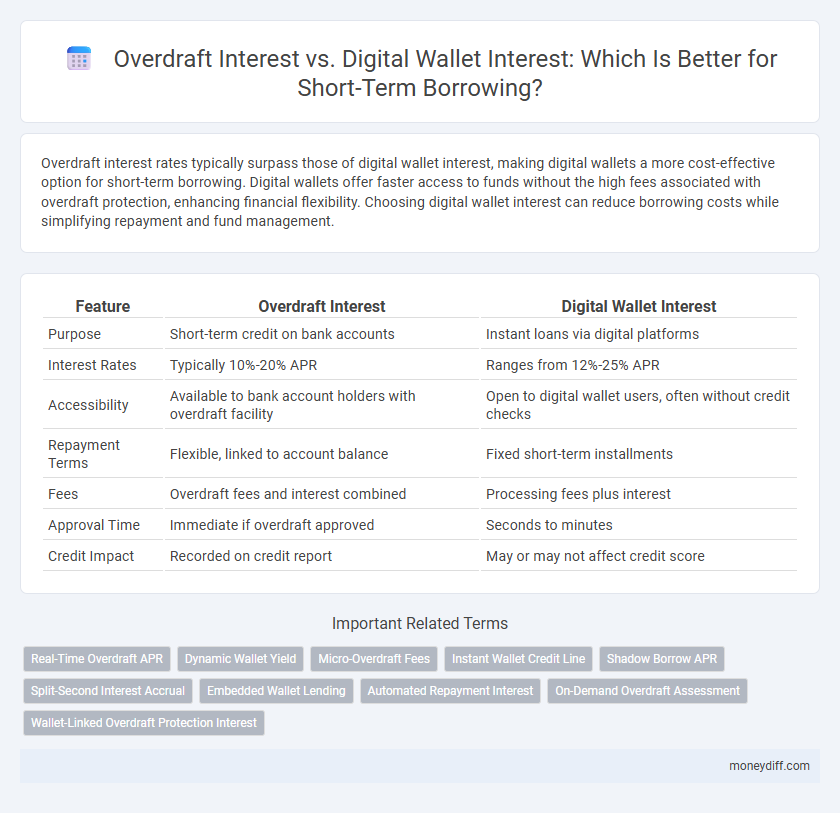

Overdraft interest rates typically surpass those of digital wallet interest, making digital wallets a more cost-effective option for short-term borrowing. Digital wallets offer faster access to funds without the high fees associated with overdraft protection, enhancing financial flexibility. Choosing digital wallet interest can reduce borrowing costs while simplifying repayment and fund management.

Table of Comparison

| Feature | Overdraft Interest | Digital Wallet Interest |

|---|---|---|

| Purpose | Short-term credit on bank accounts | Instant loans via digital platforms |

| Interest Rates | Typically 10%-20% APR | Ranges from 12%-25% APR |

| Accessibility | Available to bank account holders with overdraft facility | Open to digital wallet users, often without credit checks |

| Repayment Terms | Flexible, linked to account balance | Fixed short-term installments |

| Fees | Overdraft fees and interest combined | Processing fees plus interest |

| Approval Time | Immediate if overdraft approved | Seconds to minutes |

| Credit Impact | Recorded on credit report | May or may not affect credit score |

Understanding Overdraft Interest: Key Concepts

Overdraft interest is charged when an account balance goes below zero, typically applied at a daily or monthly rate, making it a flexible yet often costly option for short-term borrowing. Unlike digital wallet interest, which may offer promotional or lower rates on borrowed funds, overdraft interest rates can be significantly higher due to the immediate liquidity it provides. Understanding the calculation method, such as annual percentage rate (APR) applied to the negative balance, helps consumers evaluate the true cost of overdraft borrowing.

