Mortgage interest involves borrowing money from a lender to buy a home, with the borrower paying back the loan plus interest over time, which can impact monthly payments and overall affordability. Shared equity interest means partnering with an investor or organization that provides funds for the home purchase in exchange for a share of the property's future value, reducing upfront costs but sharing potential profits or losses. Choosing between mortgage interest and shared equity interest requires evaluating financial goals, risk tolerance, and long-term homeownership plans.

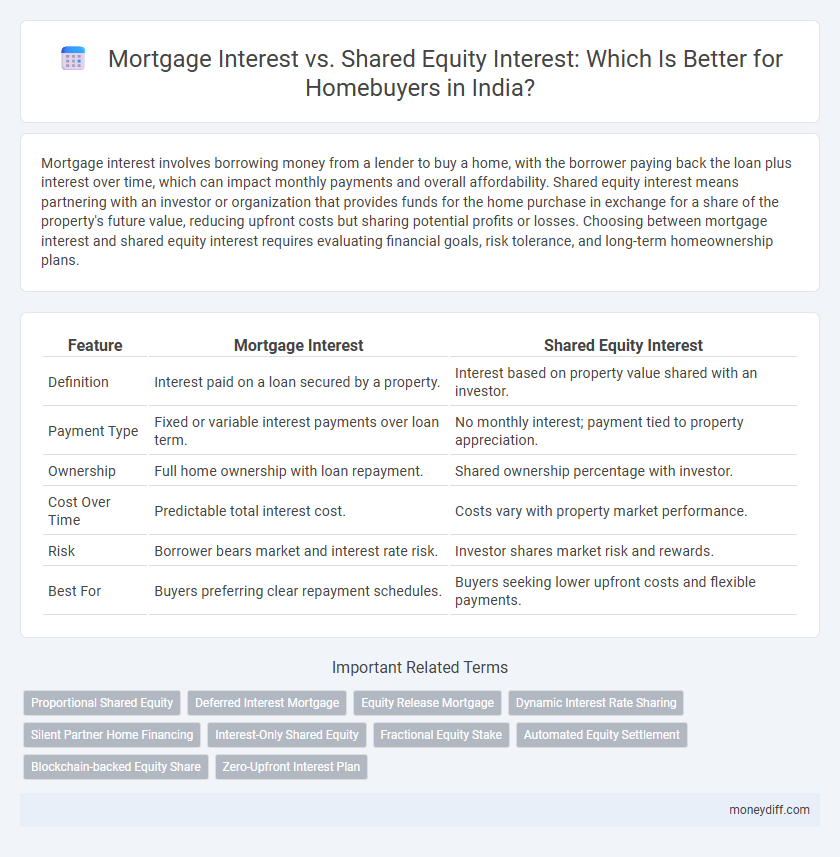

Table of Comparison

| Feature | Mortgage Interest | Shared Equity Interest |

|---|---|---|

| Definition | Interest paid on a loan secured by a property. | Interest based on property value shared with an investor. |

| Payment Type | Fixed or variable interest payments over loan term. | No monthly interest; payment tied to property appreciation. |

| Ownership | Full home ownership with loan repayment. | Shared ownership percentage with investor. |

| Cost Over Time | Predictable total interest cost. | Costs vary with property market performance. |

| Risk | Borrower bears market and interest rate risk. | Investor shares market risk and rewards. |

| Best For | Buyers preferring clear repayment schedules. | Buyers seeking lower upfront costs and flexible payments. |

Understanding Mortgage Interest: Key Concepts

Mortgage interest is the cost borrowers pay to lenders for the use of funds to purchase a home, typically expressed as an annual percentage rate (APR) on the outstanding loan balance. It directly impacts monthly mortgage payments and overall affordability, with rates influenced by credit scores, loan terms, and market conditions. Unlike shared equity interest, which involves co-ownership and profit-sharing, mortgage interest represents a fixed financial obligation until the loan is fully repaid.

