Nominal interest represents the stated return on an investment without adjusting for inflation, reflecting the actual dollar amount earned. Real yield accounts for inflation, providing a more accurate measure of purchasing power gained from the investment. Understanding the difference between nominal interest and real yield is essential for evaluating true investment performance and potential returns.

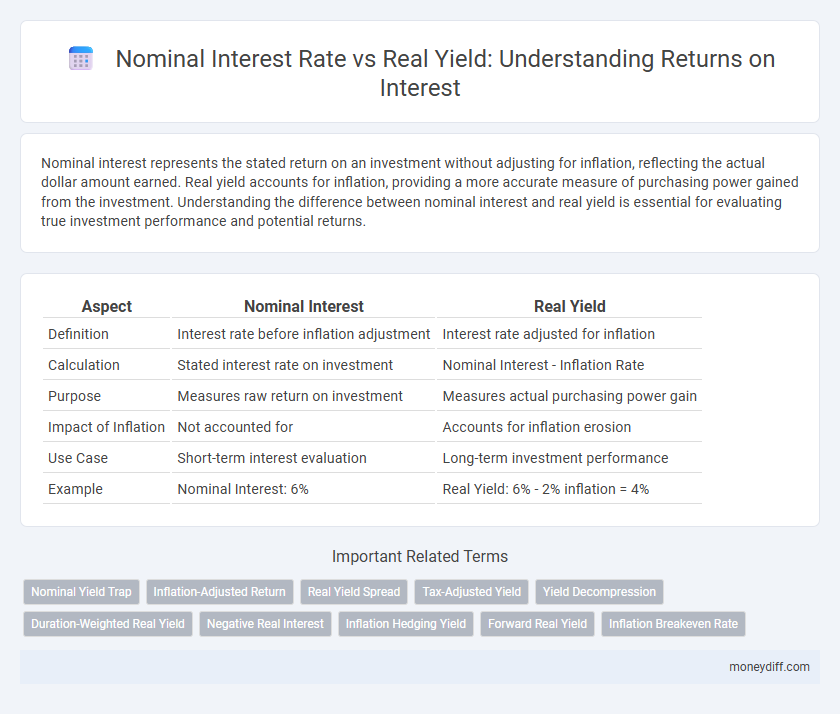

Table of Comparison

| Aspect | Nominal Interest | Real Yield |

|---|---|---|

| Definition | Interest rate before inflation adjustment | Interest rate adjusted for inflation |

| Calculation | Stated interest rate on investment | Nominal Interest - Inflation Rate |

| Purpose | Measures raw return on investment | Measures actual purchasing power gain |

| Impact of Inflation | Not accounted for | Accounts for inflation erosion |

| Use Case | Short-term interest evaluation | Long-term investment performance |

| Example | Nominal Interest: 6% | Real Yield: 6% - 2% inflation = 4% |

Understanding Nominal Interest: The Basics

Nominal interest represents the stated rate on a loan or investment without adjusting for inflation, reflecting the actual percentage increase in money received. It differs from real yield, which accounts for inflation by subtracting the inflation rate from the nominal interest rate to show the true purchasing power gained. Understanding nominal interest helps investors gauge the basic return before inflation impacts the effective value of their earnings.

What Is Real Yield? Key Definitions

Real yield represents the return on an investment after adjusting for inflation, reflecting the true increase in purchasing power. It is calculated by subtracting the inflation rate from the nominal interest rate, providing a more accurate measure of an investment's profitability. Understanding real yield is essential for investors seeking to preserve or grow wealth in environments with fluctuating inflation.

The Impact of Inflation on Returns

Nominal interest represents the stated return on an investment without adjusting for inflation, often overstating actual purchasing power gains. Real yield, calculated by subtracting inflation from nominal interest, provides a clearer measure of true investment growth by reflecting the change in purchasing power. Inflation erodes nominal returns, making real yield essential for assessing the genuine profitability of fixed-income assets and long-term investments.

Calculating Nominal vs Real Interest Rates

Nominal interest rates represent the stated return on an investment without adjusting for inflation, reflecting the percentage increase in money earned over a period. Real interest rates provide a more accurate measure of purchasing power by subtracting the inflation rate from the nominal interest rate using the formula: Real Interest Rate = Nominal Interest Rate - Inflation Rate. Calculating real yields helps investors compare the true profitability of investments by accounting for the erosion of value caused by rising prices.

Why Real Yield Matters for Investors

Real yield reflects the true purchasing power of investment returns by adjusting nominal interest rates for inflation, providing investors with a more accurate measure of profitability. Unlike nominal interest, which can be misleading during periods of rising inflation, real yield ensures that investors understand the actual increase in wealth after accounting for inflation erosion. Monitoring real yield helps investors make informed decisions, preserve capital value, and achieve long-term financial goals despite fluctuating economic conditions.

