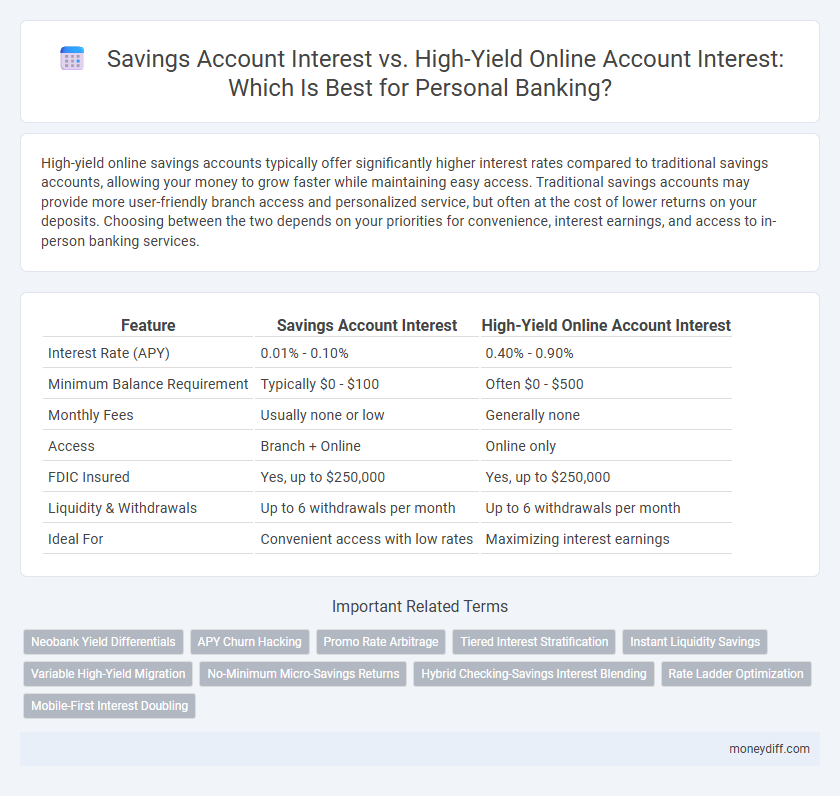

High-yield online savings accounts typically offer significantly higher interest rates compared to traditional savings accounts, allowing your money to grow faster while maintaining easy access. Traditional savings accounts may provide more user-friendly branch access and personalized service, but often at the cost of lower returns on your deposits. Choosing between the two depends on your priorities for convenience, interest earnings, and access to in-person banking services.

Table of Comparison

| Feature | Savings Account Interest | High-Yield Online Account Interest |

|---|---|---|

| Interest Rate (APY) | 0.01% - 0.10% | 0.40% - 0.90% |

| Minimum Balance Requirement | Typically $0 - $100 | Often $0 - $500 |

| Monthly Fees | Usually none or low | Generally none |

| Access | Branch + Online | Online only |

| FDIC Insured | Yes, up to $250,000 | Yes, up to $250,000 |

| Liquidity & Withdrawals | Up to 6 withdrawals per month | Up to 6 withdrawals per month |

| Ideal For | Convenient access with low rates | Maximizing interest earnings |

Understanding Savings Account Interest Rates

Savings account interest rates typically range from 0.01% to 0.10% APY, offering low returns but high liquidity and safety for personal banking. High-yield online savings accounts provide significantly higher interest rates, often between 3% and 5% APY, leveraging lower overhead costs to maximize earnings. Understanding the differences in annual percentage yield (APY), compounding frequency, and minimum balance requirements is crucial for optimizing interest gains on savings.

What Is a High-Yield Online Savings Account?

A high-yield online savings account offers significantly higher interest rates compared to traditional savings accounts, often ranging from 4% to 5% APY, compared to the national average of around 0.05%. These accounts are typically provided by online-only banks with lower overhead costs, allowing them to pass on higher returns to customers. They provide an efficient way to grow savings faster while maintaining FDIC insurance protection.

Comparing Traditional vs. Online Savings Account Interest

Traditional savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10% APY, which results in slower growth of deposited funds. High-yield online savings accounts provide significantly higher rates, often ranging from 3.50% to 4.50% APY, enabling account holders to maximize their interest earnings over time. The reduced overhead costs of online banks allow these institutions to pass savings to customers through better interest rates compared to brick-and-mortar banks.

How Banks Calculate Interest on Savings Accounts

Banks calculate interest on savings accounts primarily using the daily balance method, where interest accrues based on the account's balance each day and is compounded monthly or quarterly. High-yield online savings accounts often use the same calculation method but offer significantly higher annual percentage yields (APYs) due to lower overhead costs and competitive interest rates. Understanding the formula--principal multiplied by the daily interest rate and the number of days held--helps consumers compare the effective returns between traditional savings accounts and high-yield online alternatives.

Accessibility and Convenience: Brick-and-Mortar vs. Online Accounts

Traditional savings accounts at brick-and-mortar banks offer easy in-person access and customer service, which benefits those preferring face-to-face interactions. High-yield online savings accounts provide higher interest rates but rely on digital platforms, offering 24/7 account management and mobile banking convenience. Accessibility to funds through online accounts may involve electronic transfers and ATM networks, which can be less immediate than withdrawing cash directly at a physical branch.

