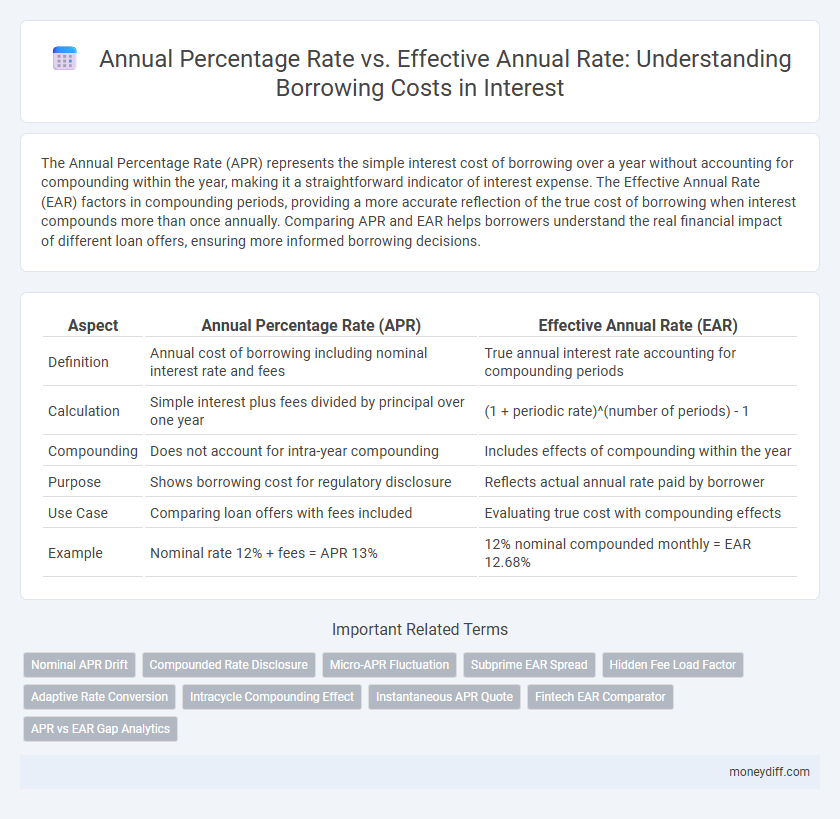

The Annual Percentage Rate (APR) represents the simple interest cost of borrowing over a year without accounting for compounding within the year, making it a straightforward indicator of interest expense. The Effective Annual Rate (EAR) factors in compounding periods, providing a more accurate reflection of the true cost of borrowing when interest compounds more than once annually. Comparing APR and EAR helps borrowers understand the real financial impact of different loan offers, ensuring more informed borrowing decisions.

Table of Comparison

| Aspect | Annual Percentage Rate (APR) | Effective Annual Rate (EAR) |

|---|---|---|

| Definition | Annual cost of borrowing including nominal interest rate and fees | True annual interest rate accounting for compounding periods |

| Calculation | Simple interest plus fees divided by principal over one year | (1 + periodic rate)^(number of periods) - 1 |

| Compounding | Does not account for intra-year compounding | Includes effects of compounding within the year |

| Purpose | Shows borrowing cost for regulatory disclosure | Reflects actual annual rate paid by borrower |

| Use Case | Comparing loan offers with fees included | Evaluating true cost with compounding effects |

| Example | Nominal rate 12% + fees = APR 13% | 12% nominal compounded monthly = EAR 12.68% |

Understanding Annual Percentage Rate (APR)

Annual Percentage Rate (APR) represents the yearly cost of borrowing, including interest and certain fees, expressed as a percentage. APR helps borrowers compare loan offers by standardizing costs over a year, but it may not account for compounding within the period. Understanding APR is crucial for evaluating the upfront cost of loans, distinct from the Effective Annual Rate (EAR), which reflects the true cost incorporating compounding effects.

What Is Effective Annual Rate (EAR)?

