Interest-only mortgage payments allow borrowers to pay only the interest for a set period, resulting in lower initial monthly payments but no reduction in the loan principal. In contrast, principal and interest payments cover both the loan balance and the interest, gradually reducing the mortgage over time. Choosing between these options depends on financial goals, affordability, and long-term repayment plans.

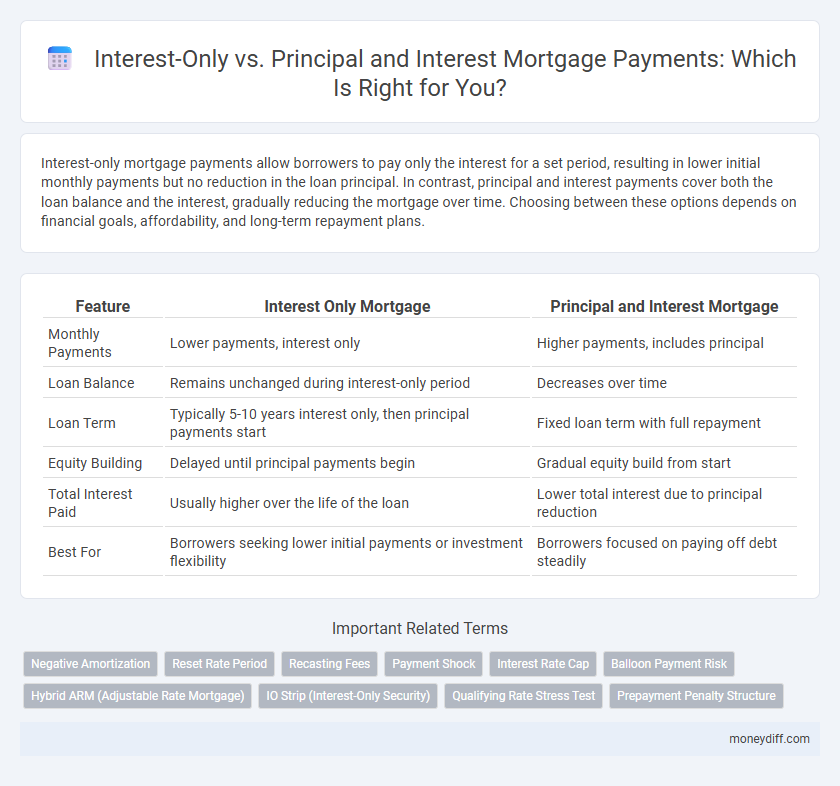

Table of Comparison

| Feature | Interest Only Mortgage | Principal and Interest Mortgage |

|---|---|---|

| Monthly Payments | Lower payments, interest only | Higher payments, includes principal |

| Loan Balance | Remains unchanged during interest-only period | Decreases over time |

| Loan Term | Typically 5-10 years interest only, then principal payments start | Fixed loan term with full repayment |

| Equity Building | Delayed until principal payments begin | Gradual equity build from start |

| Total Interest Paid | Usually higher over the life of the loan | Lower total interest due to principal reduction |

| Best For | Borrowers seeking lower initial payments or investment flexibility | Borrowers focused on paying off debt steadily |

Understanding Interest Only and Principal & Interest Mortgages

Interest-only mortgages allow borrowers to pay only the interest on the loan for a set period, typically resulting in lower monthly payments but no reduction in the principal balance during that time. Principal and interest mortgages require payments that cover both the loan principal and accrued interest, gradually reducing the mortgage balance and building home equity. Choosing between these options depends on factors like cash flow, long-term financial goals, and the ability to manage higher payments once the interest-only period ends.

Key Differences Between Interest Only and Principal & Interest Loans

Interest-only mortgage loans require borrowers to pay only the interest for a set initial period, resulting in lower monthly payments but no reduction in the loan principal. Principal and interest loans include payments toward both the interest and the principal, gradually reducing the loan balance over time and leading to home ownership equity. Interest-only loans often have higher long-term costs and risks compared to principal and interest loans, making them suitable primarily for short-term financing strategies or investors.

Pros and Cons of Interest Only Mortgage Payments

Interest-only mortgage payments offer lower initial monthly costs by requiring payments solely on the loan principal's interest, which increases cash flow flexibility for borrowers. However, this approach leads to no reduction in the principal balance during the interest-only period, potentially resulting in higher overall loan costs and a substantial payment increase when principal payments begin. Borrowers must weigh short-term affordability against long-term financial obligations and the risk of insufficient equity buildup.

Advantages and Disadvantages of Principal & Interest Mortgages

Principal and interest mortgages ensure gradual repayment of the loan balance, building equity faster and providing predictable monthly payments. This method reduces overall interest costs compared to interest-only loans, which only cover interest and do not decrease the principal. However, higher initial payments can strain budgets, potentially limiting cash flow flexibility for some borrowers.

Who Should Consider Interest Only Home Loans?

Interest only home loans are ideal for borrowers with irregular income streams such as self-employed professionals or investors seeking to maximize cash flow during the initial loan period. These loans allow for lower monthly payments by paying only interest, enabling financial flexibility when managing short-term expenses or anticipating higher future earnings. Homebuyers with a plan to refinance, sell, or increase income before principal repayments begin should carefully assess interest only options to optimize their mortgage strategy.

When Is Principal & Interest the Smarter Choice?