What is Shared Equity Interest in Home Buying?

Shared equity interest in home buying refers to a financial arrangement where the homeowner and an investor or government entity jointly own the property, sharing the appreciation or depreciation in its value over time. Instead of paying traditional mortgage interest, the homeowner repays a portion of the property's increased value when selling or refinancing. This model reduces upfront costs and monthly payments, making homeownership more accessible while aligning both parties' interests in the property's market performance.

Comparing Costs: Mortgage Interest vs Shared Equity

Mortgage interest requires regular monthly payments typically based on a fixed or variable interest rate applied to the loan principal, leading to predictable long-term costs but higher upfront financial obligations. Shared equity interest involves sharing ownership with an investor who receives a percentage of the property's appreciation, reducing initial cash flow demands but potentially increasing overall costs if the property value rises significantly. Evaluating the total cost impact involves comparing mortgage interest rates, amortization terms, and expected property value growth under shared equity agreements.

Pros and Cons of Mortgage Interest

Mortgage interest allows homeowners to retain full ownership and build equity over time while benefiting from predictable monthly payments and potential tax deductions. However, high interest rates can significantly increase the overall cost of the loan, and missed payments risk foreclosure. Unlike shared equity, mortgage interest does not require sharing property appreciation, but it demands a strong credit profile and consistent income for approval.

Pros and Cons of Shared Equity Interest

Shared equity interest offers homebuyers lower initial costs and reduced monthly mortgage payments by sharing home ownership with an investor, making it easier to enter the housing market. However, shared equity interest limits future equity gains, as a portion of any home appreciation must be shared, and it may restrict refinancing options due to shared ownership agreements. Homebuyers benefit from reduced financial burden but face potential loss of full property control and equity growth.

Impact on Monthly Payments: Mortgage vs Shared Equity

Mortgage interest directly affects monthly payments by increasing the amount owed through fixed or variable interest rates, resulting in predictable or fluctuating payment schedules. Shared equity interest involves sharing a percentage of home ownership with an investor, which reduces the initial monthly mortgage payment but requires a portion of future home appreciation to be paid upon sale. Comparing the two, mortgage interest typically leads to higher consistent monthly costs, while shared equity lowers monthly payments but impacts long-term financial returns.

Long-Term Financial Implications

Mortgage interest accrues as a fixed or variable percentage based on the outstanding loan balance, impacting monthly payments and total borrowing costs over time. Shared equity interest involves co-ownership with an investor who gains a percentage of the property's appreciation or depreciation, affecting long-term equity growth and financial returns. Evaluating both options requires analyzing potential tax benefits, risk exposure, and the impact on net worth in the context of rising property values and interest rates.

Equity Accumulation: Which Option Wins?

Mortgage interest payments primarily build equity through principal reduction over time, with interest mostly benefiting the lender, while shared equity interest allows homeowners to accumulate equity jointly with an investor, sharing both risks and rewards. Equity accumulation tends to be faster in mortgage interest arrangements due to full ownership rights, though shared equity offers lower initial costs and potential for shared appreciation in property value. For long-term wealth growth, mortgage interest is typically more advantageous, whereas shared equity suits buyers prioritizing affordability and risk mitigation.

Tax Benefits: Mortgage Interest vs Shared Equity

Mortgage interest on a home loan is often tax-deductible, reducing taxable income and providing significant annual savings for homeowners in many jurisdictions. Shared equity interest typically does not qualify for tax deductions since homeowners do not directly pay interest but share property appreciation or value with an investor. Understanding these distinctions helps buyers optimize tax benefits when choosing between traditional mortgage financing and shared equity arrangements.

Suitability: Which Interest Model Fits Your Financial Goals?