Effective Annual Rate (EAR) represents the true annual cost of borrowing, accounting for compounding interest throughout the year. Unlike Annual Percentage Rate (APR), which does not factor in intra-year compounding, EAR provides a more accurate measure of the actual interest paid. Borrowers use EAR to compare loan offers and understand the real financial impact of interest costs over time.

Key Differences Between APR and EAR

Annual Percentage Rate (APR) represents the nominal interest rate on a loan, including certain fees, but does not account for compounding within the year, making it less precise for comparing borrowing costs. Effective Annual Rate (EAR) reflects the true annual cost of borrowing by incorporating the effects of compounding interest over the year, providing a more accurate measure of financial cost. The key difference lies in APR being a simple rate used primarily for disclosure, while EAR reveals the real growth rate of debt or investment by factoring in compounding frequency.

Calculating Borrowing Costs: APR vs EAR

Calculating borrowing costs requires understanding the differences between Annual Percentage Rate (APR) and Effective Annual Rate (EAR). APR represents the nominal interest rate without accounting for compounding within the year, while EAR reflects the true annual cost by including compounding effects, making it a more accurate measure of borrowing expense. For precise cost comparison and financial decision-making, EAR provides a comprehensive view of total interest paid over a year.

Why Lenders Use APR and EAR

Lenders use Annual Percentage Rate (APR) to provide borrowers with a standardized borrowing cost that includes interest and certain fees, facilitating easier comparison across loan products. Effective Annual Rate (EAR) captures the true cost of borrowing by accounting for compounding periods, which reflects the actual interest paid over a year. APR is primarily used for regulatory disclosure and transparency, while EAR offers a more precise measure of lending costs, helping lenders present both nominal rates and compounding effects clearly.

Impact of Compounding on EAR

The Annual Percentage Rate (APR) represents the nominal interest rate without accounting for compounding within the year, making it less reflective of the true borrowing cost. The Effective Annual Rate (EAR) incorporates the effects of compounding periods, providing a more accurate measure of the actual interest expense over a year. Compounding frequency significantly impacts the EAR by increasing the total interest owed, as interest is calculated on accumulated interest from prior periods.

How to Compare Loans Using APR and EAR

When comparing loans, Annual Percentage Rate (APR) represents the nominal interest cost including fees, expressed annually, while Effective Annual Rate (EAR) accounts for compounding periods, providing the true cost of borrowing. Evaluating both APR and EAR reveals differences in loan affordability, especially when compounding frequency varies, allowing borrowers to assess the real financial impact. Selecting loans with lower EAR ensures minimized borrowing expenses over time, offering a clearer comparison than APR alone.

Common Misconceptions About APR and EAR

Annual Percentage Rate (APR) commonly confuses borrowers because it excludes the impact of compounding within the year, resulting in a lower figure than the true borrowing cost. Effective Annual Rate (EAR) provides a more accurate measure by incorporating compounding effects, reflecting the actual interest paid over the year. Many mistakenly assume APR and EAR are interchangeable, but relying on APR alone can lead to underestimating the total loan expense.

Real-World Examples: APR Versus EAR

APR represents the nominal borrowing cost without compounding effects, while EAR accounts for compounding within the year, providing a more accurate measure of the true interest expense. For instance, a loan with a 12% APR compounded monthly results in an EAR of approximately 12.68%, reflecting additional costs borrowers incur. Real-world mortgage and credit card loans often list APRs, but comparing EARs reveals the actual financial impact over time, emphasizing the need for borrowers to evaluate EAR for cost-efficient borrowing decisions.

Choosing the Best Rate for Your Financial Situation

The Annual Percentage Rate (APR) represents the nominal interest cost including fees, providing a standardized measure for loan comparisons, while the Effective Annual Rate (EAR) accounts for compounding periods, reflecting the true borrowing cost. Selecting the best rate depends on loan frequency and compounding; EAR is more accurate for loans with multiple compounding intervals per year. Evaluating both APR and EAR against your financial situation ensures you understand total expenses and avoid unexpected interest costs.

