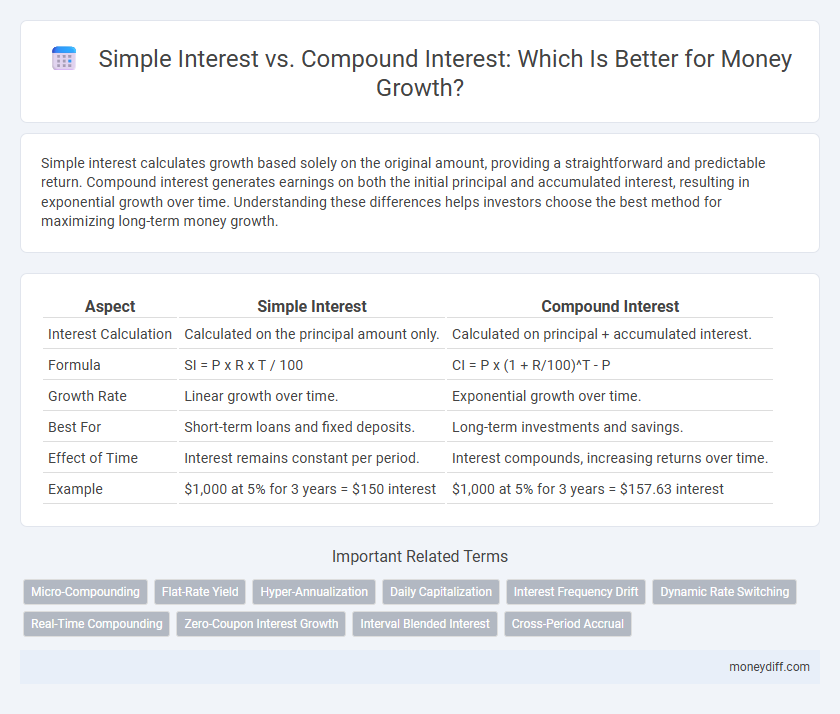

Simple interest calculates growth based solely on the original amount, providing a straightforward and predictable return. Compound interest generates earnings on both the initial principal and accumulated interest, resulting in exponential growth over time. Understanding these differences helps investors choose the best method for maximizing long-term money growth.

Table of Comparison

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Interest Calculation | Calculated on the principal amount only. | Calculated on principal + accumulated interest. |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)^T - P |

| Growth Rate | Linear growth over time. | Exponential growth over time. |

| Best For | Short-term loans and fixed deposits. | Long-term investments and savings. |

| Effect of Time | Interest remains constant per period. | Interest compounds, increasing returns over time. |

| Example | $1,000 at 5% for 3 years = $150 interest | $1,000 at 5% for 3 years = $157.63 interest |

Understanding Simple Interest: The Basics

Simple interest calculates growth by applying a fixed percentage rate to the initial principal amount over a specified period. The formula for simple interest is I = P x r x t, where I is interest, P is principal, r is annual interest rate, and t is time in years. This method results in linear growth, making it easier to predict returns but less effective for long-term money accumulation compared to compound interest.

What Is Compound Interest?

Compound interest is the process where the interest earned on an initial principal is reinvested, generating earnings on both the principal and accumulated interest from previous periods. This exponential growth mechanism significantly accelerates money growth compared to simple interest, which calculates interest only on the original principal. Financial experts emphasize compound interest as a powerful tool for wealth accumulation over time due to its ability to maximize returns through compounding cycles.

Key Differences Between Simple and Compound Interest

Simple interest calculates earnings only on the initial principal, resulting in linear growth over time. Compound interest generates returns on both the principal and accumulated interest, leading to exponential growth. The frequency of compounding intervals significantly impacts the total amount accrued, making compound interest more beneficial for long-term investments.

Calculating Simple Interest: Step-by-Step Guide

Calculating simple interest involves multiplying the principal amount by the interest rate and the time period, using the formula I = P x r x t. The principal (P) is the initial sum of money, the annual interest rate (r) is expressed as a decimal, and the time (t) is measured in years. This straightforward calculation helps determine the fixed amount of interest earned without compounding effects, making it useful for short-term loans or investments.

How Compound Interest Is Calculated

Compound interest is calculated by applying the interest rate to the initial principal and the accumulated interest from previous periods, resulting in exponential money growth. The formula A = P(1 + r/n)^(nt) expresses the total amount, where P is the principal, r the annual interest rate, n the number of compounding periods per year, and t the time in years. This method accelerates wealth accumulation compared to simple interest, which only considers the principal amount.

Impact of Time on Simple vs Compound Interest

Simple interest grows linearly over time by applying a fixed percentage to the principal, resulting in steady but limited returns. Compound interest accelerates growth exponentially as interest accumulates on both the principal and previously earned interest, significantly increasing total returns with longer investment durations. Extended time horizons greatly amplify the advantages of compound interest, making it a more powerful tool for wealth accumulation compared to simple interest.