Comparing Nominal Interest and Real Yield

Comparing nominal interest and real yield is essential for understanding true investment returns, as nominal interest reflects the stated rate without accounting for inflation. Real yield adjusts nominal interest by subtracting the inflation rate, providing a clearer measure of purchasing power gained or lost. Investors prioritize real yield to evaluate the actual profitability of their investments over time.

Risks of Ignoring Inflation in Your Return

Nominal interest rates reflect the stated return on investment without accounting for inflation, potentially overstating true profitability. Real yield adjusts nominal returns by subtracting inflation, providing a more accurate measure of purchasing power gained. Ignoring inflation risks eroding investment value, leading to misleading assessments of financial growth and reduced effective returns.

Practical Examples: Nominal vs Real Returns

Nominal interest refers to the stated percentage return on an investment without adjusting for inflation, while real yield accounts for inflation, representing the actual purchasing power gained. For example, a nominal interest rate of 6% with an inflation rate of 3% results in a real yield of approximately 3%, demonstrating how inflation erodes investment returns. Investors relying solely on nominal returns may overestimate profits, highlighting the importance of considering real yield for accurate financial planning.

How to Use Real Yield in Investment Decisions

Real yield reflects the actual purchasing power of investment returns by adjusting nominal interest rates for inflation, making it crucial for evaluating true profitability. Investors use real yield to compare different assets and ensure their returns outpace inflation, preserving or increasing wealth over time. Incorporating real yield into investment decisions helps identify opportunities with genuine value growth rather than misleading nominal gains.

Maximizing Returns: Strategies Based on Real Interest

Maximizing returns requires focusing on real interest rates, which account for inflation and provide a clearer measure of purchasing power growth compared to nominal interest rates. Investors should prioritize assets with higher real yields to preserve and enhance capital value over time. Strategies such as investing in inflation-protected securities and index-linked bonds help align returns with real economic gains rather than nominal figures.

Related Important Terms

Nominal Yield Trap

Nominal interest rates often mask the true earning potential of investments by failing to account for inflation, leading to the nominal yield trap where apparent returns are overstated. Understanding real yield, which adjusts nominal interest by inflation rates, is crucial for accurately assessing the purchasing power and genuine profitability of financial assets.

Inflation-Adjusted Return

Nominal interest rates represent the stated return without adjusting for inflation, while real yield reflects the inflation-adjusted return, providing a more accurate measure of an investment's purchasing power growth. Understanding the difference between nominal interest and real yield is crucial for evaluating true investment performance, as inflation erodes the value of nominal gains over time.

Real Yield Spread

Real yield spread represents the difference between nominal interest rates and inflation expectations, reflecting the true purchasing power return on investments. Investors prioritize real yield spread to assess the genuine profitability of bonds and fixed-income assets beyond inflation impacts.

Tax-Adjusted Yield

Nominal interest represents the stated rate without inflation adjustment, whereas real yield accounts for inflation's impact, providing a more accurate return measure. Tax-adjusted yield further refines real yield by considering the investor's tax bracket, thereby revealing the true post-tax purchasing power of investment returns.

Yield Decompression

Nominal interest represents the stated return on an investment without adjusting for inflation, while real yield accounts for the inflation rate, providing a clearer measure of purchasing power gains. Yield decompression occurs when the gap between nominal interest rates and real yields narrows, often signaling rising inflation expectations or changes in monetary policy.

Duration-Weighted Real Yield

Nominal interest reflects the stated return on investment without adjusting for inflation, while real yield represents the inflation-adjusted return, providing a more accurate measure of purchasing power growth. Duration-weighted real yield further refines this by incorporating the time to maturity, allowing investors to assess the true yield over the investment horizon, adjusting for inflation and interest rate risk.

Negative Real Interest

Negative real interest occurs when nominal interest rates fall below inflation, eroding purchasing power and resulting in a loss of actual returns for investors. This scenario often prompts a search for inflation-protected assets or higher-yield investments to preserve capital in an inflationary environment.

Inflation Hedging Yield

Nominal interest rates reflect the total return on an investment without adjusting for inflation, while real yield accounts for inflation's erosion of purchasing power, providing a clearer picture of true investment gains. Inflation-hedging yield is crucial for preserving wealth, as it ensures returns exceed inflation rates, maintaining the investor's inflation-adjusted purchasing power.

Forward Real Yield

Forward real yield represents the inflation-adjusted return expected on an investment over a specific future period, distinguishing it from nominal interest rates which do not account for inflation. Investors rely on forward real yields to gauge the true purchasing power growth of returns, allowing more accurate comparisons of investment profitability amid changing inflation expectations.

Inflation Breakeven Rate

Nominal interest rates represent the stated returns without adjusting for inflation, while real yield accounts for the inflation breakeven rate to reflect the true purchasing power of returns. Investors compare nominal rates to the inflation breakeven rate to determine if the real yield is positive, indicating profitable investment gains after inflation erosion.

Nominal Interest vs Real Yield for returns. Infographic

moneydiff.com

moneydiff.com