Simple interest calculates returns based only on the original principal, offering straightforward growth over a fixed period. Compound interest, however, generates earnings on both the principal and accumulated interest, resulting in exponential growth over time. Choosing compound interest can significantly increase returns, especially for long-term investments.

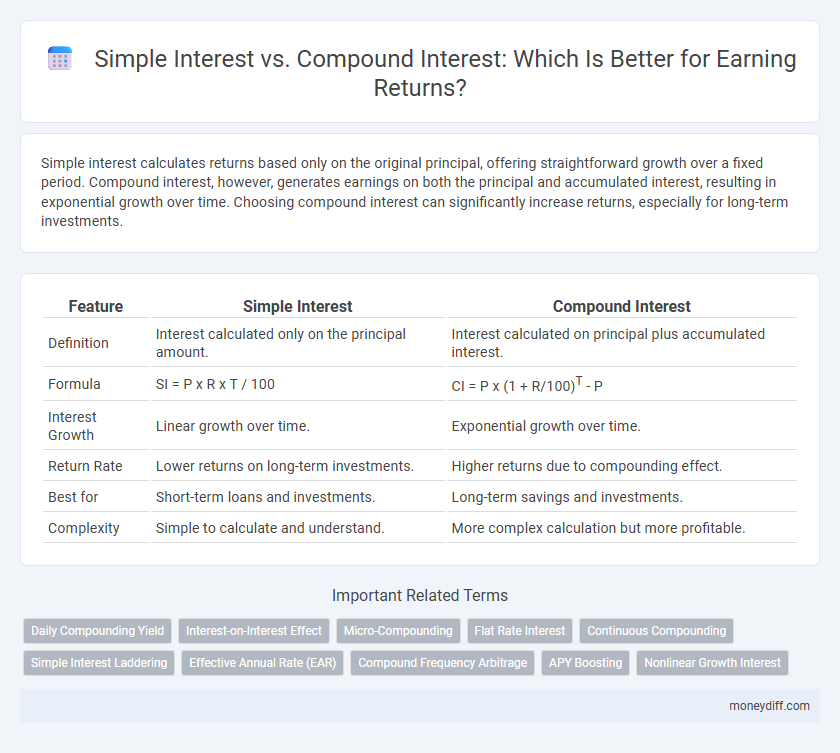

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Interest calculated only on the principal amount. | Interest calculated on principal plus accumulated interest. |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)T - P |

| Interest Growth | Linear growth over time. | Exponential growth over time. |

| Return Rate | Lower returns on long-term investments. | Higher returns due to compounding effect. |

| Best for | Short-term loans and investments. | Long-term savings and investments. |

| Complexity | Simple to calculate and understand. | More complex calculation but more profitable. |

Understanding Simple and Compound Interest

Simple interest calculates returns based on the original principal throughout the investment period, resulting in linear growth. Compound interest generates returns on both the initial principal and accumulated interest, leading to exponential growth over time. Understanding the distinction is crucial for optimizing investment strategies and maximizing long-term earnings.

Key Differences Between Simple and Compound Interest

Simple interest calculates returns solely on the original principal, providing fixed earnings over time, whereas compound interest generates returns on both the principal and accumulated interest, resulting in exponential growth. The frequency of compounding periods--annually, semi-annually, quarterly, or monthly--significantly impacts the total earnings under compound interest, making it more advantageous for long-term investments. Investors seeking predictable, straightforward returns may prefer simple interest, while those aiming for higher growth over extended periods benefit from the reinvestment effect inherent in compound interest.

How Simple Interest Works for Investors

Simple interest calculates returns based solely on the original principal amount, providing a fixed, predictable gain over time without reinvesting earned interest. Investors benefit from straightforward interest accumulation on their initial investment, making it easier to estimate total earnings for short-term lending or fixed deposits. This method suits conservative financial strategies where clarity and stability in returns are prioritized over exponential growth.

The Power of Compound Interest Over Time

Compound interest exponentially increases earnings by reinvesting interest, allowing returns to generate additional returns over time. Unlike simple interest, which calculates returns only on the principal, compound interest accelerates growth, especially over long periods with frequent compounding intervals. This effect demonstrates the importance of starting early and maintaining investments to fully leverage the power of compound interest for wealth accumulation.

Interest Calculation Examples: Simple vs Compound

Simple interest is calculated using the principal amount multiplied by the interest rate and time, resulting in linear growth; for example, $1,000 at 5% simple interest for 3 years yields $150 interest. Compound interest calculates interest on the initial principal and accumulated interest from previous periods, leading to exponential growth; the same $1,000 at 5% compounded annually for 3 years results in $157.63 interest. Comparing the two, compound interest offers higher returns over time due to interest-on-interest effects, especially notable in long-term investments.

Which Is Better for Your Savings Goals?