Related Important Terms

Nominal APR Drift

Nominal APR drift occurs when the Annual Percentage Rate (APR) does not accurately reflect the true borrowing cost due to compounding frequency differences between APR and Effective Annual Rate (EAR). Borrowers benefit from understanding EAR as it incorporates compounding effects, revealing a more precise cost of debt compared to the typically understated nominal APR.

Compounded Rate Disclosure

Annual Percentage Rate (APR) represents the nominal borrowing cost without accounting for compounding within the year, while Effective Annual Rate (EAR) reflects the true cost by incorporating compounding effects, making EAR a more accurate measure for borrowers. Compounded rate disclosure ensures transparency by revealing the impact of interest capitalization frequency on total borrowing expenses, enabling informed financial decisions.

Micro-APR Fluctuation

Micro-APR fluctuations reflect minor variations in the Annual Percentage Rate, which can cause differences in the total borrowing cost when compared to the Effective Annual Rate that accounts for compounding within the year. Understanding these small APR movements is crucial for accurately assessing the true cost of loans and making informed borrowing decisions.

Subprime EAR Spread

The Annual Percentage Rate (APR) reflects the nominal interest rate plus fees for borrowing costs, while the Effective Annual Rate (EAR) accounts for compounding periods, providing a more accurate measure of the true cost of credit. Subprime EAR Spread indicates the difference in effective annual borrowing costs between subprime borrowers and prime borrowers, highlighting the higher risk premium charged in subprime lending markets.

Hidden Fee Load Factor

The Annual Percentage Rate (APR) often understates the true borrowing cost by excluding compounding effects captured by the Effective Annual Rate (EAR), which reflects the Hidden Fee Load Factor embedded in fees and interest calculation frequency. Borrowers should prioritize the EAR to accurately assess the total cost of loans, as it incorporates all fees and compounding periods, revealing the genuine financial burden beyond nominal APR figures.

Adaptive Rate Conversion

The Annual Percentage Rate (APR) represents the nominal interest rate for borrowing costs without accounting for compounding within the year, while the Effective Annual Rate (EAR) includes the effect of compounding periods, providing a more accurate measure of the true cost. Adaptive rate conversion models convert APR to EAR by factoring in variable compounding frequencies, enabling borrowers to compare loan offers with different compounding structures effectively.

Intracycle Compounding Effect

The Annual Percentage Rate (APR) often understates the true borrowing cost by excluding intracycle compounding, which the Effective Annual Rate (EAR) captures by reflecting interest accrued within each payment period. Understanding the intracycle compounding effect is crucial since EAR provides a more accurate measure of the total cost of borrowing by incorporating interest-on-interest throughout the year.

Instantaneous APR Quote

Instantaneous APR quote reflects the exact borrowing cost at a specific moment, offering precision unlike the standard Annual Percentage Rate (APR) which averages costs over a year. Effective Annual Rate (EAR) accounts for compounding within the year, often resulting in a higher borrowing cost than the nominal Instantaneous APR, making it crucial for borrowers to compare these metrics for true cost assessment.

Fintech EAR Comparator

The Annual Percentage Rate (APR) represents the nominal interest rate including fees, offering a standardized borrowing cost metric, while the Effective Annual Rate (EAR) accounts for compounding effects, providing a more accurate reflection of true borrowing expenses. Fintech EAR comparators leverage advanced algorithms and real-time data to help consumers identify loans with the most cost-efficient effective rates, improving financial decision-making and transparency in lending markets.

APR vs EAR Gap Analytics

The gap between Annual Percentage Rate (APR) and Effective Annual Rate (EAR) quantifies the true borrowing cost, with APR representing the nominal interest rate including fees and EAR reflecting the compounded interest over a year. Borrowers must analyze the APR vs EAR gap to identify hidden costs and accurately compare loan offers where higher compounding frequency significantly widens this discrepancy.

Annual Percentage Rate vs Effective Annual Rate for borrowing cost Infographic

moneydiff.com

moneydiff.com