Real-Life Examples: Simple Interest vs Compound Interest

Simple interest calculates growth on the initial principal, making it straightforward but less lucrative over time, such as earning $100 annually on a $1,000 investment at 10% interest. Compound interest reinvests earned interest, accelerating growth exponentially, exemplified by turning the same $1,000 at 10% into $1,610 after six years versus $1,600 with simple interest. Real-life examples like savings accounts and loans show compound interest significantly increases returns or costs compared to simple interest due to interest-on-interest effects.

Which Interest Type Grows Your Money Faster?

Compound interest grows your money faster than simple interest because it calculates interest on both the principal and accumulated interest, leading to exponential growth over time. Simple interest only applies to the original principal, resulting in linear growth, making it less effective for long-term investments. For maximizing returns, especially in longer investment horizons, compound interest offers significantly higher growth potential.

Pros and Cons: Simple Interest vs Compound Interest

Simple interest offers straightforward calculation and predictable returns, making it ideal for short-term loans or investments, but it yields lower growth compared to compound interest. Compound interest accelerates money growth by reinvesting earned interest, maximizing long-term returns, though it involves more complex calculations and can lead to higher costs on loans. Choosing between simple and compound interest depends on investment duration, risk tolerance, and financial goals.

Choosing the Right Interest Option for Your Financial Goals

Simple interest calculates earnings solely on the original principal, making it ideal for short-term savings or loans with fixed returns. Compound interest generates growth on both the initial amount and accumulated interest, accelerating wealth accumulation over longer periods. Selecting compound interest suits long-term investments aiming for exponential growth, while simple interest benefits those prioritizing predictability and ease in financial planning.

Related Important Terms

Micro-Compounding

Micro-compounding accelerates money growth by calculating interest on principal and previously earned interest at extremely short intervals, unlike simple interest which only accrues on the initial principal. This frequent compounding effect significantly boosts returns over time, making micro-compounding a powerful strategy for maximizing investment gains.

Flat-Rate Yield

Simple interest calculates earnings based on the original principal, resulting in a flat-rate yield that remains constant over time. Compound interest generates growth by reinvesting earnings, producing an accelerating yield as interest is earned on both principal and accumulated interest.

Hyper-Annualization

Simple interest calculates growth based solely on the initial principal, resulting in linear returns over time, while compound interest accelerates growth by reinvesting earned interest, creating exponential returns through hyper-annualization. Hyper-annualization maximizes profit by applying compounding more frequently than annually, significantly boosting the effective annual rate and overall investment growth.

Daily Capitalization

Simple interest calculates earnings based solely on the original principal, resulting in linear growth, while compound interest with daily capitalization reinvests interest earned each day, leading to exponential money growth. This frequent compounding significantly increases the effective annual rate, maximizing investment returns over time.

Interest Frequency Drift

Simple interest calculates growth linearly based on the initial principal, whereas compound interest accrues more rapidly due to interest being earned on both principal and accumulated interest. Interest frequency drift occurs when varying compounding intervals, such as daily or monthly, influence the effective annual return, significantly impacting long-term investment growth.

Dynamic Rate Switching

Simple interest calculates earnings solely on the initial principal, maintaining a fixed growth rate, while compound interest dynamically increases returns by applying interest on accumulated interest, enabling faster money growth over time. Dynamic rate switching allows investors to alternate between simple and compound interest methods based on market conditions, optimizing total interest earned and enhancing portfolio flexibility.

Real-Time Compounding

Simple interest calculates growth on the original principal only, resulting in linear increases over time, while compound interest applies interest on accumulated interest, driving exponential growth. Real-time compounding enhances this effect by continuously updating the principal balance, maximizing earnings through more frequent interest accumulation.

Zero-Coupon Interest Growth

Zero-coupon bonds grow through compound interest by reinvesting earnings, magnifying returns over time without intermediate payouts, unlike simple interest which only accrues on the principal amount. The absence of periodic interest payments in zero-coupon investments allows for exponential growth, making compound interest highly effective for long-term wealth accumulation.

Interval Blended Interest

Interval blended interest combines features of simple interest and compound interest by applying interest calculations at specified intervals, resulting in more accurate growth projections for investments over time. This method optimizes money growth by calculating simple interest within intervals and compounding the accumulated amount at each interval, balancing steady earnings with compounding benefits.

Cross-Period Accrual

Simple interest calculates growth based solely on the original principal, resulting in linear accumulation over time, whereas compound interest accrues interest on both the principal and previously earned interest, leading to exponential growth. Cross-period accrual in compound interest magnifies returns as interest compounds across multiple periods, significantly increasing the total amount compared to simple interest.

Simple Interest vs Compound Interest for money growth. Infographic

moneydiff.com

moneydiff.com