Overdraft interest on credit purchases typically accrues immediately and at higher rates, making it a costly option for short-term borrowing. Buy Now Pay Later (BNPL) interest often offers interest-free periods or lower rates, allowing consumers to spread payments without incurring extra costs if paid within the agreed timeframe. Understanding these differences helps manage credit expenses more effectively and avoid unnecessary debt.

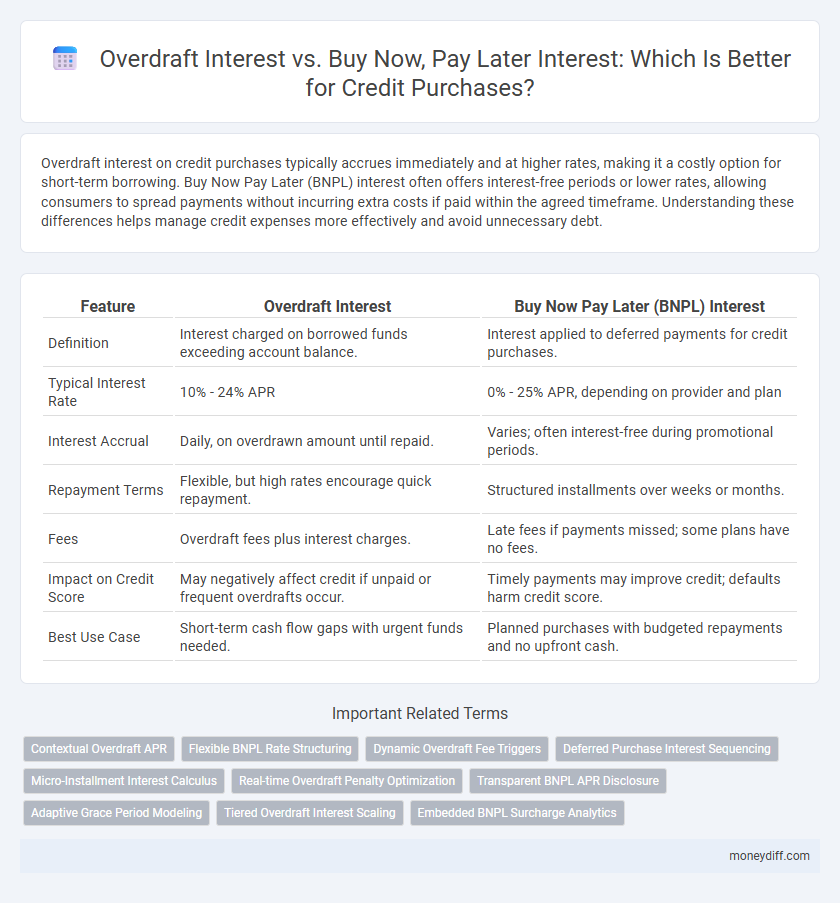

Table of Comparison

| Feature | Overdraft Interest | Buy Now Pay Later (BNPL) Interest |

|---|---|---|

| Definition | Interest charged on borrowed funds exceeding account balance. | Interest applied to deferred payments for credit purchases. |

| Typical Interest Rate | 10% - 24% APR | 0% - 25% APR, depending on provider and plan |

| Interest Accrual | Daily, on overdrawn amount until repaid. | Varies; often interest-free during promotional periods. |

| Repayment Terms | Flexible, but high rates encourage quick repayment. | Structured installments over weeks or months. |

| Fees | Overdraft fees plus interest charges. | Late fees if payments missed; some plans have no fees. |

| Impact on Credit Score | May negatively affect credit if unpaid or frequent overdrafts occur. | Timely payments may improve credit; defaults harm credit score. |

| Best Use Case | Short-term cash flow gaps with urgent funds needed. | Planned purchases with budgeted repayments and no upfront cash. |

Understanding Overdraft Interest Rates

Overdraft interest rates are typically higher than standard credit card rates, often ranging from 18% to 35% APR, reflecting the unsecured nature of overdraft facilities. These rates apply continuously from the moment the account balance goes below zero, leading to potentially significant costs if the negative balance is not cleared quickly. Understanding the compounding effect of overdraft interest is crucial, as daily or monthly interest charges can rapidly increase debt compared to Buy Now Pay Later (BNPL) options that often offer interest-free periods or fixed, lower interest rates.

