Simple interest calculates earnings solely on the initial principal, making it straightforward but less profitable over time. Compound interest generates returns by reinvesting earned interest, leading to exponential growth of savings. Choosing compound interest maximizes long-term benefits for pet owners saving for veterinary care or other expenses.

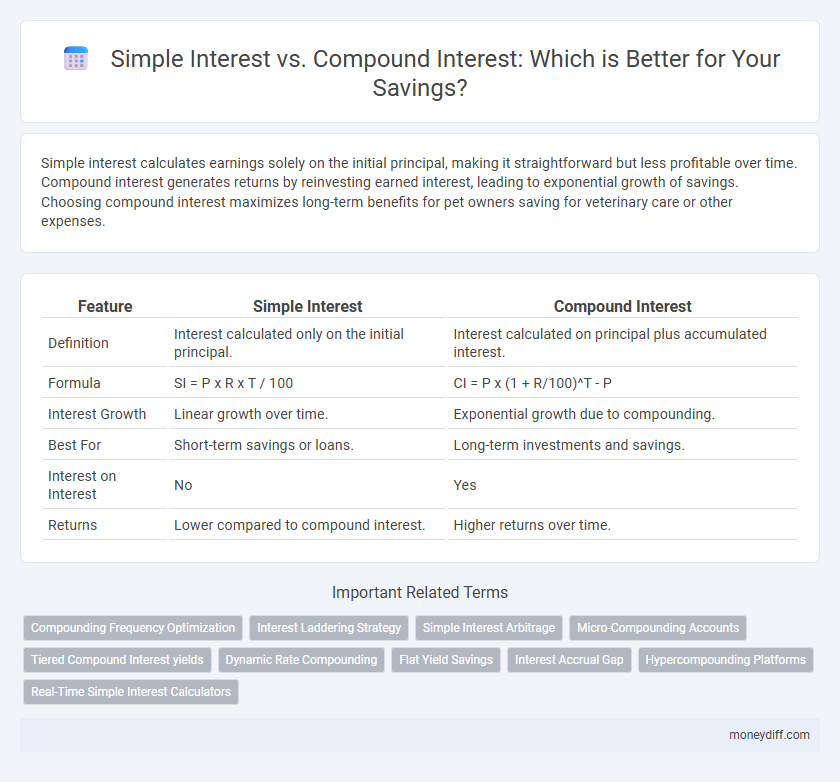

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Interest calculated only on the initial principal. | Interest calculated on principal plus accumulated interest. |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)^T - P |

| Interest Growth | Linear growth over time. | Exponential growth due to compounding. |

| Best For | Short-term savings or loans. | Long-term investments and savings. |

| Interest on Interest | No | Yes |

| Returns | Lower compared to compound interest. | Higher returns over time. |

Understanding Simple Interest: Key Concepts

Simple interest calculates earnings based solely on the original principal amount, using a fixed interest rate over a set period. The formula for simple interest is I = P x r x t, where P is the principal, r is the annual interest rate, and t is the time in years. This method provides straightforward, predictable returns, making it ideal for short-term savings or loans without reinvested earnings.

What Is Compound Interest? An Overview

Compound interest is the process where interest earned on an initial principal also earns interest over time, resulting in exponential growth of savings. This interest-on-interest effect accelerates asset accumulation, making it a powerful growth mechanism compared to simple interest, which is calculated solely on the principal amount. Investors benefit from compound interest by reinvesting earnings, maximizing returns through the cumulative effect on savings balances.

Simple Interest: How It Works for Savings

Simple interest calculates earnings on the original principal amount, providing a fixed percentage over a set period, making it predictable for savings growth. Interest is earned only on the initial deposit, not on accumulated interest, resulting in slower growth compared to compound interest. This method suits short-term savings goals where stability and ease of calculation are priorities.

Compound Interest: Maximizing Growth Over Time

Compound interest accelerates savings growth by reinvesting earned interest, resulting in exponential accumulation over time. Unlike simple interest, which calculates returns only on the initial principal, compound interest applies interest on both the principal and the accumulated interest from previous periods. This powerful effect significantly enhances long-term savings, making it the preferred strategy for maximizing wealth in investment accounts and retirement funds.

Key Differences Between Simple and Compound Interest

Simple interest calculates earnings solely on the principal amount, making it a linear growth method often used for short-term savings or loans. Compound interest generates earnings on both the principal and previously accrued interest, resulting in exponential growth ideal for long-term investments and savings accounts. The key difference lies in compound interest's ability to maximize returns over time through reinvestment, while simple interest provides consistent, predictable interest without compounding effects.

When to Choose Simple Interest Accounts

Simple interest accounts are ideal for short-term savings goals where the principal is not reinvested, providing straightforward and predictable earnings based solely on the initial deposit. They benefit individuals seeking consistent returns without the complexity of fluctuating interest calculations, especially when quick access to funds is required. Choosing simple interest accounts suits scenarios with low-risk tolerance and minimal interest compounding opportunities.

