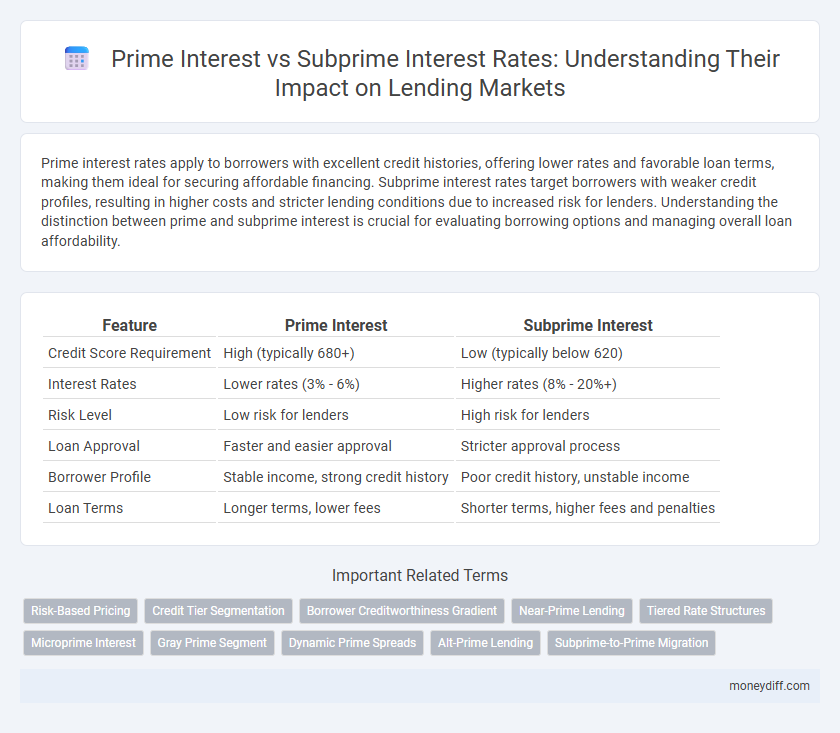

Prime interest rates apply to borrowers with excellent credit histories, offering lower rates and favorable loan terms, making them ideal for securing affordable financing. Subprime interest rates target borrowers with weaker credit profiles, resulting in higher costs and stricter lending conditions due to increased risk for lenders. Understanding the distinction between prime and subprime interest is crucial for evaluating borrowing options and managing overall loan affordability.

Table of Comparison

| Feature | Prime Interest | Subprime Interest |

|---|---|---|

| Credit Score Requirement | High (typically 680+) | Low (typically below 620) |

| Interest Rates | Lower rates (3% - 6%) | Higher rates (8% - 20%+) |

| Risk Level | Low risk for lenders | High risk for lenders |

| Loan Approval | Faster and easier approval | Stricter approval process |

| Borrower Profile | Stable income, strong credit history | Poor credit history, unstable income |

| Loan Terms | Longer terms, lower fees | Shorter terms, higher fees and penalties |

Understanding Prime vs Subprime Interest Rates

Prime interest rates apply to borrowers with strong credit histories, offering lower borrowing costs and reflecting lower default risk in lending markets. Subprime interest rates target borrowers with weaker credit profiles, resulting in higher rates to compensate lenders for increased risk. Understanding the distinction between these rates is critical for assessing loan affordability, credit risk, and financial stability in lending practices.

Key Differences Between Prime and Subprime Lending

Prime interest rates apply to borrowers with high credit scores and reliable financial histories, resulting in lower rates and favorable loan terms. Subprime interest rates target borrowers with poor credit or limited credit histories, leading to higher rates and increased risk of default. The key differences between prime and subprime lending include credit score requirements, interest rate levels, and borrower risk profiles.

How Lenders Determine Prime and Subprime Borrowers

Lenders determine prime and subprime borrowers based on credit scores, debt-to-income ratios, and repayment history, with prime borrowers typically having credit scores above 700 and lower risk profiles. Subprime borrowers often exhibit lower credit scores, higher delinquency rates, and unstable income, leading to higher interest rates to offset increased default risk. Data from credit bureaus and financial statements play a crucial role in underwriting decisions and interest pricing within lending markets.

Factors Affecting Prime Interest Rates

Prime interest rates are primarily influenced by the central bank's benchmark rates, inflation expectations, and overall economic growth indicators. Strong economic performance and low inflation typically lead to lower prime rates, encouraging borrowing and investment. Credit risk remains minimal for prime borrowers, allowing lenders to offer more favorable rates compared to subprime borrowers who face higher default probabilities.

What Drives Subprime Interest Rates Higher?

Subprime interest rates are driven higher primarily by increased credit risk, as borrowers with poor credit histories present a greater likelihood of default. Lenders compensate for this risk by imposing steeper interest rates to cover potential losses and administrative costs. Economic factors like rising unemployment and volatile market conditions further amplify the risk premium associated with subprime loans.

Credit Scores: The Gateway to Prime Interest

Credit scores play a crucial role in determining access to prime interest rates, with higher scores indicating lower risk to lenders and qualifying borrowers for more favorable terms. Subprime interest rates apply to individuals with lower credit scores, reflecting higher credit risk and resulting in increased borrowing costs. Lenders analyze credit score ranges to segment applicants, ensuring that prime borrowers benefit from reduced interest rates, while subprime borrowers face premiums tailored to their risk profiles.