How Buy Now Pay Later (BNPL) Interest Works

Buy Now Pay Later (BNPL) interest typically accrues only if payments are missed or not made by the due date, often starting with a zero-interest grace period. Unlike overdraft interest, which is charged immediately on the overdrawn balance, BNPL interest is generally calculated based on the outstanding installment amount and the specified annual percentage rate (APR). BNPL services often provide clear repayment schedules and may include penalty fees or retroactive interest if customers fail to adhere to the agreed payment terms.

Key Differences Between Overdraft and BNPL Interest

Overdraft interest typically accrues immediately on the overdrawn amount with rates ranging from 10% to 30% annually, while Buy Now Pay Later (BNPL) interest often applies only if payments are missed, frequently offering interest-free periods up to 30 days. Overdraft fees compound daily or monthly, increasing the total cost, whereas BNPL interest charges are usually calculated as a fixed fee or a set percentage applied after the promotional period. Consumers face higher financial risk with overdrafts due to unpredictable fees and continuous interest accumulation, contrasting BNPL's structured repayment plans that promote short-term credit without upfront interest costs.

Comparing Costs: Overdraft vs BNPL for Credit Purchases

Overdraft interest typically accrues immediately at rates ranging from 18% to 30% APR, often leading to higher overall costs for credit purchases compared to Buy Now Pay Later (BNPL) services, which may offer interest-free periods or fixed fees. BNPL interest or fees usually apply only if payments are missed or extended beyond the agreed period, making it a potentially cheaper option for short-term credit. Comparing costs requires analyzing the APR for overdrafts against the potential late fees or interest charges of BNPL plans, factoring in repayment timelines and spending behavior.

Impact on Credit Score: Overdraft vs BNPL

Overdraft interest can negatively impact credit scores if the account becomes overdrawn for an extended period or exceeds agreed limits, signaling higher credit risk to lenders. Buy Now Pay Later (BNPL) interest may not affect credit scores immediately but missed or late payments can lead to reports on credit bureaus, potentially lowering credit ratings. Responsible management of both overdrafts and BNPL plans is crucial to maintaining a healthy credit score.

Risks of Overdraft Interest on Everyday Spending

Overdraft interest rates are typically higher than Buy Now Pay Later (BNPL) interest rates, leading to increased costs when spending exceeds account balances. Regular reliance on overdraft facilities for everyday purchases can result in escalating debt and financial strain due to compounding interest charges. Unlike BNPL, which often offers interest-free periods, overdraft interest accrues immediately, amplifying the risk of long-term financial difficulties.

Common Traps with BNPL Interest Charges

Buy Now Pay Later (BNPL) plans often advertise zero or low interest but can carry hidden fees and high-interest rates if payments are missed or delayed. Unlike standard overdraft interest, BNPL interest compounds quickly and may not be clearly disclosed, leading to unexpected debt accumulation. Consumers frequently underestimate the impact of these charges, resulting in higher overall credit costs compared to traditional overdraft fees.

Managing Repayment Strategies for Overdraft and BNPL

Effective management of repayment strategies for overdraft interest and Buy Now Pay Later (BNPL) interest involves prioritizing timely payments to avoid high interest accrual and fees. Overdraft interest typically compounds daily and can be more expensive over time, so minimizing overdraft usage or repaying the negative balance quickly reduces costs. For BNPL plans, understanding installment schedules and paying within interest-free periods prevents additional charges, making strategic budgeting essential to optimize cash flow and credit health.

When to Choose Overdraft vs Buy Now Pay Later

Overdraft interest applies when your bank account balance falls below zero, typically incurring higher daily rates and fees than Buy Now Pay Later (BNPL) options. Choose overdraft for short-term emergency expenses when immediate access to funds is critical and repayment is expected quickly. Opt for BNPL for planned credit purchases with fixed installment schedules and lower or zero interest offers available within the promotional period.

Tips to Minimize Interest on Credit Purchases

To minimize interest on credit purchases, prioritize paying off Buy Now Pay Later (BNPL) balances before overdraft amounts, as BNPL interest rates often compound more aggressively. Utilize credit cards with 0% introductory APR offers or work within interest-free periods to avoid accumulating interest on both overdraft and BNPL transactions. Regularly monitor spending and make early payments to reduce the principal balance, effectively lowering the overall interest charged on credit purchases.