Benefits of Compound Interest for Long-Term Savers

Compound interest accelerates wealth growth by reinvesting earned interest, resulting in exponential growth over time, unlike simple interest which only calculates interest on the principal amount. Long-term savers significantly benefit as compound interest maximizes returns, especially when savings are left untouched for many years. This effect is most pronounced with higher interest rates and more frequent compounding periods, making it ideal for retirement funds and educational savings plans.

Calculating Savings: Simple vs. Compound Interest Examples

Simple interest calculates savings based on the initial principal and a fixed interest rate over time, resulting in linear growth. Compound interest generates savings by reinvesting earned interest, leading to exponential growth as interest accumulates on both principal and previous interest. For example, investing $1,000 at a 5% annual rate yields $150 in simple interest after three years, while compound interest results in approximately $157.63.

Which Interest Type Yields Higher Returns?

Compound interest yields higher returns than simple interest as it calculates interest on both the principal and the accumulated interest, allowing savings to grow exponentially over time. Simple interest is computed solely on the initial principal, resulting in linear growth. For long-term savings, compound interest significantly maximizes investment growth compared to simple interest.

Making the Best Savings Choice: Simple or Compound Interest

Choosing compound interest for savings maximizes growth by earning interest on both the initial principal and accumulated interest, leading to exponential asset increase over time. Simple interest calculates returns solely on the original principal, resulting in linear growth and potentially lower earnings for long-term savings goals. Understanding the differences and applying compound interest in high-yield savings accounts or investment vehicles optimizes financial growth and boosts overall wealth accumulation.

Related Important Terms

Compounding Frequency Optimization

Compound interest maximizes savings growth by reinvesting earnings at varying compounding frequencies, with more frequent compounding intervals such as monthly or daily significantly increasing the effective interest earned compared to simple interest, which earns interest only on the initial principal. Optimizing compounding frequency enhances the exponential growth effect, making it a critical factor in long-term wealth accumulation strategies.

Interest Laddering Strategy

Simple interest calculates earnings solely on the initial principal, offering predictable but limited growth, while compound interest generates returns on both the principal and accumulated interest, accelerating wealth accumulation over time. Employing an interest laddering strategy diversifies savings across accounts with varying interest rates and compounding frequencies, optimizing overall return and managing liquidity effectively.

Simple Interest Arbitrage

Simple interest arbitrage involves exploiting the difference between simple interest rates to maximize returns without reinvesting earnings, unlike compound interest which accumulates by reinvesting interest over time. Savers using simple interest arbitrage can benefit from predictable, linear growth on principal investments, making it suitable for short-term, low-risk savings strategies.

Micro-Compounding Accounts

Micro-compounding accounts apply compound interest on small, frequent deposits, significantly increasing savings growth compared to simple interest which calculates earned interest only on the initial principal. The exponential effect of micro-compounding accelerates wealth accumulation by reinvesting interest continuously, maximizing returns even on modest balances.

Tiered Compound Interest yields

Tiered compound interest yields typically offer higher returns than simple interest by applying different interest rates to various balance tiers, allowing savers to maximize growth as their savings increase. This structure compounds interest periodically on both the principal and accumulated interest, significantly enhancing long-term savings performance compared to fixed-rate simple interest.

Dynamic Rate Compounding

Dynamic rate compounding in compound interest allows interest rates to fluctuate over time, resulting in potentially higher returns compared to the fixed rate simple interest. This dynamic approach leverages the power of reinvested earnings, maximizing growth by adapting to changing market conditions, unlike straightforward simple interest which calculates based only on the principal.

Flat Yield Savings

Flat Yield Savings accounts typically offer simple interest, where the interest is calculated only on the principal amount, resulting in a predictable but lower return compared to compound interest accounts that generate earnings on both the principal and accumulated interest. Choosing flat yield savings benefits those seeking straightforward growth without reinvestment complexity, while compound interest maximizes returns through exponential growth over time.

Interest Accrual Gap

Simple interest calculates returns solely on the initial principal, resulting in linear growth over time, whereas compound interest accrues on both the principal and accumulated interest, leading to exponential growth. The interest accrual gap widens significantly as the investment duration increases, making compound interest substantially more beneficial for long-term savings.

Hypercompounding Platforms

Hypercompounding platforms leverage compound interest by reinvesting earnings continuously, significantly amplifying savings growth compared to simple interest, which calculates returns only on the principal amount. Over time, the exponential effect of compound interest on these platforms can result in substantially higher accumulated wealth, making them ideal for long-term savings strategies.

Real-Time Simple Interest Calculators

Real-time simple interest calculators enable savings account holders to quickly estimate earnings by applying a fixed interest rate on the principal over a specified period, providing clear insight into straightforward growth without reinvestment. Unlike compound interest calculators that factor in interest on accumulated interest, these tools simplify decision-making for users prioritizing transparency and predictable returns.

Simple Interest vs Compound Interest for savings. Infographic

moneydiff.com

moneydiff.com