Traditional bank interest rates offer predictable but generally lower returns on investments compared to decentralized finance (DeFi) yields, which can provide significantly higher returns through mechanisms like liquidity mining and staking. However, DeFi investments often carry increased risk due to market volatility, smart contract vulnerabilities, and regulatory uncertainties. Investors seeking higher yield potential must weigh these risks against the stability and insurance protections typically provided by traditional banking systems.

Table of Comparison

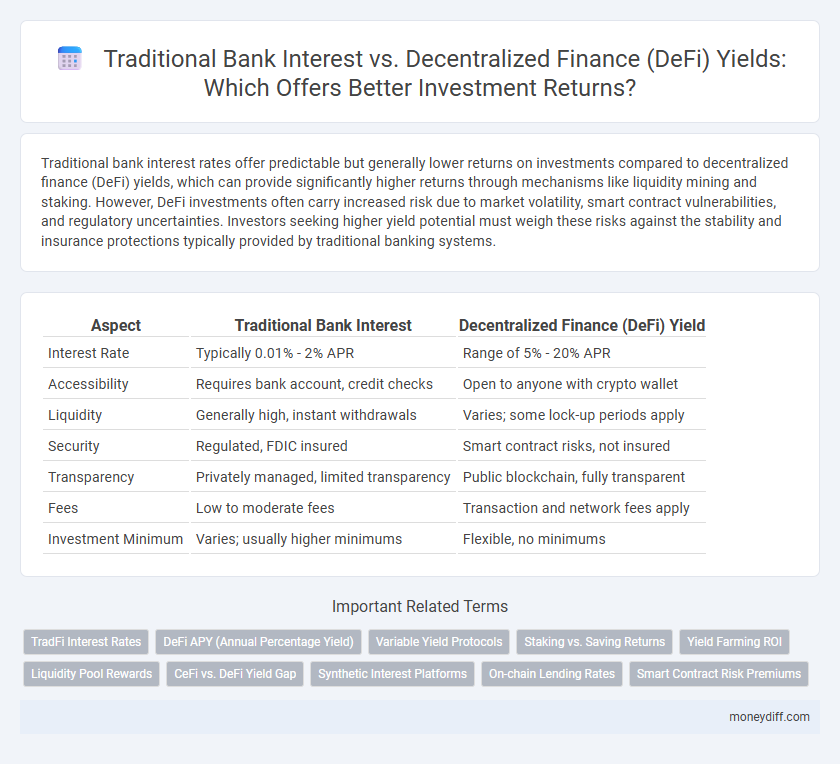

| Aspect | Traditional Bank Interest | Decentralized Finance (DeFi) Yield |

|---|---|---|

| Interest Rate | Typically 0.01% - 2% APR | Range of 5% - 20% APR |

| Accessibility | Requires bank account, credit checks | Open to anyone with crypto wallet |

| Liquidity | Generally high, instant withdrawals | Varies; some lock-up periods apply |

| Security | Regulated, FDIC insured | Smart contract risks, not insured |

| Transparency | Privately managed, limited transparency | Public blockchain, fully transparent |

| Fees | Low to moderate fees | Transaction and network fees apply |

| Investment Minimum | Varies; usually higher minimums | Flexible, no minimums |

Traditional Bank Interest: An Overview

Traditional bank interest rates typically offer lower returns compared to decentralized finance (DeFi) yields, with average savings account interest often below 1% annually. These rates are regulated by central banks and influenced by monetary policies, providing a stable but modest growth on deposited funds. The security and insured deposits in traditional banks appeal to conservative investors prioritizing lower risk over high yields.

DeFi Yield Explained: A New Era of Returns

Decentralized Finance (DeFi) yield offers investors significantly higher returns compared to traditional bank interest rates, often ranging from 5% to over 20% annually, contrasting with typical bank savings accounts that yield less than 1%. DeFi platforms leverage smart contracts and blockchain technology to facilitate peer-to-peer lending, staking, and liquidity mining, creating more efficient and transparent investment opportunities. This new era of returns revolutionizes passive income generation by providing flexible access to global markets without the limitations and low yields of conventional banking.