Fees, Minimum Balances, and Account Requirements

Savings account interest rates typically offer lower returns but come with minimal fees and low minimum balance requirements, making them accessible for everyday banking needs. High-yield online accounts provide significantly higher interest rates, often exceeding 3.5% APY, but may impose stricter account requirements such as higher minimum balances and potential monthly fees if conditions are not met. Understanding fee structures and balance thresholds is crucial for maximizing interest earnings and avoiding penalties in both personal banking options.

Safety and Security: FDIC Insurance in Both Account Types

Savings accounts and high-yield online accounts both offer the safety of FDIC insurance, protecting deposits up to $250,000 per depositor, per insured bank. This federal guarantee ensures that funds remain secure even if the financial institution fails. Customers benefit from equal protection regardless of whether they choose a traditional savings account or a high-yield online alternative.

Pros and Cons of Traditional Savings Account Interest

Traditional savings accounts offer stable, federally insured interest rates typically ranging from 0.01% to 0.10%, providing security but low returns compared to high-yield online accounts. The main drawbacks include lower dividend payouts and often higher minimum balance requirements, which can limit growth potential. However, convenience, widespread branch access, and easy transfer options make them ideal for emergency funds despite limited earning capacity.

Advantages and Drawbacks of High-Yield Online Savings Accounts

High-yield online savings accounts offer significantly higher interest rates, often ranging from 3% to 5%, compared to traditional savings accounts with rates around 0.01% to 0.10%, enabling faster growth of personal savings. These accounts typically have lower fees and no minimum balance requirements, but they may lack immediate access to funds due to online-only platforms and limited branch access. The trade-off between higher returns and potential delays in transactions makes high-yield online savings accounts ideal for long-term savings rather than everyday banking needs.

Choosing the Right Account to Maximize Your Savings Interest

Choosing the right savings account significantly impacts the interest earned on your deposits, with high-yield online savings accounts typically offering rates several times higher than traditional savings accounts. While traditional savings accounts provide easier access and branch support, high-yield online accounts maximize growth potential through competitive interest rates and low fees. Evaluating factors such as interest rate, account fees, minimum balance requirements, and accessibility helps optimize your savings strategy for maximum interest accumulation.

Related Important Terms

Neobank Yield Differentials

Neobank high-yield online savings accounts typically offer interest rates ranging from 3.5% to 4.5%, significantly outperforming traditional savings accounts with average rates around 0.05% to 0.15%. This yield differential stems from lower operational costs and digital-only platforms enabling neobanks to provide enhanced returns on personal banking deposits.

APY Churn Hacking

High-yield online savings accounts typically offer annual percentage yields (APYs) that are 5 to 10 times higher than traditional savings accounts, making them a strategic choice for maximizing interest earnings. APY churn hacking, involving moving funds between accounts to capture introductory rates repeatedly, can further boost returns but requires careful tracking to avoid penalties or complications.

Promo Rate Arbitrage

Savings account interest rates typically range from 0.01% to 0.10%, while high-yield online accounts offer promotional rates between 3% and 5% for an introductory period, creating an opportunity for promo rate arbitrage by temporarily maximizing returns before the rates normalize. Consumers leverage these short-term high yields to grow their savings faster, shifting funds strategically to benefit from periodic promotional offers in personal banking.

Tiered Interest Stratification

Tiered interest stratification in savings accounts offers progressively higher rates based on account balances, while high-yield online accounts typically provide uniformly elevated interest rates across balance tiers. This structure enables customers to maximize earnings by optimizing deposits in accounts with favorable tier thresholds, leveraging digital platforms for competitive interest growth.

Instant Liquidity Savings

Instant Liquidity Savings accounts typically offer lower interest rates compared to high-yield online savings accounts, which can provide significantly higher annual percentage yields (APYs) due to reduced overhead costs and digital-only access. While traditional savings accounts prioritize immediate fund accessibility, online high-yield options balance competitive interest earnings with convenient electronic transfers, making them ideal for maximizing personal savings growth without sacrificing liquidity.

Variable High-Yield Migration

Variable high-yield online savings accounts offer significantly higher interest rates compared to traditional savings accounts, with rates often adjusting based on market conditions to maximize returns. Migrating to these high-yield accounts can enhance personal banking strategies by providing more competitive, flexible interest earnings that adapt to economic fluctuations.

No-Minimum Micro-Savings Returns

No-minimum micro-savings returns in high-yield online accounts typically offer significantly higher interest rates compared to traditional savings accounts, allowing even small deposits to grow more effectively over time. Personal banking customers benefit from flexible access and compounding interest, maximizing earnings without stringent minimum balance requirements.

Hybrid Checking-Savings Interest Blending

Hybrid checking-savings accounts combine the liquidity of checking with the higher interest rates typical of savings accounts, often offering blended interest rates that outperform standard savings accounts but may not reach high-yield online account levels. These accounts provide a balance between easy access to funds and improved interest earnings, making them ideal for individuals seeking moderate growth without sacrificing transactional flexibility.

Rate Ladder Optimization

High-yield online accounts typically offer interest rates 3 to 5 times higher than traditional savings accounts, maximizing returns through optimized rate ladders that increase yields as balances grow. Structured rate tiers encourage larger deposits by progressively raising interest rates at higher balance thresholds, enhancing overall savings performance in personal banking.

Mobile-First Interest Doubling

High-yield online savings accounts offer significantly higher interest rates, often double those of traditional savings accounts, by leveraging lower overhead costs through mobile-first platforms. Mobile-first interest doubling strategies optimize user engagement and automate rate adjustments, maximizing returns for personal banking customers.

Savings Account Interest vs High-Yield Online Account Interest for personal banking. Infographic

moneydiff.com

moneydiff.com