Related Important Terms

Contextual Overdraft APR

Contextual Overdraft APR typically incurs higher interest rates than Buy Now Pay Later (BNPL) options for credit purchases, as overdrafts function as short-term credit with variable APR that can exceed 20%. BNPL plans often offer fixed, lower or zero interest rates during promotional periods, making them more cost-effective for planned purchases compared to the often unpredictable and compounding charges of overdraft interest.

Flexible BNPL Rate Structuring

Overdraft interest typically incurs higher fees and variable rates based on daily balances, whereas Buy Now Pay Later (BNPL) interest offers more flexible rate structuring, often including interest-free periods or fixed installment plans tailored to consumer repayment capacity. Flexible BNPL rate structuring enables consumers to manage credit purchases with predictable costs and improved budgeting control, reducing the risk of accumulating expensive debt compared to overdraft usage.

Dynamic Overdraft Fee Triggers

Dynamic overdraft fee triggers activate fees based on real-time account balance thresholds, intensifying costs compared to fixed Buy Now Pay Later interest rates that accrue only on outstanding credit amounts. This mechanism causes interest on overdrafts to compound quickly during low balance periods, in contrast to predictable, scheduled BNPL interest charges.

Deferred Purchase Interest Sequencing

Overdraft interest typically accrues immediately on negative balances from credit purchases, while Buy Now Pay Later (BNPL) interest often follows a deferred purchase interest sequencing, delaying interest charges until after a set repayment period. This sequencing allows BNPL users to avoid interest during the initial grace period, whereas overdraft fees and interest begin accumulating as soon as the account enters overdraft status.

Micro-Installment Interest Calculus

Overdraft interest typically accrues daily on the negative balance, calculated based on the outstanding amount and daily interest rate, often resulting in higher effective costs compared to Buy Now Pay Later (BNPL) options that use micro-installment interest calculus to spread interest charges evenly over multiple small payments, reducing compounding effects. BNPL's micro-installment model enhances affordability by distributing interest proportionally across each installment, enabling clearer cost forecasting and potentially lower total interest compared to variable overdraft interest rates.

Real-time Overdraft Penalty Optimization

Real-time overdraft penalty optimization reduces excess fees by dynamically managing overdraft interest charges based on transaction timing and account balance, offering a cost-effective alternative to the typically higher and more rigid Buy Now Pay Later interest rates for credit purchases. This approach leverages predictive analytics and machine learning to minimize overdraft penalties while maintaining liquidity, enhancing financial control compared to BNPL's fixed interest structures.

Transparent BNPL APR Disclosure

Buy Now Pay Later (BNPL) services often advertise transparent APR disclosures, allowing consumers to understand the true cost of credit upfront, unlike traditional overdraft interest which can involve unpredictable fees and rates. This clarity in BNPL APR helps buyers make informed decisions by clearly outlining payment terms and interest charges for credit purchases.

Adaptive Grace Period Modeling

Overdraft interest rates typically apply immediately upon exceeding the credit limit, while Buy Now Pay Later (BNPL) interest often incorporates adaptive grace period modeling that dynamically adjusts repayment windows to minimize interest accrual based on user payment behavior. This adaptive system enhances cash flow flexibility by tailoring interest-free intervals, contrasting with the fixed, often higher, cost structure of traditional overdraft interest on credit purchases.

Tiered Overdraft Interest Scaling

Tiered overdraft interest rates escalate based on the overdraft amount, typically starting lower and increasing as the negative balance grows, resulting in varied costs for credit purchases. Buy Now Pay Later (BNPL) interest often features fixed or zero-percent promotional rates but can impose higher penalty fees if payments are missed, contrasting with the structured, scalable cost model of tiered overdraft interest.

Embedded BNPL Surcharge Analytics

Overdraft interest typically accrues at higher annual percentage rates (APRs), often exceeding 20%, resulting in immediate cost implications for credit purchases, while Buy Now Pay Later (BNPL) interest is usually interest-free but may include embedded surcharges that affect overall expense. Embedded BNPL surcharge analytics reveal hidden fees that can increase the total repayment amount by 5-8%, offering a nuanced comparison against overdraft interest costs for informed consumer and financial institution decisions.

Overdraft Interest vs Buy Now Pay Later Interest for credit purchases. Infographic

moneydiff.com

moneydiff.com