How Digital Wallet Interest Works for Borrowing

Digital wallet interest for borrowing typically operates by charging users a fixed or variable interest rate on the amount borrowed, calculated daily or monthly, similar to overdraft interest but often at more competitive rates. Unlike overdrafts linked to traditional bank accounts with potential fees and penalties, digital wallet interest is usually integrated seamlessly within the app, providing transparent and immediate access to credit. This allows users to manage short-term borrowing efficiently, with interest directly deducted from wallet balances or linked accounts upon repayment.

Overdraft vs Digital Wallet: Interest Rate Comparison

Overdraft interest rates typically range between 15% and 25% APR, often higher than digital wallet interest rates, which average around 10% to 18% APR for short-term borrowing. Digital wallets generally offer more competitive and transparent interest terms with fewer hidden fees compared to traditional overdraft services provided by banks. Consumers should evaluate the effective interest rate and associated fees when choosing between overdraft protection and digital wallet credit for short-term financing needs.

Short-Term Borrowing: Which Option Is Cheaper?

Overdraft interest rates typically range from 10% to 20% annually, making them a costly option for short-term borrowing. Digital wallet interest or fees are often lower or sometimes waived for small amounts, presenting a more affordable alternative for quick cash needs. Comparing specific rates and fees is essential, but digital wallets generally provide a cheaper option for short-term credit.

Fees and Hidden Costs: Overdrafts vs Digital Wallets

Overdraft interest typically involves higher fees and hidden costs such as daily interest accrual and overdraft processing charges, driving up the total borrowing expense. Digital wallet interest often offers more transparent fee structures with lower or no interest rates for short-term borrowing, reducing unexpected financial burdens. Evaluating these differences helps consumers avoid costly overdrafts and choose more affordable digital wallet options for managing short-term credit needs.

Flexibility and Accessibility in Short-Term Borrowing

Overdraft interest rates typically apply immediately and provide flexible access to funds linked directly to a checking account, enabling users to cover short-term cash flow gaps without prior approval. Digital wallet interest or credit options often offer easy accessibility through mobile apps with lower fees but may have borrowing limits and delayed fund availability compared to overdrafts. For short-term borrowing, overdrafts deliver immediate liquidity with continuous access, while digital wallets emphasize user-friendly interfaces and convenience within preset credit boundaries.

Impact of Overdraft Interest on Your Credit Score

Overdraft interest rates typically range from 15% to 35%, making them a costly option for short-term borrowing compared to digital wallet interest, which often offers lower or no interest rates. High overdraft usage can negatively impact your credit score by increasing your credit utilization ratio and signaling financial distress to lenders. Digital wallets, with their transparent fees and lower interest, provide a less risky alternative that helps maintain better credit health over time.

Digital Wallet Borrowing: Approval and Repayment Terms

Digital wallet borrowing offers quick approval processes, often granting instant access to funds with minimal credit checks, making it ideal for urgent short-term needs. Repayment terms for digital wallet loans are typically flexible, with scheduled deductions directly from linked accounts, reducing the risk of missed payments. Overdraft interest rates tend to be higher, whereas digital wallet borrowing may provide competitive interest rates and transparent fee structures tailored for short-term financial management.

Risks of Accruing Overdraft Interest vs Wallet Interest

Overdraft interest typically carries higher interest rates and can accumulate quickly, increasing the cost of short-term borrowing and potentially leading to significant debt if not repaid promptly. Digital wallet interest rates, while generally lower and more transparent, may include fees or conditions that reduce overall savings benefits, posing risks if users misunderstand terms. Borrowers relying on overdraft facilities face unpredictable expenses and negative credit impacts, whereas digital wallet borrowing risks center on liquidity and platform security.

Choosing the Best Short-Term Borrowing Solution

Overdraft interest rates generally tend to be higher than digital wallet interest rates, making digital wallets a more cost-effective option for short-term borrowing. Digital wallets offer flexible repayment terms and instant access to funds, reducing the risk of accumulating excessive interest charges. Selecting a borrowing solution depends on comparing the effective interest rates, repayment convenience, and potential fees associated with each option.