Risk Assessment: Bank Interest vs. DeFi Yields

Traditional bank interest rates offer lower but more stable returns due to regulatory oversight and deposit insurance mitigating principal risk. Decentralized Finance (DeFi) yields provide higher potential returns by leveraging smart contracts and liquidity pools but carry increased risks such as smart contract vulnerabilities, impermanent loss, and market volatility. Investors must weigh the consistent safety of bank interest against the higher, yet unpredictable, DeFi yield opportunities when assessing investment risk profiles.

Accessibility: Who Can Benefit from Each?

Traditional bank interest primarily benefits individuals with established credit and access to banking infrastructure, often requiring minimum balances or credit checks that limit participation. Decentralized finance (DeFi) yields offer broader accessibility by allowing anyone with an internet connection and a digital wallet to earn returns, eliminating intermediaries and reducing entry barriers. This inclusivity enhances financial participation for unbanked or underbanked populations globally, expanding investment opportunities beyond traditional financial systems.

Transparency in Traditional Banks vs. DeFi Platforms

Traditional banks offer interest rates regulated by central authorities with clear disclosures, but their processes lack real-time transparency, often keeping investors unaware of the exact sources and allocations of their returns. DeFi platforms operate on blockchain technology, enabling open access to transaction histories and smart contract protocols, which provide unparalleled transparency into how yields are generated and distributed. This transparent environment in DeFi enhances investor trust by allowing verification of interest accrual mechanisms, contrasting with the opaque nature of traditional banking interest calculations.

Interest Calculation: Fixed Rates vs. Variable Yields

Traditional bank interest typically offers fixed rates, providing predictable and stable returns over a set period, which suits risk-averse investors seeking consistent income. In contrast, decentralized finance (DeFi) yields fluctuate based on market demand, liquidity, and protocol mechanisms, leading to variable returns that can significantly exceed traditional rates but carry higher risk. Understanding these distinctions in interest calculation is crucial for investors aiming to balance security and growth potential in their portfolios.

Security Considerations: FDIC vs. Smart Contract Risks

Traditional banks offer FDIC insurance that guarantees deposits up to $250,000, providing a high level of security against loss. In contrast, decentralized finance (DeFi) platforms rely on smart contracts, which carry risks such as coding vulnerabilities and potential exploits that could result in loss of funds. Investors seeking higher yields in DeFi must carefully evaluate the security audits and reliability of smart contracts compared to the federal protections backing traditional bank accounts.

Regulatory Environment: Banks vs. Decentralized Finance

Traditional banks operate within a highly regulated framework enforced by central banks and governmental agencies, ensuring investor protection and financial stability through oversight and compliance requirements. Decentralized finance (DeFi) platforms, however, often function in a largely unregulated or loosely regulated environment, exposing investors to higher risks but potentially greater yields due to reduced intermediaries and operational costs. The distinct regulatory environments shape the risk-return profiles of investments, with banks prioritizing security and DeFi emphasizing innovation and accessibility.

Liquidity and Flexibility: Comparing Withdrawal Options

Traditional bank interest typically offers fixed withdrawal schedules and limited liquidity, often requiring advance notice or penalties for early access to funds. Decentralized finance (DeFi) yields provide greater flexibility with on-demand withdrawals and no intermediaries, enhancing liquidity for investors. The instant accessibility in DeFi platforms outperforms traditional banking withdrawal restrictions, making it more suitable for those prioritizing flexible investment returns.

Future Trends: Evolving Returns in Banks and DeFi

Traditional bank interest rates are expected to remain relatively stable but low, typically ranging between 1% to 3% annually, due to regulatory constraints and risk-averse policies. Decentralized Finance (DeFi) yields offer higher potential returns, often fluctuating between 5% to 20% or more, driven by liquidity mining, staking, and algorithmic protocols. Future trends indicate growing integration of traditional banks with blockchain technology, potentially narrowing the yield gap and fostering hybrid financial products that optimize returns through decentralized mechanisms.

