reduces with each payment. | Higher, due to interest compounding on growing balance. |

Understanding Amortized Interest in Loan Structures

Amortized interest in loan structures involves spreading the total interest cost evenly over the loan term, resulting in fixed periodic payments that cover both principal and interest. This method ensures gradual reduction of the principal balance, enhancing predictability and financial planning for borrowers. Unlike negative amortization, where unpaid interest adds to the loan balance, amortized interest prevents debt expansion and promotes steady loan payoff.

What Is Negative Amortization Interest?

Negative amortization interest occurs when the loan payment made is less than the accrued interest, causing unpaid interest to be added to the principal balance, increasing the total loan amount over time. This contrasts with amortized interest loans where payments cover both principal and interest, gradually reducing the loan balance. Negative amortization can lead to higher debt levels and increased financial risk for borrowers unable to meet fully amortized payment requirements.

Key Differences Between Amortized and Negative Amortization Loans

Amortized interest loans require regular payments that cover both principal and interest, reducing the loan balance steadily over time, while negative amortization loans allow payments that are less than the interest due, causing the loan balance to increase. In amortized loans, borrowers build equity as the principal decreases, whereas negative amortization results in growing debt despite ongoing payments. The choice between these structures impacts long-term loan cost, payment stability, and risk exposure.

Pros and Cons of Amortized Interest Loans

Amortized interest loans offer predictable payments that gradually reduce the principal balance, providing clarity and financial discipline over the loan term. The consistent payment schedule helps borrowers avoid debt escalation and build equity steadily, making budgeting easier and reducing overall interest costs compared to negative amortization loans. However, higher monthly payments in amortized loans may strain cash flow for borrowers seeking lower initial expenses, limiting flexibility in short-term financial planning.

Pros and Cons of Negative Amortization Interest Loans

Negative amortization interest loans allow monthly payments lower than the accrued interest, increasing the loan balance over time, which can be beneficial for borrowers needing immediate cash flow relief. However, this loan structure can lead to higher total debt, increased financial risk, and potential payment shock when negative amortization ends and principal repayment increases. Borrowers must carefully evaluate their capacity to manage escalating loan balances and future payment obligations to avoid default or refinancing challenges.

Impact on Monthly Payments: Amortized vs Negative Amortization

Amortized interest results in consistent monthly payments that gradually reduce both principal and interest, providing predictable budgeting and full loan payoff by term end. Negative amortization interest increases the loan balance as monthly payments cover less than the accruing interest, causing rising monthly obligations and delayed principal repayment. This leads to higher long-term costs and potential payment shock when negative amortization ends or payments fully cover interest plus principal.

Long-Term Financial Implications for Borrowers

Amortized interest ensures borrowers steadily reduce principal balance over the loan term, leading to predictable monthly payments and decreased overall interest costs. Negative amortization interest causes the loan balance to grow as unpaid interest is added to the principal, resulting in higher long-term debt and increased financial risk for borrowers. Understanding these differences is crucial for managing loan affordability and minimizing long-term financial strain.

Suitability: Which Loan Structure Fits Your Financial Goals?

Amortized interest loans provide a clear repayment schedule, gradually reducing the principal balance and making them suitable for borrowers seeking predictable monthly payments and long-term financial stability. Negative amortization interest loans allow for lower initial payments by adding unpaid interest to the loan balance, fitting borrowers who anticipate increased future income or plan to refinance before the loan balance grows substantially. Understanding your financial goals and cash flow capacity helps determine whether a steady amortization approach or flexibility with negative amortization aligns best with your loan strategy.

Avoiding Pitfalls: Risks of Negative Amortization Loans

Negative amortization loans increase the principal balance when payments do not cover the interest, leading to a growing debt burden that can surpass the original loan amount. This risk creates payment shock when the loan eventually requires full interest or principal payments, potentially causing financial strain or default. Careful loan structure analysis and fixed payment options help mitigate the dangers associated with negative amortization compared to standard amortized interest loans.