Risks and Rewards of Subprime Lending Markets

Subprime lending markets carry higher interest rates to compensate for elevated default risks associated with borrowers who have lower credit scores. These higher rates generate increased revenue opportunities for lenders but also expose them to significant potential losses in the event of widespread loan defaults. Managing risks in subprime markets requires rigorous credit assessments and strategic portfolio diversification to balance the rewards against the probability of borrower default.

Impact of Prime and Subprime Rates on Loan Approval

Prime interest rates, typically offered to borrowers with strong credit histories, result in lower borrowing costs and higher loan approval rates, reflecting reduced risk for lenders. Subprime interest rates, assigned to individuals with poor credit scores, carry higher costs to compensate for increased default risk, leading to stricter approval criteria and fewer loans granted. The disparity between prime and subprime rates significantly influences lender risk assessment and borrower access to credit markets.

Market Trends: Prime vs Subprime Interest Over Time

Prime interest rates have historically remained lower and more stable, reflecting borrowers with strong credit profiles and lower default risks, while subprime interest rates tend to be significantly higher and more volatile due to increased lending risks. Market trends indicate that during economic downturns, subprime rates can spike sharply as lenders tighten risk assessments, whereas prime rates often decline in response to monetary policy easing aimed at stimulating borrowing. Data from the past decade shows widening spreads between prime and subprime interest rates during financial crises, highlighting the sensitivity of subprime markets to macroeconomic shifts.

Strategies for Borrowers to Transition from Subprime to Prime

Borrowers aiming to transition from subprime to prime interest must focus on improving credit scores by consistently paying down debts and avoiding late payments. Securing stable employment and reducing credit utilization ratios are essential strategies for demonstrating creditworthiness to lenders. Establishing a history of timely payments on smaller loans or credit cards can also pave the way for access to prime interest rates in lending markets.

Related Important Terms

Risk-Based Pricing

Prime interest rates offer lower borrowing costs to individuals with strong credit histories, reflecting lower default risk in lending markets. Subprime interest rates are higher, incorporating greater risk-based pricing to compensate lenders for increased default probability among borrowers with weaker credit profiles.

Credit Tier Segmentation

Prime interest rates apply to borrowers with high credit scores, reflecting lower risk and resulting in lower lending rates, while subprime interest rates target borrowers with poor credit histories, leading to higher interest costs due to increased default risk. Credit tier segmentation enables lenders to differentiate loan terms and interest rates based on borrower creditworthiness, optimizing risk management and profitability in lending markets.

Borrower Creditworthiness Gradient

Prime interest rates apply to borrowers with high creditworthiness, reflecting lower risk and resulting in more favorable lending terms, while subprime interest rates target borrowers with lower credit scores, compensating lenders for higher credit risk through increased rates. The borrower creditworthiness gradient directly influences lending costs, with a steeper gradient causing wider interest rate spreads between prime and subprime loans.

Near-Prime Lending

Near-prime lending bridges the gap between prime and subprime interest rates, offering borrowers with moderate credit scores access to loans at terms better than subprime but slightly higher than prime rates. This segment mitigates risk for lenders by targeting individuals who fall just below prime eligibility, balancing affordability with increased default risk.

Tiered Rate Structures

Prime interest rates apply to borrowers with high creditworthiness, offering lower borrowing costs due to reduced risk, while subprime interest rates target higher-risk borrowers with less favorable credit profiles, resulting in elevated costs. Tiered rate structures differentiate these lending categories through adjustable rates that reflect credit risk, market conditions, and borrower profiles, optimizing lender risk management and borrower access.

Microprime Interest

Microprime interest rates typically fall between prime and subprime rates, targeting borrowers with limited credit history who are seen as moderately risky. These rates reflect a balance in lending markets, offering slightly higher costs than prime loans but lower than subprime, thereby expanding credit access while managing default risk.

Gray Prime Segment

The Gray Prime segment in lending markets represents borrowers with near-prime credit scores, often facing interest rates slightly higher than traditional prime but substantially lower than subprime rates, balancing risk and affordability for lenders. This segment bridges the gap between prime and subprime lending, with interest rates typically ranging from 6% to 10%, reflecting moderate default risks compared to prime (usually under 6%) and subprime rates (which can exceed 15%).

Dynamic Prime Spreads

Dynamic prime spreads reflect fluctuations in the interest rate difference between prime and subprime loans, driven by market risk assessment and economic conditions. These spreads serve as key indicators of credit risk appetite, influencing lending rates and borrower access to capital in fluctuating financial markets.

Alt-Prime Lending

Alt-prime lending bridges the gap between prime and subprime interest rates by offering borrowers with moderate credit scores access to loans at rates lower than subprime but higher than prime. This market segment mitigates risk through tailored underwriting criteria, enabling lenders to serve a broader range of consumers while managing default probabilities effectively.

Subprime-to-Prime Migration

Subprime-to-prime migration reflects borrowers improving credit profiles, enabling access to lower prime interest rates and reducing overall lending risk. This transition enhances loan performance metrics and increases profitability for lenders by shifting high-cost subprime debt into more stable prime categories.

Prime Interest vs Subprime Interest for lending markets. Infographic

moneydiff.com

moneydiff.com