Related Important Terms

TradFi Interest Rates

Traditional bank interest rates typically range from 0.01% to 2% annually, offering stable but lower returns compared to decentralized finance yields, which can exceed 10% but carry higher risk. These conservative rates reflect regulatory frameworks and risk mitigation strategies inherent in traditional finance institutions.

DeFi APY (Annual Percentage Yield)

Decentralized finance (DeFi) platforms often offer significantly higher APYs compared to traditional bank interest rates, with yields frequently exceeding 10-20%, driven by liquidity mining and staking rewards. Traditional banks typically provide much lower interest rates, usually below 2%, due to conservative risk management and regulatory constraints.

Variable Yield Protocols

Variable yield protocols in decentralized finance (DeFi) offer dynamic interest rates influenced by market demand and liquidity, often outperforming traditional bank interest rates that remain fixed or low. These protocols leverage smart contracts to optimize returns through mechanisms like yield farming and liquidity mining, providing investors with flexible and potentially higher investment yields compared to conventional banking products.

Staking vs. Saving Returns

Traditional bank interest rates for savings accounts typically range from 0.01% to 1.5% annually, offering low-risk but minimal returns, whereas decentralized finance (DeFi) staking yields can exceed 5% to 20% depending on the cryptocurrency and network conditions. Staking in DeFi involves locking digital assets in blockchain protocols to earn rewards, presenting higher potential returns compared to the predictable but modest interest accrued from traditional bank savings.

Yield Farming ROI

Traditional bank interest rates typically range from 0.01% to 0.5% annually, offering low-risk but minimal returns, whereas decentralized finance (DeFi) yield farming can provide significantly higher ROI, often exceeding 10% to 100% or more, depending on the protocol and market conditions. Yield farming leverages liquidity provision and staking on platforms like Uniswap, Aave, and Compound, enabling investors to maximize returns through token rewards and compound interest strategies in a highly volatile but potentially lucrative environment.

Liquidity Pool Rewards

Liquidity pool rewards in decentralized finance typically offer higher yields compared to traditional bank interest rates by providing incentives for users to supply assets that facilitate trading and borrowing. These rewards are often paid in native tokens, increasing potential returns but also exposing investors to market volatility and smart contract risks absent in conventional banking systems.

CeFi vs. DeFi Yield Gap

Traditional banks typically offer fixed interest rates ranging from 0.5% to 2% annually, whereas decentralized finance (DeFi) platforms can provide yields between 5% and 20% through liquidity mining, staking, and lending protocols. The CeFi vs. DeFi yield gap highlights higher returns in DeFi, driven by automated smart contracts and reduced intermediaries, but it carries increased risks like smart contract vulnerabilities and market volatility.

Synthetic Interest Platforms

Synthetic interest platforms leverage blockchain technology to offer higher yields than traditional banks by utilizing decentralized finance protocols and algorithmic strategies, which optimize asset efficiency and liquidity. These platforms reduce intermediaries and fees, allowing investors to earn compounded returns through synthetic assets that mirror real-world interest-bearing instruments without centralized control.

On-chain Lending Rates

On-chain lending rates in decentralized finance (DeFi) often surpass traditional bank interest rates, offering higher yields due to automated smart contracts and reduced intermediaries. Unlike traditional banks that provide average annual interest rates around 1-3%, DeFi platforms can offer variable returns ranging from 5% to over 20%, driven by supply-demand dynamics and liquidity incentives.

Smart Contract Risk Premiums

Traditional bank interest rates generally offer lower returns due to regulatory constraints and minimal risk premiums, whereas decentralized finance (DeFi) yields incorporate smart contract risk premiums that significantly enhance potential returns but expose investors to vulnerabilities such as code bugs and exploits. This risk premium in DeFi compensates for the higher technological and security risks inherent in automated protocols, making yield comparisons critical for informed investment decisions.

Traditional Bank Interest vs Decentralized Finance Yield for investment returns. Infographic

moneydiff.com

moneydiff.com