Simple interest calculates earnings on the original principal only, resulting in consistent but limited growth over time. Compound interest generates returns on both the initial principal and accumulated interest, leading to exponential savings growth. Choosing compound interest investments typically maximizes long-term financial gains due to the power of reinvested earnings.

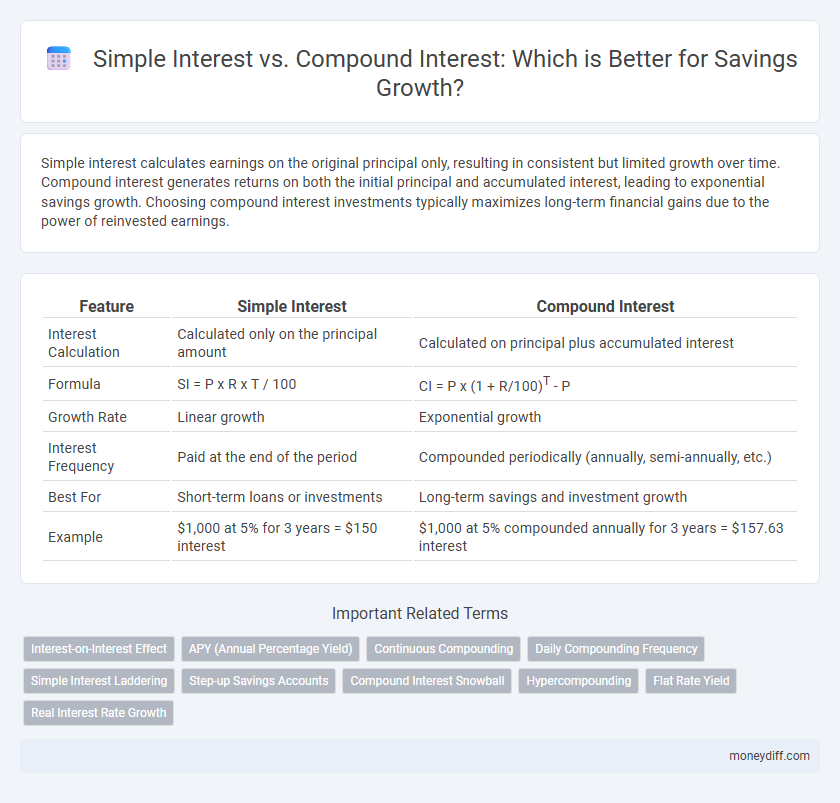

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest Calculation | Calculated only on the principal amount | Calculated on principal plus accumulated interest |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)T - P |

| Growth Rate | Linear growth | Exponential growth |

| Interest Frequency | Paid at the end of the period | Compounded periodically (annually, semi-annually, etc.) |

| Best For | Short-term loans or investments | Long-term savings and investment growth |

| Example | $1,000 at 5% for 3 years = $150 interest | $1,000 at 5% compounded annually for 3 years = $157.63 interest |

Introduction to Simple vs Compound Interest

Simple interest calculates earnings based only on the initial principal amount, offering straightforward growth with a fixed percentage over time. Compound interest accelerates savings by calculating interest on both the initial principal and the accumulated interest from previous periods, resulting in exponential growth. Understanding the difference between these two interest types is crucial for optimizing long-term savings strategies.

Understanding Simple Interest: Basics and Calculation

Simple interest calculates earnings based on the original principal amount only, using the formula I = P x r x t, where I is interest, P is principal, r is annual interest rate, and t is time in years. This method provides a linear growth of savings without reinvesting earned interest, making it easier to predict total returns. Simple interest is commonly used for short-term loans and fixed deposits, offering straightforward calculation and transparent interest accumulation.

Compound Interest Explained: How It Works

Compound interest accelerates savings growth by reinvesting both the initial principal and the accumulated interest, allowing interest to be earned on interest over time. This exponential effect results in a significantly higher return compared to simple interest, which calculates interest solely on the principal amount. Understanding compound interest involves recognizing the impact of compounding frequency, where more frequent compounding periods, such as monthly or daily, increase the total interest earned.

Key Differences Between Simple and Compound Interest

Simple interest calculates earnings solely on the principal amount, resulting in linear growth over time, whereas compound interest generates returns on both the principal and accumulated interest, causing exponential growth. Compound interest typically leads to higher savings accumulation, especially over long periods, due to interest compounding at regular intervals. The key difference lies in the calculation method: simple interest multiplies principal by rate and time, while compound interest applies interest periodically, significantly boosting the final amount.

How Each Interest Type Impacts Savings Growth

Simple interest calculates returns based solely on the initial principal, resulting in linear growth over time. Compound interest generates returns on both the principal and accumulated interest, leading to exponential growth and significantly higher savings. The difference in growth impact becomes more pronounced with longer investment periods and higher interest rates, making compound interest more effective for maximizing savings.

