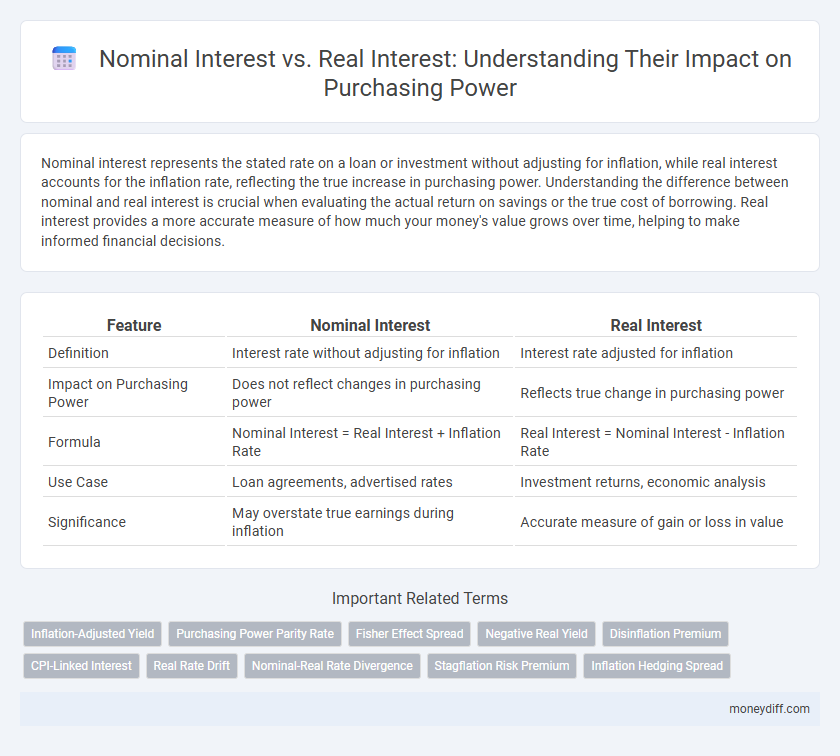

Nominal interest represents the stated rate on a loan or investment without adjusting for inflation, while real interest accounts for the inflation rate, reflecting the true increase in purchasing power. Understanding the difference between nominal and real interest is crucial when evaluating the actual return on savings or the true cost of borrowing. Real interest provides a more accurate measure of how much your money's value grows over time, helping to make informed financial decisions.

Table of Comparison

| Feature | Nominal Interest | Real Interest |

|---|---|---|

| Definition | Interest rate without adjusting for inflation | Interest rate adjusted for inflation |

| Impact on Purchasing Power | Does not reflect changes in purchasing power | Reflects true change in purchasing power |

| Formula | Nominal Interest = Real Interest + Inflation Rate | Real Interest = Nominal Interest - Inflation Rate |

| Use Case | Loan agreements, advertised rates | Investment returns, economic analysis |

| Significance | May overstate true earnings during inflation | Accurate measure of gain or loss in value |

Understanding Nominal vs Real Interest Rates

Nominal interest rates represent the percentage return on a loan or investment without adjusting for inflation, while real interest rates account for inflation's impact, reflecting the true purchasing power gained or lost. Investors prioritize real interest rates to assess the actual increase in value over time and preserve wealth against rising prices. Understanding the difference is crucial for making informed financial decisions, as nominal rates can be misleading when inflation significantly erodes purchasing power.

The Impact of Inflation on Purchasing Power

Nominal interest rates represent the stated return on an investment without accounting for inflation, while real interest rates adjust nominal rates by subtracting inflation, reflecting the true increase in purchasing power. Inflation erodes the value of money, decreasing the real return on investments when nominal interest rates remain constant. Understanding the difference between nominal and real interest is crucial for evaluating the actual impact of inflation on purchasing power and ensuring financial decisions preserve wealth over time.

Why Real Interest Rates Matter for Savers

Real interest rates reflect the true growth of purchasing power by adjusting nominal interest rates for inflation, making them essential for savers to assess the actual value of their returns. When inflation rises, nominal interest may appear attractive, but the real interest rate could be low or negative, eroding savings' value over time. Understanding real interest rates helps savers make informed decisions to preserve and enhance their financial wealth in inflationary environments.

Calculating Real Interest from Nominal Interest

Calculating real interest involves adjusting nominal interest rates for inflation to accurately measure purchasing power. The formula for real interest rate is nominal interest rate minus inflation rate, which reveals the true gain or loss on an investment. Understanding this calculation helps investors assess the actual value of returns in terms of increased purchasing power.

The Role of Nominal Interest in Loan Agreements

Nominal interest rates in loan agreements determine the stated cost borrowers pay without adjusting for inflation, directly impacting monthly payments and overall debt burden. Lenders set nominal interest rates based on risk factors, creditworthiness, and market conditions, influencing the affordability and accessibility of credit. Though nominal interest dictates the loan's face value cost, real interest rates reveal the true purchasing power effect by accounting for inflation's erosion of money value over time.