Principal and interest mortgage payments are often the smarter choice when building equity and ensuring long-term financial stability. Choosing this option reduces the loan balance with each payment, decreasing overall interest costs and preparing homeowners for eventual full ownership. This method benefits borrowers planning to stay in their property long-term or aiming to improve their creditworthiness through consistent principal reduction.

Interest Only vs Principal & Interest: Impact on Total Interest Paid

Interest-only mortgage payments result in lower initial payments but cause a higher total interest cost over the loan term since the principal remains unchanged during the interest-only period. Principal and interest payments gradually reduce the loan balance, leading to significantly less interest paid overall. Choosing principal and interest repayment accelerates equity building and minimizes total interest expenditure compared to interest-only options.

Repayment Flexibility: Comparing Both Mortgage Types

Interest-only mortgages offer repayment flexibility by requiring borrowers to pay only the interest for a set period, resulting in lower initial monthly payments and increased cash flow. Principal and interest mortgages, in contrast, combine both components in each payment, gradually reducing the loan balance and building equity over time. Borrowers prioritizing short-term financial flexibility may prefer interest-only options, while those focused on long-term wealth accumulation typically benefit from principal and interest repayment structures.

How Your Financial Goals Affect Mortgage Payment Choices

Choosing between interest-only and principal and interest mortgage payments depends heavily on your financial goals, such as cash flow management or long-term asset building. Interest-only payments offer lower initial monthly costs, maximizing short-term liquidity for investments or expenses, but do not reduce the loan principal. Principal and interest payments increase monthly obligations but accelerate equity growth and debt reduction, aligning with goals focused on homeownership and financial stability over time.

Choosing the Right Mortgage: Factors to Consider

Choosing the right mortgage depends on your financial goals, cash flow needs, and loan term preferences. Interest-only mortgages offer lower initial payments but do not reduce the principal, potentially leading to higher total costs and payment increases later. Principal and interest mortgages involve higher payments upfront but steadily decrease the loan balance, providing long-term equity and predictability in budgeting.

Related Important Terms

Negative Amortization

Interest-only mortgage payments cover just the loan's interest, causing the principal balance to remain unchanged or increase if payments are insufficient, leading to negative amortization. In contrast, principal and interest payments reduce the loan balance over time, preventing the risk of owing more than the original loan amount.

Reset Rate Period

Interest-only mortgage payments during the reset rate period allow borrowers to pay only the interest, resulting in lower monthly payments but no equity buildup. In contrast, principal and interest payments increase monthly costs but steadily reduce the loan balance, minimizing the impact of interest rate changes at the reset period.

Recasting Fees

Interest-only mortgage payments reduce monthly costs by paying just interest, but recasting fees can apply when switching to principal and interest payments, increasing upfront expenses. Principal and interest payments build equity over time, and while recasting fees may affect refinancing or payment adjustments, they can lead to long-term savings by reducing total interest paid.

Payment Shock

Interest-only mortgage payments initially result in lower monthly costs, but switching to principal and interest payments can cause significant payment shock due to the sudden increase in repayment amounts. Borrowers should carefully evaluate their financial capacity to manage higher payments when the interest-only period ends to avoid potential default risks.

Interest Rate Cap

Interest-only mortgage payments typically result in a lower monthly outlay initially, but the principal remains unchanged, potentially leading to higher costs if the interest rate cap increases. Principal and interest repayments gradually reduce the loan balance while protecting borrowers through an interest rate cap that limits the maximum payable rate, stabilizing monthly costs over the loan term.

Balloon Payment Risk

Interest-only mortgage payments offer lower monthly costs initially but carry the risk of a substantial balloon payment at the end of the term, which can be difficult to refinance or repay. Principal and interest payments provide predictable amortization, reducing the risk of a large lump sum payment and promoting steady equity building over time.

Hybrid ARM (Adjustable Rate Mortgage)

Hybrid ARM mortgages combine an initial fixed-rate period with subsequent adjustable rates, allowing borrowers to choose interest-only payments initially to lower monthly costs before switching to principal and interest payments, which gradually reduce the loan balance. This structure offers flexibility for homeowners expecting income growth or planning to refinance, balancing short-term affordability with long-term equity build-up.

IO Strip (Interest-Only Security)

IO Strips (Interest-Only Securities) represent mortgage-backed securities that pay only the interest portion of the mortgage payments, providing investors with a cash flow stream detached from principal repayments, which differ significantly from traditional Principal and Interest loans where payments reduce both principal and interest. These securities are sensitive to prepayment risks and interest rate fluctuations, making them attractive for investors seeking exposure to interest rate volatility without principal amortization.

Qualifying Rate Stress Test

Interest-only mortgage payments require borrowers to qualify based on higher stress test rates applied to the full principal balance, while principal and interest payments often result in lower qualifying payments since both components reduce the loan amount over time. Lenders typically apply the qualifying rate stress test to ensure borrowers can sustain payments if interest rates rise, making principal and interest loans more favorable for passing these assessments.

Prepayment Penalty Structure

Interest-only mortgage payments typically have prepayment penalties structured with fixed fees or percentage charges on early principal repayments, limiting borrower flexibility. Principal and interest loans often feature lower or no prepayment penalties, encouraging faster loan payoff without substantial additional costs.

Interest Only vs Principal and Interest for mortgage payments Infographic

moneydiff.com

moneydiff.com