Mortgage interest suits buyers seeking full property ownership with predictable monthly payments and tax-deductible interest, ideal for long-term financial planning and building equity independently. Shared equity interest appeals to those looking to reduce upfront costs by partnering with an investor or entity, aligning with buyers aiming for flexibility and willing to share future property appreciation. Evaluating your financial stability, risk tolerance, and homeownership timeline is crucial to determine which interest model aligns best with your goals.

Related Important Terms

Proportional Shared Equity

Proportional Shared Equity in home buying allows investors to share mortgage interest costs relative to their ownership stake, reducing individual financial burden compared to traditional mortgage interest payments. This method aligns monthly interest payments directly with each party's equity percentage, promoting fair cost distribution and enhancing affordability for co-owners.

Deferred Interest Mortgage

Deferred interest mortgages allow homebuyers to postpone interest payments, reducing initial monthly expenses and increasing affordability compared to traditional mortgages with immediate interest accrual. Shared equity interest involves the lender or investor owning a percentage of the property, sharing both appreciation and depreciation risks, which can complement or replace deferred interest structures depending on buyer preference.

Equity Release Mortgage

Mortgage interest typically involves fixed or variable rates applied to the loan principal, while shared equity interest allows homeowners to release equity without monthly repayments by sharing a percentage of future property appreciation with the investor. Equity release mortgages provide a flexible alternative by enabling homeowners to access cash tied up in their property, often used for renovations or debt consolidation, without increasing monthly financial burdens.

Dynamic Interest Rate Sharing

Mortgage interest involves fixed or variable rates paid on loans directly by the homeowner, while shared equity interest allows investors to share the property's appreciation or depreciation, often with dynamic interest rate sharing that adjusts returns based on market conditions. Dynamic interest rate sharing offers flexibility in payment structures and risk distribution, aligning investor returns more closely with property performance compared to traditional mortgage interest models.

Silent Partner Home Financing

Mortgage interest involves borrowing funds with a fixed or variable rate, typically requiring regular payments that build home equity over time, while shared equity interest allows a Silent Partner Home Financing entity to invest in the property in exchange for a percentage of future appreciation without monthly loan repayments. Silent Partner Home Financing provides flexible homebuying options by reducing initial financial burdens and sharing investment risks through equity partnerships rather than traditional mortgage debt.

Interest-Only Shared Equity

Interest-only shared equity financing allows homebuyers to pay interest only on the equity portion borrowed, reducing monthly costs compared to traditional mortgage interest where principal and interest payments are required. This method optimizes cash flow for buyers by limiting payments to interest on the shared equity stake, while the mortgage interest builds equity gradually through amortization.

Fractional Equity Stake

Mortgage interest involves fixed or variable rates paid on a loan secured by the property, whereas shared equity interest provides a fractional equity stake in the home, allowing investors to share in the property's appreciation or depreciation. This fractional equity stake reduces upfront borrowing costs and aligns investor returns with the property's market performance, offering a flexible alternative to traditional mortgage financing.

Automated Equity Settlement

Mortgage interest typically involves paying a fixed or variable percentage on the loan amount, influencing monthly payments and total loan cost, while shared equity interest requires sharing future property appreciation with the investor. Automated equity settlement streamlines the tracking and distribution of these shared interests, enhancing transparency and accuracy in equity calculations during home buying transactions.

Blockchain-backed Equity Share

Mortgage interest involves traditional loan repayments with fixed or variable rates, whereas shared equity interest allows homeowners to share property appreciation with investors. Blockchain-backed equity share enhances transparency and security by recording ownership stakes on an immutable ledger, streamlining transactions, and reducing administrative costs in home buying.

Zero-Upfront Interest Plan

The Zero-Upfront Interest Plan in mortgage financing eliminates initial interest payments, contrasting with Shared Equity Interest where borrowers share property appreciation with investors instead of paying traditional interest. This plan reduces immediate financial burden, making home buying more accessible without compromising long-term equity growth.

Mortgage Interest vs Shared Equity Interest for home buying Infographic

moneydiff.com

moneydiff.com