Real-Life Examples: Simple vs Compound Interest

Simple interest earns a fixed percentage on the principal amount, making it ideal for short-term savings with predictable returns, such as a $1,000 deposit earning $50 annually at 5% interest over three years, totaling $1,150. Compound interest calculates interest on both the initial principal and accumulated interest, leading to exponential growth, exemplified by a $1,000 investment at 5% compounded annually growing to $1,157.63 in three years. Real-life scenarios demonstrate how compound interest significantly outperforms simple interest for long-term savings goals like retirement funds or education savings.

Pros and Cons of Simple Interest for Savings

Simple interest offers the advantage of straightforward calculation and predictable growth on savings, making it easy to understand for investors. However, its drawback lies in the fact that it does not capitalize on interest earned, resulting in slower accumulation of wealth compared to compound interest. This linear growth model limits long-term savings potential, especially in fluctuating interest rate environments where compounding accelerates earnings.

Advantages of Compound Interest for Long-Term Growth

Compound interest accelerates savings growth by earning interest on both the initial principal and the accumulated interest, resulting in exponential wealth accumulation over time. This effect is particularly advantageous for long-term investments, as reinvested earnings generate higher returns compared to simple interest, which only calculates interest on the principal. As a result, compound interest significantly outperforms simple interest in maximizing the future value of savings and enhancing financial goals.

Choosing the Right Interest for Your Savings Goals

Simple interest calculates growth solely on the original principal, offering straightforward, predictable returns ideal for short-term savings goals. Compound interest reinvests earned interest, accelerating growth exponentially over time and best suited for long-term investments seeking maximum returns. Selecting between simple and compound interest depends on your savings timeline and desired growth trajectory to align with financial objectives.

Tips for Maximizing Returns with Compound Interest

Maximizing returns with compound interest involves making consistent contributions to your savings and allowing the interest to reinvest over time, which exponentially increases growth compared to simple interest. Choosing accounts with higher compound interest rates and longer compounding periods, such as daily or monthly compounding, significantly boosts your overall earnings. Monitoring and adjusting your savings strategy by comparing annual percentage yields (APYs) helps optimize the compounding effect for accelerated financial growth.

Related Important Terms

Interest-on-Interest Effect

Simple interest calculates earnings only on the principal amount, resulting in linear growth, while compound interest generates returns on both the initial principal and accumulated interest, creating exponential growth through the interest-on-interest effect. This effect significantly accelerates savings growth over time, making compound interest more beneficial for long-term investments.

APY (Annual Percentage Yield)

Simple interest calculates earnings solely on the principal amount, while compound interest generates returns on both the principal and accrued interest, leading to higher growth over time; APY (Annual Percentage Yield) reflects the actual annual return, accounting for compounding frequency and providing a more accurate measure of savings growth potential. Understanding APY helps investors compare savings options effectively, emphasizing the superior wealth accumulation of compound interest compared to simple interest.

Continuous Compounding

Simple interest calculates earnings only on the initial principal, resulting in linear growth over time, while compound interest reinvests earnings, producing exponential growth. Continuous compounding maximizes savings growth by calculating interest at every moment, following the formula A = Pe^(rt), where A is the amount, P is the principal, r is the rate, and t is time.

Daily Compounding Frequency

Daily compounding frequency accelerates savings growth by calculating interest on the principal and accrued interest every day, unlike simple interest which only applies to the principal amount. Over time, daily compounding significantly increases total returns, maximizing the effect of interest-on-interest compared to simple interest's linear growth.

Simple Interest Laddering

Simple Interest Laddering divides savings into multiple fixed-term deposits earning simple interest, providing predictable returns without the complexity of compounding calculations. This strategy optimizes liquidity and minimizes risk while ensuring steady interest accumulation, contrasting with compound interest's exponential growth but higher volatility.

Step-up Savings Accounts

Step-up savings accounts leverage compound interest to accelerate savings growth by increasing the interest rate at predefined intervals, unlike simple interest which calculates earnings solely on the principal amount. Compound interest maximizes returns over time by earning interest on both the initial principal and accumulated interest, making step-up savings accounts ideal for long-term financial growth.

Compound Interest Snowball

Compound interest accelerates savings growth by reinvesting earned interest, creating a snowball effect that exponentially increases the principal over time compared to simple interest, which only calculates interest on the initial amount. This exponential growth makes compound interest especially powerful for long-term investments, maximizing returns through continuous accumulation and compounding periods.

Hypercompounding

Simple interest calculates returns based on the initial principal only, resulting in linear growth of savings over time. Compound interest, especially through hypercompounding, exponentially accelerates savings growth by reinvesting earnings, allowing interest to be earned on both the principal and accumulated interest.

Flat Rate Yield

Simple interest calculates growth using a flat rate yield based solely on the initial principal throughout the investment period, resulting in linear and predictable returns. Compound interest, in contrast, applies the flat rate yield repeatedly on both principal and accrued interest, leading to exponential savings growth over time.

Real Interest Rate Growth

Real interest rate growth measures the increase in purchasing power from savings by accounting for inflation, making compound interest more effective than simple interest over time due to interest-on-interest accumulation. While simple interest calculates returns solely on the principal amount, compound interest accelerates savings growth by reinvesting earned interest, enhancing real returns when inflation is considered.

Simple Interest vs Compound Interest for savings growth Infographic

moneydiff.com

moneydiff.com