Protecting Your Investments from Inflation Erosion

Nominal interest rates show the stated return on investments without accounting for inflation's impact on purchasing power. Real interest rates adjust nominal rates by subtracting inflation, providing a clearer measure of true investment growth. Protecting your investments from inflation erosion requires focusing on real interest rates to ensure that returns outpace rising prices and maintain purchasing power.

How to Interpret Interest Rate Advertisements

Nominal interest rates represent the stated percentage return without adjustments for inflation, while real interest rates reflect the actual increase in purchasing power after accounting for inflation. Interpreting interest rate advertisements requires distinguishing between nominal rates offered and the real yield investors or borrowers will experience. Understanding the difference helps consumers assess the true cost of loans or the genuine growth potential of savings in terms of purchasing power.

Using Real Interest Rates for Financial Planning

Real interest rates account for inflation, offering a clearer picture of the true cost or return of financial transactions by reflecting changes in purchasing power. Utilizing real interest rates in financial planning helps individuals and businesses make more accurate forecasts about investment growth and loan repayments. This approach ensures that financial decisions preserve or increase purchasing power over time, preventing misleading assessments caused by nominal interest rates alone.

The Difference Between Nominal and Real Returns

Nominal interest rates represent the percentage increase in money invested without adjusting for inflation, whereas real interest rates account for inflation to reflect the true purchasing power of returns. The difference between nominal and real returns is crucial for investors, as inflation erodes the actual value of nominal gains over time. Understanding this distinction helps in making informed decisions by evaluating the real growth of investment purchasing power.

Strategies to Maximize Purchasing Power

Nominal interest rates reflect the stated return without adjusting for inflation, while real interest rates account for inflation, revealing true purchasing power gains. To maximize purchasing power, investors should seek real interest rates that exceed inflation, invest in inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS), and diversify portfolios to include assets that historically outperform during inflationary periods. Monitoring inflation trends alongside nominal yields enables more informed decisions that preserve and enhance purchasing power over time.

Related Important Terms

Inflation-Adjusted Yield

Nominal interest represents the stated rate without accounting for inflation, while real interest adjusts for inflation to accurately reflect purchasing power changes. Inflation-adjusted yield ensures investors understand the true return on investment by subtracting inflation from the nominal rate, protecting against erosion of value over time.

Purchasing Power Parity Rate

The Purchasing Power Parity (PPP) rate adjusts nominal interest to reflect changes in inflation, offering a more accurate measure of real interest that preserves purchasing power across different currencies. Real interest rates, derived by subtracting inflation from nominal rates, indicate the true cost of borrowing and are crucial for comparing investment returns internationally under the PPP framework.

Fisher Effect Spread

Nominal interest rates reflect the stated return on an investment, while real interest rates account for inflation, measuring true purchasing power changes; the Fisher Effect illustrates how nominal rates adjust to expected inflation, maintaining a near-constant real interest rate over time. The Fisher Effect spread represents the gap between nominal and real interest rates, quantifying anticipated inflation's impact on investment returns and consumer purchasing power.

Negative Real Yield

Negative real yield occurs when nominal interest rates fall below inflation, eroding purchasing power despite apparent gains. Investors face a loss in real terms, emphasizing the importance of considering inflation-adjusted returns in financial decisions.

Disinflation Premium

Nominal interest rates reflect the total return without adjusting for inflation, while real interest rates account for purchasing power by subtracting inflation expectations, crucial for evaluating true investment gains. The disinflation premium represents the additional yield investors demand as inflation slows, preserving returns amid declining price growth.

CPI-Linked Interest

CPI-linked interest adjusts nominal interest rates according to inflation, preserving the real interest and maintaining purchaser's buying power over time. Unlike nominal interest, which can be eroded by rising Consumer Price Index (CPI), real interest reflects the true rate of return after accounting for inflation fluctuations.

Real Rate Drift

Nominal interest rates fail to account for inflation, causing the real interest rate--the nominal rate adjusted for inflation--to drift and misrepresent true purchasing power over time. This real rate drift erodes the actual returns on investments, reducing consumers' ability to maintain their purchasing power despite seemingly positive nominal gains.

Nominal-Real Rate Divergence

Nominal interest rates reflect the stated percentage without accounting for inflation, whereas real interest rates adjust for inflation to show the true cost of borrowing or return on investment. The divergence between nominal and real rates can significantly impact purchasing power, as high inflation erodes the real value of nominal returns, leading to reduced economic decision-making efficiency.

Stagflation Risk Premium

Nominal interest rates represent the stated percentage without adjusting for inflation, whereas real interest rates account for changes in purchasing power by subtracting inflation expectations, crucial in evaluating the stagflation risk premium. During periods of stagflation, the risk premium rises as investors demand higher returns to compensate for both stagnant economic growth and eroding purchasing power, emphasizing the disparity between nominal and real interest rates.

Inflation Hedging Spread

Nominal interest rates reflect the stated return without adjusting for inflation, while real interest rates account for the inflation rate, representing the true purchasing power of returns. The inflation hedging spread measures the difference between nominal and real interest rates, indicating the premium investors demand to protect against inflation eroding their purchasing power.

Nominal Interest vs Real Interest for purchasing power. Infographic

moneydiff.com

moneydiff.com