Expert Tips for Choosing the Right Interest Structure

Evaluate loan terms carefully by comparing amortized interest, which gradually reduces principal over time, with negative amortization interest that initially increases loan balance due to unpaid interest. Consider your financial stability, expected income growth, and repayment flexibility to determine which structure aligns with your long-term goals. Consult a financial expert to analyze cash flow impacts and avoid loan scenarios that could lead to higher debt burdens or payment shocks.

Related Important Terms

Dynamic Amortization Scheduling

Dynamic amortization scheduling adjusts payment allocations over time, balancing principal and interest to prevent negative amortization and reduce overall loan costs. Unlike traditional amortization, it recalibrates based on payment frequency and interest accrual, ensuring consistent loan payoff without increasing principal due to unpaid interest.

Negative Equity Interest Impact

Negative amortization interest increases loan principal over time, resulting in negative equity where the outstanding loan balance exceeds the property value. This riskier loan structure can lead to financial instability for borrowers as accrued interest compounds, reducing homeownership equity.

Reverse Amortization Triggers

Reverse amortization triggers occur when loan payments are insufficient to cover the interest due, causing unpaid interest to be added to the principal balance, unlike amortized interest loans where payments steadily reduce both principal and interest. This negative amortization effect can increase the loan balance over time, affecting borrower equity and potentially leading to higher financial risk and default.

Interest-Only Negative Amortization

Interest-only negative amortization loans allow borrowers to pay only the interest due, causing the principal balance to increase as unpaid interest is added to the loan amount. This loan structure results in higher total interest costs over time compared to standard amortized loans, where payments reduce both principal and interest.

Deferred Interest Accrual

Amortized interest involves regular payments that reduce both principal and accrued interest over time, ensuring the loan balance decreases steadily; in contrast, negative amortization interest occurs when payments are insufficient to cover the accrued interest, causing deferred interest accrual to increase the principal balance. Deferred interest accrual leads to higher loan costs and extended repayment periods, significantly impacting borrower cash flow and overall loan affordability.

Hybrid Amortization-Deferred Models

Hybrid amortization-deferred models combine scheduled periodic payments with deferred interest accumulation, balancing principal reduction and interest capitalization. This structure mitigates negative amortization by allowing temporary interest deferral while ensuring eventual loan amortization, optimizing cash flow management and total loan cost.

AI-Powered Amortization Forecasting

AI-powered amortization forecasting enables precise differentiation between amortized interest, where loan principal gradually decreases with each payment, and negative amortization interest, which causes the principal to increase due to unpaid accrued interest. Advanced machine learning models analyze payment patterns and loan parameters to predict future loan balances, optimizing loan repayment strategies and reducing financial risk.

Recursive Principal Escalation

Amortized interest involves regular payments gradually reducing both principal and interest, while negative amortization interest results in unpaid interest being added to the loan principal, causing recursive principal escalation and increasing the overall debt. This compounding effect significantly raises the loan balance over time, making negative amortization loans riskier due to the growing principal that borrowers must eventually repay.

Balloon Negative Amortization

Balloon negative amortization occurs when loan payments are insufficient to cover the accrued interest, causing the unpaid interest to be added to the principal balance, which contrasts with amortized interest loans where payments steadily reduce principal and interest over time. This loan structure results in a larger final balloon payment, increasing the borrower's total debt burden and financial risk at maturity.

Re-amortization Penalty Clauses

Re-amortization penalty clauses often impose fees or restrictions when modifying loan terms to address changes in amortized interest or negative amortization interest structures, limiting borrowers' ability to reduce monthly payments by recalculating the loan schedule. These penalties can increase the overall loan cost and deter refinancing or adjustment of negatively amortizing loans to mitigate rising principal balances.

Amortized Interest vs Negative Amortization Interest for loan structure. Infographic

moneydiff.com

moneydiff.com