Simple interest calculates returns on the original principal only, making it ideal for short-term savings or loans with fixed returns. Compound interest earns returns on both the initial principal and accumulated interest, resulting in exponentially higher growth over time, which benefits long-term savings or investment goals. Choosing between simple and compound interest depends on your financial horizon and whether you prioritize steady earnings or maximized growth potential.

Pros and Cons: Simple Interest vs Compound Interest

Simple interest offers straightforward calculations and consistent returns, making it ideal for short-term investments but lacks the growth potential of compounding. Compound interest accelerates wealth accumulation by reinvesting earnings, benefiting long-term investors but involves more complex calculations and potential variability. Choosing between simple and compound interest depends on investment duration, risk tolerance, and financial goals.

Maximizing Returns Using Compound Interest

Compound interest significantly maximizes returns by reinvesting earned interest, leading to exponential growth over time compared to simple interest, which calculates returns only on the principal amount. Investors benefit from compound interest especially with frequent compounding periods, such as daily or monthly compounding, accelerating wealth accumulation. Understanding the impact of interest rates, compounding frequency, and investment duration is crucial for leveraging compound interest for higher long-term returns.

Common Mistakes When Choosing Interest Options

Many investors mistakenly assume simple interest yields higher returns without considering compound interest's effect of earning interest on accumulated interest, which significantly amplifies growth over time. Overlooking the compounding frequency--daily, monthly, or annually--can lead to underestimating potential earnings when selecting compound interest options. Failure to account for the investment period length further distorts expected returns, as compound interest benefits become more pronounced with longer durations.

Tips for Leveraging Interest Rates in Money Management

Maximize returns by prioritizing compound interest investments, as they grow exponentially over time through reinvested earnings. Track interest rate fluctuations regularly and shift funds to accounts or instruments offering higher rates to enhance gains. Opt for shorter compounding intervals, such as daily or monthly, to accelerate interest accumulation efficiently.

Related Important Terms

Daily Compounding Yield

Simple interest calculates returns solely on the initial principal, resulting in consistent but limited growth, while compound interest with daily compounding yields exponential growth by reinvesting earnings each day, maximizing total returns over time. Daily compounding leverages the power of frequent interest calculations to significantly enhance earnings compared to simple interest or less frequent compounding periods.

Interest-on-Interest Effect

Simple interest calculates returns solely on the principal amount, resulting in linear growth over time. Compound interest generates exponential returns by earning interest on both the initial principal and the accumulated interest, maximizing the interest-on-interest effect.

Micro-Compounding

Micro-compounding enhances returns by applying compound interest more frequently, such as daily or monthly, compared to simple interest which calculates based only on the initial principal. This continuous reinvestment effect accelerates growth, making compound interest highly advantageous for long-term investments even with small principal amounts.

Flat Rate Interest

Flat rate interest calculates returns based on the original principal throughout the loan term, resulting in predictable but often lower earnings compared to compound interest, which reinvests accrued interest to generate exponential growth. Investors seeking straightforward and transparent interest calculations commonly prefer flat rate interest despite its potential for reduced total returns over time.

Continuous Compounding

Continuous compounding maximizes earnings by calculating interest at every possible instant, resulting in higher returns compared to simple interest, which accrues only on the principal, or compound interest, which compounds at discrete intervals. The formula for continuous compounding A = P * e^(rt) leverages Euler's number (e 2.71828) to exponentially grow the investment over time.

Simple Interest Laddering

Simple interest laddering involves investing fixed amounts at different intervals with simple interest, ensuring predictable returns without reinvesting interest earnings. This strategy contrasts with compound interest, where interest is earned on both principal and accumulated interest, often leading to higher but less predictable growth.

Effective Annual Rate (EAR)

Simple interest calculates returns solely on the principal amount, resulting in a fixed interest rate over time, whereas compound interest earns returns on both principal and accumulated interest, significantly increasing the Effective Annual Rate (EAR). The EAR for compound interest always exceeds simple interest rates due to interest-on-interest effects, making compound interest more advantageous for maximizing investment growth.

Compound Frequency Arbitrage

Compound interest outperforms simple interest by reinvesting earnings, generating exponential growth over time. Compound frequency arbitrage exploits differences in compounding intervals across financial instruments to maximize returns by strategically switching investments.

APY Boosting

Simple interest calculates returns solely on the principal amount, resulting in linear growth, whereas compound interest reinvests earnings, exponentially increasing the returns by boosting the Annual Percentage Yield (APY) over time. The APY boost from compounding interest significantly enhances investment growth, making it a more powerful tool for maximizing earnings compared to simple interest.

Nonlinear Growth Interest

Simple interest grows linearly, calculating returns solely on the principal amount, resulting in fixed earnings over time. Compound interest generates nonlinear growth by earning returns on both the principal and accumulated interest, accelerating wealth accumulation through exponential increase.

Simple Interest vs Compound Interest for earning returns. Infographic

moneydiff.com

moneydiff.com