Related Important Terms

Real-Time Overdraft APR

Real-time overdraft APR typically offers lower interest rates for short-term borrowing compared to digital wallet interest, which often includes higher fees and less transparent rates. Choosing a real-time overdraft can optimize cost efficiency by providing immediate access to funds with clear interest accrual, enhancing financial management and reducing borrowing expenses.

Dynamic Wallet Yield

Overdraft interest rates typically surpass digital wallet interest, making short-term borrowing through overdrafts more expensive, whereas digital wallets offer dynamic wallet yield--an adaptive interest rate that fluctuates based on market conditions and user balance, providing potential cost savings. This dynamic wallet yield optimizes returns and reduces borrowing costs, positioning digital wallets as a more flexible and economically efficient option for managing short-term credit needs.

Micro-Overdraft Fees

Micro-overdraft fees typically incur higher interest rates compared to digital wallet interest, making overdrafts a costlier option for short-term borrowing. Digital wallets often offer lower interest rates and reduced fees, providing a more affordable alternative for managing small, urgent cash needs.

Instant Wallet Credit Line

Overdraft interest rates typically range from 15% to 25% annually, whereas digital wallet interest for Instant Wallet Credit Lines can be as low as 10% to 18%, offering a more cost-effective solution for short-term borrowing. Instant Wallet Credit Lines provide immediate access to funds with flexible repayment options, enhancing financial agility compared to traditional overdraft facilities.

Shadow Borrow APR

Overdraft interest rates typically range from 18% to 35% APR, often with hidden fees that can significantly increase borrowing costs, while digital wallet interest for short-term borrowing tends to offer lower APRs around 5% to 15%, providing a more transparent repayment process. Shadow Borrow APR, a lesser-known fintech metric, averages near 22%, reflecting the real cost of short-term credit beyond stated rates in both overdraft and digital wallet services.

Split-Second Interest Accrual

Overdraft interest accrues in real-time, resulting in split-second charges that can rapidly increase borrowing costs for short-term needs. Digital wallet interest often applies daily rates with less immediate compounding, offering more predictable expense management during brief borrowing periods.

Embedded Wallet Lending

Overdraft interest rates typically range from 18% to 25% APR, making them costlier for short-term borrowing compared to digital wallet interest tied to embedded wallet lending, which often offers rates between 8% and 15% APR due to streamlined credit assessments and reduced overhead. Embedded wallet lending leverages real-time transaction data and consumer behavior analytics to provide customized, lower-interest credit options within digital wallets, enhancing affordability and accessibility for users needing immediate funds.

Automated Repayment Interest

Automated repayment interest rates for overdraft services typically range from 15% to 25% annually, reflecting higher risk and immediate access to funds compared to digital wallet interest, which often offers lower rates around 5% to 12% due to integrated budgeting tools and shorter loan terms. Digital wallets automate repayment schedules that reduce late fees and compound interest impact, making them a cost-effective solution for short-term borrowing despite potentially lower credit limits.

On-Demand Overdraft Assessment

Overdraft interest rates typically range from 15% to 25% APR, providing immediate access to funds with interest calculated daily on the borrowed amount, ideal for short-term liquidity needs. Digital wallet interest, often lower at 5% to 10% APR, offers flexible borrowing terms through on-demand overdraft assessment, leveraging real-time account data to approve instant credit with transparent repayment schedules.

Wallet-Linked Overdraft Protection Interest

Wallet-linked overdraft protection interest typically offers lower rates compared to traditional overdraft interest, providing a cost-effective short-term borrowing solution by directly linking digital wallets to bank accounts. This integration reduces fees and facilitates instant coverage of transactions, making it a preferred choice over higher-interest overdraft options for managing temporary cash flow gaps.

Overdraft Interest vs Digital Wallet Interest for short-term borrowing Infographic

moneydiff.com

moneydiff.com